Fund Type

Mixed Fund

Dividend Policy

None

Inception Date

22 March 2019

Investment Policy

The Fund will invest in

1. Listed stock, stock during IPO pending listing on the stock exchanges, as well as property units or infra units.

2. Fixed-income instruments, deposits, or deposit-equivalent instruments onshore and/or offshore.

3. No more than 100% of its NAV in units of mutual funds under management of the Management Company in accordance with the criteria and conditions prescribed by the SEC.

4. Aggregate of no more than 20% of its NAV in fixed-income instruments of non-investment grade or unrated securities and may also invest in unlisted securities.

Fund Manager

Porntipa Nungnamjai, Thalit Choktippattana

Asset Allocation

14.30%

Instruments issued by Sovereign or Supra-national organization

3.97%

Fixed Income Instruments issued by Bank of Thailand

2.01%

Deposits and Fixed Income Instruments issued by Financial Institutions

21.30%

Fixed Income Instruments Issued by Corporates

4.01%

Other Assets

-1.74%

Other Liabilities

54.85%

Equity and Unit Trusts

0.85%

Foreign CIS - Equity

0.44%

Foreign CIS - Commodity

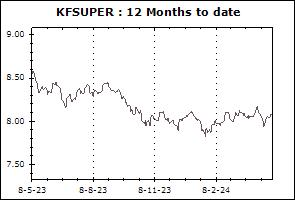

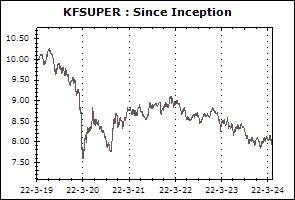

Return Chart

NAV Movement

- 3 Months

- 12 Months

- Since inception

Transaction Details

Minimum Purchase Amount (Baht): 500

Minimum Redemption Amount (Unit): 500 Baht or 50 units

Transaction Period: Every dealing date of the fund by 15.30 hrs.

Proceeds Payment Period: 3 business days after the execution (T+3)

Fund Redemption Period: Every dealing date of the fund by 15.30 hrs.

Transaction Channel: Krungsri Asset Management,Online Service,AGENT

Asset Allocation (30 Jan 2026)

| Instruments issued by Sovereign or Supra-national organization | 14.74% |

| Fixed Income Instruments issued by Bank of Thailand | 2.30% |

| Deposits and Fixed Income Instruments issued by Financial Institutions | 2.11% |

| Fixed Income Instruments Issued by Corporates | 22.28% |

| Equity and Unit Trusts | 57.64% |

| Foreign CIS - Equity | 0.98% |

| Foreign CIS - Commodity | 0.54% |

| Other Assets | 4.85% |

| Other Liabilities | -5.43% |

Top Five Issuers/Guarantors

| Security Code | Issue / Issuer Rating | % of NAV |

|---|---|---|

| Debt Management Government Bond FY. B.E. 2567 NO.23 | - | 6.77% |

| PTT Plc. | AAA | 5.02% |

| Gulf Development Plc. | AA- | 4.33% |

| Advanced Info Service Plc. | AAA | 4.00% |

| CP ALL Plc. | AA- | 2.65% |

Mixed Funds

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Flexible Fund (KFFLEX) | -1.53% | +1.90% | +3.27% | -4.52% | -8.96% | -3.79% | -1.47% | +2.86% | 93 |

| Benchmark(4) | +0.97% | +3.91% | +2.57% | +4.72% | -0.25% | +1.23% | +2.85% | +5.30% | |

| Standard Deviation of Fund | +11.40% | +12.29% | +12.52% | +15.53% | +13.20% | +12.36% | +13.69% | +17.90% | |

| Standard Deviation of Benchmark | +5.69% | +5.49% | +6.60% | +6.62% | +5.56% | +5.27% | +6.29% | +7.95% | |

| Krungsri Flexible Dividend Fund (KFFLEX-D) | -1.69% | +2.00% | +3.24% | -3.55% | -8.52% | -3.48% | -1.29% | +5.68% | 736 |

