Fund Type

Super Savings Fund which is an Equity Fund and Feeder Fund

Dividend Policy

Dividends shall be paid when the Fund has retained earnings and such dividend payment shall not result in the Fund incurring retained losses during the accounting period for which the dividends are paid out. In the event that the dividend payment is less than 0.25 baht per unit, the Fund reserves the right not to pay. For further detail pertaining to dividend payment, please study Fund Prospectus and Fund Project and Commitment.

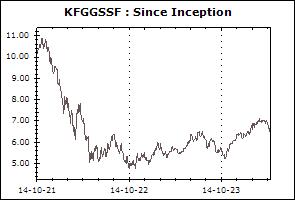

Inception Date

14 October 2021

Investment Policy

Minimum 80% of NAV in average of fund accounting year are invested in the Master Fund named, Baillie Gifford Worldwide Long Term Global Growth Fund, Class B USD Acc which managed by Baillie Gifford Worldwide Funds PLC. The master fund has the policy to invest in global equity which are stocks with strong growth potential and listed, traded or dealt in on Regulated Markets.

Fund Manager

Jaturun Sornvai, Chusak Ouypornchaisakul

Asset Allocation

-

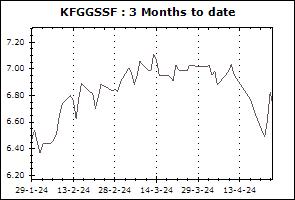

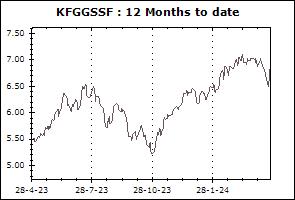

Return Chart

NAV Movement

- 3 Months

- 12 Months

- Since inception

Transaction Details

Minimum Purchase Amount (Baht): 500

Minimum Redemption Amount (Unit): Not specified

Proceeds Payment Period: 4 working days after the execution day excluding relevant Master Fund’s holidays (T+4)

Fund Subscription Period: After IPO: Every subscription date until 15.30 hrs. (start from 18 October 2021 onward)

Fund Redemption Period: Every Redemption date until 14.30 hrs. (start from 18 October 2021 onward)

Transaction Channel: Krungsri Asset Management,Online Service,AGENT

Asset Allocation (30 Jan 2026)

| Deposits and Fixed Income Instruments issued by Financial Institutions | 1.97% |

| Baillie Gifford Worldwide Long Term Global Growth Fund | 96.82% |

| Other Assets | 1.57% |

| Other Liabilities | -0.36% |

Super Savings Fund (SSF)

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Cash Management-SSF (KFCASHSSF) | +0.21% | +0.47% | +0.07% | +1.19% | +1.49% | +1.00% | N/A | +0.88% | 586 |

| Benchmark(4) | +0.23% | +0.50% | +0.07% | +1.17% | +1.38% | +0.99% | N/A | +0.91% | |

| Standard Deviation of Fund | +0.03% | +0.04% | +0.04% | +0.05% | +0.07% | +0.07% | N/A | +0.06% | |

| Standard Deviation of Benchmark | +0.03% | +0.02% | +0.03% | +0.02% | +0.02% | +0.02% | N/A | +0.02% | |

| Krungsri Active Fixed Income-SSF (KFAFIXSSF) | -0.01% | -0.17% | -0.50% | +2.79% | +2.77% | +2.03% | N/A | +1.98% | 1,049 |

| Benchmark(5) | +0.32% | +0.40% | -0.35% | +3.24% | +2.61% | +1.62% | N/A | +1.67% | |

| Standard Deviation of Fund | +0.77% | +1.01% | +0.87% | +0.92% | +0.69% | +0.81% | N/A | +0.83% | |

| Standard Deviation of Benchmark | +0.76% | +0.85% | +0.84% | +0.80% | +0.73% | +0.95% | N/A | +0.94% | |

| Krungsri Happy Life-SSF (KFHAPPYSSF) | +0.86% | +1.55% | +0.18% | +3.66% | +1.64% | +1.34% | N/A | +1.65% | 213 |

| Benchmark(6) | +0.60% | +2.09% | +1.01% | +2.70% | +0.69% | +1.20% | N/A | +2.23% | |

| Standard Deviation of Fund | +1.86% | +2.03% | +2.05% | +2.51% | +2.20% | +2.11% | N/A | +2.36% | |

| Standard Deviation of Benchmark | +2.36% | +2.32% | +2.69% | +2.88% | +2.29% | +2.12% | N/A | +2.38% | |

| Krungsri The One Mild SSF (KF1MILDSSF) | +1.46% | +3.73% | +1.02% | +4.64% | N/A | N/A | N/A | +3.58% | 14 |

| Benchmark(7) | +1.94% | +5.14% | +1.44% | +8.29% | N/A | N/A | N/A | +7.76% | |

| Standard Deviation of Fund | +2.85% | +2.75% | +3.28% | +3.69% | N/A | N/A | N/A | +3.48% | |

| Standard Deviation of Benchmark | +2.80% | +2.79% | +2.93% | +3.65% | N/A | N/A | N/A | +3.06% | |

