Fund Transaction

SAM - Smart Allocation Model

SAM - Your investment portfolio assistant

SAM - Smart Allocation Model via @ccess mobile of Krungsri Asset Management is designed to provide recommendations, implement asset allocation, and monitor the investment portfolio which is appropriate for the investment goal through an automated system which will compile necessary information of the investor such as investment objective, investment time horizon, initial investment amount, etc., to assess and recommend the investment portfolio that fits the need of each investor.

To access SAM system, click.

See White Paper, click.

See Fund Universe, click.

| To access SAM system, you can either click link or QR code shown below: |

|---|

| SAM outstanding features |

- SAM values every information obtained from investors and processes them into the well-balanced investment portfolio that best suits investment goal of each investor based on more than 70 established portfolios in the system.

- SAM will process the information and make recommendations on the optimized and customized portfolios that have been carefully selected by the system as the best choice of portfolios for the investment goal of each investor taking into consideration the opportunity to generate the potential return according to your target with lowest risk exposure.

- SAM will monitor the investment allocation of investors’ actual portfolio in comparison with the recommended portfolio on a daily basis, and whenever the actual investment weightings deviate significantly above the predetermined threshold, the system will promptly make recommendation for rebalancing. Thus, investors do not have to wait for a routine rebalancing quarterly, semi-annually, or annually.

- Investors can start investing with SAM with an initial investment sum of just 10,000 Baht, and they will have an investment portfolio professionally designed to suit their investment goal with no need to spend lots of time searching for the analytical data to support investment decision, adjust the portfolio or wait for the recommendations from investment consultant. With a minimum outstanding investment amount of only 5,000 Baht in the portfolio, SAM will provide investors with the rebalancing recommendation automatically.

- Investors will be exempted from the Switching Fee* arising from rebalancing of the portfolio as recommended by SAM. Thus, investors will therefore be worry-free about incurring the transaction fees to keep the investment ratio in line with the recommended portfolio.

| How does SAM work |

To access SAM system, click.

See White Paper, click.

See Fund Universe, click.

