Online Fund Account Opening

In this regard, there are three channels for identity verification you can select as follows:

1. NDID platform through mobile banking applications of banks providing NDID services

2. Krungsi i-CONFIRM service area

3. 7-Eleven’s Counter Service

See more details, click here

| To open online fund account, you can either click link or QR code shown below: |

|---|

| https://krungsriasset.onelink.me/RUCv/ha5dlgwf |

.aspx) |

1. Acknowledge and accept privacy notice. Then, accept service terms & conditions and perform identity authentication via mobile/ OTP. (Please prepare following documents: ID card, 1st page of book bank, or Digital Banking screen specifying name and account number)

For those who never has a fund account with Krungsri Asset Management before, please download @ccess Mobile Application from the App Store or Google Play.

2. Check FATCA status and fill out the form of DOPA with the Citizen ID Card information.

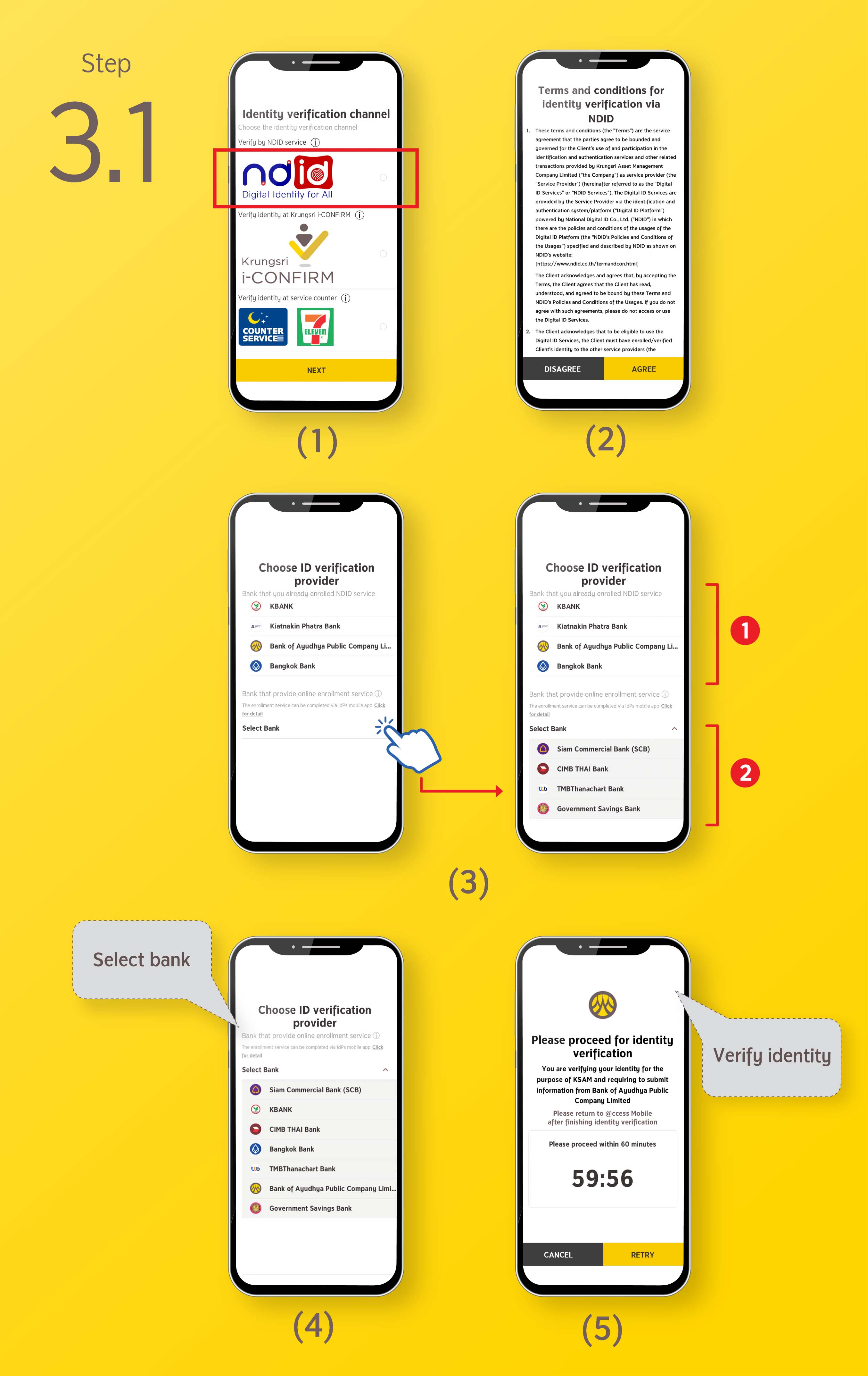

3. When opening the fund account for the 1st time, you must perform an identity verification through three available channels as follows:

3.1 Identity verification through National Digital ID: Select the bank with which you have performed identity verification, which must be done through mobile banking application of the chosen bank within 60 minutes before getting back to proceed with the next step.