| Krungsri The One Mean SSF (KF1MEANSSF) | +1.35% | +3.95% | +1.14% | +3.92% | N/A | N/A | N/A | +3.07% | 7 |

| Benchmark(8) | +2.33% | +7.23% | +2.15% | +10.56% | N/A | N/A | N/A | +9.83% | |

| Standard Deviation of Fund | +3.88% | +3.87% | +4.06% | +5.60% | N/A | N/A | N/A | +5.01% | |

| Standard Deviation of Benchmark | +4.53% | +4.60% | +4.89% | +6.31% | N/A | N/A | N/A | +5.30% | |

| Krungsri The One Max SSF (KF1MAXSSF) | +1.66% | +5.22% | +1.40% | +5.38% | N/A | N/A | N/A | +4.14% | 10 |

| Benchmark(9) | +3.53% | +10.92% | +3.24% | +15.49% | N/A | N/A | N/A | +14.72% | |

| Standard Deviation of Fund | +5.21% | +5.20% | +5.19% | +7.47% | N/A | N/A | N/A | +6.60% | |

| Standard Deviation of Benchmark | +6.75% | +6.99% | +7.10% | +9.92% | N/A | N/A | N/A | +8.29% | |

| Krungsri Enhanced SET50-SSF (KFENS50SSF) | +3.08% | +8.38% | +5.62% | +5.83% | -2.67% | +0.69% | N/A | +4.92% | 727 |

| SET50 TRI | +3.91% | +9.95% | +5.62% | +7.71% | -0.51% | +2.39% | N/A | +5.77% | |

| Standard Deviation of Fund | +14.41% | +14.51% | +15.28% | +19.78% | +15.47% | +14.17% | N/A | +16.30% | |

| Standard Deviation of Benchmark | +13.94% | +13.99% | +14.95% | +19.25% | +15.10% | +13.88% | N/A | +15.92% | |

| Krungsri Dividend Stock SSF (KFDIVSSF) | +2.10% | +5.35% | +3.96% | +0.77% | -6.51% | -2.64% | N/A | -2.21% | 547 |

| SET TRI | +1.56% | +8.28% | +5.24% | +5.39% | -4.08% | +1.25% | N/A | +3.67% | |

| Standard Deviation of Fund | +11.13% | +11.53% | +12.20% | +16.16% | +13.42% | +12.54% | N/A | +13.23% | |

| Standard Deviation of Benchmark | +14.70% | +14.20% | +16.58% | +17.92% | +14.12% | +13.00% | N/A | +13.94% | |

| Krungsri SET100-SSF (KFS100SSF) | +3.14% | +9.02% | +5.52% | +6.57% | -2.53% | +1.21% | N/A | +2.78% | 594 |

| SET100 TRI | +3.48% | +9.60% | +5.37% | +7.09% | -2.30% | +1.39% | N/A | +2.97% | |

| Standard Deviation of Fund | +14.40% | +14.25% | +15.63% | +19.25% | +15.07% | +13.75% | N/A | +14.72% | |

| Standard Deviation of Benchmark | +14.22% | +14.19% | +15.40% | +19.27% | +15.15% | +13.85% | N/A | +14.79% | |

| Tracking Difference (TD) | N/A | N/A | N/A | -0.52% | N/A | N/A | N/A | N/A | |

| Tracking Error (TE) | N/A | N/A | N/A | +2.00% | N/A | N/A | N/A | N/A | |

| Krungsri Global Core Allocation SSF (KFCORESSF) | +1.75% | +7.58% | +1.66% | +8.23% | N/A | N/A | N/A | +8.03% | 29 |

| Standard Deviation of Fund | +7.64% | +7.14% | +6.09% | +8.53% | N/A | N/A | N/A | +7.72% | |

| Krungsri Global Brands Equity Dividend SSF (KFGBRANSSF) | -4.47% | -10.81% | -4.29% | -11.95% | +1.19% | +1.25% | N/A | +3.39% | 1,825 |

| Benchmark(10) | -6.15% | -12.40% | -4.36% | -14.32% | +3.99% | +5.65% | N/A | +6.32% | |

| Standard Deviation of Fund | +10.15% | +9.75% | +12.71% | +12.68% | +11.55% | +14.23% | N/A | +14.42% | |

| Standard Deviation of Benchmark | +11.37% | +11.69% | +12.43% | +15.68% | +13.55% | +14.96% | N/A | +15.15% | |

| Krungsri China A Shares Equity SSF (KF-ACHINASSF) | +0.12% | +5.79% | -0.21% | +12.41% | -4.62% | -11.53% | N/A | -10.58% | 396 |

| Benchmark(10) | -1.74% | +3.94% | -0.22% | +9.22% | -2.55% | -8.01% | N/A | -6.86% | |

| Standard Deviation of Fund | +10.56% | +11.59% | +11.91% | +12.03% | +15.18% | +19.13% | N/A | +19.21% | |

| Standard Deviation of Benchmark | +11.33% | +12.88% | +12.74% | +13.51% | +16.56% | +19.86% | N/A | +19.95% | |