Log in to SAM services

1. Log in to SAM

3. Viewing portfolio recommendation

4. Start investing

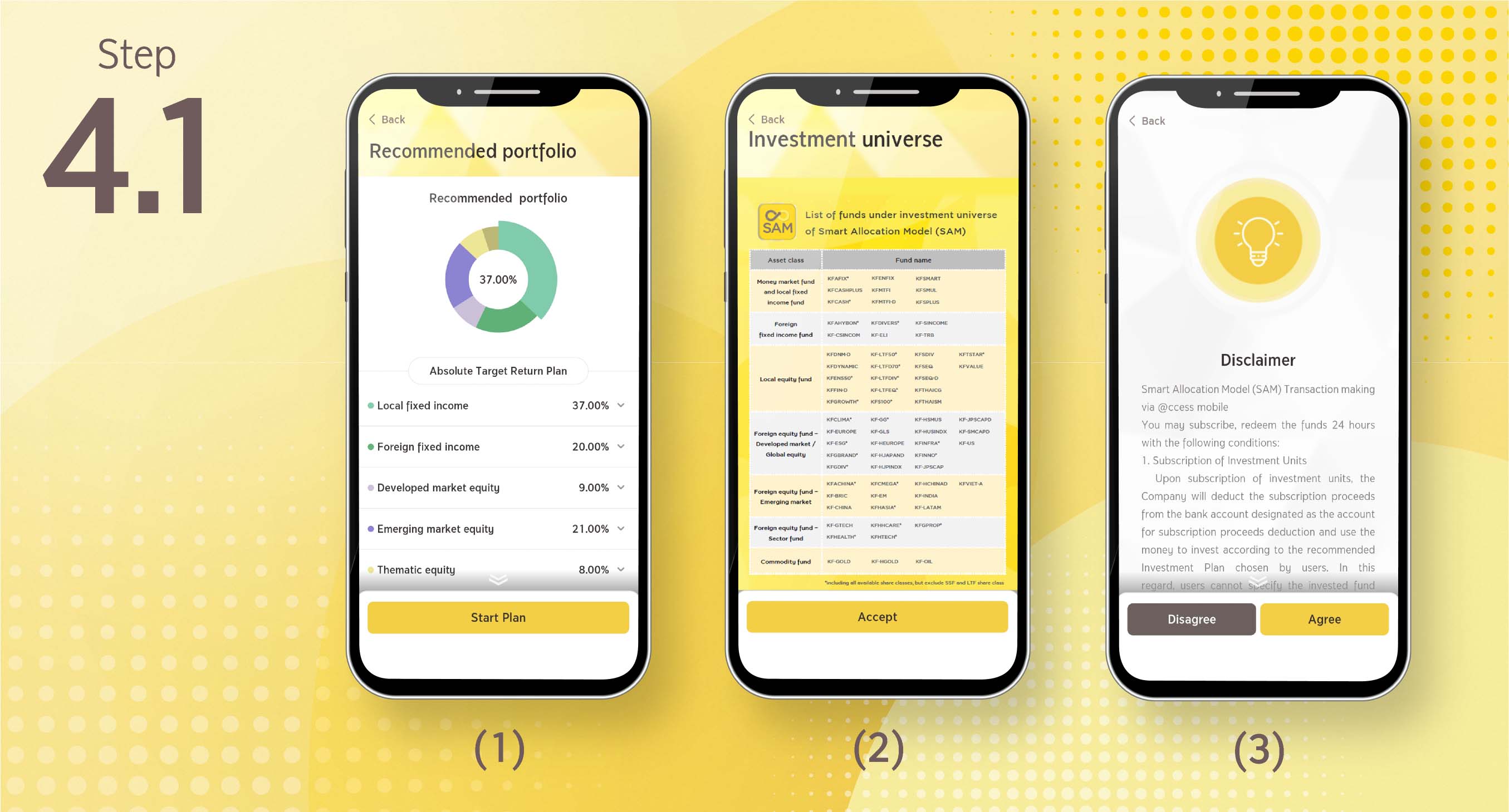

4.1 After the account opening is completed, the system will display the information of your planned investment portfolio. Select “Start Plan”. The system will display the list of funds under Investment Universe and transaction terms and conditions for your acknowledgement.

4.2 The system will take you to the “Subscribe” page, select “Single investment”. The system will display the investment details, then select “Next” and accept associated risks

