Fund Type

Feeder fund invests in Foreign Equity Fund

Dividend Policy

None

Inception Date

31 May 2019

Investment Policy

The Fund allocates minimum 80% of Funds assets in average of fund accounting year to invest in the Master Fund named, BGF World Technology Fund (Class D2 USD). BGF World Technology Fund, which invests globally in the equity securities of companies whose predominant economic activity is in the technology sector.

Fund Manager

Jaturun Sornvai, Chusak Ouypornchaisakul

Asset Allocation

-

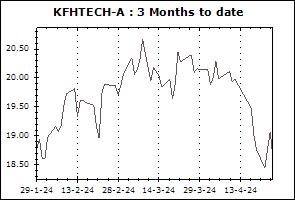

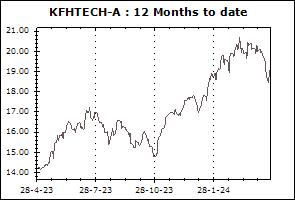

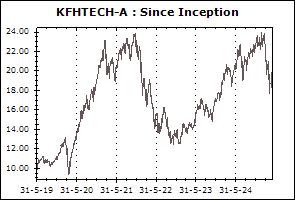

Return Chart

NAV Movement

- 3 Months

- 12 Months

- Since inception

Transaction Details

Minimum Purchase Amount (Baht): 500

Minimum Redemption Amount (Unit): 500 Baht or 50 units

Transaction Period: Every dealing date of the fund by 15.30 hrs.

Proceeds Payment Period: 4 working days after the execution day excluding relevant Master Fund’s holidays (T+4)

Fund Redemption Period: Every dealing date of the fund by 14.30 hrs.

Transaction Channel: Krungsri Asset Management,Online Service,AGENT

Asset Allocation (30 Jan 2026)

| Deposits and Fixed Income Instruments issued by Financial Institutions | 4.58% |

| BGF World Technology Fund (Class D2 USD) | 97.55% |

| Other Assets | 0.80% |

| Other Liabilities | -2.93% |

Foreign Investment Funds

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Gold Fund (KF-GOLD) | +22.96% | +46.23% | +16.35% | +67.49% | +33.95% | +21.51% | +12.94% | +8.10% | 3,153 |

| Benchmark(7) | +23.85% | +48.29% | +16.77% | +70.98% | +36.19% | +23.28% | +14.54% | +9.34% | |

| Standard Deviation of Fund | +23.49% | +21.83% | +34.37% | +18.40% | +13.98% | +13.11% | +12.92% | +14.39% | |

| Standard Deviation of Benchmark | +26.03% | +24.40% | +36.08% | +20.62% | +17.78% | +16.18% | +15.60% | +17.03% | |

| Krungsri Gold Hedged Fund (KF-HGOLD) | +24.94% | +49.27% | +15.97% | +73.94% | +32.02% | +17.57% | +12.68% | +6.59% | 2,685 |

| Benchmark(9) | +27.50% | +54.14% | +17.14% | +83.20% | +38.46% | +22.10% | +16.01% | +8.61% | |

| Standard Deviation of Fund | +25.55% | +23.44% | +36.44% | +20.65% | +16.33% | +15.37% | +14.49% | +14.77% | |

| Standard Deviation of Benchmark | +26.35% | +23.80% | +36.99% | +20.75% | +17.70% | +16.31% | +15.77% | +16.83% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Oil Fund (KF-OIL) | +7.51% | -1.68% | +12.59% | -6.13% | -2.65% | +8.60% | +2.84% | -5.26% | 536 |

| Benchmark(7) | +6.60% | -2.66% | +13.71% | -7.95% | +0.08% | +13.09% | +6.15% | -2.54% | |

| Standard Deviation of Fund | +24.56% | +24.19% | +27.86% | +30.41% | +27.85% | +31.20% | +31.28% | +29.81% | |

| Standard Deviation of Benchmark | +29.93% | +28.50% | +33.65% | +32.70% | +29.56% | +31.73% | +31.60% | +29.85% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Global Private Equity Fund-Not for Retail Investors (KFGPE-UI)(4) | -0.45% | +0.94% | +11.17% | +2.28% | +2.87% | N/A | N/A | +2.82% | 626 |

| Standard Deviation of Fund | N/A | N/A | N/A | N/A | +4.15% | N/A | N/A | +4.05% | |

| Krungsri Long Term Private Capital Fund-Not for Retail Investors (KFLTPC-UI)(5) | -2.73% | -2.10% | -1.75% | -3.53% | +10.24% | N/A | N/A | +9.96% | 418 |

| Krungsri Private Credit Fund-Not for Retail Investors (KFPCD-UI)(6) | +0.05% | +0.71% | -2.03% | -2.21% | N/A | N/A | N/A | -2.71% | 555 |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Total Return Bond Fund-A (KFTRB-A) | -0.26% | +2.41% | -0.14% | +4.30% | +0.69% | -3.01% | -0.14% | +1.04% | 615 |

| Benchmark(9) | +0.69% | +4.28% | +0.10% | +7.92% | +4.18% | -0.70% | +1.50% | +1.52% | |

| Standard Deviation of Fund | +2.99% | +3.38% | +2.86% | +4.95% | +5.80% | +5.76% | +4.82% | +4.34% | |

| Standard Deviation of Benchmark | +3.01% | +3.37% | +3.04% | +4.70% | +5.79% | +5.81% | +4.89% | +4.39% | |

| Krungsri Total Return Bond Fund-I (KFTRB-I) | -0.27% | +2.38% | -0.14% | +4.24% | +0.34% | N/A | N/A | +0.99% | 0 |

| Benchmark(9) | +0.69% | +4.28% | +0.10% | +7.92% | +4.18% | N/A | N/A | +5.13% | |

| Standard Deviation of Fund | +3.00% | +3.38% | +2.87% | +4.95% | +6.13% | N/A | N/A | +6.13% | |

| Standard Deviation of Benchmark | +3.01% | +3.37% | +3.04% | +4.70% | +5.79% | N/A | N/A | +5.86% | |

| Krungsri Global Smart Income Fund (KF-SINCOME) | +0.65% | +3.34% | +0.22% | +5.70% | +2.86% | +0.56% | N/A | +1.88% | 881 |

| Benchmark(9) | +1.72% | +5.50% | +0.50% | +9.97% | +7.24% | +3.79% | N/A | +4.69% | |

| Standard Deviation of Fund | +2.28% | +2.71% | +2.11% | +3.78% | +4.20% | +4.46% | N/A | +4.17% | |

| Standard Deviation of Benchmark | +2.20% | +2.61% | +2.20% | +3.49% | +4.13% | +4.43% | N/A | +4.17% | |

| Krungsri Global Collective Smart Income Fund (KF-CSINCOME) | +0.62% | +3.35% | +0.17% | +5.61% | +2.88% | +0.56% | N/A | +1.86% | 14,554 |

| Benchmark(9) | +1.72% | +5.50% | +0.50% | +9.97% | +7.24% | +3.79% | N/A | +4.69% | |

| Standard Deviation of Fund | +2.27% | +2.71% | +2.11% | +3.79% | +4.20% | +4.46% | N/A | +4.17% | |