| Krungsri US Equity SSF (KFUSSSF) | +4.42% | -0.14% | +1.42% | -14.66% | +8.22% | N/A | N/A | -12.10% | 88 |

| Benchmark(10) | +2.79% | -1.59% | +1.55% | -16.91% | +11.65% | N/A | N/A | -9.24% | |

| Standard Deviation of Fund | +9.55% | +9.37% | +9.75% | +13.66% | +21.92% | N/A | N/A | +33.33% | |

| Standard Deviation of Benchmark | +11.73% | +11.77% | +13.69% | +15.19% | +22.71% | N/A | N/A | +33.19% | |

| Krungsri Next Generation Infrastructure SSF (KFINFRASSF) | +5.92% | +4.11% | +4.28% | +11.87% | +5.13% | N/A | N/A | +0.47% | 46 |

| Benchmark(11) | +7.59% | +6.96% | +4.90% | +17.89% | +10.37% | N/A | N/A | +5.40% | |

| Standard Deviation of Fund | +7.48% | +7.77% | +7.59% | +11.58% | +11.56% | N/A | N/A | +13.75% | |

| Standard Deviation of Benchmark | +7.65% | +7.89% | +7.97% | +11.93% | +11.89% | N/A | N/A | +14.13% | |

| Krungsri ESG Climate Tech SSF (KFCLIMASSF) | +1.11% | +5.46% | +3.93% | +17.73% | +4.81% | N/A | N/A | -1.49% | 75 |

| Standard Deviation of Fund | +15.51% | +14.37% | +12.13% | +17.28% | +16.11% | N/A | N/A | +19.03% | |

| Krungsri Global Growth SSF (KFGGSSF) | -10.28% | -5.20% | -4.15% | -0.97% | +13.56% | N/A | N/A | -4.37% | 981 |

| Benchmark(11) | -9.34% | -2.92% | -3.86% | +4.09% | +19.62% | N/A | N/A | +0.52% | |

| Standard Deviation of Fund | +18.79% | +17.06% | +16.99% | +22.76% | +21.27% | N/A | N/A | +28.76% | |

| Standard Deviation of Benchmark | +20.44% | +18.51% | +18.40% | +26.40% | +22.95% | N/A | N/A | +30.12% | |

| Krungsri China Megatrends SSF (KFCMEGASSF) | -4.49% | +2.86% | +1.56% | +12.37% | -4.49% | N/A | N/A | -3.16% | 62 |

| Benchmark(12) | -1.29% | +7.88% | +4.25% | +28.27% | +7.19% | N/A | N/A | +6.67% | |

| Standard Deviation of Fund | +18.27% | +20.91% | +24.39% | +27.10% | +29.53% | N/A | N/A | +30.20% | |

| Standard Deviation of Benchmark | +15.75% | +16.71% | +14.93% | +22.96% | +22.30% | N/A | N/A | +23.53% | |

| Krungsri Equity Sustainable Global Growth SSF (KFESGSSF) | -4.47% | -1.53% | -0.51% | -1.73% | +2.12% | N/A | N/A | +2.93% | 35 |

| Benchmark(11) | -3.23% | +1.02% | -0.09% | +3.38% | +7.36% | N/A | N/A | +8.24% | |

| Standard Deviation of Fund | +12.33% | +12.39% | +10.85% | +18.63% | +15.26% | N/A | N/A | +16.38% | |

| Standard Deviation of Benchmark | +12.90% | +12.70% | +11.81% | +18.55% | +15.48% | N/A | N/A | +16.86% | |

| Krungsri Vietnam Equity SSF (KFVIETSSF) | +6.74% | +13.78% | +5.05% | +16.72% | +5.63% | N/A | N/A | +1.18% | 189 |

| Benchmark(13) | +6.27% | +22.87% | +1.98% | +39.66% | +18.13% | N/A | N/A | +8.87% | |

| Standard Deviation of Fund | +18.28% | +19.40% | +14.25% | +20.49% | +16.79% | N/A | N/A | +17.44% | |

| Standard Deviation of Benchmark | +20.37% | +24.07% | +19.04% | +24.45% | +20.39% | N/A | N/A | +22.69% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri SET100-SSFX (KFS100SSFX) | +3.14% | +9.02% | +5.52% | +6.57% | -2.53% | +1.21% | N/A | +3.28% | 1,442 |

| SET100 TRI | +3.48% | +9.60% | +5.37% | +7.09% | -2.30% | +1.39% | N/A | +3.99% | |

| Standard Deviation of Fund | +14.40% | +14.25% | +15.63% | +19.25% | +15.07% | +13.75% | N/A | +15.20% | |

| Standard Deviation of Benchmark | +14.22% | +14.19% | +15.40% | +19.27% | +15.15% | +13.85% | N/A | +15.31% | |

| Tracking Difference (TD) | N/A | N/A | N/A | -0.52% | N/A | N/A | N/A | N/A | |

| Tracking Error (TE) | N/A | N/A | N/A | +2.00% | N/A | N/A | N/A | N/A | |

Remark