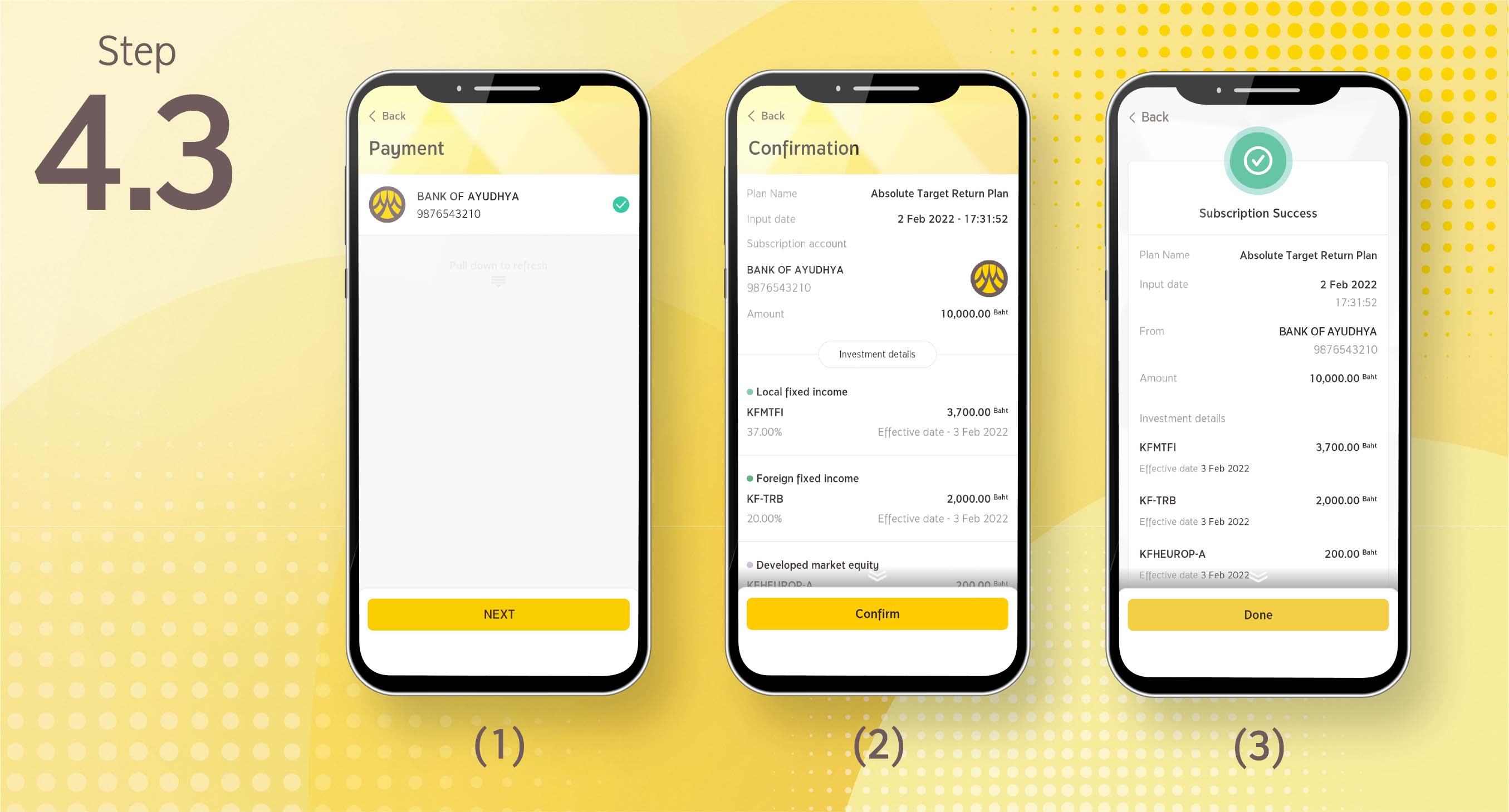

4.3 Select the account for paying the subscription proceeds. (In this process, you have yet to link the account for paying the subscription proceeds, or you can study how to proceed by clicking here. The system will then summarize the information on the “Confirmation” page, please select “Confirm”. The system will display the transaction result and save the transaction slip as evidence on your phone.

5. Rebalancing the Portfolio

Portfolio Rebalancing can happen when the asset allocation of your investment portfolio deviates from the recommended portfolio higher than the specified level, which may be due to:

