Fund Type

Super Savings Fund (Money Market Fund)

Dividend Policy

None

Inception Date

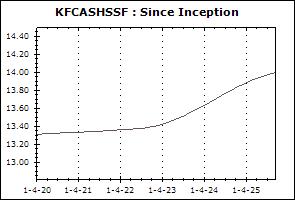

1 April 2020

Investment Policy

1. Minimum 70% of fund assets are invested in debt instruments of government sector.

2. The remaining is invested in debt instruments of private sector, financial institutions or bank deposits.

- The above instruments are assigned the top two ratings for short-term credit rating or equivalent long-term credit rating or the top three ratings for long-term credit rating except for government instruments with duration not exceeding 397 days since the fund incepted.

- The fund’s portfolio duration at any point in time is not over 92 days.

Fund Manager

Theerapab Chirasakyakul, Porntipa Nungnamjai

Asset Allocation

99.29%

Fixed Income Instruments issued by Bank of Thailand

0.35%

Deposits and Fixed Income Instruments issued by Financial Institutions

0.54%

Other Assets

-0.18%

Other Liabilities

Transaction Details

Minimum Purchase Amount (Baht): 500

Minimum Redemption Amount (Unit): Not specified

Proceeds Payment Period: 1 working days after the redemption date (T+1)

Fund Subscription Period: Every dealing date of the fund by 15.30 hrs.

Fund Redemption Period: Every dealing date of the fund by 15.30 hrs.

Transaction Channel: Krungsri Asset Management,Online Service,AGENT

Asset Allocation (30 Jan 2026)

| Fixed Income Instruments issued by Bank of Thailand | 98.83% |

| Deposits and Fixed Income Instruments issued by Financial Institutions | 0.87% |

| Other Assets | 0.52% |

| Other Liabilities | -0.22% |

Top Five Issuers/Guarantors (30 Jan 2026)

| Bank of Thailand | 98.83% |

| United Overseas Bank (Thai) Plc. | 0.87% |

Top Five Securities

| Security Code | Issue / Issuer Rating | % of NAV |

|---|---|---|

| Bank of Thailand Bond 47/91/2025 | - | 10.85% |

| Bank of Thailand Bond 46/91/2025 | - | 10.33% |

| Bank of Thailand Bond 51/91/2025 | - | 10.32% |

| Bank of Thailand Bond 2/91/2026 | - | 8.54% |

| Bank of Thailand Bond 45/91/2025 | - | 8.27% |

Super Savings Fund (SSF)

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

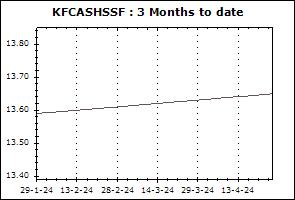

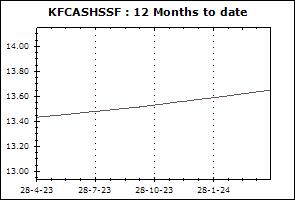

| Krungsri Cash Management-SSF (KFCASHSSF) | +0.21% | +0.47% | +0.07% | +1.19% | +1.49% | +1.00% | N/A | +0.88% | 586 |

| Benchmark(4) | +0.23% | +0.50% | +0.07% | +1.17% | +1.38% | +0.99% | N/A | +0.91% | |

| Standard Deviation of Fund | +0.03% | +0.04% | +0.04% | +0.05% | +0.07% | +0.07% | N/A | +0.06% | |

| Standard Deviation of Benchmark | +0.03% | +0.02% | +0.03% | +0.02% | +0.02% | +0.02% | N/A | +0.02% | |

| Krungsri Active Fixed Income-SSF (KFAFIXSSF) | -0.01% | -0.17% | -0.50% | +2.79% | +2.77% | +2.03% | N/A | +1.98% | 1,049 |

| Benchmark(5) | +0.32% | +0.40% | -0.35% | +3.24% | +2.61% | +1.62% | N/A | +1.67% | |

