Fund Type

Retirement Mutual Fund (Mixed Fund)

Dividend Policy

None

Inception Date

12 October 2017

Investment Policy

The Fund will invest in fixed-income instruments, deposits, or deposit-equivalent instruments onshore and/or offshore, listed stock, stock during IPO pending listing on the stock exchanges, as well as property units or infra units. The Fund may invest no more than 100 per cent of its NAV in units of mutual funds under management of the Management Company in accordance with the criteria and conditions prescribed by the SEC. (Krungsri Happy Life RMF will invest in unit investment of Krungsri Happy Life Fund (KFHAPPY) approximately 100% of NAV since inception date.) The Fund may invest in aggregate of no more than 20 per cent of its NAV in fixed-income instruments of non-investment grade or unrated securities and may also invest in unlisted equity securities.

Fund Manager

Porntipa Nungnamjai, Thalit Choktippattana

Asset Allocation

20.21%

Instruments issued by Sovereign or Supra-national organization

5.83%

Fixed Income Instruments issued by Bank of Thailand

5.51%

Deposits and Fixed Income Instruments issued by Financial Institutions

49.81%

Fixed Income Instruments Issued by Corporates

1.88%

Other Assets

-0.35%

Other Liabilities

17.11%

Equity and Unit Trusts

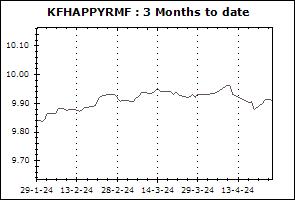

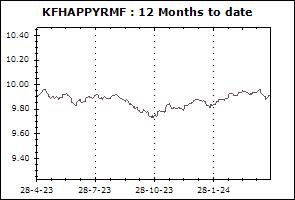

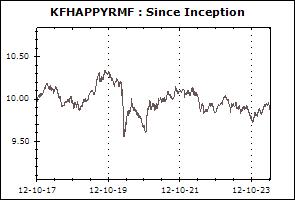

Return Chart

NAV Movement

- 3 Months

- 12 Months

- Since inception

Transaction Details

Minimum Purchase Amount (Baht): 500

Minimum Redemption Amount (Unit): None (Investors can only redeem the units of RMF and get exemption on the capital gains when they have held the units for more than 5 years and are at least 55 years old. The exceptions are when they die or become disable.)

Proceeds Payment Period: 3 business days after the redemption date (T+3)

Fund Subscription Period: Every dealing date of the fund by 15.30 hrs.

Fund Redemption Period: Every dealing date of the fund by 15.30 hrs.

Transaction Channel: Krungsri Asset Management,Online Service,AGENT

Asset Allocation (30 Dec 2025)

| Instruments issued by Sovereign or Supra-national organization | 19.62% |

| Fixed Income Instruments issued by Bank of Thailand | 7.59% |

| Deposits and Fixed Income Instruments issued by Financial Institutions | 7.21% |

| Fixed Income Instruments Issued by Corporates | 46.72% |

| Equity and Unit Trusts | 17.38% |

| Foreign CIS - Equity | 0.55% |

| Foreign CIS - Commodity | 0.23% |

| Other Assets | 1.78% |

| Other Liabilities | -1.09% |

Top Five Issuers/Guarantors

| Security Code | Issue / Issuer Rating | % of NAV |

|---|---|---|

| BONDS OF GULF DEVELOPMENT PUBLIC COMPANY LIMITED NO. 1/2568 SERIES 2 DUE B.E. 2573 | AA- | 3.46% |

| DEBENTURES OF MUANGTHAI CAPITAL PUBLIC COMPANY LIMITED NO. 3/2568 TRANCHE 1 DUE B.E. 2572 | A- | 3.40% |

| Goverment Housing Bank. | AAA | 3.28% |

| Debt Management Government Bond FY. B.E. 2566/25 | - | 3.13% |

| Savings Deposit-United Overseas Bank (Thai) Plc. | AAA | 2.82% |

Retirement Mutual Funds (RMF: All funds support PVD transfers)