| Benchmark(4) | +0.97% | +3.91% | +2.57% | +4.72% | -0.25% | +1.23% | +2.85% | +7.29% | |

| Standard Deviation of Fund | +11.46% | +12.36% | +12.45% | +15.18% | +12.99% | +12.21% | +13.56% | +17.79% | |

| Standard Deviation of Benchmark | +5.69% | +5.49% | +6.60% | +6.62% | +5.56% | +5.27% | +6.71% | +9.74% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Star Multiple Fund (KFSMUL) | +0.05% | -0.14% | -0.55% | +2.68% | +2.55% | +1.81% | +1.85% | +2.75% | 1,402 |

| Benchmark(5) | +0.47% | +0.65% | -0.07% | +2.83% | +2.08% | +1.15% | +2.02% | +5.06% | |

| Standard Deviation of Fund | +0.91% | +1.11% | +0.96% | +0.97% | +0.72% | +0.74% | +0.77% | +3.33% | |

| Standard Deviation of Benchmark | +0.41% | +0.47% | +0.33% | +0.47% | +0.41% | +0.50% | +1.22% | +8.72% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Happy Life Fund-A (KFHAPPY-A) | +0.86% | +1.55% | +0.18% | +3.66% | +1.64% | +1.34% | N/A | +1.05% | 515 |

| Benchmark(6) | +0.60% | +2.09% | +1.01% | +2.70% | +0.69% | +1.20% | N/A | +1.33% | |

| Standard Deviation of Fund | +1.86% | +2.03% | +2.04% | +2.51% | +2.20% | +2.11% | N/A | +2.56% | |

| Standard Deviation of Benchmark | +2.36% | +2.32% | +2.69% | +2.88% | +2.29% | +2.12% | N/A | +2.47% | |

| Krungsri Good Life Fund (KFGOOD) | +1.29% | +2.66% | +0.98% | +3.40% | +0.02% | +0.77% | N/A | -0.46% | 313 |

| Benchmark(7) | +0.85% | +3.62% | +2.06% | +3.37% | -0.43% | +1.22% | N/A | +0.70% | |

| Standard Deviation of Fund | +3.81% | +4.02% | +4.24% | +5.30% | +4.60% | +4.36% | N/A | +5.08% | |

| Standard Deviation of Benchmark | +4.55% | +4.38% | +5.31% | +5.21% | +4.33% | +4.10% | N/A | +4.80% | |

| Krungsri Super Life Fund (KFSUPER) | +1.81% | +3.79% | +2.28% | +3.47% | -1.84% | -0.21% | N/A | -2.80% | 109 |

| Benchmark(8) | +1.09% | +5.16% | +3.12% | +4.05% | -1.60% | +1.23% | N/A | +0.63% | |

| Standard Deviation of Fund | +6.33% | +6.63% | +6.96% | +8.79% | +7.54% | +7.05% | N/A | +8.74% | |

| Standard Deviation of Benchmark | +6.91% | +6.69% | +7.98% | +8.08% | +6.62% | +6.20% | N/A | +7.53% | |

| Krungsri Yenjai Fund-A (KFYENJAI-A) | -0.10% | -0.04% | -0.48% | +1.75% | +1.40% | N/A | N/A | +1.40% | 5,995 |

| Benchmark(9) | +0.70% | +1.60% | +0.33% | +3.60% | +1.92% | N/A | N/A | +1.96% | |

| Standard Deviation of Fund | +1.25% | +1.20% | +1.42% | +1.14% | +1.08% | N/A | N/A | +1.04% | |

| Standard Deviation of Benchmark | +0.70% | +0.75% | +0.68% | +0.95% | +0.81% | N/A | N/A | +0.79% | |

| Krungsri The One Mild Fund-A (KF1MILD-A) | +1.65% | +4.14% | +1.11% | +5.37% | N/A | N/A | N/A | +2.89% | 228 |

| Benchmark(10) | +1.94% | +5.14% | +1.44% | +8.29% | N/A | N/A | N/A | +6.03% | |