| Standard Deviation of Benchmark | +2.20% | +2.61% | +2.20% | +3.49% | +4.13% | +4.43% | N/A | +4.17% | |

| Krungsri Global Smart Income FX Fund-A (KF-SINCOME-FX-A) | -1.40% | +0.99% | +0.11% | +1.57% | N/A | N/A | N/A | +2.44% | 6,279 |

| Benchmark(7) | -1.19% | +1.50% | +0.18% | +2.63% | N/A | N/A | N/A | +3.57% | |

| Standard Deviation of Fund | +6.91% | +6.71% | +8.09% | +8.09% | N/A | N/A | N/A | +8.55% | |

| Standard Deviation of Benchmark | +7.94% | +7.04% | +9.08% | +8.64% | N/A | N/A | N/A | +8.10% | |

| Krungsri Global Smart Income FX Fund-R (KF-SINCOME-FX-R) | -1.40% | +0.99% | +0.11% | +1.57% | N/A | N/A | N/A | +2.44% | 459 |

| Benchmark(7) | -1.19% | +1.50% | +0.18% | +2.63% | N/A | N/A | N/A | +3.57% | |

| Standard Deviation of Fund | +6.91% | +6.71% | +8.10% | +8.09% | N/A | N/A | N/A | +8.55% | |

| Standard Deviation of Benchmark | +7.94% | +7.04% | +9.08% | +8.64% | N/A | N/A | N/A | +8.10% | |

| Krungsri Global Smart Income FX Fund-C (KF-SINCOME-FX-C) | -1.36% | +1.08% | +0.12% | +1.76% | N/A | N/A | N/A | -0.43% | 3 |

| Benchmark(7) | -1.19% | +1.50% | +0.18% | +2.63% | N/A | N/A | N/A | +1.27% | |

| Standard Deviation of Fund | +6.91% | +6.70% | +8.09% | +8.08% | N/A | N/A | N/A | +8.09% | |

| Standard Deviation of Benchmark | +7.94% | +7.04% | +9.08% | +8.64% | N/A | N/A | N/A | +8.68% | |

| Krungsri Global Smart Income FX Fund-I (KF-SINCOME-FX-I) | -1.40% | +0.99% | +0.11% | +1.57% | N/A | N/A | N/A | +0.38% | 60 |

| Benchmark(7) | -1.19% | +1.50% | +0.18% | +2.63% | N/A | N/A | N/A | +1.32% | |

| Standard Deviation of Fund | +6.91% | +6.71% | +8.09% | +8.09% | N/A | N/A | N/A | +7.98% | |

| Standard Deviation of Benchmark | +7.94% | +7.04% | +9.08% | +8.64% | N/A | N/A | N/A | +8.06% | |

| Krungsri Diversified Income Fund-A (KFDIVERS-A) | +0.44% | +3.10% | +0.21% | +5.33% | +3.07% | -1.58% | N/A | -0.18% | 278 |

| Benchmark(9) | +1.64% | +5.40% | +0.58% | +9.87% | +7.69% | +1.77% | N/A | +3.10% | |

| Standard Deviation of Fund | +2.24% | +2.46% | +2.36% | +3.67% | +4.25% | +5.01% | N/A | +4.83% | |

| Standard Deviation of Benchmark | +3.67% | +3.63% | +2.78% | +4.33% | +4.91% | +5.41% | N/A | +5.23% | |

| Krungsri Diversified Income Fund-R (KFDIVERS-R) | +0.44% | +3.10% | +0.21% | +5.33% | +3.07% | -1.58% | N/A | -0.18% | 5 |

| Benchmark(9) | +1.64% | +5.40% | +0.58% | +9.87% | +7.69% | +1.77% | N/A | +3.10% | |

| Standard Deviation of Fund | +2.23% | +2.46% | +2.36% | +3.67% | +4.25% | +5.01% | N/A | +4.83% | |

| Standard Deviation of Benchmark | +3.67% | +3.63% | +2.78% | +4.33% | +4.91% | +5.41% | N/A | +5.23% | |

| Krungsri Diversified Income Fund-C (KFDIVERS-C) | +0.40% | +3.06% | +0.23% | +5.47% | N/A | N/A | N/A | +5.95% | 0 |

| Benchmark(9) | +1.64% | +5.40% | +0.58% | +9.87% | N/A | N/A | N/A | +11.39% | |

| Standard Deviation of Fund | +2.59% | +2.67% | +2.36% | +3.75% | N/A | N/A | N/A | +3.67% | |

| Standard Deviation of Benchmark | +3.67% | +3.63% | +2.78% | +4.33% | N/A | N/A | N/A | +4.33% | |

| Krungsri Diversified Income Fund-I (KFDIVERS-I) | +0.44% | +3.37% | +0.21% | +5.80% | N/A | N/A | N/A | +5.45% | 0 |

| Benchmark(9) | +1.64% | +5.40% | +0.58% | +9.87% | N/A | N/A | N/A | +9.37% | |

| Standard Deviation of Fund | +2.23% | +2.53% | +2.36% | +3.72% | N/A | N/A | N/A | +3.70% | |

| Standard Deviation of Benchmark | +3.67% | +3.63% | +2.78% | +4.33% | N/A | N/A | N/A | +4.36% | |

| Krungsri Asian High Yield Bond Fund-A (KFAHYBON-A) | +0.66% | +4.64% | +1.49% | +7.76% | +1.32% | N/A | N/A | -7.24% | 382 |

| Benchmark(9) | +1.92% | +7.16% | +1.92% | +12.76% | +6.06% | N/A | N/A | -3.36% | |

| Standard Deviation of Fund | +2.17% | +2.52% | +1.93% | +4.40% | +4.72% | N/A | N/A | +8.04% | |

| Standard Deviation of Benchmark | +2.27% | +2.58% | +2.23% | +4.66% | +4.82% | N/A | N/A | +8.14% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Oriental Flexible Fund (KF-ORTFLEX) | +12.15% | +21.14% | +11.57% | +37.42% | +10.68% | +3.15% | +8.71% | +5.48% | 392 |

| Benchmark(7) | +10.52% | +19.55% | +11.93% | +35.29% | +13.74% | +7.27% | +11.91% | +7.19% | |

| Standard Deviation of Fund | +17.59% | +16.70% | +14.56% | +19.56% | +18.59% | +19.85% | +18.33% | +17.44% | |

| Standard Deviation of Benchmark | +18.63% | +17.18% | +14.41% | +20.32% | +19.32% | +19.69% | +18.51% | +17.69% | |

| Krungsri Global Income Fund (KF-INCOME) | +1.70% | +4.34% | +1.22% | +6.30% | +4.53% | +2.23% | +2.74% | +2.83% | 1,007 |

| Benchmark(7) | +0.07% | +2.87% | +1.29% | +3.95% | +7.32% | +6.32% | +4.30% | +4.26% | |

| Standard Deviation of Fund | +5.07% | +4.62% | +4.01% | +7.08% | +6.20% | +6.67% | +6.50% | +6.71% | |

| Standard Deviation of Benchmark | +8.43% | +7.18% | +9.13% | +9.78% | +9.11% | +8.86% | +7.91% | +7.98% | |