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Cash RMF (KFCASHRMF) | +0.30% | +0.62% | +1.46% | +1.46% | +1.65% | +1.09% | +0.97% | +1.59% | 10,947 |

| Benchmark(4) | +0.24% | +0.53% | +1.22% | +1.22% | +1.40% | +1.03% | +1.16% | +1.67% | |

| Standard Deviation of Fund | +0.06% | +0.07% | +0.09% | +0.09% | +0.09% | +0.08% | +0.07% | +0.11% | |

| Standard Deviation of Benchmark | 0.00% | +0.01% | +0.01% | +0.01% | +0.01% | +0.02% | +0.02% | +0.04% | |

| Krungsri Government Bond RMF (KFGOVRMF) | -0.18% | +0.58% | +3.25% | +3.25% | +2.36% | +1.24% | +1.38% | +2.04% | 8,352 |

| Benchmark(5) | +0.32% | +0.86% | +2.28% | +2.28% | +1.87% | +1.25% | +2.29% | +2.99% | |

| Standard Deviation of Fund | +1.07% | +1.21% | +1.10% | +1.10% | +0.76% | +0.71% | +0.65% | +1.96% | |

| Standard Deviation of Benchmark | +0.23% | +0.25% | +0.24% | +0.24% | +0.21% | +0.25% | +0.85% | +1.29% | |

| Krungsri Medium Term Fixed Income RMF (KFMTFIRMF) | +0.07% | +1.00% | +3.82% | +3.82% | +2.98% | +2.03% | +2.02% | +1.92% | 5,831 |

| Benchmark(6) | +0.48% | +1.02% | +2.45% | +2.45% | +1.93% | +1.28% | +2.31% | +2.97% | |

| Standard Deviation of Fund | +0.93% | +1.06% | +0.94% | +0.94% | +0.67% | +0.73% | +0.71% | +0.57% | |

| Standard Deviation of Benchmark | +0.35% | +0.31% | +0.27% | +0.27% | +0.23% | +0.26% | +0.85% | +1.29% | |

| Krungsri Long Term Government Bond RMF (KFLTGOVRMF) | -1.16% | +0.13% | +4.95% | +4.95% | +3.25% | +1.63% | +2.09% | +2.01% | 1,902 |

| Benchmark(7) | +0.18% | +0.92% | +3.08% | +3.08% | +2.35% | +1.38% | +2.42% | +3.02% | |

| Standard Deviation of Fund | +2.26% | +2.74% | +2.37% | +2.37% | +1.70% | +1.63% | +1.57% | +1.11% | |

| Standard Deviation of Benchmark | +0.52% | +0.57% | +0.54% | +0.54% | +0.51% | +0.68% | +1.01% | +1.34% | |

| Krungsri Active Fixed Income RMF (KFAFIXRMF) | +0.01% | +0.89% | +3.61% | +3.61% | +3.00% | +2.07% | N/A | +2.47% | 3,898 |

| Benchmark(8) | +0.32% | +1.32% | +4.08% | +4.08% | +3.09% | +2.03% | N/A | +2.55% | |

| Standard Deviation of Fund | +1.01% | +1.12% | +0.98% | +0.98% | +0.72% | +0.78% | N/A | +1.02% | |

| Standard Deviation of Benchmark | +0.73% | +0.80% | +0.76% | +0.76% | +0.72% | +0.95% | N/A | +0.99% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Taweesap RMF (KFTSRMF) | -3.89% | +8.52% | -13.28% | -13.28% | -9.94% | -4.48% | -2.04% | +6.73% | 1,589 |

| Standard Deviation of Fund | +11.82% | +13.39% | +15.70% | +15.70% | +13.13% | +12.34% | +13.68% | +18.24% | |

| Krungsri Flexible 2 RMF (KFFLEX2RMF) | -3.88% | +8.60% | -13.23% | -13.23% | -9.97% | -4.49% | -2.07% | +5.76% | 615 |

| Standard Deviation of Fund | +11.85% | +13.43% | +15.71% | +15.71% | +13.11% | +12.32% | +13.62% | +17.53% | |

| Benchmark(9) | -0.67% | +8.90% | -0.81% | -0.81% | -0.92% | +0.97% | +2.70% | N/A | |

| Standard Deviation of Benchmark | +9.39% | +9.91% | +11.54% | +11.54% | +9.20% | +8.70% | +9.83% | N/A | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Happy Life RMF (KFHAPPYRMF) | +0.31% | +3.08% | +3.02% | +3.02% | +1.62% | +1.14% | N/A | +0.58% | 1,243 |

| (1)2-year Zero Rate Return (ZRR) Index 40% (2)An average 1-year fixed deposit rate for individuals of Bangkok Bank, Kasikorn Bank and Siam Commercial Bank 40% (3)SET Total Return Index (SET TRI) 20% | +0.13% | +4.14% | +0.62% | +0.62% | +0.37% | +1.10% | N/A | +1.02% | |

