Fund Type

Mixed fund / Fund of Funds / Cross Investing Fund

Dividend Policy

None

Inception Date

22 February 2023

Investment Policy

The fund shall invest on average no less than 80% of NAV in an accounting year in the investment units of at least two domestic and foreign mutual funds and/or exchange traded funds (ETFs) which have the policy to invest in one or several types of assets. However, investment in any single fund shall not exceed an average of 79% of NAV during the accounting year. The proportion of investment is at the discretion of the fund manager. The Management Company appoints an investment committee of Krungsri Group as the investment adviser to provide investment advice as well as recommendations on asset allocation strategies. The investment adviser does not have any control over the operations of the Management Company. The fund may invest no more than 100% of NAV in average of fund accounting year in other units of mutual funds under management of the Company.

Fund Manager

Jaturun Sornvai, Chusak Ouypornchaisakul

Asset Allocation

1.81%

Other Assets

-0.24%

Other Liabilities

30.12%

CIS - Equity

62.19%

CIS - Fixed income

2.48%

CIS - Mixed

3.64%

CIS - Commodity

Download

Prospectus (Thai Version Only)

Prospectus (Thai Version Only)

Mutual Fund Project & Commitment (Thai Version Only)

Mutual Fund Project & Commitment (Thai Version Only)

Fund Fact Sheet

Fund Fact Sheet

Market View (Thai version only)

Market View (Thai version only)

Semi Annual Report (Thai Version Only)

Semi Annual Report (Thai Version Only)

Annual Report (Thai Version Only)

Annual Report (Thai Version Only)

Fund Calendar

Fund Calendar

Examples For NAV Calculation (Thai versionn only)

Examples For NAV Calculation (Thai versionn only)

Asset Allocation (Data as of 30 December 2025)

Asset Allocation (Data as of 30 December 2025)

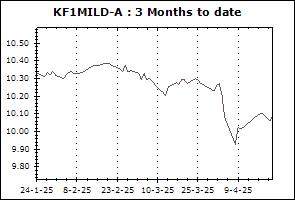

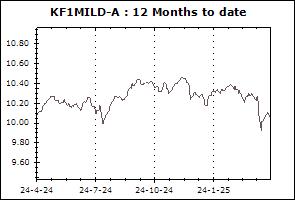

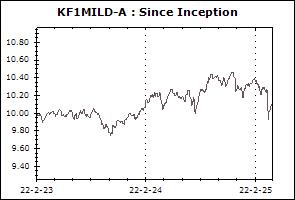

Return Chart

NAV Movement

- 3 Months

- 12 Months

- Since inception

Transaction Details

Minimum Purchase Amount (Baht): 500

Minimum Redemption Amount (Unit): 500 Baht or 50 units

Transaction Period: Every subscription date by 14.30 hrs.

Proceeds Payment Period: Not exceed 7 working days following the NAV calculation date but in general practice, the payment date will be 6 working days after the execution day (T+6)

Fund Redemption Period: Every redemption date by 14.30 hrs.

Transaction Channel: Krungsri Asset Management,Online Service,AGENT

Asset Allocation (30 Dec 2025)

| CIS - Equity | 30.12% |

| CIS - Fixed income | 62.19% |

| CIS - Mixed | 2.48% |

| CIS - Commodity | 3.64% |

| Other Assets | 1.81% |

| Other Liabilities | -0.24% |

Top Five Issuers/Guarantors

| Security Code | Issue / Issuer Rating | % of NAV |

|---|---|---|

| Krungsri Global Collective Smart Income Fund | - | 32.42% |

| Krungsri Active Fixed Income Fund-I | - | 14.96% |

| Krungsri Smart Fixed Income Fund-I | - | 13.11% |

| Krungsri World Equity Index Fund-I | - | 13.03% |

| Krungsri Dynamic Fund | - | 6.03% |

Mixed Funds

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Flexible Fund (KFFLEX) | -3.87% | +8.50% | -13.24% | -13.24% | -9.93% | -4.42% | -1.90% | +2.70% | 92 |

| Standard Deviation of Fund | +11.76% | +13.34% | +15.64% | +15.64% | +13.11% | +12.36% | +13.75% | +17.92% | |

