Fund Type

Super Savings Fund which is an Equity Fund, Feeder Fund, and Cross Investing Fund.

Dividend Policy

Dividends shall be paid when the Fund has retained earnings and such dividend payment shall not result in the Fund incurring retained losses during the accounting period for which the dividends are paid out. In the event that the dividend payment is less than 0.25 baht per unit, the Fund reserves the right not to pay. For further detail pertaining to dividend payment, please study Fund Prospectus and Fund Project and Commitment.

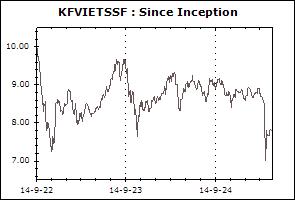

Inception Date

14 September 2022

Investment Policy

Invest in only one CIS unit. Minimum 80% of NAV in average of fund accounting year are invested in the Master Fund named, Krungsri Vietnam Equity Fund-I (KFVIET-I) which managed by Krungsri Asset Management Co., Ltd. The Master Fund will invest in the investment units of foreign equity funds and/or exchange traded funds (ETFs) which have the investment policy of investing in the securities of listed companies in Vietnam and/or whose business or interest from business in Vietnam. The fund may invest no more than 100% of fund assets in units of mutual funds under management of the Company.

Fund Manager

Jaturan Sornvai, Chusak Ouypornchaisakul

Asset Allocation

-

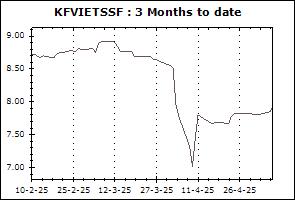

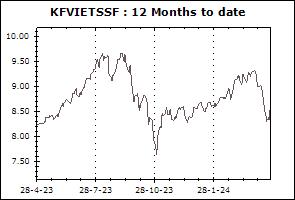

Return Chart

NAV Movement

- 3 Months

- 12 Months

- Since inception

Transaction Details

Minimum Purchase Amount (Baht): 500

Minimum Redemption Amount (Unit): None

Proceeds Payment Period: Not exceed 5 working days following the NAV calculation date but in general practice, the payment date will be 6 working days after the execution day (T+6)

Fund Subscription Period: Every subscription date (start from 19 September 2022 onward)

Fund Redemption Period: Every subscription date (start from 19 September 2022 onward)

Transaction Channel: Krungsri Asset Management,Online Service,AGENT

Asset Allocation (30 Jan 2026)

| Krungsri Vietnam Equity Fund-I | 96.91% |

| Other Assets | 3.12% |

| Other Liabilities | -0.02% |

Super Savings Fund (SSF)

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Cash Management-SSF (KFCASHSSF) | +0.21% | +0.47% | +0.07% | +1.19% | +1.49% | +1.00% | N/A | +0.88% | 586 |

| Benchmark(4) | +0.23% | +0.50% | +0.07% | +1.17% | +1.38% | +0.99% | N/A | +0.91% | |

| Standard Deviation of Fund | +0.03% | +0.04% | +0.04% | +0.05% | +0.07% | +0.07% | N/A | +0.06% | |

| Standard Deviation of Benchmark | +0.03% | +0.02% | +0.03% | +0.02% | +0.02% | +0.02% | N/A | +0.02% | |

| Krungsri Active Fixed Income-SSF (KFAFIXSSF) | -0.01% | -0.17% | -0.50% | +2.79% | +2.77% | +2.03% | N/A | +1.98% | 1,049 |

| Benchmark(5) | +0.32% | +0.40% | -0.35% | +3.24% | +2.61% | +1.62% | N/A | +1.67% | |

| Standard Deviation of Fund | +0.77% | +1.01% | +0.87% | +0.92% | +0.69% | +0.81% | N/A | +0.83% | |

| Standard Deviation of Benchmark | +0.76% | +0.85% | +0.84% | +0.80% | +0.73% | +0.95% | N/A | +0.94% | |

| Krungsri Happy Life-SSF (KFHAPPYSSF) | +0.86% | +1.55% | +0.18% | +3.66% | +1.64% | +1.34% | N/A | +1.65% | 213 |

| Benchmark(6) | +0.60% | +2.09% | +1.01% | +2.70% | +0.69% | +1.20% | N/A | +2.23% | |

| Standard Deviation of Fund | +1.86% | +2.03% | +2.05% | +2.51% | +2.20% | +2.11% | N/A | +2.36% | |

| Standard Deviation of Benchmark | +2.36% | +2.32% | +2.69% | +2.88% | +2.29% | +2.12% | N/A | +2.38% | |

| Krungsri The One Mild SSF (KF1MILDSSF) | +1.46% | +3.73% | +1.02% | +4.64% | N/A | N/A | N/A | +3.58% | 14 |

| Benchmark(7) | +1.94% | +5.14% | +1.44% | +8.29% | N/A | N/A | N/A | +7.76% | |

| Standard Deviation of Fund | +2.85% | +2.75% | +3.28% | +3.69% | N/A | N/A | N/A | +3.48% | |