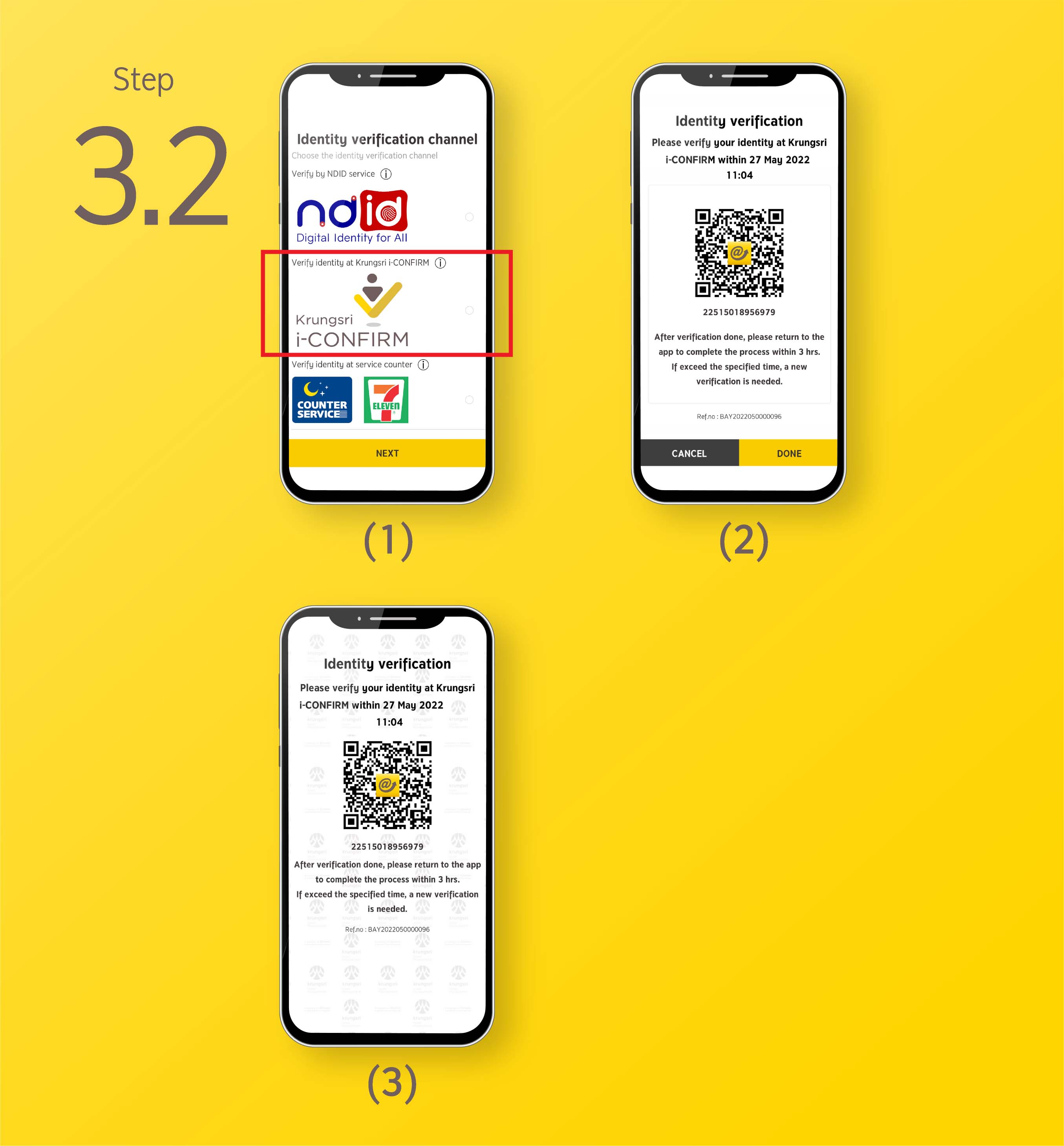

3.2. Krungsri i-CONFIRM

Once selecting the Krungsri i-CONFIRM service, you will receive QR code which you must bring along with ID card at the service point and proceed with identity verification steps to open Krungsri Asset fund account. Then, you can complete identity verification.

