News/Announcement

Promotions/Fund Highlight

Top Selected SSF | RMF ... Trending Stocks with Growth Potential

Receive KFCASH-A units valued at 100 Baht for every investment of 50,000 Baht*

A collection of top selected SSF/ RMF accessing all investment themes, ranging from Thai to foreign stocks that suit the current market outlook and seize the opportunity for high growth in the future in order that investors can potentially optimize tax saving schemes and plans.

- Invest in top Thai stocks ranking top 100 in SET’s market capital.

- Passive Fund with an aim to enable the Fund to track investment returns of SET100 Total Return Index, while tracking error (TE) of the Fund and the benchmark will be not greater than 1.00% per annum.

- Opportunity to generate returns along with Thailand’s post covid-19 economic recovery and stimulus measures of the Government.

Support Factors

- China’s fundamentals still have potential to grow if COVID-19 situation gets better and tend to recover.

- Increase in the Government’s spending on economic stimulus program and easing of regulatory measures, supporting Tech stocks that is one of potentially growing sectors along with e-commerce, Internet, EV, and Healthcare

- The falling of China’s stock market marks the good timing for investment.

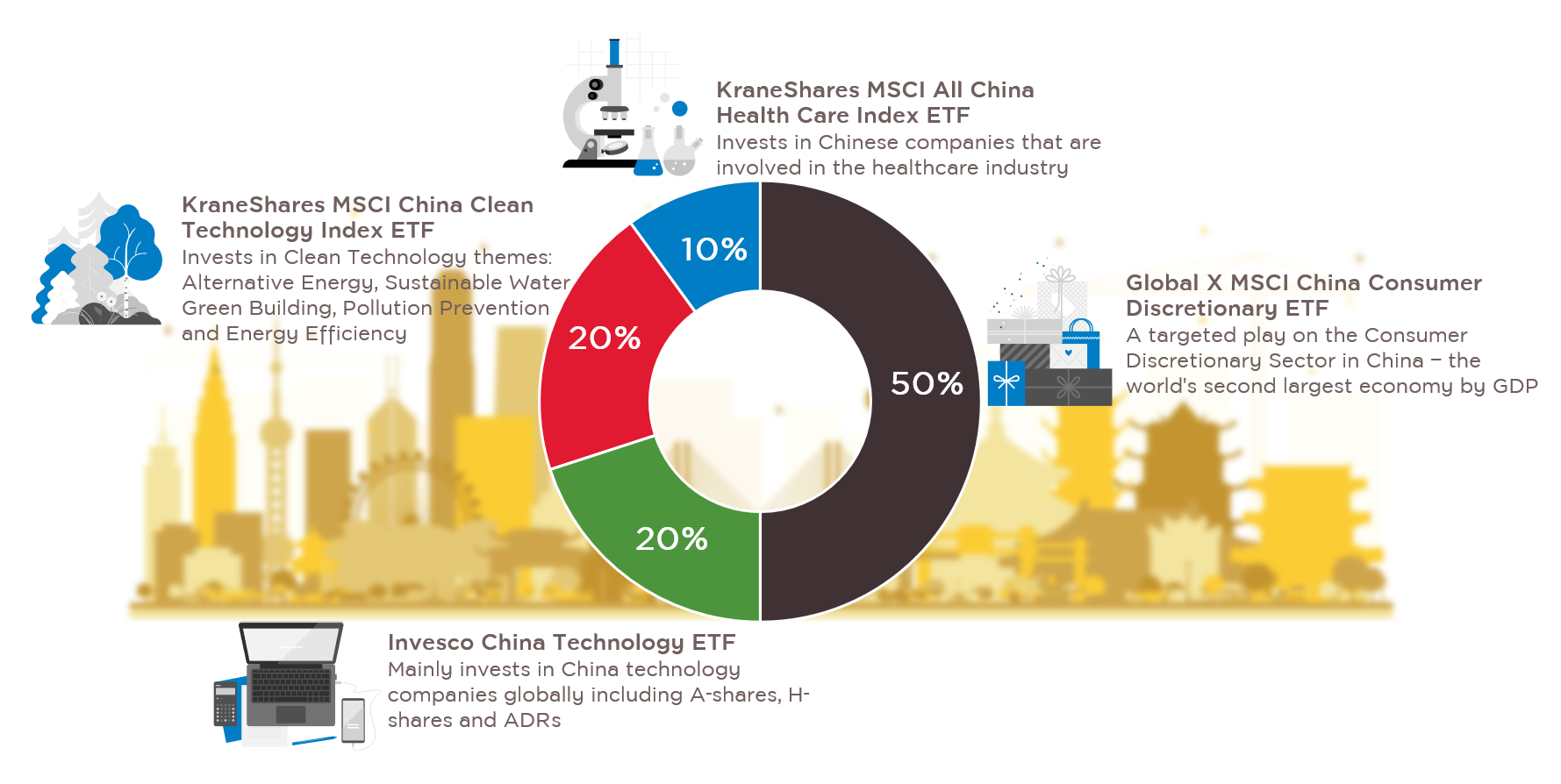

- Get access to five China’s mega trends in one fund: Consumption, Technology, Healthcare, Clean energy, and New transportation

- Invest through the master fund, Krungsri China Mega Trend (KFCMEGA) with portfolio diversifying in 4 ETF to access China’s five mega trends based on initial asset allocation as shown below. In this respect, the Fund’s asset exposure will be adjusted upon fund manager’s discretion to suit the market situation in the future.

For fund info, click: KFCMEGASSF / KFCMEGARMF

- Focus to invest in global dominant brands with strong competitiveness, including customers base around the world for an opportunity to gain the solid sales revenues. These brands ranges from consumer staple companies, technologies to entertainment, namely Microsoft, Visa, etc.

- Investment in the master fund, Morgan Stanley Investment Funds - Global Brands Fund, the long-established master fund with outstanding track record of performance, plus the proven investment approach for over 2 decades as the global investment manager.