| Standard Deviation of Benchmark | +2.80% | +2.79% | +2.93% | +3.65% | N/A | N/A | N/A | +3.06% | |

| Krungsri The One Mean SSF (KF1MEANSSF) | +1.35% | +3.95% | +1.14% | +3.92% | N/A | N/A | N/A | +3.07% | 7 |

| Benchmark(8) | +2.33% | +7.23% | +2.15% | +10.56% | N/A | N/A | N/A | +9.83% | |

| Standard Deviation of Fund | +3.88% | +3.87% | +4.06% | +5.60% | N/A | N/A | N/A | +5.01% | |

| Standard Deviation of Benchmark | +4.53% | +4.60% | +4.89% | +6.31% | N/A | N/A | N/A | +5.30% | |

| Krungsri The One Max SSF (KF1MAXSSF) | +1.66% | +5.22% | +1.40% | +5.38% | N/A | N/A | N/A | +4.14% | 10 |

| Benchmark(9) | +3.53% | +10.92% | +3.24% | +15.49% | N/A | N/A | N/A | +14.72% | |

| Standard Deviation of Fund | +5.21% | +5.20% | +5.19% | +7.47% | N/A | N/A | N/A | +6.60% | |

| Standard Deviation of Benchmark | +6.75% | +6.99% | +7.10% | +9.92% | N/A | N/A | N/A | +8.29% | |

| Krungsri Enhanced SET50-SSF (KFENS50SSF) | +3.08% | +8.38% | +5.62% | +5.83% | -2.67% | +0.69% | N/A | +4.92% | 727 |

| SET50 TRI | +3.91% | +9.95% | +5.62% | +7.71% | -0.51% | +2.39% | N/A | +5.77% | |

| Standard Deviation of Fund | +14.41% | +14.51% | +15.28% | +19.78% | +15.47% | +14.17% | N/A | +16.30% | |

| Standard Deviation of Benchmark | +13.94% | +13.99% | +14.95% | +19.25% | +15.10% | +13.88% | N/A | +15.92% | |

| Krungsri Dividend Stock SSF (KFDIVSSF) | +2.10% | +5.35% | +3.96% | +0.77% | -6.51% | -2.64% | N/A | -2.21% | 547 |

| SET TRI | +1.56% | +8.28% | +5.24% | +5.39% | -4.08% | +1.25% | N/A | +3.67% | |

| Standard Deviation of Fund | +11.13% | +11.53% | +12.20% | +16.16% | +13.42% | +12.54% | N/A | +13.23% | |

| Standard Deviation of Benchmark | +14.70% | +14.20% | +16.58% | +17.92% | +14.12% | +13.00% | N/A | +13.94% | |

| Krungsri SET100-SSF (KFS100SSF) | +3.14% | +9.02% | +5.52% | +6.57% | -2.53% | +1.21% | N/A | +2.78% | 594 |

| SET100 TRI | +3.48% | +9.60% | +5.37% | +7.09% | -2.30% | +1.39% | N/A | +2.97% | |

| Standard Deviation of Fund | +14.40% | +14.25% | +15.63% | +19.25% | +15.07% | +13.75% | N/A | +14.72% | |

| Standard Deviation of Benchmark | +14.22% | +14.19% | +15.40% | +19.27% | +15.15% | +13.85% | N/A | +14.79% | |

| Tracking Difference (TD) | N/A | N/A | N/A | -0.52% | N/A | N/A | N/A | N/A | |

| Tracking Error (TE) | N/A | N/A | N/A | +2.00% | N/A | N/A | N/A | N/A | |

| Krungsri Global Core Allocation SSF (KFCORESSF) | +1.75% | +7.58% | +1.66% | +8.23% | N/A | N/A | N/A | +8.03% | 29 |

| Standard Deviation of Fund | +7.64% | +7.14% | +6.09% | +8.53% | N/A | N/A | N/A | +7.72% | |

| Krungsri Global Brands Equity Dividend SSF (KFGBRANSSF) | -4.47% | -10.81% | -4.29% | -11.95% | +1.19% | +1.25% | N/A | +3.39% | 1,825 |

| Benchmark(10) | -6.15% | -12.40% | -4.36% | -14.32% | +3.99% | +5.65% | N/A | +6.32% | |

| Standard Deviation of Fund | +10.15% | +9.75% | +12.71% | +12.68% | +11.55% | +14.23% | N/A | +14.42% | |

| Standard Deviation of Benchmark | +11.37% | +11.69% | +12.43% | +15.68% | +13.55% | +14.96% | N/A | +15.15% | |

| Krungsri China A Shares Equity SSF (KF-ACHINASSF) | +0.12% | +5.79% | -0.21% | +12.41% | -4.62% | -11.53% | N/A | -10.58% | 396 |

| Benchmark(10) | -1.74% | +3.94% | -0.22% | +9.22% | -2.55% | -8.01% | N/A | -6.86% | |

| Standard Deviation of Fund | +10.56% | +11.59% | +11.91% | +12.03% | +15.18% | +19.13% | N/A | +19.21% | |

| Standard Deviation of Benchmark | +11.33% | +12.88% | +12.74% | +13.51% | +16.56% | +19.86% | N/A | +19.95% | |