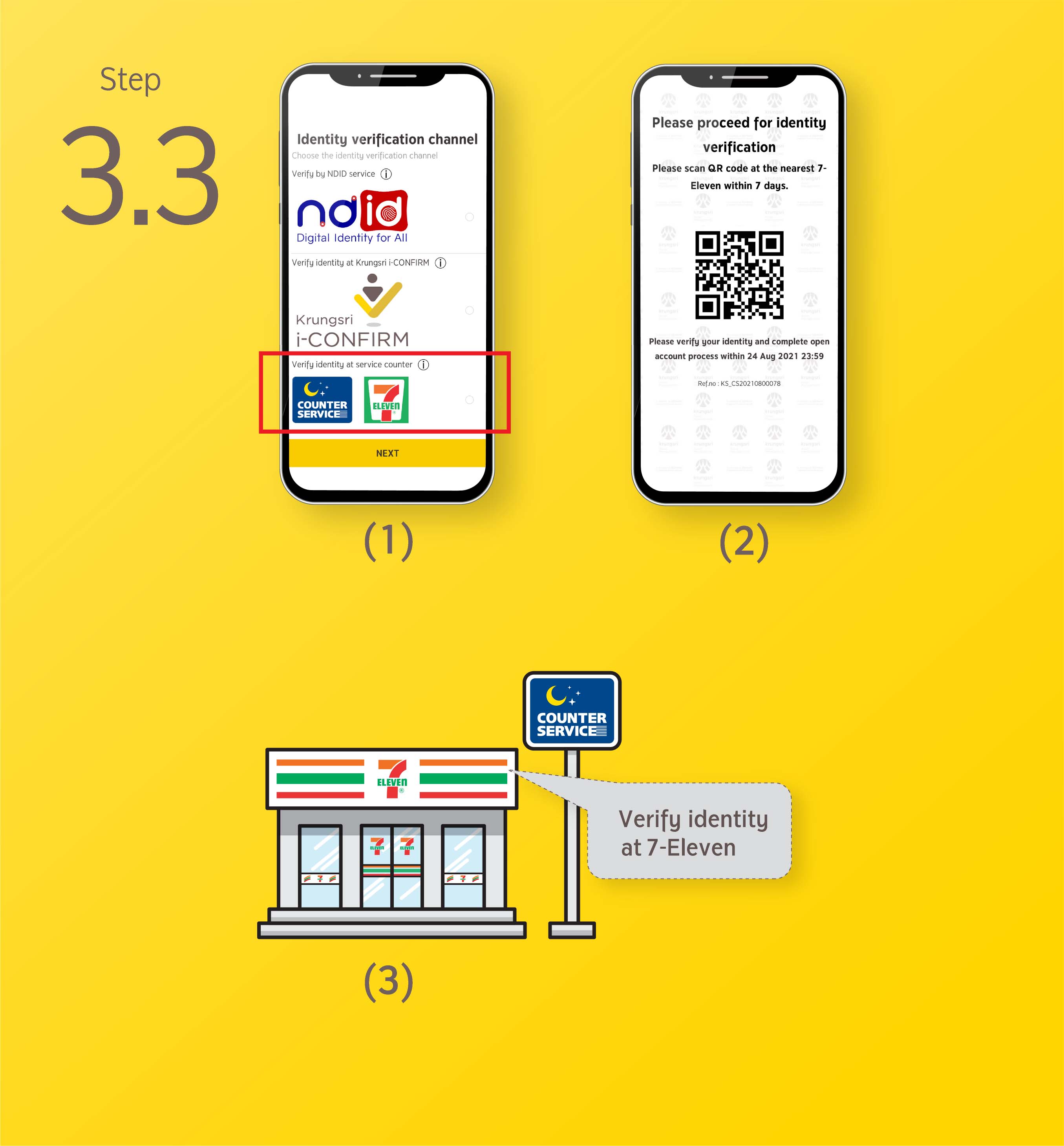

3.3 Identity verification at Counter Service in 7-Eleven stores nationwide*

Once selecting the Counter Service as your channel, you will receive the QR code for scanning at the service point where you can show your ID card and inform staff that you would like to perform Krungsri Asset fund account. Then, you can complete identity verification.

*Please see the branches that do not provide the service from FAQ, click here.