| Standard Deviation of Fund | +0.77% | +1.01% | +0.87% | +0.92% | +0.69% | +0.81% | N/A | +0.83% | |

| Standard Deviation of Benchmark | +0.76% | +0.85% | +0.84% | +0.80% | +0.73% | +0.95% | N/A | +0.94% | |

| Krungsri Happy Life-SSF (KFHAPPYSSF) | +0.86% | +1.55% | +0.18% | +3.66% | +1.64% | +1.34% | N/A | +1.65% | 213 |

| Benchmark(6) | +0.60% | +2.09% | +1.01% | +2.70% | +0.69% | +1.20% | N/A | +2.23% | |

| Standard Deviation of Fund | +1.86% | +2.03% | +2.05% | +2.51% | +2.20% | +2.11% | N/A | +2.36% | |

| Standard Deviation of Benchmark | +2.36% | +2.32% | +2.69% | +2.88% | +2.29% | +2.12% | N/A | +2.38% | |

| Krungsri The One Mild SSF (KF1MILDSSF) | +1.46% | +3.73% | +1.02% | +4.64% | N/A | N/A | N/A | +3.58% | 14 |

| Benchmark(7) | +1.94% | +5.14% | +1.44% | +8.29% | N/A | N/A | N/A | +7.76% | |

| Standard Deviation of Fund | +2.85% | +2.75% | +3.28% | +3.69% | N/A | N/A | N/A | +3.48% | |

| Standard Deviation of Benchmark | +2.80% | +2.79% | +2.93% | +3.65% | N/A | N/A | N/A | +3.06% | |

| Krungsri The One Mean SSF (KF1MEANSSF) | +1.35% | +3.95% | +1.14% | +3.92% | N/A | N/A | N/A | +3.07% | 7 |

| Benchmark(8) | +2.33% | +7.23% | +2.15% | +10.56% | N/A | N/A | N/A | +9.83% | |

| Standard Deviation of Fund | +3.88% | +3.87% | +4.06% | +5.60% | N/A | N/A | N/A | +5.01% | |

| Standard Deviation of Benchmark | +4.53% | +4.60% | +4.89% | +6.31% | N/A | N/A | N/A | +5.30% | |

| Krungsri The One Max SSF (KF1MAXSSF) | +1.66% | +5.22% | +1.40% | +5.38% | N/A | N/A | N/A | +4.14% | 10 |

| Benchmark(9) | +3.53% | +10.92% | +3.24% | +15.49% | N/A | N/A | N/A | +14.72% | |

| Standard Deviation of Fund | +5.21% | +5.20% | +5.19% | +7.47% | N/A | N/A | N/A | +6.60% | |

| Standard Deviation of Benchmark | +6.75% | +6.99% | +7.10% | +9.92% | N/A | N/A | N/A | +8.29% | |

| Krungsri Enhanced SET50-SSF (KFENS50SSF) | +3.08% | +8.38% | +5.62% | +5.83% | -2.67% | +0.69% | N/A | +4.92% | 727 |

| SET50 TRI | +3.91% | +9.95% | +5.62% | +7.71% | -0.51% | +2.39% | N/A | +5.77% | |

| Standard Deviation of Fund | +14.41% | +14.51% | +15.28% | +19.78% | +15.47% | +14.17% | N/A | +16.30% | |

| Standard Deviation of Benchmark | +13.94% | +13.99% | +14.95% | +19.25% | +15.10% | +13.88% | N/A | +15.92% | |

| Krungsri Dividend Stock SSF (KFDIVSSF) | +2.10% | +5.35% | +3.96% | +0.77% | -6.51% | -2.64% | N/A | -2.21% | 547 |

| SET TRI | +1.56% | +8.28% | +5.24% | +5.39% | -4.08% | +1.25% | N/A | +3.67% | |

| Standard Deviation of Fund | +11.13% | +11.53% | +12.20% | +16.16% | +13.42% | +12.54% | N/A | +13.23% | |