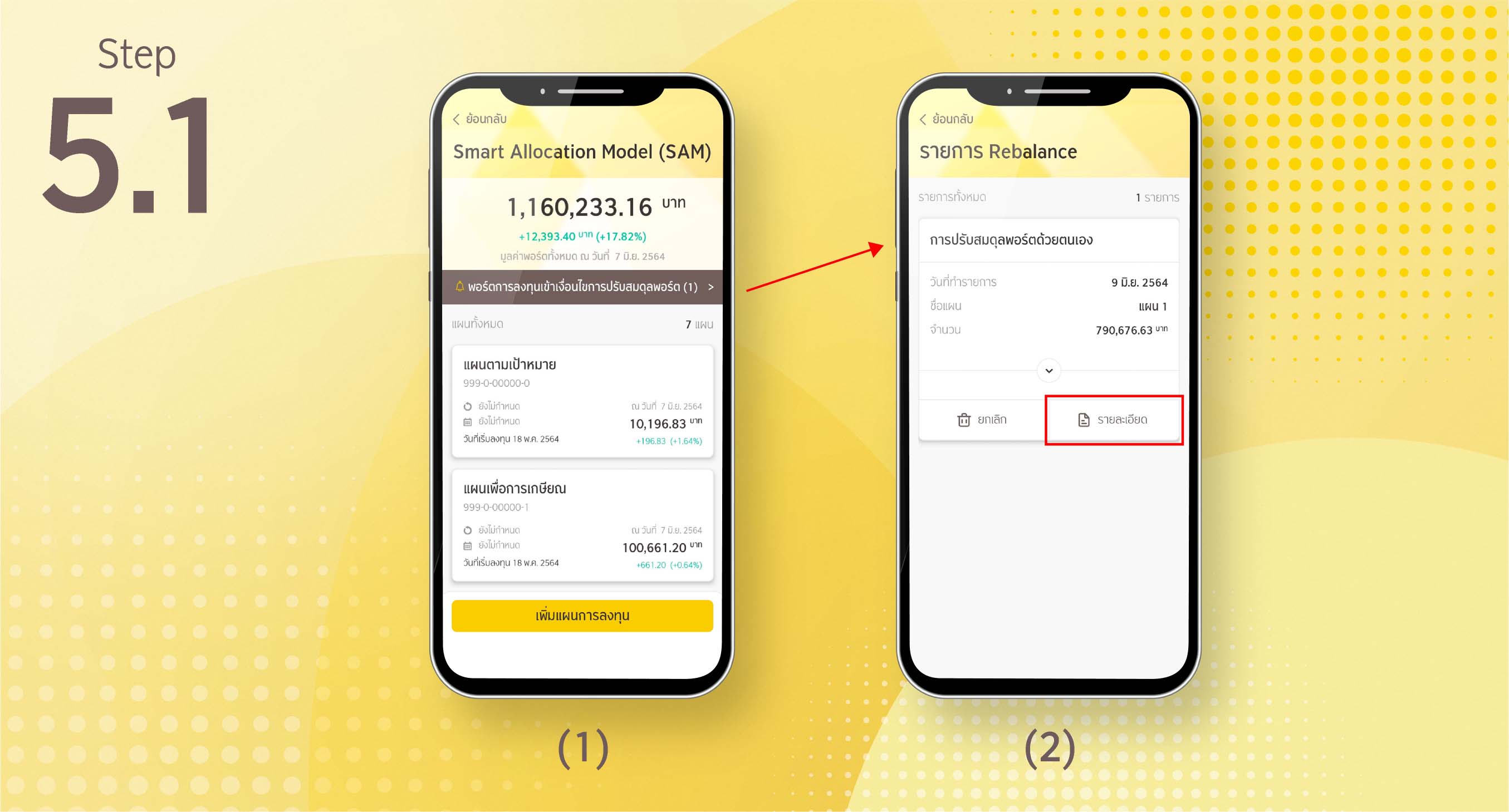

5.1 The system will display the portfolio information that falls under the criteria of portfolio rebalancing, then select “Detail” to proceed

5.2 The system will display all details for you to proceed and acknowledge associated risks and will summarize the information at the Confirmation page where you can select “Confirm” to get the transaction done.

This manual portfolio rebalancing can be proceeded only when you approve after your thorough consideration over the previous and new portfolio weights.

- For new customers: Select SAM banner of SAM on the application’s home page to start using the application instantly.

- For existing customers: Select SAM banner on the application’s home page, or log-in to the application and then select “SAM” menu on main menu page

