Fund Type

Retirement Mutual Fund (Mixed Fund)

Dividend Policy

None

Objective

To promote long term investment as a retirement planning for investors.

Inception Date

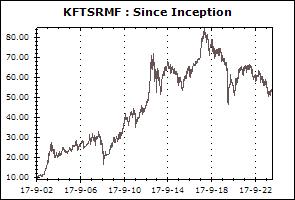

17 September 2002

Investment Policy

To invest in bank deposits, fixed income securities, hybrid instruments, or equity, or other securities or other means of seeking interest in accordance with the SEC’s notification.

Fund Manager

Sawinee Sooksiwong, Thalit Choktippattana

Asset Allocation

13.15%

Deposits and Fixed Income Instruments issued by Financial Institutions

1.43%

Other Assets

-0.42%

Other Liabilities

85.84%

Equity and Unit Trusts

Transaction Details

Minimum Purchase Amount (Baht): 500

Minimum Redemption Amount (Unit): None (Investors can only redeem the units of RMF and get exemption on the capital gains when they have held the units for more than 5 years and are at least 55 years old. The exceptions are when they die or become disable.)

Transaction Period: Every fund`s dealing date within 15.30 hrs.

Proceeds Payment Period: 3 business days after the redemption date (T+3)

Fund Redemption Period: Every fund`s dealing date within 15.30 hrs.

Transaction Channel: Krungsri Asset Management,Online Service,AGENT

Asset Allocation (30 Jan 2026)

| Deposits and Fixed Income Instruments issued by Financial Institutions | 8.95% |

| Equity and Unit Trusts | 89.74% |

| Other Assets | 2.85% |

| Other Liabilities | -1.55% |

Top Five Issuers/Guarantors

| Security Code | Issue / Issuer Rating | % of NAV |

|---|---|---|

| Advanced Info Service Plc. | AAA | 6.22% |

| Savings Deposit-United Overseas Bank (Thai) Plc. | AAA | 6.19% |

| PTT Plc. | AAA | 5.54% |

| MBK Plc. | A- | 5.17% |

| Delta Electronics (Thailand) Plc. | - | 4.85% |

Retirement Mutual Funds (RMF: All funds support PVD transfers)

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Cash RMF (KFCASHRMF) | +0.27% | +0.56% | +0.07% | +1.36% | +1.65% | +1.10% | +0.97% | +1.59% | 10,833 |

| Benchmark(4) | +0.22% | +0.50% | +0.07% | +1.17% | +1.40% | +1.04% | +1.15% | +1.67% | |

| Standard Deviation of Fund | +0.08% | +0.07% | +0.09% | +0.09% | +0.09% | +0.08% | +0.07% | +0.11% | |

| Standard Deviation of Benchmark | +0.01% | +0.01% | +0.01% | +0.01% | +0.01% | +0.02% | +0.02% | +0.04% | |

| Krungsri Government Bond RMF (KFGOVRMF) | -0.17% | -0.46% | -0.73% | +2.42% | +2.13% | +1.11% | +1.26% | +2.00% | 7,995 |

| Benchmark(5) | +0.36% | +0.63% | -0.01% | +2.15% | +1.90% | +1.25% | +2.21% | +2.98% | |

| Standard Deviation of Fund | +1.11% | +1.29% | +1.19% | +1.15% | +0.79% | +0.73% | +0.66% | +1.96% | |

| Standard Deviation of Benchmark | +0.22% | +0.24% | +0.17% | +0.24% | +0.21% | +0.25% | +0.84% | +1.29% | |

| Krungsri Medium Term Fixed Income RMF (KFMTFIRMF) | +0.21% | +0.16% | -0.45% | +3.27% | +2.83% | +1.93% | +1.93% | +1.89% | 5,733 |

| Benchmark(6) | +0.59% | +0.81% | 0.00% | +2.32% | +1.96% | +1.29% | +2.23% | +2.96% | |

| Standard Deviation of Fund | +0.90% | +1.10% | +0.93% | +0.97% | +0.69% | +0.74% | +0.71% | +0.57% | |