| Standard Deviation of Fund | +1.74% | +2.08% | +2.48% | +2.48% | +2.12% | +2.07% | N/A | +2.50% | |

| Standard Deviation of Benchmark | +2.33% | +2.52% | +2.88% | +2.88% | +2.26% | +2.13% | N/A | +2.49% | |

| Krungsri Good Life RMF (KFGOODRMF) | +0.42% | +5.16% | +1.25% | +1.25% | -0.17% | +0.41% | N/A | -0.62% | 340 |

| (1)2-year Zero Rate Return (ZRR) Index 30% (2)An average 1-year fixed deposit rate for individuals of Bangkok Bank, Kasikorn Bank and Siam Commercial Bank 30% (3)SET Total Return Index (SET TRI) 40% | -0.05% | +7.44% | -1.03% | -1.03% | -1.13% | +0.94% | N/A | +0.80% | |

| Standard Deviation of Fund | +3.65% | +4.20% | +5.23% | +5.23% | +4.45% | +4.27% | N/A | +5.00% | |

| Standard Deviation of Benchmark | +4.35% | +4.51% | +5.16% | +5.16% | +4.25% | +4.09% | N/A | +4.83% | |

| Krungsri Super Life RMF (KFSUPERRMF) | +0.03% | +7.24% | -1.08% | -1.08% | -2.50% | -0.72% | N/A | -3.10% | 136 |

| Benchmark(14) | -0.23% | +10.74% | -2.69% | -2.69% | -2.63% | +0.79% | N/A | +0.20% | |

| Standard Deviation of Fund | +6.10% | +7.04% | +8.69% | +8.69% | +7.29% | +6.90% | N/A | +8.59% | |

| Standard Deviation of Benchmark | +6.65% | +6.95% | +8.00% | +8.00% | +6.48% | +6.18% | N/A | +7.49% | |

| Krungsri The One Mild RMF (KF1MILDRMF) | +0.63% | +3.51% | +4.19% | +4.19% | N/A | N/A | N/A | +3.44% | 55 |

| Benchmark(15) | +1.31% | +6.01% | +6.87% | +6.87% | N/A | N/A | N/A | +6.60% | |

| Standard Deviation of Fund | +2.75% | +2.54% | +3.77% | +3.77% | N/A | N/A | N/A | +3.51% | |

| Standard Deviation of Benchmark | +2.91% | +2.86% | +3.62% | +3.62% | N/A | N/A | N/A | +3.06% | |

| Krungsri The One Mean RMF (KF1MEANRMF) | +0.40% | +4.09% | +3.33% | +3.33% | N/A | N/A | N/A | +2.98% | 34 |

| Benchmark(16) | +1.60% | +8.96% | +8.03% | +8.03% | N/A | N/A | N/A | +8.28% | |

| Standard Deviation of Fund | +3.99% | +3.63% | +5.62% | +5.62% | N/A | N/A | N/A | +5.04% | |

| Standard Deviation of Benchmark | +4.68% | +4.75% | +6.29% | +6.29% | N/A | N/A | N/A | +5.32% | |

| Krungsri The One Max RMF (KF1MAXRMF) | +0.52% | +5.19% | +4.67% | +4.67% | N/A | N/A | N/A | +4.24% | 40 |

| Benchmark(17) | +2.45% | +12.83% | +12.07% | +12.07% | N/A | N/A | N/A | +12.55% | |

| Standard Deviation of Fund | +5.41% | +4.94% | +7.46% | +7.46% | N/A | N/A | N/A | +6.64% | |

| Standard Deviation of Benchmark | +7.24% | +7.14% | +9.91% | +9.91% | N/A | N/A | N/A | +8.33% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Dividend Stock RMF (KFDIVRMF) | -1.55% | +13.25% | -9.01% | -9.01% | -8.22% | -3.56% | -1.62% | +4.00% | 6,060 |

| Standard Deviation of Fund | +11.54% | +13.23% | +16.96% | +16.96% | +13.80% | +12.94% | +14.59% | +15.51% | |

| Krungsri Equity RMF (KFEQRMF) | -2.14% | +10.18% | -10.93% | -10.93% | -9.28% | -2.62% | -1.89% | +3.49% | 1,139 |