| Krungsri Asian Income Hedged Fund-A (KF-AINCOME-A) | +3.14% | +11.22% | +3.66% | +13.98% | +5.61% | +1.04% | N/A | +1.39% | 311 |

| Benchmark(9) | +3.54% | +12.14% | +3.94% | +15.52% | +7.58% | +2.55% | N/A | +2.62% | |

| Standard Deviation of Fund | +8.26% | +7.75% | +8.17% | +8.83% | +7.77% | +7.37% | N/A | +7.46% | |

| Standard Deviation of Benchmark | +7.96% | +7.73% | +6.34% | +9.00% | +7.91% | +7.50% | N/A | +7.67% | |

| Krungsri Asian Income Hedged Fund-R (KF-AINCOME-R) | +3.14% | +11.22% | +3.66% | +13.98% | +5.61% | +1.04% | +2.75% | +2.12% | 515 |

| Benchmark(9) | +3.54% | +12.14% | +3.94% | +15.52% | +7.58% | +2.55% | +3.87% | +3.15% | |

| Standard Deviation of Fund | +8.26% | +7.75% | +8.17% | +8.83% | +7.76% | +7.37% | +7.06% | +7.18% | |

| Standard Deviation of Benchmark | +7.96% | +7.73% | +6.34% | +9.00% | +7.91% | +7.50% | +7.14% | +7.10% | |

| Krungsri Collective Global Income Fund-A (KF-CINCOME-A) | +1.71% | +4.44% | +1.20% | +6.40% | +4.50% | +2.18% | +2.73% | +2.22% | 1,276 |

| Benchmark(7) | +0.06% | +2.87% | +1.29% | +3.95% | +7.32% | +6.32% | +4.31% | +3.78% | |

| Standard Deviation of Fund | +5.07% | +4.65% | +3.99% | +7.08% | +6.21% | +6.68% | +6.51% | +6.52% | |

| Standard Deviation of Benchmark | +8.43% | +7.18% | +9.12% | +9.77% | +9.11% | +8.85% | +7.91% | +7.90% | |

| Krungsri Collective Global Income Fund-I (KF-CINCOME-I) | +1.71% | +4.44% | +1.20% | +6.40% | +4.50% | N/A | N/A | +4.68% | 0 |

| Benchmark(7) | +0.06% | +2.87% | +1.29% | +3.95% | +7.32% | N/A | N/A | +5.13% | |

| Standard Deviation of Fund | +5.07% | +4.65% | +3.99% | +7.08% | +6.21% | N/A | N/A | +6.19% | |

| Standard Deviation of Benchmark | +8.43% | +7.18% | +9.12% | +9.77% | +9.11% | N/A | N/A | +9.06% | |

| Krungsri Global Multi Asset Income Hedged FX Fund-A (KF-MINCOME-A) | +4.47% | +8.34% | +4.53% | +11.20% | +3.10% | -0.42% | N/A | +0.68% | 32 |

| Standard Deviation of Fund | +6.68% | +6.20% | +7.40% | +6.24% | +5.46% | +5.61% | N/A | +5.88% | |

| Krungsri Global Multi Asset Income Hedged FX Fund-R (KF-MINCOME-R) | +4.47% | +8.34% | +4.53% | +11.20% | +3.10% | -0.42% | N/A | +0.91% | 152 |

| Standard Deviation of Fund | +6.68% | +6.20% | +7.40% | +6.24% | +5.46% | +5.61% | N/A | +5.73% | |

| Krungsri Preferred Mix Hedged FX Fund - A (KFPREFER-A) | -0.16% | +1.64% | +0.64% | +2.11% | +1.92% | -0.32% | N/A | +0.07% | 262 |

| Standard Deviation of Fund | +2.35% | +2.56% | +2.54% | +3.54% | +4.83% | +5.86% | N/A | +9.92% | |

| Krungsri Global Core Allocation Fund (KFCORE) | +1.68% | +7.62% | +1.67% | +8.51% | +5.09% | +0.39% | N/A | +0.93% | 1,689 |

| Standard Deviation of Fund | +7.64% | +7.11% | +6.03% | +8.49% | +7.51% | +7.52% | N/A | +7.45% | |

| Krungsri Global Dynamic Balance Allocation SRI Fund-A (KFGDB-A) | +6.37% | +13.20% | +4.09% | +13.80% | N/A | N/A | N/A | +10.92% | 935 |

| Standard Deviation of Fund | +8.38% | +7.07% | +8.81% | +8.14% | N/A | N/A | N/A | +8.05% | |

| Krungsri Global Dynamic Balance Allocation SRI Fund-I (KFGDB-I) | +6.37% | +13.20% | +4.09% | +13.80% | N/A | N/A | N/A | +10.92% | 65 |

| Standard Deviation of Fund | +8.38% | +7.07% | +8.81% | +8.14% | N/A | N/A | N/A | +8.05% | |

| Krungsri Global Dynamic Balance Allocation SRI Fund-IX (KFGDB-IX) | +6.47% | +13.43% | +4.13% | +14.26% | N/A | N/A | N/A | +11.36% | 57 |

| Standard Deviation of Fund | +8.38% | +7.07% | +8.81% | +8.14% | N/A | N/A | N/A | +8.05% | |

| Krungsri Global Dynamic Aggressive Allocation SRI Fund-A (KFGDA-A) | +7.91% | +16.72% | +4.84% | +16.13% | N/A | N/A | N/A | +13.82% | 215 |

| Standard Deviation of Fund | +11.15% | +9.57% | +11.15% | +11.38% | N/A | N/A | N/A | +10.98% | |

| Krungsri Global Dynamic Aggressive Allocation SRI Fund-I (KFGDA-I) | +7.91% | +16.72% | +4.84% | +16.13% | N/A | N/A | N/A | +13.82% | 425 |

| Standard Deviation of Fund | +11.15% | +9.57% | +11.15% | +11.38% | N/A | N/A | N/A | +10.98% | |

| Krungsri Global Dynamic Aggressive Allocation SRI Fund-IX (KFGDA-IX) | +8.04% | +17.01% | +4.89% | +16.72% | N/A | N/A | N/A | +14.39% | 59 |

| Standard Deviation of Fund | +11.15% | +9.57% | +11.15% | +11.38% | N/A | N/A | N/A | +10.98% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri BIC Stars Fund (KF-BIC) | -1.59% | +10.95% | +1.64% | +11.06% | +2.37% | -3.66% | +4.70% | -2.38% | 60 |

| Benchmark(7) | -1.22% | +12.13% | +2.35% | +16.67% | +4.74% | -2.51% | +5.88% | -1.39% | |

| Standard Deviation of Fund | +14.07% | +14.70% | +13.96% | +16.59% | +15.50% | +17.96% | +17.97% | +23.00% | |

| Standard Deviation of Benchmark | +14.54% | +15.76% | +14.60% | +17.10% | +16.40% | +18.87% | +18.66% | +23.53% | |

| Krungsri China H Shares Equity Index Fund (KF-HSHARE-INDX) | +0.77% | +3.66% | +3.26% | +23.51% | +6.52% | -4.33% | -0.65% | -1.52% | 2,009 |