| Standard Deviation of Benchmark | +0.33% | +0.31% | +0.25% | +0.28% | +0.23% | +0.26% | +0.84% | +1.29% | |

| Krungsri Long Term Government Bond RMF (KFLTGOVRMF) | -1.48% | -2.60% | -2.14% | +2.76% | +2.49% | +1.23% | +1.80% | +1.90% | 1,822 |

| Benchmark(7) | +0.21% | +0.26% | -0.34% | +2.62% | +2.21% | +1.32% | +2.31% | +3.00% | |

| Standard Deviation of Fund | +2.48% | +2.96% | +2.85% | +2.53% | +1.78% | +1.67% | +1.59% | +1.13% | |

| Standard Deviation of Benchmark | +0.56% | +0.62% | +0.66% | +0.57% | +0.52% | +0.69% | +1.00% | +1.34% | |

| Krungsri Active Fixed Income RMF (KFAFIXRMF) | +0.14% | +0.03% | -0.52% | +3.00% | +2.81% | +1.95% | N/A | +2.37% | 3,961 |

| Benchmark(8) | +0.41% | +0.57% | -0.32% | +3.60% | +2.97% | +1.97% | N/A | +2.48% | |

| Standard Deviation of Fund | +0.95% | +1.17% | +0.94% | +1.01% | +0.74% | +0.79% | N/A | +1.02% | |

| Standard Deviation of Benchmark | +0.76% | +0.85% | +0.84% | +0.80% | +0.73% | +0.95% | N/A | +0.99% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

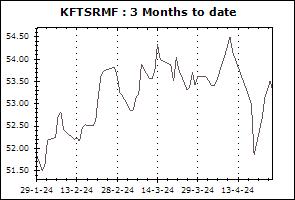

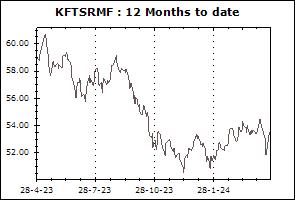

| Krungsri Taweesap RMF (KFTSRMF) | -1.55% | +1.96% | +3.29% | -4.59% | -8.97% | -3.86% | -1.62% | +6.85% | 1,620 |

| Benchmark(9) | +1.00% | +3.97% | +2.58% | +4.87% | -0.07% | +1.37% | +2.90% | +7.43% | |

| Standard Deviation of Fund | +11.47% | +12.36% | +12.61% | +15.59% | +13.23% | +12.35% | +13.63% | +18.22% | |

| Standard Deviation of Benchmark | +8.44% | +8.77% | +7.24% | +11.35% | +9.25% | +8.62% | +9.77% | +10.95% | |

| Krungsri Flexible 2 RMF (KFFLEX2RMF) | -1.53% | +2.03% | +3.31% | -4.55% | -8.99% | -3.85% | -1.65% | +5.89% | 622 |

| Benchmark(10) | +1.00% | +3.97% | +2.58% | +4.87% | -0.07% | +1.37% | +2.90% | +7.71% | |

| Standard Deviation of Fund | +11.52% | +12.41% | +12.70% | +15.61% | +13.21% | +12.33% | +13.57% | +17.51% | |

| Standard Deviation of Benchmark | +5.94% | +5.78% | +6.63% | +7.24% | +5.79% | +5.36% | +6.09% | +7.64% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Happy Life RMF (KFHAPPYRMF) | +0.82% | +1.48% | +0.19% | +3.71% | +1.66% | +1.26% | N/A | +0.59% | 1,230 |

| Benchmark(15) | +0.63% | +2.13% | +1.03% | +2.79% | +0.78% | +1.27% | N/A | +1.16% | |

| Standard Deviation of Fund | +1.83% | +1.99% | +2.04% | +2.46% | +2.13% | +2.06% | N/A | +2.50% | |

| Krungsri Good Life RMF (KFGOODRMF) | +1.47% | +2.84% | +1.18% | +3.71% | +0.28% | +0.80% | N/A | -0.45% | 341 |