| Standard Deviation of Fund | +10.48% | +13.48% | +17.10% | +17.10% | +13.87% | +12.80% | +14.96% | +18.71% | |

| Krungsri Thai All Stars Equity RMF (KFSTARRMF) | -1.14% | +10.75% | -3.88% | -3.88% | -7.57% | -1.86% | N/A | -6.24% | 474 |

| Standard Deviation of Fund | +9.92% | +12.11% | +16.04% | +16.04% | +13.59% | +12.77% | N/A | +15.13% | |

| Krungsri Dynamic RMF (KFDNMRMF) | -6.99% | +4.95% | -20.76% | -20.76% | -10.83% | +0.21% | N/A | -2.45% | 342 |

| Standard Deviation of Fund | +13.81% | +15.95% | +18.91% | +18.91% | +14.94% | +13.95% | N/A | +16.61% | |

| SET TRI | -0.59% | +17.33% | -5.99% | -5.99% | -5.63% | +0.47% | +3.05% | N/A | |

| Standard Deviation of Benchmark | +14.18% | +15.05% | +17.77% | +17.77% | +13.89% | +13.01% | +14.88% | N/A | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri SET100 RMF (KFS100RMF) | +0.98% | +19.05% | -5.16% | -5.16% | -4.52% | +0.39% | +2.48% | +5.73% | 3,717 |

| Standard Deviation of Fund | +14.29% | +15.71% | +19.31% | +19.31% | +14.92% | +13.88% | +16.33% | +20.01% | |

| SET100 TRI | +1.34% | +20.00% | -4.63% | -4.63% | -4.22% | +0.57% | +2.98% | +6.68% | |

| Standard Deviation of Benchmark | +14.24% | +15.72% | +19.29% | +19.29% | +14.99% | +13.95% | +16.46% | +20.26% | |

| Tracking Difference (TD) | N/A | N/A | N/A | -0.53% | N/A | N/A | N/A | N/A | |

| Tracking Error (TE) | N/A | N/A | N/A | +1.99% | N/A | N/A | N/A | N/A | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Gold RMF (KFGOLDRMF) | +12.49% | +28.11% | +57.39% | +57.39% | +26.78% | +13.65% | +9.32% | +6.11% | 3,395 |

| Benchmark(10) | +11.07% | +27.81% | +53.81% | +53.81% | +29.29% | +19.10% | +13.11% | +8.83% | |

| Standard Deviation of Fund | +23.57% | +19.19% | +18.03% | +18.03% | +15.30% | +14.83% | +13.85% | +14.92% | |

| Standard Deviation of Benchmark | +24.89% | +20.08% | +17.88% | +17.88% | +16.78% | +15.56% | +15.25% | +16.90% | |

| Krungsri Global Core Allocation RMF (KFCORERMF) | +3.06% | +7.70% | +7.84% | +7.84% | N/A | N/A | N/A | +8.10% | 59 |

| Standard Deviation of Fund | +7.72% | +6.90% | +8.61% | +8.61% | N/A | N/A | N/A | +7.74% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Europe Equity RMF (KFEURORMF) | +5.82% | +0.82% | +2.37% | +2.37% | +5.71% | +1.41% | +3.48% | +4.94% | 377 |

| Benchmark(10) | +5.18% | +1.89% | +8.15% | +8.15% | +7.75% | +2.46% | +4.33% | +5.25% | |

| Standard Deviation of Fund | +9.93% | +11.82% | +16.66% | +16.66% | +16.38% | +20.07% | +18.83% | +18.46% | |

| Standard Deviation of Benchmark | +11.05% | +12.80% | +16.81% | +16.81% | +17.40% | +21.20% | +19.55% | +19.28% | |

| Krungsri Global Healthcare Equity RMF (KFHCARERMF) | +11.53% | +13.69% | +10.58% | +10.58% | +0.70% | +0.32% | +2.12% | +3.34% | 2,313 |

| Benchmark(10) | +10.09% | +13.00% | +6.98% | +6.98% | +2.22% | +4.45% | +5.12% | +5.67% | |

| Standard Deviation of Fund | +12.32% | +11.58% | +14.74% | +14.74% | +13.35% | +15.26% | +15.98% | +16.23% | |

| Standard Deviation of Benchmark | +13.22% | +12.61% | +15.74% | +15.74% | +14.58% | +15.86% | +16.49% | +16.71% | |

