Fund Type

Super Savings Fund (Equity Fund)

Dividend Policy

Dividends shall be paid when the Fund has retained earnings and such dividend payment shall not result in the Fund incurring retained losses during the accounting period for which the dividends are paid out. In the event that the dividend payment is less than 0.25 baht per unit, the Fund reserves the right not to pay. For further detail pertaining to dividend payment, please study Fund Prospectus and Fund Project and Commitment.

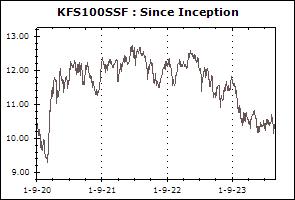

Inception Date

1 September 2020

Investment Policy

The Fund shall invest at least 80% of NAV in average of fund accounting year in shares listed on the Stock Exchange of Thailand that are constituents of the SET100 Index, in order to enable the Fund to track investment returns of SET100 Total Return Index (SET100 TRI). The Management Company will endeavor to keep the tracking error (TE) of the Fund not greater than 1.00% per annum. If the TE exceeds the specified limit, the Management Company will endeavor to bring it down to below 1.00% per annum.

Fund Manager

Kavin Riensavapak, Thalit Choktippattana

Asset Allocation

-

Transaction Details

Minimum Purchase Amount (Baht): 500

Minimum Redemption Amount (Unit): Not specific

Proceeds Payment Period: Within 3 business days after the redemption date (T+3)

Fund Subscription Period: Every dealing date of the fund by 15.30 hrs.

Fund Redemption Period: Every dealing date of the fund by 15.30 hrs.

Transaction Channel: Krungsri Asset Management,Online Service,AGENT

Top Five Sectors (30 Jan 2026)

| Energy & Utilities | 23.41% |

| Banking | 14.35% |

| Electronic Components | 12.23% |

| Information & Communication Technology | 11.70% |

| Transportation & Logistics | 7.63% |

Top Five Holdings (30 Jan 2026)

| Delta Electronics (Thailand) Plc. | 11.39% |

| Advanced Info Service Plc. | 8.40% |

| PTT Plc. | 7.71% |

| Airport of Thailand Plc. | 5.84% |

| Gulf Development Plc. | 5.73% |

Dividend Payment History (Last 4 times or last 5 years)

(Note : Paid 4 times, totalling 1.0000 Baht.)

(Note : Paid 4 times, totalling 1.0000 Baht.)

| 24 May 2024 | 0.1000 Bt./unit |

| 23 May 2023 | 0.2500 Bt./unit |

| 25 May 2022 | 0.3000 Bt./unit |

| 25 May 2021 | 0.3500 Bt./unit |

Super Savings Fund (SSF)

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Cash Management-SSF (KFCASHSSF) | +0.21% | +0.47% | +0.07% | +1.19% | +1.49% | +1.00% | N/A | +0.88% | 586 |

| Benchmark(4) | +0.23% | +0.50% | +0.07% | +1.17% | +1.38% | +0.99% | N/A | +0.91% | |

| Standard Deviation of Fund | +0.03% | +0.04% | +0.04% | +0.05% | +0.07% | +0.07% | N/A | +0.06% | |

| Standard Deviation of Benchmark | +0.03% | +0.02% | +0.03% | +0.02% | +0.02% | +0.02% | N/A | +0.02% | |

| Krungsri Active Fixed Income-SSF (KFAFIXSSF) | -0.01% | -0.17% | -0.50% | +2.79% | +2.77% | +2.03% | N/A | +1.98% | 1,049 |

| Benchmark(5) | +0.32% | +0.40% | -0.35% | +3.24% | +2.61% | +1.62% | N/A | +1.67% | |

| Standard Deviation of Fund | +0.77% | +1.01% | +0.87% | +0.92% | +0.69% | +0.81% | N/A | +0.83% | |

| Standard Deviation of Benchmark | +0.76% | +0.85% | +0.84% | +0.80% | +0.73% | +0.95% | N/A | +0.94% | |

