Krungsri Star Multiple Fund (KFSMUL)

Old Name: AYF Star Multiple Fund (AYFSMUL)

Information as of Dec 30, 2025

Fund Type

Mixed Fund (Fixed Income Series)

Dividend Policy

None

Objective

To seek current income and consistent capital appreciation.

Inception Date

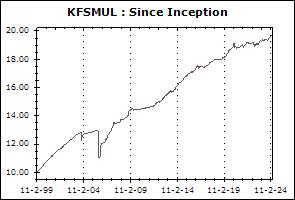

11 February 1999

Investment Policy

To invest in high quality corporate debentures and other debt securities.

Fund Manager

Porntipa Nungnamjai, Theerapab Chirasakyakul

Asset Allocation

25.97%

Instruments issued by Sovereign or Supra-national organization

16.89%

Fixed Income Instruments issued by Bank of Thailand

3.67%

Deposits and Fixed Income Instruments issued by Financial Institutions

53.32%

Fixed Income Instruments Issued by Corporates

0.29%

Other Assets

-0.14%

Other Liabilities

Transaction Details

Minimum Purchase Amount (Baht): 500

Minimum Redemption Amount (Unit): 500 Baht or 50 units

Transaction Period: Every dealing date of the fund by 15.30 hrs.

Proceeds Payment Period: 2 business days after the execution (T+2)

Fund Redemption Period: Every dealing date of the fund by 15.30 hrs.

Transaction Channel: Krungsri Asset Management,Online Service,ATM,AGENT

Asset Allocation (30 Dec 2025)

| Instruments issued by Sovereign or Supra-national organization | 25.97% |

| Fixed Income Instruments issued by Bank of Thailand | 16.89% |

| Deposits and Fixed Income Instruments issued by Financial Institutions | 3.67% |

| Fixed Income Instruments Issued by Corporates | 53.32% |

| Other Assets | 0.29% |

| Other Liabilities | -0.14% |

Top Five Issuers/Guarantors (30 Dec 2025)

| Government | 25.97% |

| Bank of Thailand | 16.89% |

| Gulf Development Plc. | 9.12% |

| CPF (Thailand) Plc. | 5.38% |

| True Corporation Plc. | 4.85% |

Top Five Securities

| Security Code | Issue / Issuer Rating | % of NAV |

|---|---|---|

| Treasury Bill 26/(DM)7/183 | - | 11.33% |

| BONDS OF GULF DEVELOPMENT PUBLIC COMPANY LIMITED NO. 1/2568 SERIES 2 | AA- | 7.43% |

| Bank of Thailand Bond 17/FRB182/2025 | - | 6.10% |

| Government Bond FY. B.E. 2568 No. 10 | - | 5.18% |

| Bank of Thailand Bond 16/FRB180/2025 | - | 4.20% |

Mixed Funds

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Flexible Fund (KFFLEX) | -3.87% | +8.50% | -13.24% | -13.24% | -9.93% | -4.42% | -1.90% | +2.70% | 92 |

| Standard Deviation of Fund | +11.76% | +13.34% | +15.64% | +15.64% | +13.11% | +12.36% | +13.75% | +17.92% | |

| Krungsri Flexible Dividend Fund (KFFLEX-D) | -4.04% | +8.71% | -12.19% | -12.19% | -9.48% | -4.11% | -1.72% | +5.56% | 709 |

| Standard Deviation of Fund | +11.82% | +13.43% | +15.28% | +15.28% | +12.90% | +12.21% | +13.62% | +17.80% | |

| Benchmark(2) | -0.70% | +8.83% | -0.97% | -0.97% | -0.84% | +0.83% | +2.69% | N/A | |

| Standard Deviation of Benchmark | +5.41% | +5.68% | +6.58% | +6.58% | +5.48% | +5.28% | +6.34% | N/A | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