| Krungsri Japan RMF (KFJAPANRMF) | +3.90% | +10.33% | +19.83% | +19.83% | +23.78% | +9.25% | +6.56% | +6.28% | 371 |

| Benchmark(10) | +0.59% | +3.92% | +18.66% | +18.66% | +15.75% | +2.71% | +5.02% | +4.49% | |

| Standard Deviation of Fund | +21.01% | +18.28% | +21.51% | +21.51% | +19.53% | +20.05% | +20.62% | +20.58% | |

| Standard Deviation of Benchmark | +19.43% | +18.27% | +20.47% | +20.47% | +18.82% | +20.03% | +20.53% | +20.50% | |

| Krungsri Global Brands Equity RMF (KFGBRANRMF) | -3.34% | -7.16% | -2.95% | -2.95% | +3.73% | +1.83% | N/A | +5.54% | 4,040 |

| Benchmark(10) | -4.69% | -7.96% | -6.26% | -6.26% | +5.49% | +6.35% | N/A | +8.72% | |

| Standard Deviation of Fund | +9.20% | +8.59% | +12.59% | +12.59% | +11.58% | +14.22% | N/A | +14.26% | |

| Standard Deviation of Benchmark | +11.22% | +11.19% | +15.59% | +15.59% | +13.63% | +14.92% | N/A | +14.73% | |

| Krungsri Global Smart Income RMF (KF-SINCOMERMF) | +1.28% | +2.84% | +6.20% | +6.20% | +3.66% | +0.56% | N/A | +1.84% | 1,462 |

| Benchmark(11) | +2.46% | +5.03% | +10.66% | +10.66% | +8.22% | +3.78% | N/A | +4.72% | |

| Standard Deviation of Fund | +2.40% | +2.87% | +3.88% | +3.88% | +4.27% | +4.44% | N/A | +4.18% | |

| Standard Deviation of Benchmark | +2.22% | +2.80% | +3.60% | +3.60% | +4.22% | +4.43% | N/A | +4.21% | |

| Krungsri Global Smart Income FX RMF (KF-SINCOME-FXRMF) | -0.55% | +1.28% | +1.32% | +1.32% | N/A | N/A | N/A | +2.00% | 119 |

| Benchmark(10) | -0.27% | +1.89% | +2.28% | +2.28% | N/A | N/A | N/A | +3.32% | |

| Standard Deviation of Fund | +6.21% | +6.45% | +8.10% | +8.10% | N/A | N/A | N/A | +8.00% | |

| Standard Deviation of Benchmark | +7.55% | +6.55% | +8.57% | +8.57% | N/A | N/A | N/A | +8.58% | |

| Krungsri Greater China Equity Hedged FX RMF (KF-GCHINARMF) | -2.94% | +7.38% | +10.97% | +10.97% | -0.07% | -5.44% | N/A | +0.59% | 1,120 |

| Benchmark(11) | -1.94% | +9.81% | +15.82% | +15.82% | +4.60% | -2.02% | N/A | +4.01% | |

| Standard Deviation of Fund | +15.53% | +14.36% | +19.44% | +19.44% | +19.50% | +21.38% | N/A | +20.70% | |

| Standard Deviation of Benchmark | +15.56% | +14.23% | +20.34% | +20.34% | +20.02% | +21.65% | N/A | +20.99% | |

| Krungsri Global Technology Equity RMF (KFGTECHRMF) | +1.16% | +12.33% | +20.62% | +20.62% | +31.16% | +0.83% | N/A | +7.50% | 3,983 |

| Benchmark(10) | -0.30% | +11.83% | +17.79% | +17.79% | +34.34% | +5.56% | N/A | +12.14% | |

| Standard Deviation of Fund | +26.58% | +23.32% | +28.54% | +28.54% | +25.47% | +34.52% | N/A | +30.54% | |

| Standard Deviation of Benchmark | +27.31% | +24.21% | +29.24% | +29.24% | +26.07% | +33.94% | N/A | +30.36% | |

| Krungsri Emerging Markets ex China Index RMF (KF-EMXCN-INDXRMF) | +5.75% | +12.18% | +21.47% | +21.47% | N/A | N/A | N/A | +17.08% | 60 |

| Benchmark(10) | +6.89% | +13.91% | +24.85% | +24.85% | N/A | N/A | N/A | +19.08% | |

| Standard Deviation of Fund | +14.86% | +12.63% | +16.24% | +16.24% | N/A | N/A | N/A | +16.05% | |