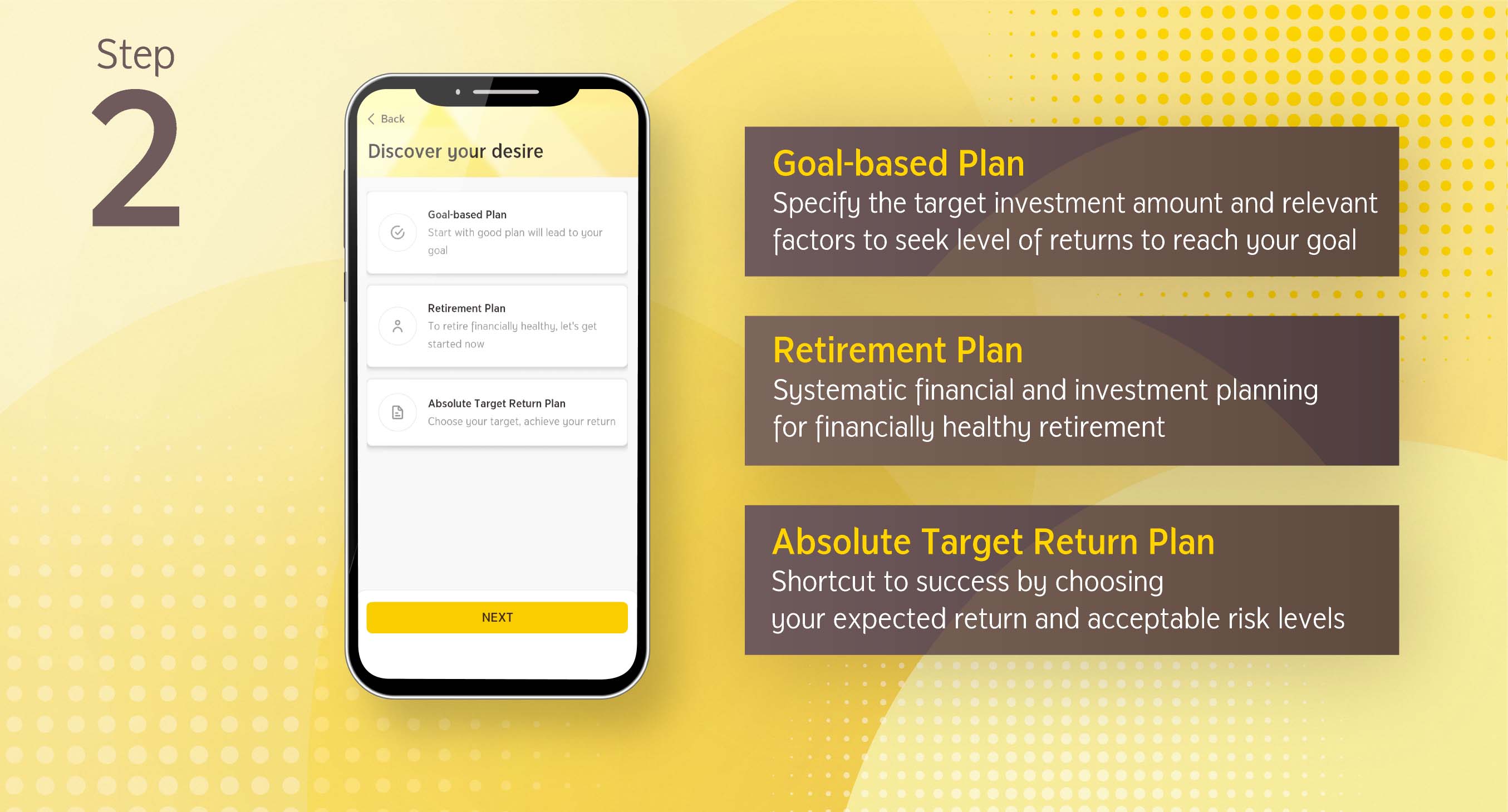

2. Assessing your investment goal

Select the desired type of investment plan. There are three types of investment plans in the system. Then, specify the information in order.

Select the desired type of investment plan. There are three types of investment plans in the system. Then, specify the information in order.

3. Viewing portfolio recommendation

3.1 Once completing the investment goal assessment, you can select “Recommended portfolio”. The The system will display the “Terms and Conditions for Use of SAM Service”, select “Agree” to proceed.

3.2 Now you will be asked to conduct investor risk profile assessment, then select “Next”

3.3 The system will display asset allocation recommendation according to your risk profile and the guidelines on asset allocation of SAM, if you accept such guidelines, select “Accept” to proceed

3.4 The system will display the recommended portfolio that is consistent with the level of return according to your investment target. You can select “Edit” to go back to the page specifying the information of investment plan or select the menu “Show investment growth chart” to view the forecast investment growth under such recommended portfolio.

3.2 Now you will be asked to conduct investor risk profile assessment, then select “Next”

3.3 The system will display asset allocation recommendation according to your risk profile and the guidelines on asset allocation of SAM, if you accept such guidelines, select “Accept” to proceed

3.4 The system will display the recommended portfolio that is consistent with the level of return according to your investment target. You can select “Edit” to go back to the page specifying the information of investment plan or select the menu “Show investment growth chart” to view the forecast investment growth under such recommended portfolio.

Then, select “Open Account” to proceed to opening an account and starting investment. You can study how to proceed with online account opening by clicking here

4. Start investing

4.1 After the account opening is completed, the system will display the information of your planned investment portfolio. Select “Start Plan”. The system will display the list of funds under Investment Universe and transaction terms and conditions for your acknowledgement.

4.2 The system will take you to the “Subscribe” page, select “Single investment”. The system will display the investment details, then select “Next” and accept associated risks

4.3 Select the account for paying the subscription proceeds. (In this process, you have yet to link the account for paying the subscription proceeds, or you can study how to proceed by clicking here. The system will then summarize the information on the “Confirmation” page, please select “Confirm”. The system will display the transaction result and save the transaction slip as evidence on your phone.