| Benchmark(16) | +0.87% | +3.65% | +2.08% | +3.44% | -0.36% | +1.26% | N/A | +1.10% | |

| Standard Deviation of Fund | +3.74% | +3.92% | +4.08% | +5.17% | +4.47% | +4.26% | N/A | +4.99% | |

| Standard Deviation of Benchmark | +4.59% | +4.39% | +5.31% | +5.20% | +4.32% | +4.09% | N/A | +4.83% | |

| Krungsri Super Life RMF (KFSUPERRMF) | +1.84% | +3.76% | +2.32% | +3.40% | -1.59% | -0.06% | N/A | -2.74% | 136 |

| Benchmark(17) | +1.11% | +5.18% | +3.13% | +4.09% | -1.55% | +1.26% | N/A | +0.67% | |

| Standard Deviation of Fund | +6.24% | +6.52% | +6.85% | +8.60% | +7.34% | +6.89% | N/A | +8.58% | |

| Standard Deviation of Benchmark | +6.96% | +6.69% | +7.97% | +8.06% | +6.59% | +6.18% | N/A | +7.50% | |

| Krungsri The One Mild RMF (KF1MILDRMF) | +1.48% | +3.86% | +1.02% | +4.86% | N/A | N/A | N/A | +3.77% | 57 |

| Benchmark(18) | +1.95% | +5.15% | +1.45% | +8.30% | N/A | N/A | N/A | +7.76% | |

| Standard Deviation of Fund | +2.86% | +2.77% | +3.32% | +3.74% | N/A | N/A | N/A | +3.50% | |

| Standard Deviation of Benchmark | +2.80% | +2.79% | +2.93% | +3.65% | N/A | N/A | N/A | +3.06% | |

| Krungsri The One Mean RMF (KF1MEANRMF) | +1.42% | +4.11% | +1.11% | +4.34% | N/A | N/A | N/A | +3.36% | 35 |

| Benchmark(19) | +2.34% | +7.24% | +2.16% | +10.57% | N/A | N/A | N/A | +9.83% | |

| Standard Deviation of Fund | +3.83% | +3.81% | +3.97% | +5.56% | N/A | N/A | N/A | +5.00% | |

| Krungsri The One Max RMF (KF1MAXRMF) | +1.68% | +5.33% | +1.36% | +5.66% | N/A | N/A | N/A | +4.69% | 40 |

| Benchmark(20) | +3.53% | +10.93% | +3.24% | +15.49% | N/A | N/A | N/A | +14.72% | |

| Standard Deviation of Fund | +5.13% | +5.14% | +5.11% | +7.41% | N/A | N/A | N/A | +6.59% | |

| Standard Deviation of Benchmark | +6.75% | +6.99% | +7.10% | +9.92% | N/A | N/A | N/A | +8.29% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Dividend Stock RMF (KFDIVRMF) | +2.20% | +5.51% | +4.15% | +0.90% | -6.65% | -2.65% | -1.27% | +4.21% | 6,191 |

| Standard Deviation of Fund | +11.68% | +12.03% | +12.90% | +16.79% | +13.92% | +12.93% | +14.53% | +15.50% | |

| Krungsri Equity RMF (KFEQRMF) | +2.46% | +2.98% | +3.59% | -1.62% | -8.25% | -1.91% | -1.33% | +3.66% | 1,161 |

| Standard Deviation of Fund | +11.00% | +12.20% | +13.33% | +16.91% | +13.98% | +12.83% | +14.91% | +18.69% | |

| Krungsri Thai All Stars Equity RMF (KFSTARRMF) | +5.03% | +5.09% | +4.16% | +6.47% | -6.10% | -1.02% | N/A | -5.72% | 487 |

| Standard Deviation of Fund | +11.65% | +11.54% | +14.61% | +16.02% | +13.75% | +12.78% | N/A | +15.13% | |