| Benchmark(7) | -1.57% | +1.98% | +2.98% | +19.76% | +9.25% | -0.35% | +2.65% | +0.83% | |

| Standard Deviation of Fund | +17.10% | +18.26% | +17.64% | +23.89% | +25.92% | +27.91% | +23.63% | +23.52% | |

| Standard Deviation of Benchmark | +18.88% | +19.08% | +19.12% | +25.84% | +26.52% | +27.96% | +23.94% | +23.94% | |

| Krungsri China Tech 10 Plus Fund-A (KFCHINA-T10PLUS-A) | -6.13% | -3.38% | -0.58% | N/A | N/A | N/A | N/A | -7.50% | 1,194 |

| Benchmark(8) | -6.39% | +1.58% | +1.84% | N/A | N/A | N/A | N/A | -2.23% | |

| Standard Deviation of Fund | +21.95% | +25.36% | +24.10% | N/A | N/A | N/A | N/A | +25.33% | |

| Standard Deviation of Benchmark | +23.23% | +26.01% | +24.06% | N/A | N/A | N/A | N/A | +25.67% | |

| Krungsri China Tech 10 Plus Fund-I (KFCHINA-T10PLUS-I) | -6.16% | -3.52% | -0.59% | N/A | N/A | N/A | N/A | -7.64% | 0 |

| Benchmark(8) | -6.39% | +1.58% | +1.84% | N/A | N/A | N/A | N/A | -2.23% | |

| Standard Deviation of Fund | +21.96% | +25.36% | +24.10% | N/A | N/A | N/A | N/A | +25.33% | |

| Standard Deviation of Benchmark | +23.23% | +26.01% | +24.06% | N/A | N/A | N/A | N/A | +25.67% | |

| Krungsri Latin America Equity Fund (KF-LATAM) | +18.07% | +31.53% | +12.80% | +47.94% | +11.25% | +8.39% | +5.86% | -0.23% | 548 |

| Benchmark(7) | +18.52% | +32.43% | +13.96% | +48.96% | +12.45% | +10.61% | +7.24% | +0.84% | |

| Standard Deviation of Fund | +18.13% | +15.62% | +18.22% | +17.53% | +18.22% | +21.09% | +24.40% | +23.09% | |

| Standard Deviation of Benchmark | +20.62% | +17.51% | +19.50% | +18.80% | +18.61% | +21.29% | +24.73% | +23.43% | |

| Krungsri US Equity Fund-A (KFUS-A) | +4.36% | -0.16% | +1.44% | -14.69% | +6.74% | -11.57% | -0.89% | +2.11% | 760 |

| Benchmark(7) | +2.79% | -1.59% | +1.55% | -16.91% | +11.65% | -6.81% | +2.41% | +4.73% | |

| Standard Deviation of Fund | +9.54% | +9.36% | +9.70% | +13.61% | +21.85% | +33.06% | +26.70% | +23.81% | |

| Standard Deviation of Benchmark | +11.73% | +11.77% | +13.69% | +15.19% | +22.71% | +32.74% | +26.84% | +23.96% | |

| Krungsri US Equity Fund–I (KFUS-I) | +4.36% | -0.16% | +1.44% | -14.69% | +6.76% | N/A | N/A | +7.91% | 0 |

| Benchmark(7) | +2.79% | -1.59% | +1.55% | -16.91% | +11.65% | N/A | N/A | +10.50% | |

| Standard Deviation of Fund | +9.54% | +9.36% | +9.70% | +13.61% | +21.85% | N/A | N/A | +22.81% | |

| Standard Deviation of Benchmark | +11.73% | +11.77% | +13.69% | +15.19% | +22.71% | N/A | N/A | +23.79% | |

| Krungsri US Select Equity Plus Fund-A (KF-US-PLUS-A) | -0.27% | +3.83% | -0.35% | N/A | N/A | N/A | N/A | +7.02% | 410 |

| Benchmark(7) | -2.06% | +2.17% | -0.31% | N/A | N/A | N/A | N/A | +3.81% | |

| Standard Deviation of Fund | +12.89% | +12.15% | +9.28% | N/A | N/A | N/A | N/A | +17.32% | |

| Standard Deviation of Benchmark | +15.31% | +13.87% | +13.48% | N/A | N/A | N/A | N/A | +20.78% | |

| Krungsri US Select Equity Plus Fund-I (KF-US-PLUS-I) | -0.27% | +3.82% | -0.35% | N/A | N/A | N/A | N/A | +7.01% | 0 |

| Benchmark(7) | -2.06% | +2.17% | -0.31% | N/A | N/A | N/A | N/A | +3.81% | |

| Standard Deviation of Fund | +12.89% | +12.15% | +9.27% | N/A | N/A | N/A | N/A | +17.32% | |

| Standard Deviation of Benchmark | +15.31% | +13.87% | +13.48% | N/A | N/A | N/A | N/A | +20.78% | |

| Krungsri Emerging Markets Equity Fund (KF-EM) | +3.53% | +9.37% | +4.24% | +10.42% | +3.32% | -5.21% | -0.07% | -0.04% | 67 |

| Benchmark(7) | +2.14% | +8.40% | +4.60% | +8.70% | +6.86% | -0.01% | +3.89% | +3.19% | |

| Standard Deviation of Fund | +15.70% | +13.93% | +16.73% | +15.39% | +15.22% | +17.18% | +15.78% | +14.90% | |

| Standard Deviation of Benchmark | +16.96% | +14.31% | +17.38% | +16.08% | +15.89% | +17.07% | +15.93% | +15.04% | |

| Krungsri Emerging Markets ex China Equity Fund-A (KF-EMXCN-A) | +9.96% | +25.21% | +7.92% | N/A | N/A | N/A | N/A | +35.72% | 260 |

| Benchmark(7) | +9.03% | +24.22% | +8.43% | N/A | N/A | N/A | N/A | +32.96% | |

| Standard Deviation of Fund | +14.38% | +12.85% | +14.87% | N/A | N/A | N/A | N/A | +12.23% | |

| Standard Deviation of Benchmark | +15.80% | +13.94% | +13.16% | N/A | N/A | N/A | N/A | +13.40% | |

| Krungsri Emerging Markets ex China Equity Fund-I (KF-EMXCN-I) | +9.96% | +25.20% | +7.92% | N/A | N/A | N/A | N/A | +35.71% | 0 |

| Benchmark(7) | +9.03% | +24.22% | +8.43% | N/A | N/A | N/A | N/A | +32.96% | |

| Standard Deviation of Fund | +14.38% | +12.85% | +14.87% | N/A | N/A | N/A | N/A | +12.23% | |

| Standard Deviation of Benchmark | +15.80% | +13.94% | +13.16% | N/A | N/A | N/A | N/A | +13.40% | |

| Krungsri Europe Equity Fund (KF-EUROPE) | +10.28% | +10.74% | +6.66% | +6.44% | +7.76% | +3.41% | +5.13% | +5.90% | 618 |

| Benchmark(7) | +10.82% | +13.52% | +6.86% | +9.13% | +8.92% | +4.22% | +5.97% | +6.63% | |

| Standard Deviation of Fund | +11.09% | +11.80% | +9.60% | +15.81% | +16.87% | +20.81% | +19.15% | +18.11% | |