| Krungsri Happy Life-SSF (KFHAPPYSSF) | +0.86% | +1.55% | +0.18% | +3.66% | +1.64% | +1.34% | N/A | +1.65% | 213 |

| Benchmark(6) | +0.60% | +2.09% | +1.01% | +2.70% | +0.69% | +1.20% | N/A | +2.23% | |

| Standard Deviation of Fund | +1.86% | +2.03% | +2.05% | +2.51% | +2.20% | +2.11% | N/A | +2.36% | |

| Standard Deviation of Benchmark | +2.36% | +2.32% | +2.69% | +2.88% | +2.29% | +2.12% | N/A | +2.38% | |

| Krungsri The One Mild SSF (KF1MILDSSF) | +1.46% | +3.73% | +1.02% | +4.64% | N/A | N/A | N/A | +3.58% | 14 |

| Benchmark(7) | +1.94% | +5.14% | +1.44% | +8.29% | N/A | N/A | N/A | +7.76% | |

| Standard Deviation of Fund | +2.85% | +2.75% | +3.28% | +3.69% | N/A | N/A | N/A | +3.48% | |

| Standard Deviation of Benchmark | +2.80% | +2.79% | +2.93% | +3.65% | N/A | N/A | N/A | +3.06% | |

| Krungsri The One Mean SSF (KF1MEANSSF) | +1.35% | +3.95% | +1.14% | +3.92% | N/A | N/A | N/A | +3.07% | 7 |

| Benchmark(8) | +2.33% | +7.23% | +2.15% | +10.56% | N/A | N/A | N/A | +9.83% | |

| Standard Deviation of Fund | +3.88% | +3.87% | +4.06% | +5.60% | N/A | N/A | N/A | +5.01% | |

| Standard Deviation of Benchmark | +4.53% | +4.60% | +4.89% | +6.31% | N/A | N/A | N/A | +5.30% | |

| Krungsri The One Max SSF (KF1MAXSSF) | +1.66% | +5.22% | +1.40% | +5.38% | N/A | N/A | N/A | +4.14% | 10 |

| Benchmark(9) | +3.53% | +10.92% | +3.24% | +15.49% | N/A | N/A | N/A | +14.72% | |

| Standard Deviation of Fund | +5.21% | +5.20% | +5.19% | +7.47% | N/A | N/A | N/A | +6.60% | |

| Standard Deviation of Benchmark | +6.75% | +6.99% | +7.10% | +9.92% | N/A | N/A | N/A | +8.29% | |

| Krungsri Enhanced SET50-SSF (KFENS50SSF) | +3.08% | +8.38% | +5.62% | +5.83% | -2.67% | +0.69% | N/A | +4.92% | 727 |

| SET50 TRI | +3.91% | +9.95% | +5.62% | +7.71% | -0.51% | +2.39% | N/A | +5.77% | |

| Standard Deviation of Fund | +14.41% | +14.51% | +15.28% | +19.78% | +15.47% | +14.17% | N/A | +16.30% | |

| Standard Deviation of Benchmark | +13.94% | +13.99% | +14.95% | +19.25% | +15.10% | +13.88% | N/A | +15.92% | |

| Krungsri Dividend Stock SSF (KFDIVSSF) | +2.10% | +5.35% | +3.96% | +0.77% | -6.51% | -2.64% | N/A | -2.21% | 547 |

| SET TRI | +1.56% | +8.28% | +5.24% | +5.39% | -4.08% | +1.25% | N/A | +3.67% | |

| Standard Deviation of Fund | +11.13% | +11.53% | +12.20% | +16.16% | +13.42% | +12.54% | N/A | +13.23% | |

| Standard Deviation of Benchmark | +14.70% | +14.20% | +16.58% | +17.92% | +14.12% | +13.00% | N/A | +13.94% | |

