Fund Type

Mixed fund/ Cross Investing Fund

Dividend Policy

None

Inception Date

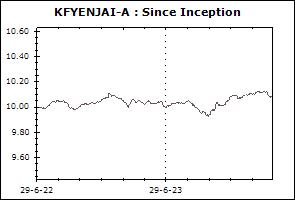

29 June 2022

Investment Policy

Invest in any of the following securities or assets, or some combination thereof: 1) Debt instruments, deposits or deposit-equivalent instruments both local and foreign in average of fund accounting year totaling at least 70% of NAV. 2) Invest no more than 15% of NAV in average of fund accounting year in listed stock. 3) Invest no more than 15% of NAV in average of fund accounting year in REIT and/or Property Fund or Foreign REIT. The fund may invest no more than 79% of NAV in average of fund accounting year in other units of mutual funds under management of the Company.

Fund Manager

Porntipa Nungnamjai, Thalit Choktippattana

Asset Allocation

22.93%

Instruments issued by Sovereign or Supra-national organization

40.47%

Fixed Income Instruments issued by Bank of Thailand

0%

Deposits and Fixed Income Instruments issued by Financial Institutions

25.19%

Fixed Income Instruments Issued by Corporates

2.68%

Other Assets

-0.86%

Other Liabilities

4.39%

Equity and Unit Trusts

5.15%

CIS - Equity

0.07%

CIS - Fixed income

Return Chart

NAV Movement

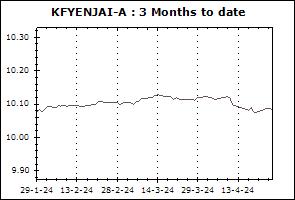

- 3 Months

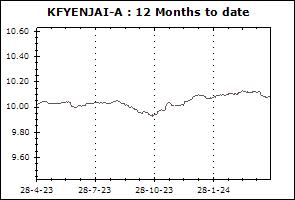

- 12 Months

- Since inception

Transaction Details

Minimum Purchase Amount (Baht): 500

Minimum Redemption Amount (Unit): 500 Baht or 50 units

Transaction Period: Every subscription date within 15.30 hrs.

Proceeds Payment Period: Within 5 business days following the redemption date. Normally the proceeds will be received 3 business days following the redemption date (T+3).

Fund Redemption Period: Every redemption date within 15.30 hrs.

Transaction Channel: Krungsri Asset Management,Online Service,AGENT

Asset Allocation (28 Nov 2025)

| Instruments issued by Sovereign or Supra-national organization | 22.93% |

| Fixed Income Instruments issued by Bank of Thailand | 40.47% |

| Fixed Income Instruments Issued by Corporates | 25.19% |

| Equity and Unit Trusts | 4.39% |

| CIS - Equity | 5.15% |

| CIS - Fixed income | 0.07% |

| Other Assets | 2.68% |

| Other Liabilities | -0.86% |

Top Five Issuers/Guarantors

| Security Code | Issue / Issuer Rating | % of NAV |

|---|---|---|

| Bank of Thailand Bond 10/FRB363/2025 | - | 9.77% |

| Bank of Thailand Bond 20/FRB182/2025 | - | 9.02% |

| Government Bond FY. B.E. 2568 No. 10 | - | 8.26% |

| Bank of Thailand Bond 18/FRB182/2025 | - | 7.52% |

| Bank of Thailand Bond 9/FRB364/2025 | - | 7.52% |

Mixed Funds

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Flexible Fund (KFFLEX) | -1.85% | +2.17% | -13.66% | -15.20% | -9.58% | -4.70% | -2.29% | +2.69% | 92 |

| Standard Deviation of Fund | +12.02% | +15.04% | +16.09% | +16.02% | +13.09% | +12.65% | +13.81% | +17.95% | |

| Krungsri Flexible Dividend Fund (KFFLEX-D) | -1.71% | +2.35% | -12.64% | -14.22% | -9.12% | -4.38% | -2.11% | +5.56% | 717 |

| Standard Deviation of Fund | +12.07% | +15.08% | +15.70% | +15.64% | +12.88% | +12.49% | +13.67% | +17.82% | |

| Benchmark(2) | +0.39% | +6.24% | -1.28% | -1.82% | -0.45% | +1.12% | +2.39% | N/A | |

| Standard Deviation of Benchmark | +5.22% | +6.07% | +6.73% | +6.61% | +5.46% | +5.42% | +6.38% | N/A | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Star Multiple Fund (KFSMUL) | -0.55% | +0.97% | +2.88% | +3.15% | +2.78% | +1.95% | +1.95% | +2.78% | 1,469 |

| Benchmark(4) | -0.01% | +1.11% | +2.65% | +2.77% | +2.06% | +1.15% | +1.84% | +5.08% | |

| Standard Deviation of Fund | +1.30% | +1.06% | +0.95% | +0.94% | +0.70% | +0.73% | +0.77% | +3.34% | |

| Standard Deviation of Benchmark | +0.54% | +0.48% | +0.48% | +0.46% | +0.42% | +0.50% | +1.84% | +8.74% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Happy Life Fund-A (KFHAPPY-A) | +0.10% | +2.18% | +2.12% | +1.92% | +1.48% | +1.14% | N/A | +0.95% | 515 |

| Benchmark(5) | +0.60% | +2.86% | +0.30% | +0.05% | +0.48% | +1.15% | N/A | +1.21% | |

| Standard Deviation of Fund | +2.00% | +2.31% | +2.60% | +2.61% | +2.18% | +2.18% | N/A | +2.57% | |

| Standard Deviation of Benchmark | +2.24% | +2.70% | +2.94% | +2.87% | +2.25% | +2.19% | N/A | +2.47% | |