| Krungsri Dynamic RMF (KFDNMRMF) | -1.87% | -3.17% | +1.57% | -13.47% | -10.30% | +0.05% | N/A | -2.21% | 343 |

| Standard Deviation of Fund | +14.21% | +15.03% | +16.21% | +18.96% | +15.12% | +13.96% | N/A | +16.60% | |

| SET TRI | +1.56% | +8.28% | +5.24% | +5.39% | -4.08% | +1.25% | +3.47% | N/A | |

| Standard Deviation of Benchmark | +14.70% | +14.20% | +16.58% | +17.92% | +14.12% | +13.00% | +14.83% | N/A | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri SET100 RMF (KFS100RMF) | +3.23% | +9.11% | +5.55% | +6.66% | -2.49% | +1.25% | +2.95% | +5.99% | 3,834 |

| Standard Deviation of Fund | +14.34% | +14.25% | +15.66% | +19.32% | +15.10% | +13.78% | +16.22% | +19.99% | |

| SET100 TRI | +3.48% | +9.60% | +5.37% | +7.09% | -2.30% | +1.39% | +3.40% | +6.92% | |

| Standard Deviation of Benchmark | +14.22% | +14.19% | +15.40% | +19.27% | +15.15% | +13.85% | +16.35% | +20.24% | |

| Tracking Difference (TD) | N/A | N/A | N/A | -0.43% | N/A | N/A | N/A | N/A | |

| Tracking Error (TE) | N/A | N/A | N/A | +2.01% | N/A | N/A | N/A | N/A | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Gold RMF (KFGOLDRMF) | +24.84% | +48.79% | +15.93% | +72.19% | +31.58% | +17.50% | +10.62% | +7.04% | 4,255 |

| Benchmark(11) | +23.85% | +48.29% | +16.77% | +70.98% | +36.19% | +23.28% | +14.54% | +9.82% | |

| Standard Deviation of Fund | +25.92% | +23.77% | +37.20% | +20.89% | +16.46% | +15.47% | +14.24% | +15.12% | |

| Standard Deviation of Benchmark | +26.03% | +24.40% | +36.08% | +20.62% | +17.78% | +16.18% | +15.60% | +17.07% | |

| Krungsri Global Core Allocation RMF (KFCORERMF) | +1.66% | +7.58% | +1.64% | +8.32% | N/A | N/A | N/A | +8.56% | 73 |

| Standard Deviation of Fund | +7.62% | +7.11% | +6.11% | +8.55% | N/A | N/A | N/A | +7.69% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Europe Equity RMF (KFEURORMF) | +9.97% | +10.33% | +5.98% | +1.90% | +6.05% | +2.83% | +4.94% | +5.45% | 397 |

| Benchmark(11) | +10.82% | +13.52% | +6.86% | +9.13% | +8.92% | +4.22% | +5.97% | +5.84% | |

| Standard Deviation of Fund | +10.38% | +11.11% | +9.19% | +16.04% | +16.20% | +20.05% | +18.72% | +18.41% | |

| Standard Deviation of Benchmark | +11.29% | +12.00% | +9.72% | +16.14% | +17.20% | +21.18% | +19.54% | +19.23% | |

| Krungsri Global Healthcare Equity RMF (KFHCARERMF) | +5.98% | +14.49% | +0.02% | +2.48% | +1.02% | -0.21% | +3.65% | +3.32% | 2,302 |

| Benchmark(11) | +4.29% | +12.90% | +0.02% | 0.00% | +3.89% | +3.89% | +6.73% | +5.63% | |

| Standard Deviation of Fund | +12.74% | +12.58% | +15.56% | +15.02% | +13.42% | +15.23% | +15.83% | +16.22% | |

| Standard Deviation of Benchmark | +14.67% | +14.23% | +19.18% | +16.27% | +14.79% | +15.87% | +16.36% | +16.73% | |

| Krungsri Japan Equity Index RMF (KF-JP-INDXRMF) | +1.28% | N/A | +5.46% | N/A | N/A | N/A | N/A | +10.08% | 24 |