| Krungsri Flexible Dividend Fund (KFFLEX-D) | -4.04% | +8.71% | -12.19% | -12.19% | -9.48% | -4.11% | -1.72% | +5.56% | 709 |

| Standard Deviation of Fund | +11.82% | +13.43% | +15.28% | +15.28% | +12.90% | +12.21% | +13.62% | +17.80% | |

| Benchmark(2) | -0.70% | +8.83% | -0.97% | -0.97% | -0.84% | +0.83% | +2.69% | N/A | |

| Standard Deviation of Benchmark | +5.41% | +5.68% | +6.58% | +6.58% | +5.48% | +5.28% | +6.34% | N/A | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Star Multiple Fund (KFSMUL) | -0.02% | +0.73% | +3.29% | +3.29% | +2.73% | +1.93% | +1.96% | +2.78% | 1,483 |

| Benchmark(4) | +0.32% | +1.02% | +3.00% | +3.00% | +2.01% | +1.14% | +2.12% | +5.08% | |

| Standard Deviation of Fund | +0.89% | +1.05% | +0.93% | +0.93% | +0.70% | +0.73% | +0.77% | +3.33% | |

| Standard Deviation of Benchmark | +0.44% | +0.48% | +0.46% | +0.46% | +0.42% | +0.50% | +1.61% | +8.73% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Happy Life Fund-A (KFHAPPY-A) | +0.36% | +3.14% | +2.94% | +2.94% | +1.57% | +1.22% | N/A | +1.04% | 516 |

| Benchmark(5) | +0.11% | +4.11% | +0.54% | +0.54% | +0.37% | +1.05% | N/A | +1.22% | |

| Standard Deviation of Fund | +1.79% | +2.11% | +2.53% | +2.53% | +2.19% | +2.11% | N/A | +2.56% | |

| Standard Deviation of Benchmark | +2.30% | +2.51% | +2.87% | +2.87% | +2.26% | +2.13% | N/A | +2.47% | |

| Krungsri Good Life Fund (KFGOOD) | +0.36% | +5.22% | +1.06% | +1.06% | -0.38% | +0.41% | N/A | -0.59% | 316 |

| Benchmark(6) | -0.06% | +7.42% | -1.09% | -1.09% | -1.06% | +0.90% | N/A | +0.44% | |

| Standard Deviation of Fund | +3.69% | +4.29% | +5.37% | +5.37% | +4.57% | +4.37% | N/A | +5.08% | |

| Standard Deviation of Benchmark | +4.32% | +4.51% | +5.17% | +5.17% | +4.26% | +4.10% | N/A | +4.80% | |

| Krungsri Super Life Fund (KFSUPER) | +0.03% | +7.50% | -1.06% | -1.06% | -2.72% | -0.86% | N/A | -3.16% | 114 |

| Benchmark(7) | -0.24% | +10.72% | -2.72% | -2.72% | -2.54% | +0.76% | N/A | +0.20% | |

| Standard Deviation of Fund | +6.18% | +7.19% | +8.90% | +8.90% | +7.49% | +7.06% | N/A | +8.76% | |

| Standard Deviation of Benchmark | +6.62% | +6.96% | +8.03% | +8.03% | +6.51% | +6.20% | N/A | +7.52% | |

| Krungsri Yenjai Fund-A (KFYENJAI-A) | -0.01% | +1.09% | +1.93% | +1.93% | +1.65% | N/A | N/A | +1.58% | 6,557 |

| Benchmark(8) | +0.56% | +2.19% | +2.97% | +2.97% | +1.85% | N/A | N/A | +1.91% | |

| Standard Deviation of Fund | +1.22% | +1.09% | +1.10% | +1.10% | +1.07% | N/A | N/A | +1.03% | |

| Standard Deviation of Benchmark | +0.80% | +0.77% | +0.96% | +0.96% | +0.81% | N/A | N/A | +0.79% | |

| Krungsri The One Mild Fund-A (KF1MILD-A) | +0.73% | +3.75% | +4.67% | +4.67% | N/A | N/A | N/A | +2.58% | 239 |