| Krungsri Good Life Fund (KFGOOD) | +0.40% | +2.87% | -0.04% | -0.68% | -0.51% | +0.18% | N/A | -0.75% | 330 |

| Benchmark(6) | +1.04% | +4.86% | -1.36% | -1.98% | -0.86% | +1.11% | N/A | +0.41% | |

| Standard Deviation of Fund | +3.83% | +4.80% | +5.52% | +5.53% | +4.56% | +4.51% | N/A | +5.10% | |

| Standard Deviation of Benchmark | +4.21% | +4.82% | +5.28% | +5.18% | +4.24% | +4.22% | N/A | +4.81% | |

| Krungsri Super Life Fund (KFSUPER) | +0.47% | +3.85% | -2.26% | -3.45% | -2.87% | -1.18% | N/A | -3.38% | 113 |

| Benchmark(7) | +1.49% | +6.86% | -3.01% | -4.01% | -2.24% | +1.07% | N/A | +0.15% | |

| Standard Deviation of Fund | +6.30% | +8.13% | +9.15% | +9.14% | +7.47% | +7.29% | N/A | +8.79% | |

| Standard Deviation of Benchmark | +6.45% | +7.48% | +8.21% | +8.05% | +6.47% | +6.38% | N/A | +7.54% | |

| Krungsri Yenjai Fund-A (KFYENJAI-A) | -0.36% | +1.01% | +1.51% | +1.54% | +1.60% | N/A | N/A | +1.50% | 6,670 |

| Benchmark(8) | +0.55% | +2.06% | +2.59% | +2.66% | +1.87% | N/A | N/A | +1.85% | |

| Standard Deviation of Fund | +1.22% | +1.11% | +1.12% | +1.12% | +1.06% | N/A | N/A | +1.03% | |

| Standard Deviation of Benchmark | +0.78% | +0.81% | +0.99% | +0.97% | +0.81% | N/A | N/A | +0.80% | |

| Krungsri The One Mild Fund-A (KF1MILD-A) | +1.40% | +4.06% | +4.06% | +2.64% | N/A | N/A | N/A | +2.44% | 241 |

| Benchmark(9) | +2.16% | +5.21% | +6.03% | +5.49% | N/A | N/A | N/A | +4.72% | |

| Standard Deviation of Fund | +2.94% | +2.82% | +4.01% | +4.04% | N/A | N/A | N/A | +3.47% | |

| Standard Deviation of Benchmark | +2.74% | +2.99% | +3.71% | +3.64% | N/A | N/A | N/A | +2.92% | |

| Krungsri The One Mild Fund-I (KF1MILD-I) | +1.40% | +4.06% | +4.06% | +2.64% | N/A | N/A | N/A | +2.54% | 110 |

| Benchmark(9) | +2.16% | +5.21% | +6.03% | +5.49% | N/A | N/A | N/A | +4.77% | |

| Standard Deviation of Fund | +2.94% | +2.82% | +4.02% | +4.04% | N/A | N/A | N/A | +3.51% | |

| Standard Deviation of Benchmark | +2.74% | +2.99% | +3.71% | +3.64% | N/A | N/A | N/A | +2.94% | |

| Krungsri The One Mean Fund-A (KF1MEAN-A) | +1.47% | +4.54% | +3.04% | +1.24% | N/A | N/A | N/A | +1.31% | 78 |

| Benchmark(10) | +3.11% | +7.87% | +7.09% | +5.91% | N/A | N/A | N/A | +5.66% | |

| Standard Deviation of Fund | +4.22% | +4.09% | +6.08% | +6.04% | N/A | N/A | N/A | +5.14% | |

| Standard Deviation of Benchmark | +4.46% | +5.07% | +6.47% | +6.36% | N/A | N/A | N/A | +5.11% | |

| Krungsri The One Mean Fund-I (KF1MEAN-I) | +1.47% | +4.54% | +3.04% | +1.24% | N/A | N/A | N/A | +1.37% | 179 |

| Benchmark(10) | +3.11% | +7.87% | +7.09% | +5.91% | N/A | N/A | N/A | +5.79% | |

| Standard Deviation of Fund | +4.22% | +4.09% | +6.08% | +6.04% | N/A | N/A | N/A | +5.18% | |

| Standard Deviation of Benchmark | +4.46% | +5.07% | +6.47% | +6.36% | N/A | N/A | N/A | +5.14% | |

| Krungsri The One Max Fund-A (KF1MAX-A) | +2.09% | +5.91% | +4.17% | +2.04% | N/A | N/A | N/A | +1.58% | 49 |

| Benchmark(11) | +4.73% | +11.63% | +10.69% | +8.81% | N/A | N/A | N/A | +9.06% | |

| Standard Deviation of Fund | +5.69% | +5.45% | +8.10% | +8.01% | N/A | N/A | N/A | +6.87% | |

| Standard Deviation of Benchmark | +6.87% | +7.56% | +10.21% | +10.02% | N/A | N/A | N/A | +8.01% | |

| Krungsri The One Max Fund-I (KF1MAX-I) | +2.09% | +5.91% | +4.17% | +2.04% | N/A | N/A | N/A | +1.65% | 206 |

| Benchmark(11) | +4.73% | +11.63% | +10.69% | +8.81% | N/A | N/A | N/A | +9.34% | |

| Standard Deviation of Fund | +5.69% | +5.45% | +8.10% | +8.01% | N/A | N/A | N/A | +6.90% | |

| Standard Deviation of Benchmark | +6.87% | +7.56% | +10.21% | +10.02% | N/A | N/A | N/A | +8.06% | |

Remark