| Standard Deviation of Benchmark | +14.70% | +14.20% | +16.58% | +17.92% | +14.12% | +13.00% | N/A | +13.94% | |

| Krungsri SET100-SSF (KFS100SSF) | +3.14% | +9.02% | +5.52% | +6.57% | -2.53% | +1.21% | N/A | +2.78% | 594 |

| SET100 TRI | +3.48% | +9.60% | +5.37% | +7.09% | -2.30% | +1.39% | N/A | +2.97% | |

| Standard Deviation of Fund | +14.40% | +14.25% | +15.63% | +19.25% | +15.07% | +13.75% | N/A | +14.72% | |

| Standard Deviation of Benchmark | +14.22% | +14.19% | +15.40% | +19.27% | +15.15% | +13.85% | N/A | +14.79% | |

| Tracking Difference (TD) | N/A | N/A | N/A | -0.52% | N/A | N/A | N/A | N/A | |

| Tracking Error (TE) | N/A | N/A | N/A | +2.00% | N/A | N/A | N/A | N/A | |

| Krungsri Global Core Allocation SSF (KFCORESSF) | +1.75% | +7.58% | +1.66% | +8.23% | N/A | N/A | N/A | +8.03% | 29 |

| Standard Deviation of Fund | +7.64% | +7.14% | +6.09% | +8.53% | N/A | N/A | N/A | +7.72% | |

| Krungsri Global Brands Equity Dividend SSF (KFGBRANSSF) | -4.47% | -10.81% | -4.29% | -11.95% | +1.19% | +1.25% | N/A | +3.39% | 1,825 |

| Benchmark(10) | -6.15% | -12.40% | -4.36% | -14.32% | +3.99% | +5.65% | N/A | +6.32% | |

| Standard Deviation of Fund | +10.15% | +9.75% | +12.71% | +12.68% | +11.55% | +14.23% | N/A | +14.42% | |

| Standard Deviation of Benchmark | +11.37% | +11.69% | +12.43% | +15.68% | +13.55% | +14.96% | N/A | +15.15% | |

| Krungsri China A Shares Equity SSF (KF-ACHINASSF) | +0.12% | +5.79% | -0.21% | +12.41% | -4.62% | -11.53% | N/A | -10.58% | 396 |

| Benchmark(10) | -1.74% | +3.94% | -0.22% | +9.22% | -2.55% | -8.01% | N/A | -6.86% | |

| Standard Deviation of Fund | +10.56% | +11.59% | +11.91% | +12.03% | +15.18% | +19.13% | N/A | +19.21% | |

| Standard Deviation of Benchmark | +11.33% | +12.88% | +12.74% | +13.51% | +16.56% | +19.86% | N/A | +19.95% | |

| Krungsri US Equity SSF (KFUSSSF) | +4.42% | -0.14% | +1.42% | -14.66% | +8.22% | N/A | N/A | -12.10% | 88 |

| Benchmark(10) | +2.79% | -1.59% | +1.55% | -16.91% | +11.65% | N/A | N/A | -9.24% | |

| Standard Deviation of Fund | +9.55% | +9.37% | +9.75% | +13.66% | +21.92% | N/A | N/A | +33.33% | |

| Standard Deviation of Benchmark | +11.73% | +11.77% | +13.69% | +15.19% | +22.71% | N/A | N/A | +33.19% | |

| Krungsri Next Generation Infrastructure SSF (KFINFRASSF) | +5.92% | +4.11% | +4.28% | +11.87% | +5.13% | N/A | N/A | +0.47% | 46 |

| Benchmark(11) | +7.59% | +6.96% | +4.90% | +17.89% | +10.37% | N/A | N/A | +5.40% | |

| Standard Deviation of Fund | +7.48% | +7.77% | +7.59% | +11.58% | +11.56% | N/A | N/A | +13.75% | |