- A concentrated high quality global portfolio of global companies with defensive characteristics that have potentials to generate consistent returns in up markets and to preserve capital in down market.

Support Factors

- Inflows to ESG stocks have been growing continually, reflecting investors’ interest

- Over 190 countries are committed to achieving the SDGs. It is thus estimated that investment in connection with relevant businesses will be massive - roughly US$90 trillion in 2030.

- Focus to invest in the high-quality companies being aligned with sustainable themes through investing in the master fund, AB Sustainable Global Thematic Portfolio that invests in quality companies around the world that operate businesses in connection with SDGs under three key themes, Climate, Health, and Empowerment.

- The master fund has the portfolio with a high-conviction strategy, informed by in-depth long-term research with an aim to generate superior financial returns than benchmark through investments that contribute to positive social and environmental outcomes backed with an outstanding track record of performance compared with benchmark.

For fund info, click: KFESGSSF / KFESGRMF

Other Recommended Funds

Key focus is less volatility- Krungsri Active Fixed Income-SSF (KFAFIXSSF)

- Krungsri Active Fixed Income-RMF (KFAFIXRMF)

For fund info, click: KFAFIXSSF / KFAFIXRMF

Seizing the Opportunities from Country’s Economy Growth

- Krungsri Vietnam Equity SSF (KFVIETSSF)

- Krungsri Vietnam Equity RMF (KFVIETRMF)

For fund info, click: KFVIETSSF / KFVIETRMF

- Krungsri China A Shares Equity SSF (KFACHINSSF)

- Krungsri China A Shares Equity RMF (KFACHINRMF)

For fund info, click: KFACHINSSF / KFACHINRMF

Minimum purchase: 500 Baht only for all funds.

Can purchase through participating Krungsri credit cards.

(Fund subscription will be not eligible for credit card promotional programs

and reward points accumulation.)

Can purchase through participating Krungsri credit cards.

(Fund subscription will be not eligible for credit card promotional programs

and reward points accumulation.)

Now you can redeem your credit card points of all Krungsri credit card types (except Krungsri Corporate Card) to invest in any SSF / RMF through @ccess Mobile Application and @ccess Online Service on a condition that 1,000 points = 100 Baht of fund units.

For terms and conditions, click here

Promotion: When investing in participating SSF /RMF 2022 according to terms & conditions*,

receive KFCASH-A units valued at 100 Baht for every investment of 50,000 Baht.