| Standard Deviation of Benchmark | +11.29% | +12.00% | +9.72% | +16.14% | +17.20% | +21.18% | +19.54% | +18.51% | |

| Krungsri Global Healthcare Equity Fund-A (KFHEALTH-A) | +3.82% | +11.82% | -0.10% | -1.39% | +2.71% | +2.78% | N/A | +5.64% | 784 |

| Benchmark(7) | +4.29% | +12.90% | +0.02% | 0.00% | +3.89% | +3.89% | N/A | +7.60% | |

| Standard Deviation of Fund | +14.48% | +14.05% | +18.95% | +16.06% | +14.56% | +15.61% | N/A | +16.48% | |

| Standard Deviation of Benchmark | +14.67% | +14.23% | +19.18% | +16.27% | +14.79% | +15.87% | N/A | +16.84% | |

| Krungsri Global Healthcare Equity Fund-D (KFHEALTH-D) | +3.82% | +11.82% | -0.10% | -1.39% | +2.71% | +2.78% | +4.99% | +5.15% | 2,871 |

| Benchmark(7) | +4.29% | +12.90% | +0.02% | 0.00% | +3.89% | +3.89% | +6.73% | +6.73% | |

| Standard Deviation of Fund | +14.48% | +14.05% | +18.95% | +16.06% | +14.56% | +15.61% | +16.03% | +16.30% | |

| Standard Deviation of Benchmark | +14.67% | +14.23% | +19.18% | +16.27% | +14.79% | +15.87% | +16.36% | +16.63% | |

| Krungsri Global Small-Mid Cap Equity Dividend Fund (KF-SMCAPD) | +8.38% | +14.73% | +4.36% | +19.36% | +7.89% | +3.57% | +3.54% | +3.34% | 49 |

| Benchmark(7) | +7.04% | +13.73% | +4.62% | +18.00% | +11.37% | +8.12% | +6.52% | +6.04% | |

| Standard Deviation of Fund | +14.22% | +14.27% | +9.57% | +18.61% | +16.18% | +17.72% | +17.37% | +16.81% | |

| Standard Deviation of Benchmark | +15.16% | +14.40% | +12.73% | +19.55% | +16.83% | +17.62% | +17.53% | +16.98% | |

| Krungsri Europe Equity Hedged Fund-A (KF-HEUROPE-A) | +9.56% | +9.92% | +5.26% | -2.47% | +4.18% | +2.18% | +5.83% | +6.35% | 1,761 |

| Benchmark(9) | +10.60% | +13.22% | +5.71% | +1.72% | +7.08% | +3.55% | +6.36% | +6.99% | |

| Standard Deviation of Fund | +10.55% | +11.06% | +10.19% | +16.85% | +16.19% | +19.85% | +18.56% | +18.53% | |

| Standard Deviation of Benchmark | +10.92% | +11.40% | +10.73% | +16.95% | +16.52% | +20.32% | +19.06% | +19.08% | |

| Krungsri Europe Equity Hedged Fund-I (KF-HEUROPE-I) | +9.56% | +9.98% | +5.26% | -2.41% | +4.20% | N/A | N/A | +4.09% | 28 |

| Benchmark(9) | +10.60% | +13.22% | +5.71% | +1.72% | +7.08% | N/A | N/A | +7.65% | |

| Standard Deviation of Fund | +10.55% | +11.09% | +10.19% | +16.86% | +16.20% | N/A | N/A | +16.34% | |

| Standard Deviation of Benchmark | +10.92% | +11.40% | +10.73% | +16.95% | +16.52% | N/A | N/A | +16.73% | |

| Krungsri Japan Hedged Dividend Fund (KF-HJAPAND) | -0.61% | +14.84% | +4.90% | +26.97% | +23.59% | +10.83% | +9.84% | +8.62% | 1,337 |

| Benchmark(9) | +4.02% | +21.34% | +5.33% | +35.09% | +25.95% | +12.13% | +11.79% | +10.36% | |

| Standard Deviation of Fund | +18.40% | +18.93% | +18.32% | +21.77% | +19.50% | +19.93% | +20.19% | +20.55% | |

| Standard Deviation of Benchmark | +17.66% | +18.96% | +19.41% | +22.12% | +19.91% | +20.60% | +20.90% | +21.24% | |

| Krungsri Greater China Equity Hedged Dividend Fund (KF-GCHINAD) | +2.36% | +9.14% | +4.58% | +17.58% | -1.50% | -5.54% | +5.81% | +2.46% | 876 |

| Benchmark(9) | +3.68% | +12.06% | +5.15% | +23.85% | +2.82% | -2.26% | +8.84% | +5.17% | |

| Standard Deviation of Fund | +13.96% | +14.59% | +14.39% | +19.19% | +19.20% | +21.01% | +19.39% | +19.49% | |

| Standard Deviation of Benchmark | +14.27% | +14.55% | +13.95% | +20.04% | +19.87% | +21.57% | +19.76% | +19.87% | |

| Krungsri Global Brands Equity Fund-A (KFGBRAND-A) | -4.41% | -10.80% | -4.21% | -12.04% | +1.18% | +1.27% | N/A | +3.89% | 2,426 |

| Benchmark(7) | -6.15% | -12.40% | -4.36% | -14.32% | +4.26% | +5.81% | N/A | +7.08% | |

| Standard Deviation of Fund | +10.08% | +9.73% | +12.60% | +12.54% | +11.46% | +14.17% | N/A | +15.69% | |

| Standard Deviation of Benchmark | +11.36% | +11.69% | +12.41% | +15.70% | +13.52% | +14.95% | N/A | +16.28% | |

| Krungsri Global Brands Equity Fund-I (KFGBRAND-I) | -4.41% | -10.80% | -4.21% | -12.04% | +1.18% | N/A | N/A | -2.69% | 28 |

| Benchmark(7) | -6.15% | -12.40% | -4.36% | -14.32% | +4.26% | N/A | N/A | +0.33% | |

| Standard Deviation of Fund | +10.08% | +9.73% | +12.60% | +12.54% | +11.46% | N/A | N/A | +14.79% | |

| Standard Deviation of Benchmark | +11.36% | +11.69% | +12.41% | +15.70% | +13.52% | N/A | N/A | +15.58% | |

| Krungsri Global Brands Equity Fund-D (KFGBRAND-D) | -4.41% | -10.80% | -4.21% | -12.04% | +1.18% | +1.27% | N/A | +4.56% | 2,436 |

| Benchmark(7) | -6.15% | -12.40% | -4.36% | -14.32% | +4.26% | +5.81% | N/A | +7.59% | |

| Standard Deviation of Fund | +10.08% | +9.73% | +12.59% | +12.54% | +11.46% | +14.17% | N/A | +14.07% | |

| Standard Deviation of Benchmark | +11.36% | +11.69% | +12.41% | +15.70% | +13.52% | +14.95% | N/A | +14.61% | |

| Krungsri Global Brands Equity Fund-ID (KFGBRAN-ID) | -4.41% | -10.80% | -4.21% | -12.04% | +2.53% | N/A | N/A | +0.27% | 365 |