| Benchmark(9) | +1.31% | +6.01% | +6.87% | +6.87% | N/A | N/A | N/A | +4.83% | |

| Standard Deviation of Fund | +2.89% | +2.64% | +3.88% | +3.88% | N/A | N/A | N/A | +3.43% | |

| Standard Deviation of Benchmark | +2.91% | +2.86% | +3.62% | +3.62% | N/A | N/A | N/A | +2.91% | |

| Krungsri The One Mild Fund-I (KF1MILD-I) | +0.73% | +3.75% | +4.67% | +4.67% | N/A | N/A | N/A | +2.67% | 113 |

| Benchmark(9) | +1.31% | +6.01% | +6.87% | +6.87% | N/A | N/A | N/A | +4.89% | |

| Standard Deviation of Fund | +2.89% | +2.64% | +3.89% | +3.89% | N/A | N/A | N/A | +3.47% | |

| Standard Deviation of Benchmark | +2.91% | +2.86% | +3.62% | +3.62% | N/A | N/A | N/A | +2.93% | |

| Krungsri The One Mean Fund-A (KF1MEAN-A) | +0.48% | +4.43% | +3.77% | +3.77% | N/A | N/A | N/A | +1.52% | 76 |

| Benchmark(10) | +1.60% | +8.96% | +8.03% | +8.03% | N/A | N/A | N/A | +5.77% | |

| Standard Deviation of Fund | +4.19% | +3.81% | +5.87% | +5.87% | N/A | N/A | N/A | +5.08% | |

| Standard Deviation of Benchmark | +4.68% | +4.75% | +6.29% | +6.29% | N/A | N/A | N/A | +5.07% | |

| Krungsri The One Mean Fund-I (KF1MEAN-I) | +0.48% | +4.43% | +3.77% | +3.77% | N/A | N/A | N/A | +1.58% | 191 |

| Benchmark(10) | +1.60% | +8.96% | +8.03% | +8.03% | N/A | N/A | N/A | +5.89% | |

| Standard Deviation of Fund | +4.19% | +3.81% | +5.87% | +5.87% | N/A | N/A | N/A | +5.12% | |

| Standard Deviation of Benchmark | +4.68% | +4.75% | +6.29% | +6.29% | N/A | N/A | N/A | +5.11% | |

| Krungsri The One Max Fund-A (KF1MAX-A) | +0.62% | +5.51% | +5.09% | +5.09% | N/A | N/A | N/A | +1.85% | 49 |

| Benchmark(11) | +2.45% | +12.83% | +12.07% | +12.07% | N/A | N/A | N/A | +9.19% | |

| Standard Deviation of Fund | +5.69% | +5.16% | +7.82% | +7.82% | N/A | N/A | N/A | +6.79% | |

| Standard Deviation of Benchmark | +7.24% | +7.14% | +9.91% | +9.91% | N/A | N/A | N/A | +7.95% | |

| Krungsri The One Max Fund-I (KF1MAX-I) | +0.62% | +5.51% | +5.09% | +5.09% | N/A | N/A | N/A | +1.92% | 215 |

| Benchmark(11) | +2.45% | +12.83% | +12.07% | +12.07% | N/A | N/A | N/A | +9.47% | |

| Standard Deviation of Fund | +5.69% | +5.16% | +7.82% | +7.82% | N/A | N/A | N/A | +6.82% | |

| Standard Deviation of Benchmark | +7.24% | +7.14% | +9.91% | +9.91% | N/A | N/A | N/A | +8.00% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Dividend Balance 70/30 Fund-D (KF-DB70-D) | -1.08% | +9.74% | -6.06% | -6.06% | -5.70% | -2.27% | N/A | -0.61% | 4 |

| Benchmark(12) | -0.72% | +17.17% | -6.11% | -6.11% | -5.68% | +0.44% | N/A | +3.53% | |

| Standard Deviation of Fund | +8.45% | +9.66% | +12.02% | +12.02% | +9.80% | +9.15% | N/A | +9.59% | |

| Standard Deviation of Benchmark | +14.17% | +15.04% | +17.76% | +17.76% | +13.89% | +13.01% | N/A | +13.66% | |

Remark