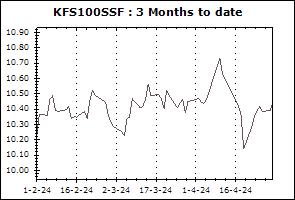

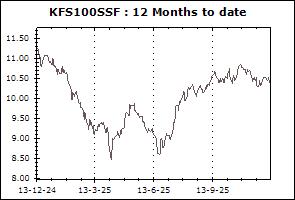

| Krungsri SET100-SSF (KFS100SSF) | +3.14% | +9.02% | +5.52% | +6.57% | -2.53% | +1.21% | N/A | +2.78% | 594 |

| SET100 TRI | +3.48% | +9.60% | +5.37% | +7.09% | -2.30% | +1.39% | N/A | +2.97% | |

| Standard Deviation of Fund | +14.40% | +14.25% | +15.63% | +19.25% | +15.07% | +13.75% | N/A | +14.72% | |

| Standard Deviation of Benchmark | +14.22% | +14.19% | +15.40% | +19.27% | +15.15% | +13.85% | N/A | +14.79% | |

| Tracking Difference (TD) | N/A | N/A | N/A | -0.52% | N/A | N/A | N/A | N/A | |

| Tracking Error (TE) | N/A | N/A | N/A | +2.00% | N/A | N/A | N/A | N/A | |

| Krungsri Global Core Allocation SSF (KFCORESSF) | +1.75% | +7.58% | +1.66% | +8.23% | N/A | N/A | N/A | +8.03% | 29 |

| Standard Deviation of Fund | +7.64% | +7.14% | +6.09% | +8.53% | N/A | N/A | N/A | +7.72% | |

| Krungsri Global Brands Equity Dividend SSF (KFGBRANSSF) | -4.47% | -10.81% | -4.29% | -11.95% | +1.19% | +1.25% | N/A | +3.39% | 1,825 |

| Benchmark(10) | -6.15% | -12.40% | -4.36% | -14.32% | +3.99% | +5.65% | N/A | +6.32% | |

| Standard Deviation of Fund | +10.15% | +9.75% | +12.71% | +12.68% | +11.55% | +14.23% | N/A | +14.42% | |

| Standard Deviation of Benchmark | +11.37% | +11.69% | +12.43% | +15.68% | +13.55% | +14.96% | N/A | +15.15% | |

| Krungsri China A Shares Equity SSF (KF-ACHINASSF) | +0.12% | +5.79% | -0.21% | +12.41% | -4.62% | -11.53% | N/A | -10.58% | 396 |

| Benchmark(10) | -1.74% | +3.94% | -0.22% | +9.22% | -2.55% | -8.01% | N/A | -6.86% | |

| Standard Deviation of Fund | +10.56% | +11.59% | +11.91% | +12.03% | +15.18% | +19.13% | N/A | +19.21% | |

| Standard Deviation of Benchmark | +11.33% | +12.88% | +12.74% | +13.51% | +16.56% | +19.86% | N/A | +19.95% | |

| Krungsri US Equity SSF (KFUSSSF) | +4.42% | -0.14% | +1.42% | -14.66% | +8.22% | N/A | N/A | -12.10% | 88 |

| Benchmark(10) | +2.79% | -1.59% | +1.55% | -16.91% | +11.65% | N/A | N/A | -9.24% | |

| Standard Deviation of Fund | +9.55% | +9.37% | +9.75% | +13.66% | +21.92% | N/A | N/A | +33.33% | |

| Standard Deviation of Benchmark | +11.73% | +11.77% | +13.69% | +15.19% | +22.71% | N/A | N/A | +33.19% | |

| Krungsri Next Generation Infrastructure SSF (KFINFRASSF) | +5.92% | +4.11% | +4.28% | +11.87% | +5.13% | N/A | N/A | +0.47% | 46 |

| Benchmark(11) | +7.59% | +6.96% | +4.90% | +17.89% | +10.37% | N/A | N/A | +5.40% | |

| Standard Deviation of Fund | +7.48% | +7.77% | +7.59% | +11.58% | +11.56% | N/A | N/A | +13.75% | |

