Fund Type

Mixed Fund

Dividend Policy

None

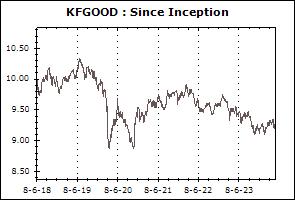

Inception Date

8 June 2018

Investment Policy

The Fund will invest in multi assets, namely 1) Fixed-income instruments, deposits, or deposit-equivalent instruments onshore and/or offshore. 2) Listed stock, stock during IPO pending listing on the stock exchanges, as well as property units or infra units. 3) No more than 100% of its NAV in units of mutual funds under management of the Management Company in accordance with the criteria and conditions prescribed by the SEC. 4) No more than 20% of its NAV in fixed-income instruments of non-investment grade or unrated securities and may also invest in unlisted securities.

Fund Manager

Porntipa Nungnamjai, Thalit Choktippattana

Asset Allocation

18.39%

Instruments issued by Sovereign or Supra-national organization

11.79%

Fixed Income Instruments issued by Bank of Thailand

3.24%

Deposits and Fixed Income Instruments issued by Financial Institutions

26.49%

Fixed Income Instruments Issued by Corporates

2.48%

Other Assets

-0.68%

Other Liabilities

38.20%

Equity and Unit Trusts

0.07%

Foreign CIS - Equity

0.04%

Foreign CIS - Commodity

Transaction Details

Minimum Purchase Amount (Baht): 500

Minimum Redemption Amount (Unit): 50 units or 500 Baht

Proceeds Payment Period: Within 3 business days after the redemption date (T+3)

Fund Subscription Period: Every dealing date of the fund by 15.30 hrs.

Fund Redemption Period: Every dealing date of the fund by 15.30 hrs.

Transaction Channel: Krungsri Asset Management,Online Service,AGENT

Asset Allocation (30 Jan 2026)

| Instruments issued by Sovereign or Supra-national organization | 18.16% |

| Fixed Income Instruments issued by Bank of Thailand | 10.92% |

| Deposits and Fixed Income Instruments issued by Financial Institutions | 3.27% |

| Fixed Income Instruments Issued by Corporates | 26.63% |

| Equity and Unit Trusts | 38.40% |

| Foreign CIS - Equity | 0.07% |

| Foreign CIS - Commodity | 0.05% |

| Other Assets | 3.12% |

| Other Liabilities | -0.64% |

Top Five Issuers/Guarantors

| Security Code | Issue / Issuer Rating | % of NAV |

|---|---|---|

| Debt Management Government Bond FY. B.E. 2567 NO.23 | - | 4.09% |

| Bank of Thailand Bond 7/FRB364/2025 | - | 3.95% |

| Government Housing Bank | AAA | 3.24% |

| Bank of Thailand Bond 11/364/2025 | - | 3.16% |

| PTT Plc. | AAA | 3.13% |

Mixed Funds

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Flexible Fund (KFFLEX) | -1.53% | +1.90% | +3.27% | -4.52% | -8.96% | -3.79% | -1.47% | +2.86% | 93 |

| Benchmark(4) | +0.97% | +3.91% | +2.57% | +4.72% | -0.25% | +1.23% | +2.85% | +5.30% | |

| Standard Deviation of Fund | +11.40% | +12.29% | +12.52% | +15.53% | +13.20% | +12.36% | +13.69% | +17.90% | |

| Standard Deviation of Benchmark | +5.69% | +5.49% | +6.60% | +6.62% | +5.56% | +5.27% | +6.29% | +7.95% | |

| Krungsri Flexible Dividend Fund (KFFLEX-D) | -1.69% | +2.00% | +3.24% | -3.55% | -8.52% | -3.48% | -1.29% | +5.68% | 736 |

| Benchmark(4) | +0.97% | +3.91% | +2.57% | +4.72% | -0.25% | +1.23% | +2.85% | +7.29% | |

| Standard Deviation of Fund | +11.46% | +12.36% | +12.45% | +15.18% | +12.99% | +12.21% | +13.56% | +17.79% | |