*For promotion details, click here

For SSF & RMF investment manuals, click here

To inquire more info or Fund prospectus, please contact Krungsri Asset Management,

Tel. 02-657-5757 and any branch of Bank of Ayudhya or Selling Agents

Tel. 02-657-5757 and any branch of Bank of Ayudhya or Selling Agents

Investment Strategies of the Funds

KFS100SSF / KFS100RMF

KFAFIXSSF / KFAFIXRMF

KFACHINASSF / KFACHINARMF

KFCMEGASSF / KFCMEGARMF

KFESGSSF / KFESGRMF

KFGBRANSSF / KFGBRANRMF

KFVIETSSF / KFVIETRMF

- The Fund shall invest at least 80% of NAV in average of fund accounting year in shares listed on the Stock Exchange of Thailand that are constituents of the SET100 Index, in order to enable the Fund to track investment returns of SET100 Total Return Index (SET100 TRI).

- Risk Level: 6 – High risk

KFAFIXSSF / KFAFIXRMF

- Invest both onshore and offshore in debt instruments and/or deposits or deposits equivalent issued, certified, avalized, or repayment guaranteed by the government, a state enterprise, a financial institution, and/or private entity with non-investment grade/unrated securities of not exceeding 20% of NAV

- Risk Level: 4 – Low to moderate risk | Fully hedge against foreign exchange rate risk

KFACHINASSF / KFACHINARMF

- Minimum 80% of NAV in average of fund accounting year are invested in the Master Fund named, UBS (Lux) Investment SICAV - China A Opportunity (USD) (Class P - acc) (Master Fund).

- Risk Level: 6 – High risk | Hedge against currency risk upon fund manager’s discretion. Normally, the Fund will hedge against the exchange rate risk at a particular time for the value of at least 90% of the foreign investment value.

KFCMEGASSF / KFCMEGARMF

- Invest in only one CIS unit. Minimum 80% of NAV in average of fund accounting year are invested in the Master Fund named, Krungsri China Megatrends Fund-I (KFCMEGA-I) which managed by Krungsri Asset Management Co., Ltd. The Master Fund will invest in the investment units of foreign equity funds and/or exchange traded funds (ETFs) which have the investment policy of investing in the securities of listed companies in China and/or companies having established a major presence or deriving a majority of their revenues from business operations in China. These companies are related to or beneficiaries of the rise of mega trends. The fund may invest no more than 100% of fund assets in units of mutual funds under management of the Company.

- Risk Level: 6 – high risk | Hedge against currency risk upon fund manager’s discretion.

KFESGSSF / KFESGRMF

- Invest in AB Sustainable Global Thematic Portfolio, Class S1 USD (The master fund), on average in an accounting year, of not less than 80% of fund’s NAV.

- Risk Level: 6 – High risk | Fully hedge against foreign exchange rate risk (Hedge against the exchange rate risk at a particular time for the value of at least 90% of the foreign investment value)

KFGBRANSSF / KFGBRANRMF

- Minimum 80% of NAV in average of fund accounting year are invested in the Master Fund named, Morgan Stanley Investment Funds - Global Brands Fund, Class ZX (Master Fund).

- Risk Level: 6 – High risk | Hedge against currency risk upon fund manager’s discretion. Normally, the Fund will hedge against the exchange rate risk at a particular time for the value of at least 90% of the foreign investment value.

KFVIETSSF / KFVIETRMF

- Invest in Krungsri Vietnam Equity (Master Fund) on average in an accounting year, of not less than 80% of fund’s NAV. The master fund will invest in the investment units of foreign equity funds and/or foreign equity ETFs which have investment policy to invest in equity securities of companies registered in Vietnam or companies with business operations in Vietnam or companies with revenues from operations in Vietnam, on average in an accounting year, of not less than 80%.

- Risk Level: 6 – high risk | Hedge against currency risk upon fund manager’s discretion.

Disclaimers

- Krungsri Asset Management Co., Ltd. believes the information contained in this document is accurate at the time of publication but does not provide any warranty of its accuracy. Similarly, any opinions or estimates included herein constitute a judgment as of the time of publication. All information, opinions and estimates are subject to change without notice.

- SSF are the funds aimed to promote savings. | RMF are for retirement investment.

- Investors will be not entitled to any tax privileges if they do not comply with the investment conditions

- KFACHINASSF/ KFACHINARMF/ KFCMEGASSF/ KFCMEGARMF/ KFGBRANSSF/ KFGBRANRMF/ KFVIETSSF, and KFVIETRMF may enter into a currency swap within discretion of fund manager. Thus, the funds are exposed to exchange rate risk, which may cause investors to lose or gain lower return than the amount initially invested.

- Investors should understand fund feature, returns, risk, and tax privileges in the investment manual before making investment decision. Past performance is not an indicative of future performance.