| Standard Deviation of Benchmark | +16.74% | +13.86% | +16.24% | +16.24% | N/A | N/A | N/A | +16.28% | |

| Krungsri India Equity RMF (KFINDIARMF) | -0.28% | -8.14% | -9.50% | -9.50% | +7.21% | +6.80% | N/A | +5.84% | 555 |

| Benchmark(10) | -1.80% | -9.09% | -12.40% | -12.40% | +8.89% | +11.11% | N/A | +9.06% | |

| Standard Deviation of Fund | +9.54% | +9.76% | +13.05% | +13.05% | +11.79% | +13.81% | N/A | +15.72% | |

| Standard Deviation of Benchmark | +12.02% | +12.01% | +15.83% | +15.83% | +14.21% | +15.16% | N/A | +17.06% | |

| Krungsri China A Shares Equity RMF (KF-ACHINARMF) | -2.53% | +8.23% | +9.97% | +9.97% | -1.79% | -10.74% | N/A | -10.74% | 1,021 |

| Benchmark(10) | -4.16% | +7.26% | +5.69% | +5.69% | -0.71% | -7.14% | N/A | -6.93% | |

| Standard Deviation of Fund | +10.86% | +11.21% | +12.06% | +12.06% | +15.31% | +19.38% | N/A | +19.36% | |

| Standard Deviation of Benchmark | +12.41% | +12.54% | +13.51% | +13.51% | +16.76% | +20.06% | N/A | +20.06% | |

| Krungsri US Equity Index FX RMF (KFUSINDFXRMF) | +0.25% | +7.47% | +7.51% | +7.51% | N/A | N/A | N/A | +10.97% | 311 |

| Benchmark(10) | +0.70% | +8.50% | +9.28% | +9.28% | N/A | N/A | N/A | +13.82% | |

| Standard Deviation of Fund | +12.87% | +11.13% | +19.48% | +19.48% | N/A | N/A | N/A | +18.23% | |

| Standard Deviation of Benchmark | +13.88% | +12.11% | +19.75% | +19.75% | N/A | N/A | N/A | +18.74% | |

| Krungsri NDQ Index RMF (KFNDQRMF) | +2.02% | +9.67% | +14.93% | +14.93% | N/A | N/A | N/A | +14.51% | 170 |

| Benchmark(10) | +0.59% | +9.22% | +11.66% | +11.66% | N/A | N/A | N/A | +11.78% | |

| Standard Deviation of Fund | +17.56% | +14.41% | +23.45% | +23.45% | N/A | N/A | N/A | +23.03% | |

| Standard Deviation of Benchmark | +18.85% | +15.70% | +23.81% | +23.81% | N/A | N/A | N/A | +23.55% | |

| Krungsri US Equity RMF (KFUSRMF) | -2.71% | -4.75% | -11.71% | -11.71% | +12.00% | N/A | N/A | -12.78% | 145 |

| Benchmark(10) | -4.05% | -5.54% | -14.50% | -14.50% | +14.62% | N/A | N/A | -9.75% | |

| Standard Deviation of Fund | +10.34% | +9.19% | +14.12% | +14.12% | +22.46% | N/A | N/A | +33.64% | |

| Standard Deviation of Benchmark | +11.81% | +11.17% | +15.58% | +15.58% | +23.26% | N/A | N/A | +33.46% | |

| Krungsri Next Generation Infrastructure RMF (KFINFRARMF) | -0.58% | -1.84% | +9.05% | +9.05% | +4.93% | N/A | N/A | -0.36% | 72 |

| Benchmark(11) | +0.70% | +0.48% | +14.42% | +14.42% | +10.10% | N/A | N/A | +4.32% | |

| Standard Deviation of Fund | +7.48% | +7.59% | +12.17% | +12.17% | +11.72% | N/A | N/A | +13.89% | |

| Standard Deviation of Benchmark | +7.64% | +7.78% | +12.49% | +12.49% | +12.03% | N/A | N/A | +14.22% | |

| Krungsri World Equity Index RMF (KF-WORLD-INDXRMF) | +2.32% | +8.61% | +16.18% | +16.18% | N/A | N/A | N/A | +12.73% | 416 |

| Benchmark(10) | +1.16% | +8.38% | +13.56% | +13.56% | N/A | N/A | N/A | +12.37% | |