| Benchmark(7) | -6.15% | -12.40% | -4.36% | -14.32% | +4.26% | N/A | N/A | +2.66% | |

| Standard Deviation of Fund | +10.07% | +9.73% | +12.59% | +12.54% | +12.97% | N/A | N/A | +15.40% | |

| Standard Deviation of Benchmark | +11.36% | +11.69% | +12.41% | +15.70% | +13.52% | N/A | N/A | +15.54% | |

| Krungsri Global Technology Equity Fund-A (KFGTECH-A) | -3.34% | +12.21% | +2.97% | +22.51% | +27.07% | +1.24% | N/A | +9.14% | 1,037 |

| Benchmark(7) | -5.31% | +9.32% | +3.25% | +19.74% | +31.65% | +5.96% | N/A | +13.55% | |

| Standard Deviation of Fund | +25.07% | +23.13% | +19.17% | +27.60% | +24.60% | +34.14% | N/A | +29.36% | |

| Standard Deviation of Benchmark | +27.29% | +24.27% | +19.32% | +28.96% | +25.47% | +33.86% | N/A | +29.38% | |

| Krungsri Global Technology Equity Fund-I (KFGTECH-I) | -3.34% | +12.21% | +2.97% | +22.51% | +27.09% | N/A | N/A | +27.62% | 0 |

| Benchmark(7) | -5.31% | +9.32% | +3.25% | +19.74% | +31.65% | N/A | N/A | +28.80% | |

| Standard Deviation of Fund | +25.07% | +23.13% | +19.17% | +27.60% | +24.61% | N/A | N/A | +25.49% | |

| Standard Deviation of Benchmark | +27.29% | +24.27% | +19.32% | +28.96% | +25.47% | N/A | N/A | +26.25% | |

| Krungsri Japan Equity Index Hedged FX Fund-A (KFJPINDX-A) | +1.43% | +28.43% | +5.45% | +33.47% | +25.42% | +14.29% | N/A | +12.35% | 613 |

| Benchmark(9) | +1.84% | +30.76% | +5.87% | +37.21% | +27.21% | +15.96% | N/A | +14.27% | |

| Standard Deviation of Fund | +19.89% | +20.11% | +20.85% | +20.69% | +20.25% | +19.43% | N/A | +18.65% | |

| Standard Deviation of Benchmark | +21.07% | +21.05% | +22.26% | +23.19% | +21.72% | +20.79% | N/A | +19.89% | |

| Krungsri Japan Equity Index Hedged FX Fund-I (KFJPINDX-I) | +1.43% | +28.46% | +5.45% | +33.63% | +27.27% | N/A | N/A | +24.05% | 0 |

| Benchmark(9) | +1.84% | +30.76% | +5.87% | +37.21% | +27.21% | N/A | N/A | +24.30% | |

| Standard Deviation of Fund | +19.88% | +20.11% | +20.85% | +20.69% | +26.85% | N/A | N/A | +26.28% | |

| Standard Deviation of Benchmark | +21.07% | +21.05% | +22.26% | +23.19% | +21.72% | N/A | N/A | +21.40% | |

| Krungsri US Equity Index Hedged FX Fund-A (KFUSINDX-A) | +0.51% | +7.30% | +0.38% | +10.87% | +15.42% | +10.67% | N/A | +10.96% | 2,109 |

| Benchmark(9) | +1.79% | +10.19% | +0.74% | +16.47% | +21.10% | +14.96% | N/A | +14.79% | |

| Standard Deviation of Fund | +10.98% | +11.13% | +9.50% | +18.67% | +14.87% | +16.74% | N/A | +18.51% | |

| Standard Deviation of Benchmark | +11.45% | +11.30% | +10.38% | +18.47% | +14.89% | +16.89% | N/A | +18.87% | |

| Krungsri US Equity Index Hedged FX Fund-I (KFUSINDX-I) | +0.51% | +7.30% | +0.38% | +10.87% | +15.42% | N/A | N/A | +10.88% | 20 |

| Benchmark(9) | +1.79% | +10.19% | +0.74% | +16.47% | +21.10% | N/A | N/A | +17.16% | |

| Standard Deviation of Fund | +10.98% | +11.13% | +9.50% | +18.67% | +14.88% | N/A | N/A | +16.21% | |

| Standard Deviation of Benchmark | +11.45% | +11.30% | +10.38% | +18.47% | +14.89% | N/A | N/A | +16.27% | |

| Krungsri US Equity Index FX Fund-A (KFUSINDFX-A) | -1.25% | +5.34% | +0.33% | +7.09% | N/A | N/A | N/A | +10.54% | 183 |

| Benchmark(7) | -1.12% | +6.01% | +0.42% | +8.70% | N/A | N/A | N/A | +13.27% | |

| Standard Deviation of Fund | +13.01% | +12.01% | +13.22% | +19.42% | N/A | N/A | N/A | +17.90% | |

| Standard Deviation of Benchmark | +13.72% | +12.98% | +14.85% | +19.79% | N/A | N/A | N/A | +18.51% | |

| Krungsri US Equity Index FX Fund-I (KFUSINDFX-I) | -1.25% | +5.34% | +0.33% | +7.09% | N/A | N/A | N/A | +10.54% | 0 |

| Benchmark(7) | -1.12% | +6.01% | +0.42% | +8.70% | N/A | N/A | N/A | +13.27% | |

| Standard Deviation of Fund | +13.02% | +12.02% | +13.22% | +19.43% | N/A | N/A | N/A | +17.90% | |

| Standard Deviation of Benchmark | +13.72% | +12.98% | +14.85% | +19.79% | N/A | N/A | N/A | +18.51% | |

| Krungsri NDQ Index Fund-A (KFNDQ-A) | -2.12% | +7.71% | +0.09% | +14.12% | N/A | N/A | N/A | +18.06% | 677 |

| Benchmark(7) | -3.83% | +6.18% | +0.08% | +11.82% | N/A | N/A | N/A | +18.46% | |

| Standard Deviation of Fund | +15.54% | +15.04% | +12.62% | +23.15% | N/A | N/A | N/A | +19.80% | |

| Standard Deviation of Benchmark | +17.70% | +16.54% | +16.53% | +23.56% | N/A | N/A | N/A | +20.63% | |

| Krungsri NDQ Index Fund-I (KFNDQ-I) | -2.12% | +7.72% | +0.09% | +14.24% | N/A | N/A | N/A | +18.11% | 0 |

| Benchmark(7) | -3.83% | +6.18% | +0.08% | +11.82% | N/A | N/A | N/A | +18.46% | |

| Standard Deviation of Fund | +15.54% | +15.05% | +12.62% | +23.17% | N/A | N/A | N/A | +19.81% | |

| Standard Deviation of Benchmark | +17.70% | +16.54% | +16.53% | +23.56% | N/A | N/A | N/A | +20.63% | |

| Krungsri Japan Small Cap Equity Fund-A (KFJPSCAP-A) | +6.83% | +15.05% | +1.79% | +24.47% | +14.57% | +8.92% | N/A | +8.91% | 184 |

| Benchmark(7) | +4.93% | +9.31% | +2.88% | +19.13% | +8.21% | +3.10% | N/A | +5.39% | |