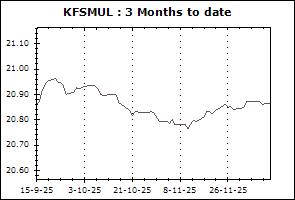

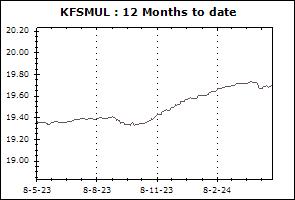

| Krungsri Star Multiple Fund (KFSMUL) | -0.02% | +0.73% | +3.29% | +3.29% | +2.73% | +1.93% | +1.96% | +2.78% | 1,483 |

| Benchmark(4) | +0.32% | +1.02% | +3.00% | +3.00% | +2.01% | +1.14% | +2.12% | +5.08% | |

| Standard Deviation of Fund | +0.89% | +1.05% | +0.93% | +0.93% | +0.70% | +0.73% | +0.77% | +3.33% | |

| Standard Deviation of Benchmark | +0.44% | +0.48% | +0.46% | +0.46% | +0.42% | +0.50% | +1.61% | +8.73% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Happy Life Fund-A (KFHAPPY-A) | +0.36% | +3.14% | +2.94% | +2.94% | +1.57% | +1.22% | N/A | +1.04% | 516 |

| Benchmark(5) | +0.11% | +4.11% | +0.54% | +0.54% | +0.37% | +1.05% | N/A | +1.22% | |

| Standard Deviation of Fund | +1.79% | +2.11% | +2.53% | +2.53% | +2.19% | +2.11% | N/A | +2.56% | |

| Standard Deviation of Benchmark | +2.30% | +2.51% | +2.87% | +2.87% | +2.26% | +2.13% | N/A | +2.47% | |

| Krungsri Good Life Fund (KFGOOD) | +0.36% | +5.22% | +1.06% | +1.06% | -0.38% | +0.41% | N/A | -0.59% | 316 |

| Benchmark(6) | -0.06% | +7.42% | -1.09% | -1.09% | -1.06% | +0.90% | N/A | +0.44% | |

| Standard Deviation of Fund | +3.69% | +4.29% | +5.37% | +5.37% | +4.57% | +4.37% | N/A | +5.08% | |

| Standard Deviation of Benchmark | +4.32% | +4.51% | +5.17% | +5.17% | +4.26% | +4.10% | N/A | +4.80% | |

| Krungsri Super Life Fund (KFSUPER) | +0.03% | +7.50% | -1.06% | -1.06% | -2.72% | -0.86% | N/A | -3.16% | 114 |

| Benchmark(7) | -0.24% | +10.72% | -2.72% | -2.72% | -2.54% | +0.76% | N/A | +0.20% | |

| Standard Deviation of Fund | +6.18% | +7.19% | +8.90% | +8.90% | +7.49% | +7.06% | N/A | +8.76% | |

| Standard Deviation of Benchmark | +6.62% | +6.96% | +8.03% | +8.03% | +6.51% | +6.20% | N/A | +7.52% | |

| Krungsri Yenjai Fund-A (KFYENJAI-A) | -0.01% | +1.09% | +1.93% | +1.93% | +1.65% | N/A | N/A | +1.58% | 6,557 |

| Benchmark(8) | +0.56% | +2.19% | +2.97% | +2.97% | +1.85% | N/A | N/A | +1.91% | |

| Standard Deviation of Fund | +1.22% | +1.09% | +1.10% | +1.10% | +1.07% | N/A | N/A | +1.03% | |

| Standard Deviation of Benchmark | +0.80% | +0.77% | +0.96% | +0.96% | +0.81% | N/A | N/A | +0.79% | |

| Krungsri The One Mild Fund-A (KF1MILD-A) | +0.73% | +3.75% | +4.67% | +4.67% | N/A | N/A | N/A | +2.58% | 239 |

| Benchmark(9) | +1.31% | +6.01% | +6.87% | +6.87% | N/A | N/A | N/A | +4.83% | |

| Standard Deviation of Fund | +2.89% | +2.64% | +3.88% | +3.88% | N/A | N/A | N/A | +3.43% | |