| Standard Deviation of Benchmark | +7.65% | +7.89% | +7.97% | +11.93% | +11.89% | N/A | N/A | +14.13% | |

| Krungsri ESG Climate Tech SSF (KFCLIMASSF) | +1.11% | +5.46% | +3.93% | +17.73% | +4.81% | N/A | N/A | -1.49% | 75 |

| Standard Deviation of Fund | +15.51% | +14.37% | +12.13% | +17.28% | +16.11% | N/A | N/A | +19.03% | |

| Krungsri Global Growth SSF (KFGGSSF) | -10.28% | -5.20% | -4.15% | -0.97% | +13.56% | N/A | N/A | -4.37% | 981 |

| Benchmark(11) | -9.34% | -2.92% | -3.86% | +4.09% | +19.62% | N/A | N/A | +0.52% | |

| Standard Deviation of Fund | +18.79% | +17.06% | +16.99% | +22.76% | +21.27% | N/A | N/A | +28.76% | |

| Standard Deviation of Benchmark | +20.44% | +18.51% | +18.40% | +26.40% | +22.95% | N/A | N/A | +30.12% | |

| Krungsri China Megatrends SSF (KFCMEGASSF) | -4.49% | +2.86% | +1.56% | +12.37% | -4.49% | N/A | N/A | -3.16% | 62 |

| Benchmark(12) | -1.29% | +7.88% | +4.25% | +28.27% | +7.19% | N/A | N/A | +6.67% | |

| Standard Deviation of Fund | +18.27% | +20.91% | +24.39% | +27.10% | +29.53% | N/A | N/A | +30.20% | |

| Standard Deviation of Benchmark | +15.75% | +16.71% | +14.93% | +22.96% | +22.30% | N/A | N/A | +23.53% | |

| Krungsri Equity Sustainable Global Growth SSF (KFESGSSF) | -4.47% | -1.53% | -0.51% | -1.73% | +2.12% | N/A | N/A | +2.93% | 35 |

| Benchmark(11) | -3.23% | +1.02% | -0.09% | +3.38% | +7.36% | N/A | N/A | +8.24% | |

| Standard Deviation of Fund | +12.33% | +12.39% | +10.85% | +18.63% | +15.26% | N/A | N/A | +16.38% | |

| Standard Deviation of Benchmark | +12.90% | +12.70% | +11.81% | +18.55% | +15.48% | N/A | N/A | +16.86% | |

| Krungsri Vietnam Equity SSF (KFVIETSSF) | +6.74% | +13.78% | +5.05% | +16.72% | +5.63% | N/A | N/A | +1.18% | 189 |

| Benchmark(13) | +6.27% | +22.87% | +1.98% | +39.66% | +18.13% | N/A | N/A | +8.87% | |

| Standard Deviation of Fund | +18.28% | +19.40% | +14.25% | +20.49% | +16.79% | N/A | N/A | +17.44% | |

| Standard Deviation of Benchmark | +20.37% | +24.07% | +19.04% | +24.45% | +20.39% | N/A | N/A | +22.69% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri SET100-SSFX (KFS100SSFX) | +3.14% | +9.02% | +5.52% | +6.57% | -2.53% | +1.21% | N/A | +3.28% | 1,442 |

| SET100 TRI | +3.48% | +9.60% | +5.37% | +7.09% | -2.30% | +1.39% | N/A | +3.99% | |

| Standard Deviation of Fund | +14.40% | +14.25% | +15.63% | +19.25% | +15.07% | +13.75% | N/A | +15.20% | |

| Standard Deviation of Benchmark | +14.22% | +14.19% | +15.40% | +19.27% | +15.15% | +13.85% | N/A | +15.31% | |

| Tracking Difference (TD) | N/A | N/A | N/A | -0.52% | N/A | N/A | N/A | N/A | |

| Tracking Error (TE) | N/A | N/A | N/A | +2.00% | N/A | N/A | N/A | N/A | |

Remark