| Standard Deviation of Fund | +13.13% | +13.53% | +12.78% | +15.32% | +17.60% | +18.03% | N/A | +19.24% | |

| Standard Deviation of Benchmark | +17.15% | +15.87% | +14.20% | +20.56% | +19.48% | +20.12% | N/A | +20.72% | |

| Krungsri Japan Small Cap Equity Fund-I (KFJPSCAP-I) | +6.86% | +15.17% | +1.79% | +24.65% | +16.66% | N/A | N/A | +14.40% | 0 |

| Benchmark(7) | +4.93% | +9.31% | +2.88% | +19.13% | +8.21% | N/A | N/A | +6.08% | |

| Standard Deviation of Fund | +13.13% | +13.53% | +12.78% | +15.32% | +18.44% | N/A | N/A | +18.16% | |

| Standard Deviation of Benchmark | +17.15% | +15.87% | +14.20% | +20.56% | +19.48% | N/A | N/A | +19.55% | |

| Krungsri Japan Small Cap Equity Dividend Fund (KF-JPSCAPD) | +7.02% | +15.21% | +1.71% | +24.60% | +15.28% | +9.43% | N/A | +9.20% | 322 |

| Benchmark(7) | +4.93% | +9.31% | +2.88% | +19.13% | +8.21% | +3.10% | N/A | +5.43% | |

| Standard Deviation of Fund | +13.44% | +13.65% | +12.88% | +15.40% | +17.48% | +17.96% | N/A | +19.18% | |

| Standard Deviation of Benchmark | +17.15% | +15.87% | +14.20% | +20.56% | +19.48% | +20.12% | N/A | +20.72% | |

| Krungsri US Small-Mid Cap Equity Hedged FX Fund (KF-HSMUS) | +10.97% | +12.05% | +4.65% | +0.84% | +3.56% | +2.87% | N/A | +3.96% | 241 |

| Benchmark(9) | +12.73% | +15.03% | +5.23% | +5.40% | +8.71% | +6.95% | N/A | +7.45% | |

| Standard Deviation of Fund | +19.36% | +18.55% | +17.28% | +21.05% | +17.53% | +18.49% | N/A | +19.02% | |

| Standard Deviation of Benchmark | +19.90% | +19.14% | +17.51% | +21.88% | +18.08% | +19.04% | N/A | +19.58% | |

| Krungsri India Equity Fund-A (KFINDIA-A) | -7.67% | -10.08% | -5.43% | -9.68% | +5.46% | +5.30% | N/A | +2.97% | 704 |

| Benchmark(7) | -9.46% | -11.73% | -5.67% | -12.24% | +8.46% | +9.54% | N/A | +6.29% | |

| Standard Deviation of Fund | +9.61% | +10.12% | +10.54% | +12.44% | +11.87% | +13.78% | N/A | +15.22% | |

| Standard Deviation of Benchmark | +11.96% | +12.75% | +13.90% | +15.53% | +14.26% | +15.20% | N/A | +16.39% | |

| Krungsri India Equity Fund-I (KFINDIA-I) | -7.67% | -10.08% | -5.43% | -9.68% | N/A | N/A | N/A | -5.12% | 1 |

| Benchmark(7) | -9.46% | -11.73% | -5.67% | -12.24% | N/A | N/A | N/A | -9.51% | |

| Standard Deviation of Fund | +9.61% | +10.12% | +10.54% | +12.44% | N/A | N/A | N/A | +12.77% | |

| Standard Deviation of Benchmark | +11.96% | +12.75% | +13.90% | +15.53% | N/A | N/A | N/A | +15.26% | |

| Krungsri China A Shares Equity Fund-A (KF-ACHINA-A) | +0.12% | +5.71% | -0.18% | +12.34% | -4.70% | -11.57% | N/A | -2.71% | 5,057 |

| Benchmark(7) | -1.74% | +3.94% | -0.22% | +9.22% | -2.55% | -8.01% | N/A | +0.25% | |

| Standard Deviation of Fund | +10.49% | +11.58% | +11.81% | +12.00% | +15.14% | +19.18% | N/A | +20.05% | |

| Standard Deviation of Benchmark | +11.33% | +12.88% | +12.74% | +13.51% | +16.56% | +19.86% | N/A | +21.03% | |

| Krungsri China A Shares Equity Fund-I (KF-ACHINA-I) | +0.12% | +5.72% | -0.18% | +12.35% | -4.69% | N/A | N/A | +0.83% | 1 |

| Benchmark(7) | -1.74% | +3.94% | -0.22% | +9.22% | -2.55% | N/A | N/A | -0.63% | |

| Standard Deviation of Fund | +10.49% | +11.59% | +11.81% | +12.01% | +15.14% | N/A | N/A | +16.75% | |

| Standard Deviation of Benchmark | +11.33% | +12.88% | +12.74% | +13.51% | +16.56% | N/A | N/A | +17.78% | |

| Krungsri China Equity CSI 300 Fund-A (KFCSI300-A) | +1.03% | +14.29% | +0.82% | +22.37% | N/A | N/A | N/A | +6.23% | 479 |

| Benchmark(7) | +1.02% | +15.30% | +1.24% | +22.18% | N/A | N/A | N/A | +6.60% | |

| Standard Deviation of Fund | +13.04% | +16.14% | +11.37% | +15.70% | N/A | N/A | N/A | +21.98% | |

| Standard Deviation of Benchmark | +12.28% | +16.59% | +9.88% | +16.14% | N/A | N/A | N/A | +23.20% | |

| Krungsri China Equity CSI 300 Fund-I (KFCSI300-I) | +1.03% | +14.29% | +0.82% | +22.37% | N/A | N/A | N/A | +6.23% | 23 |

| Benchmark(7) | +1.02% | +15.30% | +1.24% | +22.18% | N/A | N/A | N/A | +6.60% | |

| Standard Deviation of Fund | +13.04% | +16.14% | +11.37% | +15.70% | N/A | N/A | N/A | +21.98% | |

| Standard Deviation of Benchmark | +12.28% | +16.59% | +9.88% | +16.14% | N/A | N/A | N/A | +23.20% | |

| Krungsri Asian Equity Hedged FX Fund-A (KFHASIA-A) | +9.91% | +28.22% | +11.65% | +33.25% | +9.85% | +0.15% | N/A | +2.21% | 724 |

| Benchmark(9) | +11.34% | +31.87% | +12.40% | +39.81% | +14.50% | +3.18% | N/A | +5.42% | |

| Standard Deviation of Fund | +19.86% | +17.12% | +21.66% | +18.09% | +16.59% | +17.66% | N/A | +18.10% | |

| Standard Deviation of Benchmark | +20.76% | +17.78% | +22.69% | +18.49% | +16.99% | +18.09% | N/A | +18.62% | |

| Krungsri Asian Equity Hedged FX Fund-I (KFHASIA-I) | +9.91% | +28.22% | +11.65% | +33.26% | +9.88% | N/A | N/A | +11.99% | 0 |

| Benchmark(9) | +11.34% | +31.87% | +12.40% | +39.81% | +14.50% | N/A | N/A | +16.80% | |