| Standard Deviation of Benchmark | +5.69% | +5.49% | +6.60% | +6.62% | +5.56% | +5.27% | +6.71% | +9.74% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Star Multiple Fund (KFSMUL) | +0.05% | -0.14% | -0.55% | +2.68% | +2.55% | +1.81% | +1.85% | +2.75% | 1,402 |

| Benchmark(5) | +0.47% | +0.65% | -0.07% | +2.83% | +2.08% | +1.15% | +2.02% | +5.06% | |

| Standard Deviation of Fund | +0.91% | +1.11% | +0.96% | +0.97% | +0.72% | +0.74% | +0.77% | +3.33% | |

| Standard Deviation of Benchmark | +0.41% | +0.47% | +0.33% | +0.47% | +0.41% | +0.50% | +1.22% | +8.72% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Happy Life Fund-A (KFHAPPY-A) | +0.86% | +1.55% | +0.18% | +3.66% | +1.64% | +1.34% | N/A | +1.05% | 515 |

| Benchmark(6) | +0.60% | +2.09% | +1.01% | +2.70% | +0.69% | +1.20% | N/A | +1.33% | |

| Standard Deviation of Fund | +1.86% | +2.03% | +2.04% | +2.51% | +2.20% | +2.11% | N/A | +2.56% | |

| Standard Deviation of Benchmark | +2.36% | +2.32% | +2.69% | +2.88% | +2.29% | +2.12% | N/A | +2.47% | |

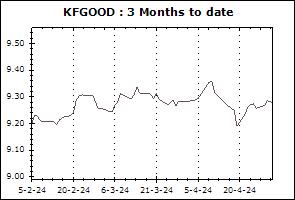

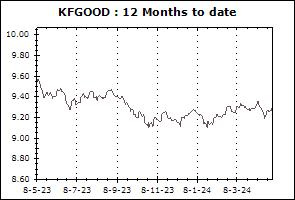

| Krungsri Good Life Fund (KFGOOD) | +1.29% | +2.66% | +0.98% | +3.40% | +0.02% | +0.77% | N/A | -0.46% | 313 |

| Benchmark(7) | +0.85% | +3.62% | +2.06% | +3.37% | -0.43% | +1.22% | N/A | +0.70% | |

| Standard Deviation of Fund | +3.81% | +4.02% | +4.24% | +5.30% | +4.60% | +4.36% | N/A | +5.08% | |

| Standard Deviation of Benchmark | +4.55% | +4.38% | +5.31% | +5.21% | +4.33% | +4.10% | N/A | +4.80% | |

| Krungsri Super Life Fund (KFSUPER) | +1.81% | +3.79% | +2.28% | +3.47% | -1.84% | -0.21% | N/A | -2.80% | 109 |

| Benchmark(8) | +1.09% | +5.16% | +3.12% | +4.05% | -1.60% | +1.23% | N/A | +0.63% | |

| Standard Deviation of Fund | +6.33% | +6.63% | +6.96% | +8.79% | +7.54% | +7.05% | N/A | +8.74% | |

| Standard Deviation of Benchmark | +6.91% | +6.69% | +7.98% | +8.08% | +6.62% | +6.20% | N/A | +7.53% | |

| Krungsri Yenjai Fund-A (KFYENJAI-A) | -0.10% | -0.04% | -0.48% | +1.75% | +1.40% | N/A | N/A | +1.40% | 5,995 |

| Benchmark(9) | +0.70% | +1.60% | +0.33% | +3.60% | +1.92% | N/A | N/A | +1.96% | |

| Standard Deviation of Fund | +1.25% | +1.20% | +1.42% | +1.14% | +1.08% | N/A | N/A | +1.04% | |

| Standard Deviation of Benchmark | +0.70% | +0.75% | +0.68% | +0.95% | +0.81% | N/A | N/A | +0.79% | |

| Krungsri The One Mild Fund-A (KF1MILD-A) | +1.65% | +4.14% | +1.11% | +5.37% | N/A | N/A | N/A | +2.89% | 228 |

| Benchmark(10) | +1.94% | +5.14% | +1.44% | +8.29% | N/A | N/A | N/A | +6.03% | |