| Benchmark(12) | +1.84% | N/A | +5.87% | N/A | N/A | N/A | N/A | +10.56% | |

| Standard Deviation of Fund | +19.91% | N/A | +20.93% | N/A | N/A | N/A | N/A | +20.32% | |

| Standard Deviation of Benchmark | +21.07% | N/A | +22.26% | N/A | N/A | N/A | N/A | +22.08% | |

| Krungsri Japan RMF (KFJAPANRMF) | -0.46% | +15.24% | +4.96% | +26.92% | +23.58% | +10.83% | +8.05% | +6.74% | 391 |

| Benchmark(11) | +1.22% | +13.47% | +6.37% | +26.58% | +17.27% | +4.80% | +6.68% | +5.09% | |

| Standard Deviation of Fund | +18.40% | +18.88% | +18.08% | +21.90% | +19.57% | +20.08% | +20.48% | +20.56% | |

| Standard Deviation of Benchmark | +15.79% | +17.82% | +15.23% | +20.64% | +18.76% | +20.00% | +20.36% | +20.46% | |

| Krungsri Global Brands Equity RMF (KFGBRANRMF) | -4.47% | -10.85% | -4.26% | -11.92% | +1.30% | +1.31% | N/A | +4.98% | 3,777 |

| Benchmark(11) | -6.15% | -12.40% | -4.36% | -14.32% | +4.26% | +5.81% | N/A | +8.11% | |

| Standard Deviation of Fund | +10.11% | +9.75% | +12.63% | +12.63% | +11.55% | +14.26% | N/A | +14.25% | |

| Standard Deviation of Benchmark | +11.36% | +11.69% | +12.41% | +15.70% | +13.52% | +14.95% | N/A | +14.71% | |

| Krungsri Global Smart Income RMF (KF-SINCOMERMF) | +0.57% | +3.25% | +0.15% | +5.52% | +2.89% | +0.53% | N/A | +1.84% | 1,478 |

| Benchmark(12) | +1.72% | +5.50% | +0.50% | +9.97% | +7.24% | +3.79% | N/A | +4.73% | |

| Standard Deviation of Fund | +2.26% | +2.71% | +2.09% | +3.78% | +4.19% | +4.44% | N/A | +4.16% | |

| Standard Deviation of Benchmark | +2.20% | +2.61% | +2.20% | +3.49% | +4.13% | +4.43% | N/A | +4.20% | |

| Krungsri Global Smart Income FX RMF (KF-SINCOME-FXRMF) | -1.41% | +0.94% | +0.12% | +1.71% | N/A | N/A | N/A | +1.96% | 126 |

| Benchmark(11) | -1.19% | +1.50% | +0.18% | +2.63% | N/A | N/A | N/A | +3.25% | |

| Standard Deviation of Fund | +6.85% | +6.64% | +8.01% | +8.04% | N/A | N/A | N/A | +7.99% | |

| Standard Deviation of Benchmark | +7.94% | +7.04% | +9.08% | +8.64% | N/A | N/A | N/A | +8.60% | |

| Krungsri Greater China Equity Hedged FX RMF (KF-GCHINARMF) | +2.33% | +9.36% | +4.55% | +18.41% | -1.55% | -5.69% | N/A | +1.12% | 1,155 |

| Benchmark(12) | +3.68% | +12.06% | +5.15% | +23.85% | +2.82% | -2.26% | N/A | +4.60% | |

| Standard Deviation of Fund | +14.04% | +14.73% | +14.49% | +19.35% | +19.45% | +21.31% | N/A | +20.65% | |

| Standard Deviation of Benchmark | +14.27% | +14.55% | +13.95% | +20.04% | +19.87% | +21.57% | N/A | +20.93% | |

| Krungsri Global Technology Equity RMF (KFGTECHRMF) | -3.74% | +10.67% | +3.07% | +21.42% | +27.16% | +1.19% | N/A | +7.81% | 4,062 |

| Benchmark(11) | -5.31% | +9.32% | +3.25% | +19.74% | +31.65% | +5.96% | N/A | +12.44% | |