| Standard Deviation of Benchmark | +2.91% | +2.86% | +3.62% | +3.62% | N/A | N/A | N/A | +2.91% | |

| Krungsri The One Mild Fund-I (KF1MILD-I) | +0.73% | +3.75% | +4.67% | +4.67% | N/A | N/A | N/A | +2.67% | 113 |

| Benchmark(9) | +1.31% | +6.01% | +6.87% | +6.87% | N/A | N/A | N/A | +4.89% | |

| Standard Deviation of Fund | +2.89% | +2.64% | +3.89% | +3.89% | N/A | N/A | N/A | +3.47% | |

| Standard Deviation of Benchmark | +2.91% | +2.86% | +3.62% | +3.62% | N/A | N/A | N/A | +2.93% | |

| Krungsri The One Mean Fund-A (KF1MEAN-A) | +0.48% | +4.43% | +3.77% | +3.77% | N/A | N/A | N/A | +1.52% | 76 |

| Benchmark(10) | +1.60% | +8.96% | +8.03% | +8.03% | N/A | N/A | N/A | +5.77% | |

| Standard Deviation of Fund | +4.19% | +3.81% | +5.87% | +5.87% | N/A | N/A | N/A | +5.08% | |

| Standard Deviation of Benchmark | +4.68% | +4.75% | +6.29% | +6.29% | N/A | N/A | N/A | +5.07% | |

| Krungsri The One Mean Fund-I (KF1MEAN-I) | +0.48% | +4.43% | +3.77% | +3.77% | N/A | N/A | N/A | +1.58% | 191 |

| Benchmark(10) | +1.60% | +8.96% | +8.03% | +8.03% | N/A | N/A | N/A | +5.89% | |

| Standard Deviation of Fund | +4.19% | +3.81% | +5.87% | +5.87% | N/A | N/A | N/A | +5.12% | |

| Standard Deviation of Benchmark | +4.68% | +4.75% | +6.29% | +6.29% | N/A | N/A | N/A | +5.11% | |

| Krungsri The One Max Fund-A (KF1MAX-A) | +0.62% | +5.51% | +5.09% | +5.09% | N/A | N/A | N/A | +1.85% | 49 |

| Benchmark(11) | +2.45% | +12.83% | +12.07% | +12.07% | N/A | N/A | N/A | +9.19% | |

| Standard Deviation of Fund | +5.69% | +5.16% | +7.82% | +7.82% | N/A | N/A | N/A | +6.79% | |

| Standard Deviation of Benchmark | +7.24% | +7.14% | +9.91% | +9.91% | N/A | N/A | N/A | +7.95% | |

| Krungsri The One Max Fund-I (KF1MAX-I) | +0.62% | +5.51% | +5.09% | +5.09% | N/A | N/A | N/A | +1.92% | 215 |

| Benchmark(11) | +2.45% | +12.83% | +12.07% | +12.07% | N/A | N/A | N/A | +9.47% | |

| Standard Deviation of Fund | +5.69% | +5.16% | +7.82% | +7.82% | N/A | N/A | N/A | +6.82% | |

| Standard Deviation of Benchmark | +7.24% | +7.14% | +9.91% | +9.91% | N/A | N/A | N/A | +8.00% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Dividend Balance 70/30 Fund-D (KF-DB70-D) | -1.08% | +9.74% | -6.06% | -6.06% | -5.70% | -2.27% | N/A | -0.61% | 4 |

| Benchmark(12) | -0.72% | +17.17% | -6.11% | -6.11% | -5.68% | +0.44% | N/A | +3.53% | |

| Standard Deviation of Fund | +8.45% | +9.66% | +12.02% | +12.02% | +9.80% | +9.15% | N/A | +9.59% | |

| Standard Deviation of Benchmark | +14.17% | +15.04% | +17.76% | +17.76% | +13.89% | +13.01% | N/A | +13.66% | |

Remark