5. Rebalancing the Portfolio

Portfolio Rebalancing can happen when the asset allocation of your investment portfolio deviates from the recommended portfolio higher than the specified level, which may be due to:

- Changing market conditions

- Rebalancing of asset allocation according to the fund manager’s perspective on a quarterly basis review

5.1 The system will display the portfolio information that falls under the criteria of portfolio rebalancing, then select “Detail” to proceed

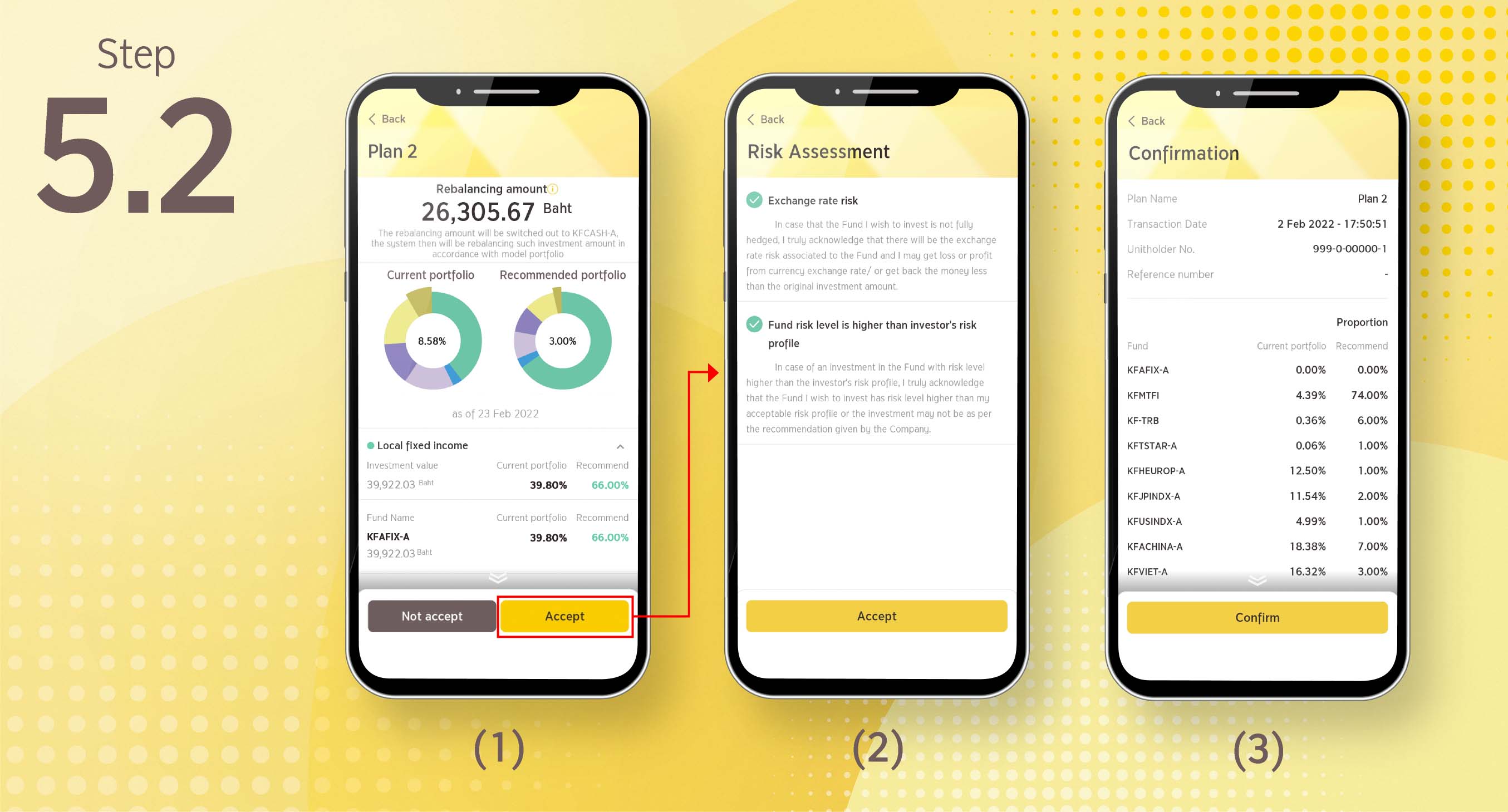

5.2 The system will display all details for you to proceed and acknowledge associated risks and will summarize the information at the Confirmation page where you can select “Confirm” to get the transaction done.

This manual portfolio rebalancing can be proceeded only when you approve after your thorough consideration over the previous and new portfolio weights.

Recommended Quarterly Investment Portfolio

Download Recommended Investment Portfolio for Quarter 1/2026, click here

Frequently Asked Questions (FAQ)

Download FAQ, click here.

User Manual

Download User Manual, click here.