| Krungsri US Equity SSF (KFUSSSF) | +4.42% | -0.14% | +1.42% | -14.66% | +8.22% | N/A | N/A | -12.10% | 88 |

| Benchmark(10) | +2.79% | -1.59% | +1.55% | -16.91% | +11.65% | N/A | N/A | -9.24% | |

| Standard Deviation of Fund | +9.55% | +9.37% | +9.75% | +13.66% | +21.92% | N/A | N/A | +33.33% | |

| Standard Deviation of Benchmark | +11.73% | +11.77% | +13.69% | +15.19% | +22.71% | N/A | N/A | +33.19% | |

| Krungsri Next Generation Infrastructure SSF (KFINFRASSF) | +5.92% | +4.11% | +4.28% | +11.87% | +5.13% | N/A | N/A | +0.47% | 46 |

| Benchmark(11) | +7.59% | +6.96% | +4.90% | +17.89% | +10.37% | N/A | N/A | +5.40% | |

| Standard Deviation of Fund | +7.48% | +7.77% | +7.59% | +11.58% | +11.56% | N/A | N/A | +13.75% | |

| Standard Deviation of Benchmark | +7.65% | +7.89% | +7.97% | +11.93% | +11.89% | N/A | N/A | +14.13% | |

| Krungsri ESG Climate Tech SSF (KFCLIMASSF) | +1.11% | +5.46% | +3.93% | +17.73% | +4.81% | N/A | N/A | -1.49% | 75 |

| Standard Deviation of Fund | +15.51% | +14.37% | +12.13% | +17.28% | +16.11% | N/A | N/A | +19.03% | |

| Krungsri Global Growth SSF (KFGGSSF) | -10.28% | -5.20% | -4.15% | -0.97% | +13.56% | N/A | N/A | -4.37% | 981 |

| Benchmark(11) | -9.34% | -2.92% | -3.86% | +4.09% | +19.62% | N/A | N/A | +0.52% | |

| Standard Deviation of Fund | +18.79% | +17.06% | +16.99% | +22.76% | +21.27% | N/A | N/A | +28.76% | |

| Standard Deviation of Benchmark | +20.44% | +18.51% | +18.40% | +26.40% | +22.95% | N/A | N/A | +30.12% | |

| Krungsri China Megatrends SSF (KFCMEGASSF) | -4.49% | +2.86% | +1.56% | +12.37% | -4.49% | N/A | N/A | -3.16% | 62 |

| Benchmark(12) | -1.29% | +7.88% | +4.25% | +28.27% | +7.19% | N/A | N/A | +6.67% | |

| Standard Deviation of Fund | +18.27% | +20.91% | +24.39% | +27.10% | +29.53% | N/A | N/A | +30.20% | |

| Standard Deviation of Benchmark | +15.75% | +16.71% | +14.93% | +22.96% | +22.30% | N/A | N/A | +23.53% | |

| Krungsri Equity Sustainable Global Growth SSF (KFESGSSF) | -4.47% | -1.53% | -0.51% | -1.73% | +2.12% | N/A | N/A | +2.93% | 35 |

| Benchmark(11) | -3.23% | +1.02% | -0.09% | +3.38% | +7.36% | N/A | N/A | +8.24% | |

| Standard Deviation of Fund | +12.33% | +12.39% | +10.85% | +18.63% | +15.26% | N/A | N/A | +16.38% | |

| Standard Deviation of Benchmark | +12.90% | +12.70% | +11.81% | +18.55% | +15.48% | N/A | N/A | +16.86% | |

| Krungsri Vietnam Equity SSF (KFVIETSSF) | +6.74% | +13.78% | +5.05% | +16.72% | +5.63% | N/A | N/A | +1.18% | 189 |

| Benchmark(13) | +6.27% | +22.87% | +1.98% | +39.66% | +18.13% | N/A | N/A | +8.87% | |

| Standard Deviation of Fund | +18.28% | +19.40% | +14.25% | +20.49% | +16.79% | N/A | N/A | +17.44% | |

| Standard Deviation of Benchmark | +20.37% | +24.07% | +19.04% | +24.45% | +20.39% | N/A | N/A | +22.69% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri SET100-SSFX (KFS100SSFX) | +3.14% | +9.02% | +5.52% | +6.57% | -2.53% | +1.21% | N/A | +3.28% | 1,442 |

| SET100 TRI | +3.48% | +9.60% | +5.37% | +7.09% | -2.30% | +1.39% | N/A | +3.99% | |

| Standard Deviation of Fund | +14.40% | +14.25% | +15.63% | +19.25% | +15.07% | +13.75% | N/A | +15.20% | |

| Standard Deviation of Benchmark | +14.22% | +14.19% | +15.40% | +19.27% | +15.15% | +13.85% | N/A | +15.31% | |

| Tracking Difference (TD) | N/A | N/A | N/A | -0.52% | N/A | N/A | N/A | N/A | |

| Tracking Error (TE) | N/A | N/A | N/A | +2.00% | N/A | N/A | N/A | N/A | |

Remark