| Standard Deviation of Fund | +12.09% | +10.37% | +16.98% | +16.98% | N/A | N/A | N/A | +16.16% | |

| Standard Deviation of Benchmark | +13.47% | +11.53% | +17.68% | +17.68% | N/A | N/A | N/A | +17.19% | |

| Krungsri Global Unconstrained Equity RMF (KFGLOBALRMF) | +0.98% | +2.43% | +7.73% | +7.73% | N/A | N/A | N/A | +5.06% | 15 |

| Benchmark(10) | -0.48% | +1.74% | +5.32% | +5.32% | N/A | N/A | N/A | +6.02% | |

| Standard Deviation of Fund | +16.97% | +14.47% | +21.06% | +21.06% | N/A | N/A | N/A | +20.24% | |

| Standard Deviation of Benchmark | +17.93% | +15.70% | +21.93% | +21.93% | N/A | N/A | N/A | +21.39% | |

| Krungsri Global Unconstrained Equity FX RMF (KFGLOBFXRMF) | -0.92% | +0.75% | +3.08% | +3.08% | N/A | N/A | N/A | +2.72% | 9 |

| Benchmark(10) | -0.48% | +1.74% | +5.32% | +5.32% | N/A | N/A | N/A | +6.02% | |

| Standard Deviation of Fund | +17.62% | +15.02% | +21.92% | +21.92% | N/A | N/A | N/A | +21.11% | |

| Standard Deviation of Benchmark | +17.93% | +15.70% | +21.93% | +21.93% | N/A | N/A | N/A | +21.39% | |

| Krungsri Global Growth RMF (KFGGRMF) | -6.84% | +1.27% | +9.84% | +9.84% | +19.59% | N/A | N/A | -3.57% | 1,498 |

| Benchmark(11) | -5.72% | +3.89% | +15.90% | +15.90% | +26.54% | N/A | N/A | +1.47% | |

| Standard Deviation of Fund | +18.78% | +16.86% | +23.21% | +23.21% | +21.36% | N/A | N/A | +28.92% | |

| Standard Deviation of Benchmark | +20.28% | +18.19% | +27.03% | +27.03% | +23.13% | N/A | N/A | +30.29% | |

| Krungsri China Megatrends RMF (KFCMEGARMF) | -9.98% | +3.61% | +16.17% | +16.17% | -1.77% | N/A | N/A | -3.54% | 205 |

| Benchmark(12) | -8.82% | +9.08% | +21.77% | +21.77% | +7.83% | N/A | N/A | +5.50% | |

| Standard Deviation of Fund | +19.77% | +19.52% | +27.01% | +27.01% | +29.55% | N/A | N/A | +30.49% | |

| Standard Deviation of Benchmark | +17.07% | +16.18% | +23.06% | +23.06% | +22.39% | N/A | N/A | +23.71% | |

| Krungsri Equity Sustainable Global Growth RMF (KFESGRMF) | -3.60% | -1.88% | +1.20% | +1.20% | +4.15% | N/A | N/A | +3.04% | 87 |

| Benchmark(11) | -2.37% | +0.47% | +6.56% | +6.56% | +9.63% | N/A | N/A | +8.49% | |

| Standard Deviation of Fund | +13.97% | +12.10% | +18.85% | +18.85% | +15.32% | N/A | N/A | +16.50% | |

| Standard Deviation of Benchmark | +13.98% | +12.24% | +18.78% | +18.78% | +15.57% | N/A | N/A | +16.97% | |

| Krungsri Vietnam Equity RMF (KFVIETRMF) | -0.83% | +16.45% | +11.47% | +11.47% | +6.50% | N/A | N/A | -0.47% | 478 |

| Benchmark(13) | +6.00% | +32.11% | +36.19% | +36.19% | +20.29% | N/A | N/A | +8.47% | |

| Standard Deviation of Fund | +20.60% | +19.32% | +19.99% | +19.99% | +16.68% | N/A | N/A | +17.43% | |

| Standard Deviation of Benchmark | +25.20% | +24.66% | +24.22% | +24.22% | +20.48% | N/A | N/A | +22.78% | |

| Krungsri ESG Climate Tech RMF (KFCLIMARMF) | -0.63% | +3.96% | +17.14% | +17.14% | +5.45% | N/A | N/A | -2.41% | 161 |

| Standard Deviation of Fund | +16.19% | +14.17% | +17.56% | +17.56% | +16.33% | N/A | N/A | +19.17% | |

Remark