| Standard Deviation of Fund | +25.61% | +23.57% | +19.22% | +28.12% | +24.95% | +34.45% | N/A | +30.45% | |

| Standard Deviation of Benchmark | +27.29% | +24.27% | +19.32% | +28.96% | +25.47% | +33.86% | N/A | +30.26% | |

| Krungsri Emerging Markets ex China Index RMF (KF-EMXCN-INDXRMF) | +8.00% | +22.22% | +8.88% | +32.35% | N/A | N/A | N/A | +24.48% | 98 |

| Benchmark(11) | +9.38% | +24.59% | +9.39% | +36.27% | N/A | N/A | N/A | +26.93% | |

| Standard Deviation of Fund | +15.63% | +13.87% | +16.70% | +16.24% | N/A | N/A | N/A | +16.13% | |

| Standard Deviation of Benchmark | +16.97% | +14.70% | +15.92% | +16.39% | N/A | N/A | N/A | +16.31% | |

| Krungsri India Equity RMF (KFINDIARMF) | -7.60% | -9.93% | -5.42% | -9.76% | +5.47% | +5.36% | N/A | +4.95% | 515 |

| Benchmark(11) | -9.46% | -11.73% | -5.67% | -12.24% | +8.46% | +9.54% | N/A | +8.07% | |

| Standard Deviation of Fund | +9.53% | +10.16% | +10.46% | +12.41% | +11.87% | +13.80% | N/A | +15.68% | |

| Standard Deviation of Benchmark | +11.96% | +12.75% | +13.90% | +15.53% | +14.26% | +15.20% | N/A | +17.03% | |

| Krungsri China H Shares Equity Index RMF (KF-HSHARE-INDXRMF) | +0.39% | N/A | +3.12% | N/A | N/A | N/A | N/A | +1.90% | 23 |

| Benchmark(11) | -1.57% | N/A | +2.98% | N/A | N/A | N/A | N/A | -3.12% | |

| Standard Deviation of Fund | +16.94% | N/A | +17.53% | N/A | N/A | N/A | N/A | +16.99% | |

| Standard Deviation of Benchmark | +18.88% | N/A | +19.12% | N/A | N/A | N/A | N/A | +19.28% | |

| Krungsri China Equity CSI 300 RMF (KF-CSI300-INDXRMF) | +0.67% | N/A | +0.64% | N/A | N/A | N/A | N/A | +2.91% | 43 |

| Benchmark(11) | +1.02% | N/A | +1.24% | N/A | N/A | N/A | N/A | +1.04% | |

| Standard Deviation of Fund | +13.05% | N/A | +11.48% | N/A | N/A | N/A | N/A | +13.12% | |

| Standard Deviation of Benchmark | +12.28% | N/A | +9.88% | N/A | N/A | N/A | N/A | +13.84% | |

| Krungsri China A Shares Equity RMF (KF-ACHINARMF) | +0.01% | +5.73% | -0.23% | +12.41% | -4.63% | -11.56% | N/A | -10.61% | 992 |

| Benchmark(11) | -1.74% | +3.94% | -0.22% | +9.22% | -2.55% | -8.01% | N/A | -6.86% | |

| Standard Deviation of Fund | +10.52% | +11.56% | +11.87% | +12.03% | +15.19% | +19.19% | N/A | +19.26% | |

| Standard Deviation of Benchmark | +11.33% | +12.88% | +12.74% | +13.51% | +16.56% | +19.86% | N/A | +19.95% | |

| Krungsri US Equity Index FX RMF (KFUSINDFXRMF) | -1.42% | +5.14% | +0.41% | +7.16% | N/A | N/A | N/A | +10.59% | 348 |

| Benchmark(11) | -1.12% | +6.01% | +0.42% | +8.70% | N/A | N/A | N/A | +13.27% | |

| Standard Deviation of Fund | +12.94% | +11.97% | +13.01% | +19.29% | N/A | N/A | N/A | +17.94% | |