| Standard Deviation of Fund | +3.00% | +2.88% | +3.46% | +3.85% | N/A | N/A | N/A | +3.43% | |

| Standard Deviation of Benchmark | +2.80% | +2.79% | +2.93% | +3.65% | N/A | N/A | N/A | +2.91% | |

| Krungsri The One Mild Fund-I (KF1MILD-I) | +1.65% | +4.14% | +1.11% | +5.37% | N/A | N/A | N/A | +2.99% | 121 |

| Benchmark(10) | +1.94% | +5.14% | +1.44% | +8.29% | N/A | N/A | N/A | +6.00% | |

| Standard Deviation of Fund | +3.00% | +2.89% | +3.46% | +3.85% | N/A | N/A | N/A | +3.47% | |

| Standard Deviation of Benchmark | +4.53% | +4.60% | +4.89% | +6.31% | N/A | N/A | N/A | +5.10% | |

| Krungsri The One Mean Fund-A (KF1MEAN-A) | +1.59% | +4.48% | +1.24% | +4.86% | N/A | N/A | N/A | +1.90% | 76 |

| Benchmark(11) | +2.33% | +7.23% | +2.15% | +10.56% | N/A | N/A | N/A | +7.44% | |

| Standard Deviation of Fund | +4.03% | +4.01% | +4.19% | +5.81% | N/A | N/A | N/A | +5.06% | |

| Standard Deviation of Benchmark | +4.53% | +4.60% | +4.89% | +6.31% | N/A | N/A | N/A | +5.07% | |

| Krungsri The One Mean Fund-I (KF1MEAN-I) | +1.58% | +4.48% | +1.24% | +4.85% | N/A | N/A | N/A | +1.98% | 197 |

| Benchmark(11) | +2.33% | +7.23% | +2.15% | +10.56% | N/A | N/A | N/A | +7.46% | |

| Standard Deviation of Fund | +4.03% | +4.01% | +4.19% | +5.81% | N/A | N/A | N/A | +5.09% | |

| Standard Deviation of Benchmark | +2.80% | +2.79% | +2.93% | +3.65% | N/A | N/A | N/A | +2.93% | |

| Krungsri The One Max Fund-A (KF1MAX-A) | +1.87% | +5.72% | +1.50% | +6.27% | N/A | N/A | N/A | +2.31% | 50 |

| Benchmark(12) | +3.53% | +10.92% | +3.24% | +15.49% | N/A | N/A | N/A | +11.57% | |

| Standard Deviation of Fund | +5.39% | +5.38% | +5.39% | +7.76% | N/A | N/A | N/A | +6.76% | |

| Standard Deviation of Benchmark | +6.75% | +6.99% | +7.10% | +9.92% | N/A | N/A | N/A | +7.93% | |

| Krungsri The One Max Fund-I (KF1MAX-I) | +1.87% | +5.72% | +1.50% | +6.27% | N/A | N/A | N/A | +2.39% | 222 |

| Benchmark(12) | +3.53% | +10.92% | +3.24% | +15.49% | N/A | N/A | N/A | +11.70% | |

| Standard Deviation of Fund | +5.39% | +5.38% | +5.39% | +7.76% | N/A | N/A | N/A | +6.78% | |

| Standard Deviation of Benchmark | +6.75% | +6.99% | +7.10% | +9.92% | N/A | N/A | N/A | +7.97% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Dividend Balance 70/30 Fund-D (KF-DB70-D) | +1.61% | +4.20% | +3.10% | +1.13% | -4.46% | -1.62% | N/A | -0.03% | 3 |

| Benchmark(13) | -0.06% | +6.55% | +3.69% | +3.71% | -4.60% | +0.92% | N/A | +4.18% | |

| Standard Deviation of Fund | +8.51% | +8.74% | +9.40% | +11.90% | +9.89% | +9.14% | N/A | +9.59% | |

| Standard Deviation of Benchmark | +12.98% | +13.37% | +11.68% | +17.59% | +13.98% | +12.91% | N/A | +13.63% | |

Remark