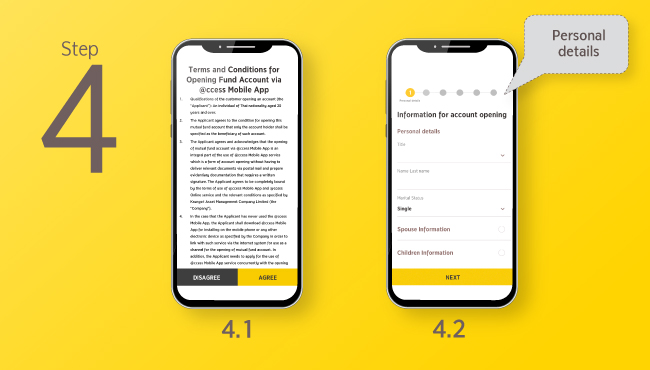

4. Upon authentication completion, the system will bring you to enter the information required* for account opening.

(*Personal information, work information, contact information, risk assessment questionnaire, and bank account for receiving redemption proceeds)

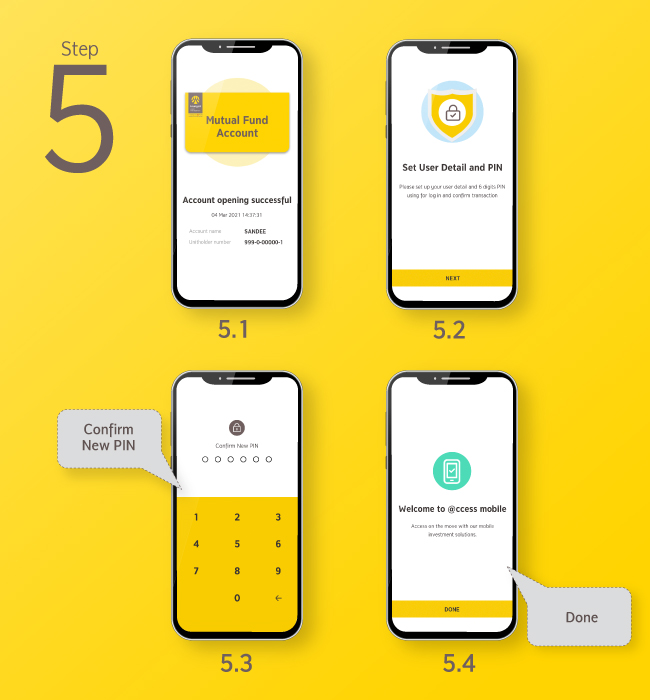

5. After entering the required information for account opening, please confirm the filled in information, as well as, set username, password, and the 6-digit PIN to start using the Mobile Application.

Let's get started with @ccess Mobile, click.

1. Identity verification through NDID of each bank

Currently, there are 10 commercial banks* offering the electronic cross-bank customers’ identity verification via the NDID platform as follows:

- Bangkok Bank Public Company Limited

- Bank of Ayudhya Public Company Limited

- KASIKORNBANK PUBLIC COMPANY LIMITED

- TMB Bank Public Company Limited

- Siam Commercial Bank Public Company Limited

- Kiatnakin Phatra Bank Public Company Limited

- Krungthai Bank Public Company Limited

- CIMB Thai Bank Public Company Limited

- Government Savings Bank

- Government Housing Bank

*Each bank will provide the service within the limited scope according to each bank’s available service hours and channels. For more details, click here (Thai version only)

And one non-bank service provider: Advanced Info Service Public Company Limited (AIS)

For more info, click here. (Thai version only)

2. Identity verification through Krungsri i-CONFIRM

Once selecting the Krungsri i-CONFIRM service in Krungsri Asset @ccess Mobile, you will receive QR code which you must bring along with ID card at the service point to perform identity verification.

3. Identity verification at 7- Eleven’s Counter Service

Once you select 7-Eleven’s Counter Service channel, you will receive the QR code which must be scanned and presented with your national ID card at 7-Eleven stores nationwide* to perform the identity verification.

*except the following branches:

1) Department store/ stores: Major Rangsit, Future Park Rangsit, THAI Shop

2) Airport: Don Mueang International Airport, Suvarnabhumi Airport, Phuket International Airport, Hat Yai International Airport, U-Tapao–Rayong–Pattaya International Airport (PTTOR PCL.))

3) Other branches: Mo Chit 2, Ko Lipe, The Customs Department Parking, Airport link, Ramathibodi Chakri Naruebodindra Hospital, Happy and Healthy Bike Lane

For manual for online account opening, click here