| Standard Deviation of Benchmark | +13.72% | +12.98% | +14.85% | +19.79% | N/A | N/A | N/A | +18.51% | |

| Krungsri NDQ Index RMF (KFNDQRMF) | -2.16% | +7.53% | +0.05% | +13.87% | N/A | N/A | N/A | +13.44% | 178 |

| Benchmark(11) | -3.83% | +6.18% | +0.08% | +11.82% | N/A | N/A | N/A | +10.96% | |

| Standard Deviation of Fund | +15.48% | +14.99% | +12.56% | +23.15% | N/A | N/A | N/A | +22.44% | |

| Standard Deviation of Benchmark | +17.70% | +16.54% | +16.53% | +23.56% | N/A | N/A | N/A | +23.09% | |

| Krungsri US Select Equity Plus RMF (KF-US-PLUSRMF) | -0.35% | N/A | -0.20% | N/A | N/A | N/A | N/A | +2.14% | 53 |

| Benchmark(11) | -2.06% | N/A | -0.31% | N/A | N/A | N/A | N/A | -0.53% | |

| Standard Deviation of Fund | +12.38% | N/A | +9.37% | N/A | N/A | N/A | N/A | +11.73% | |

| Standard Deviation of Benchmark | +15.31% | N/A | +13.48% | N/A | N/A | N/A | N/A | +14.45% | |

| Krungsri US Equity RMF (KFUSRMF) | +4.44% | -0.13% | +1.46% | -14.92% | +8.15% | N/A | N/A | -12.24% | 147 |

| Benchmark(11) | +2.79% | -1.59% | +1.55% | -16.91% | +11.65% | N/A | N/A | -9.24% | |

| Standard Deviation of Fund | +9.62% | +9.41% | +9.80% | +13.74% | +21.96% | N/A | N/A | +33.34% | |

| Standard Deviation of Benchmark | +11.73% | +11.77% | +13.69% | +15.19% | +22.71% | N/A | N/A | +33.19% | |

| Krungsri Next Generation Infrastructure RMF (KFINFRARMF) | +6.00% | +4.20% | +4.33% | +12.13% | +5.32% | N/A | N/A | +0.64% | 75 |

| Benchmark(12) | +7.59% | +6.96% | +4.90% | +17.89% | +10.37% | N/A | N/A | +5.40% | |

| Standard Deviation of Fund | +7.45% | +7.71% | +7.69% | +11.57% | +11.60% | N/A | N/A | +13.81% | |

| Standard Deviation of Benchmark | +7.65% | +7.89% | +7.97% | +11.93% | +11.89% | N/A | N/A | +14.13% | |

| Krungsri World Equity Index RMF (KF-WORLD-INDXRMF) | +2.16% | +9.65% | +1.66% | +15.51% | N/A | N/A | N/A | +13.30% | 528 |

| Benchmark(11) | +0.83% | +8.66% | +1.85% | +13.97% | N/A | N/A | N/A | +13.12% | |

| Standard Deviation of Fund | +10.87% | +10.76% | +10.04% | +16.91% | N/A | N/A | N/A | +15.82% | |

| Standard Deviation of Benchmark | +13.46% | +12.33% | +14.14% | +17.78% | N/A | N/A | N/A | +16.99% | |

| Krungsri Global Dividend RMF (KF-GDIVRMF) | +5.37% | N/A | +1.98% | N/A | N/A | N/A | N/A | +3.57% | 62 |

| Benchmark(12) | +7.11% | N/A | +2.39% | N/A | N/A | N/A | N/A | +5.50% | |

| Standard Deviation of Fund | +7.54% | N/A | +6.92% | N/A | N/A | N/A | N/A | +7.60% | |

| Standard Deviation of Benchmark | +7.85% | N/A | +7.08% | N/A | N/A | N/A | N/A | +7.88% | |

| Krungsri Global Unconstrained Equity RMF (KFGLOBALRMF) | -0.90% | +1.70% | +1.47% | +3.83% | N/A | N/A | N/A | +5.93% | 19 |