| Standard Deviation of Benchmark | +7.65% | +7.89% | +7.97% | +11.93% | +11.89% | N/A | N/A | +14.13% | |

| Krungsri ESG Climate Tech SSF (KFCLIMASSF) | +1.11% | +5.46% | +3.93% | +17.73% | +4.81% | N/A | N/A | -1.49% | 75 |

| Standard Deviation of Fund | +15.51% | +14.37% | +12.13% | +17.28% | +16.11% | N/A | N/A | +19.03% | |

| Krungsri Global Growth SSF (KFGGSSF) | -10.28% | -5.20% | -4.15% | -0.97% | +13.56% | N/A | N/A | -4.37% | 981 |

| Benchmark(11) | -9.34% | -2.92% | -3.86% | +4.09% | +19.62% | N/A | N/A | +0.52% | |

| Standard Deviation of Fund | +18.79% | +17.06% | +16.99% | +22.76% | +21.27% | N/A | N/A | +28.76% | |

| Standard Deviation of Benchmark | +20.44% | +18.51% | +18.40% | +26.40% | +22.95% | N/A | N/A | +30.12% | |

| Krungsri China Megatrends SSF (KFCMEGASSF) | -4.49% | +2.86% | +1.56% | +12.37% | -4.49% | N/A | N/A | -3.16% | 62 |

| Benchmark(12) | -1.29% | +7.88% | +4.25% | +28.27% | +7.19% | N/A | N/A | +6.67% | |

| Standard Deviation of Fund | +18.27% | +20.91% | +24.39% | +27.10% | +29.53% | N/A | N/A | +30.20% | |

| Standard Deviation of Benchmark | +15.75% | +16.71% | +14.93% | +22.96% | +22.30% | N/A | N/A | +23.53% | |

| Krungsri Equity Sustainable Global Growth SSF (KFESGSSF) | -4.47% | -1.53% | -0.51% | -1.73% | +2.12% | N/A | N/A | +2.93% | 35 |

| Benchmark(11) | -3.23% | +1.02% | -0.09% | +3.38% | +7.36% | N/A | N/A | +8.24% | |

| Standard Deviation of Fund | +12.33% | +12.39% | +10.85% | +18.63% | +15.26% | N/A | N/A | +16.38% | |

| Standard Deviation of Benchmark | +12.90% | +12.70% | +11.81% | +18.55% | +15.48% | N/A | N/A | +16.86% | |

| Krungsri Vietnam Equity SSF (KFVIETSSF) | +6.74% | +13.78% | +5.05% | +16.72% | +5.63% | N/A | N/A | +1.18% | 189 |

| Benchmark(13) | +6.27% | +22.87% | +1.98% | +39.66% | +18.13% | N/A | N/A | +8.87% | |

| Standard Deviation of Fund | +18.28% | +19.40% | +14.25% | +20.49% | +16.79% | N/A | N/A | +17.44% | |

| Standard Deviation of Benchmark | +20.37% | +24.07% | +19.04% | +24.45% | +20.39% | N/A | N/A | +22.69% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri SET100-SSFX (KFS100SSFX) | +3.14% | +9.02% | +5.52% | +6.57% | -2.53% | +1.21% | N/A | +3.28% | 1,442 |

| SET100 TRI | +3.48% | +9.60% | +5.37% | +7.09% | -2.30% | +1.39% | N/A | +3.99% | |

| Standard Deviation of Fund | +14.40% | +14.25% | +15.63% | +19.25% | +15.07% | +13.75% | N/A | +15.20% | |

| Standard Deviation of Benchmark | +14.22% | +14.19% | +15.40% | +19.27% | +15.15% | +13.85% | N/A | +15.31% | |

| Tracking Difference (TD) | N/A | N/A | N/A | -0.52% | N/A | N/A | N/A | N/A | |

| Tracking Error (TE) | N/A | N/A | N/A | +2.00% | N/A | N/A | N/A | N/A | |

Remark