| Standard Deviation of Fund | +3.00% | +2.88% | +3.46% | +3.85% | N/A | N/A | N/A | +3.43% | |

| Standard Deviation of Benchmark | +2.80% | +2.79% | +2.93% | +3.65% | N/A | N/A | N/A | +2.91% | |

| Krungsri The One Mild Fund-I (KF1MILD-I) | +1.65% | +4.14% | +1.11% | +5.37% | N/A | N/A | N/A | +2.99% | 121 |

| Benchmark(10) | +1.94% | +5.14% | +1.44% | +8.29% | N/A | N/A | N/A | +6.00% | |

| Standard Deviation of Fund | +3.00% | +2.89% | +3.46% | +3.85% | N/A | N/A | N/A | +3.47% | |

| Standard Deviation of Benchmark | +4.53% | +4.60% | +4.89% | +6.31% | N/A | N/A | N/A | +5.10% | |

| Krungsri The One Mean Fund-A (KF1MEAN-A) | +1.59% | +4.48% | +1.24% | +4.86% | N/A | N/A | N/A | +1.90% | 76 |

| Benchmark(11) | +2.33% | +7.23% | +2.15% | +10.56% | N/A | N/A | N/A | +7.44% | |

| Standard Deviation of Fund | +4.03% | +4.01% | +4.19% | +5.81% | N/A | N/A | N/A | +5.06% | |

| Standard Deviation of Benchmark | +4.53% | +4.60% | +4.89% | +6.31% | N/A | N/A | N/A | +5.07% | |

| Krungsri The One Mean Fund-I (KF1MEAN-I) | +1.58% | +4.48% | +1.24% | +4.85% | N/A | N/A | N/A | +1.98% | 197 |

| Benchmark(11) | +2.33% | +7.23% | +2.15% | +10.56% | N/A | N/A | N/A | +7.46% | |

| Standard Deviation of Fund | +4.03% | +4.01% | +4.19% | +5.81% | N/A | N/A | N/A | +5.09% | |

| Standard Deviation of Benchmark | +2.80% | +2.79% | +2.93% | +3.65% | N/A | N/A | N/A | +2.93% | |

| Krungsri The One Max Fund-A (KF1MAX-A) | +1.87% | +5.72% | +1.50% | +6.27% | N/A | N/A | N/A | +2.31% | 50 |

| Benchmark(12) | +3.53% | +10.92% | +3.24% | +15.49% | N/A | N/A | N/A | +11.57% | |

| Standard Deviation of Fund | +5.39% | +5.38% | +5.39% | +7.76% | N/A | N/A | N/A | +6.76% | |

| Standard Deviation of Benchmark | +6.75% | +6.99% | +7.10% | +9.92% | N/A | N/A | N/A | +7.93% | |

| Krungsri The One Max Fund-I (KF1MAX-I) | +1.87% | +5.72% | +1.50% | +6.27% | N/A | N/A | N/A | +2.39% | 222 |

| Benchmark(12) | +3.53% | +10.92% | +3.24% | +15.49% | N/A | N/A | N/A | +11.70% | |

| Standard Deviation of Fund | +5.39% | +5.38% | +5.39% | +7.76% | N/A | N/A | N/A | +6.78% | |

| Standard Deviation of Benchmark | +6.75% | +6.99% | +7.10% | +9.92% | N/A | N/A | N/A | +7.97% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Dividend Balance 70/30 Fund-D (KF-DB70-D) | +1.61% | +4.20% | +3.10% | +1.13% | -4.46% | -1.62% | N/A | -0.03% | 3 |

| Benchmark(13) | -0.06% | +6.55% | +3.69% | +3.71% | -4.60% | +0.92% | N/A | +4.18% | |

| Standard Deviation of Fund | +8.51% | +8.74% | +9.40% | +11.90% | +9.89% | +9.14% | N/A | +9.59% | |

| Standard Deviation of Benchmark | +12.98% | +13.37% | +11.68% | +17.59% | +13.98% | +12.91% | N/A | +13.63% | |

Remark