| Benchmark(11) | -2.34% | +0.41% | +1.73% | +2.46% | N/A | N/A | N/A | +7.04% | |

| Standard Deviation of Fund | +17.41% | +15.22% | +14.52% | +21.07% | N/A | N/A | N/A | +19.90% | |

| Standard Deviation of Benchmark | +19.47% | +16.45% | +16.74% | +22.08% | N/A | N/A | N/A | +21.09% | |

| Krungsri Global Unconstrained Equity FX RMF (KFGLOBFXRMF) | -2.77% | -0.68% | +1.45% | +0.24% | N/A | N/A | N/A | +3.70% | 10 |

| Benchmark(11) | -2.34% | +0.41% | +1.73% | +2.46% | N/A | N/A | N/A | +7.04% | |

| Standard Deviation of Fund | +18.76% | +15.74% | +16.25% | +22.05% | N/A | N/A | N/A | +20.81% | |

| Standard Deviation of Benchmark | +19.47% | +16.45% | +16.74% | +22.08% | N/A | N/A | N/A | +21.09% | |

| Krungsri Global Growth RMF (KFGGRMF) | -10.30% | -5.23% | -4.09% | -1.05% | +13.62% | N/A | N/A | -4.43% | 1,433 |

| Benchmark(12) | -9.34% | -2.92% | -3.86% | +4.09% | +19.62% | N/A | N/A | +0.52% | |

| Standard Deviation of Fund | +18.89% | +17.11% | +16.91% | +22.66% | +21.21% | N/A | N/A | +28.73% | |

| Standard Deviation of Benchmark | +20.44% | +18.51% | +18.40% | +26.40% | +22.95% | N/A | N/A | +30.12% | |

| Krungsri China Megatrends RMF (KFCMEGARMF) | -4.40% | +3.31% | +1.53% | +13.63% | -4.25% | N/A | N/A | -3.02% | 197 |

| Benchmark(13) | -1.29% | +7.88% | +4.25% | +28.27% | +7.19% | N/A | N/A | +6.67% | |

| Standard Deviation of Fund | +18.24% | +20.91% | +24.34% | +26.92% | +29.54% | N/A | N/A | +30.34% | |

| Standard Deviation of Benchmark | +15.75% | +16.71% | +14.93% | +22.96% | +22.30% | N/A | N/A | +23.53% | |

| Krungsri Equity Sustainable Global Growth RMF (KFESGRMF) | -4.44% | -1.48% | -0.50% | -1.78% | +2.21% | N/A | N/A | +2.81% | 86 |

| Benchmark(12) | -3.23% | +1.02% | -0.09% | +3.38% | +7.36% | N/A | N/A | +8.24% | |

| Standard Deviation of Fund | +12.36% | +12.42% | +10.87% | +18.67% | +15.25% | N/A | N/A | +16.39% | |

| Standard Deviation of Benchmark | +12.90% | +12.70% | +11.81% | +18.55% | +15.48% | N/A | N/A | +16.86% | |

| Krungsri Vietnam Equity RMF (KFVIETRMF) | +6.58% | +13.42% | +4.94% | +16.53% | +5.56% | N/A | N/A | +0.98% | 529 |

| Benchmark(14) | +6.27% | +22.87% | +1.98% | +39.66% | +18.13% | N/A | N/A | +8.87% | |

| Standard Deviation of Fund | +18.21% | +19.26% | +14.06% | +20.25% | +16.72% | N/A | N/A | +17.36% | |

| Standard Deviation of Benchmark | +20.37% | +24.07% | +19.04% | +24.45% | +20.39% | N/A | N/A | +22.69% | |

| Krungsri ESG Climate Tech RMF (KFCLIMARMF) | +1.00% | +5.35% | +3.85% | +17.61% | +4.77% | N/A | N/A | -1.50% | 167 |

| Standard Deviation of Fund | +15.51% | +14.39% | +12.05% | +17.17% | +16.14% | N/A | N/A | +19.06% | |

Remark