| Standard Deviation of Fund | +19.86% | +17.12% | +21.65% | +18.10% | +16.60% | N/A | N/A | +16.64% | |

| Standard Deviation of Benchmark | +20.76% | +17.78% | +22.69% | +18.49% | +16.99% | N/A | N/A | +17.05% | |

| Krungsri Vietnam Equity Fund-A (KFVIET-A) | +7.08% | +14.24% | +5.28% | +17.56% | +5.97% | +1.46% | N/A | +0.42% | 1,944 |

| Benchmark(10) | +6.27% | +22.87% | +1.98% | +39.66% | +18.13% | +14.25% | N/A | +8.99% | |

| Standard Deviation of Fund | +18.92% | +19.94% | +14.78% | +20.98% | +17.32% | +18.58% | N/A | +18.95% | |

| Standard Deviation of Benchmark | +20.37% | +24.07% | +19.04% | +24.45% | +20.39% | +22.42% | N/A | +22.12% | |

| Krungsri Vietnam Equity Fund–I (KFVIET-I) | +7.08% | +14.24% | +5.28% | +17.56% | +5.97% | N/A | N/A | -0.44% | 697 |

| Benchmark(10) | +6.27% | +22.87% | +1.98% | +39.66% | +18.13% | N/A | N/A | +8.66% | |

| Standard Deviation of Fund | +18.92% | +19.94% | +14.78% | +20.98% | +17.32% | N/A | N/A | +18.28% | |

| Standard Deviation of Benchmark | +20.37% | +24.07% | +19.04% | +24.45% | +20.39% | N/A | N/A | +22.53% | |

| Krungsri Global Healthcare Equity Hedged FX Fund-A (KFHHCARE-A) | +5.93% | +14.54% | -0.08% | +2.45% | +1.01% | -0.26% | N/A | +4.56% | 1,193 |

| Benchmark(9) | +7.36% | +17.36% | +0.34% | +7.15% | +5.58% | +2.91% | N/A | +8.06% | |

| Standard Deviation of Fund | +12.79% | +12.60% | +15.61% | +15.03% | +13.45% | +15.15% | N/A | +16.42% | |

| Standard Deviation of Benchmark | +13.35% | +12.71% | +15.32% | +16.96% | +14.28% | +15.74% | N/A | +17.05% | |

| Krungsri Global Healthcare Equity Hedged FX Fund-I (KFHHCARE-I) | +5.93% | +14.55% | -0.08% | +2.46% | +1.01% | N/A | N/A | -1.89% | 96 |

| Benchmark(9) | +7.36% | +17.36% | +0.34% | +7.15% | +5.58% | N/A | N/A | +1.98% | |

| Standard Deviation of Fund | +12.79% | +12.60% | +15.61% | +15.03% | +13.45% | N/A | N/A | +15.59% | |

| Standard Deviation of Benchmark | +13.35% | +12.71% | +15.32% | +16.96% | +14.28% | N/A | N/A | +16.31% | |

| Krungsri Global Healthcare Equity Hedged FX Fund-D (KFHHCARE-D) | +5.93% | +14.54% | -0.08% | +2.45% | +1.01% | -0.26% | N/A | +4.52% | 166 |

| Benchmark(9) | +7.36% | +17.36% | +0.34% | +7.15% | +5.58% | +2.91% | N/A | +8.06% | |

| Standard Deviation of Fund | +12.79% | +12.60% | +15.61% | +15.03% | +13.45% | +15.15% | N/A | +16.43% | |

| Standard Deviation of Benchmark | +13.35% | +12.71% | +15.32% | +16.96% | +14.28% | +15.74% | N/A | +17.05% | |

| Krungsri World Tech Equity Hedged FX Fund-A (KFHTECH-A) | -5.20% | +6.16% | +2.14% | +12.88% | +24.01% | +4.55% | N/A | +15.58% | 6,262 |

| Benchmark(9) | -3.98% | +9.27% | +2.73% | +19.04% | +30.55% | +8.42% | N/A | +20.13% | |

| Standard Deviation of Fund | +24.54% | +22.34% | +16.43% | +26.08% | +23.00% | +26.06% | N/A | +25.96% | |

| Standard Deviation of Benchmark | +25.51% | +22.74% | +16.93% | +26.99% | +23.58% | +26.54% | N/A | +26.52% | |

| Krungsri World Tech Equity Hedged FX Fund-I (KFHTECH-I) | -5.20% | +6.16% | +2.14% | +12.87% | +24.03% | N/A | N/A | +23.22% | 0 |

| Benchmark(9) | -3.98% | +9.27% | +2.73% | +19.04% | +30.55% | N/A | N/A | +29.63% | |

| Standard Deviation of Fund | +24.54% | +22.35% | +16.43% | +26.09% | +23.01% | N/A | N/A | +23.35% | |

| Standard Deviation of Benchmark | +25.51% | +22.74% | +16.93% | +26.99% | +23.58% | N/A | N/A | +23.99% | |

| Krungsri Global Dividend Hedged FX Fund-A (KFGDIV-A) | +5.51% | +5.96% | +1.88% | +15.37% | +10.83% | +6.27% | N/A | +8.12% | 1,761 |

| Benchmark(9) | +7.11% | +8.84% | +2.39% | +21.57% | +16.39% | +10.28% | N/A | +11.48% | |

| Standard Deviation of Fund | +7.56% | +7.69% | +6.80% | +11.32% | +10.34% | +12.11% | N/A | +12.21% | |

| Standard Deviation of Benchmark | +7.85% | +8.01% | +7.08% | +12.20% | +10.74% | +12.17% | N/A | +12.36% | |

| Krungsri Global Dividend Hedged FX Fund-D (KFGDIV-D) | +5.51% | +5.96% | +1.88% | +15.37% | +10.83% | +6.28% | N/A | +8.13% | 1,218 |

| Benchmark(9) | +7.11% | +8.84% | +2.39% | +21.57% | +16.39% | +10.28% | N/A | +11.48% | |

| Standard Deviation of Fund | +7.56% | +7.69% | +6.80% | +11.32% | +10.34% | +12.11% | N/A | +12.21% | |

| Standard Deviation of Benchmark | +7.85% | +8.01% | +7.08% | +12.20% | +10.74% | +12.17% | N/A | +12.36% | |

| Krungsri Global Dividend Hedged FX Fund-I (KFGDIV-I) | +5.51% | +5.96% | +1.88% | +15.37% | +7.47% | N/A | N/A | +7.47% | 36 |

| Benchmark(9) | +7.11% | +8.84% | +2.39% | +21.57% | +16.39% | N/A | N/A | +16.33% | |

| Standard Deviation of Fund | +7.56% | +7.69% | +6.80% | +11.32% | +12.71% | N/A | N/A | +12.70% | |

| Standard Deviation of Benchmark | +7.85% | +8.01% | +7.08% | +12.20% | +10.74% | N/A | N/A | +10.94% | |

| Krungsri Next Generation Infrastructure Fund-A (KFINFRA-A) | +6.04% | +4.35% | +4.36% | +12.30% | +5.59% | N/A | N/A | +1.55% | 878 |

| Benchmark(9) | +7.59% | +6.96% | +4.90% | +17.88% | +10.37% | N/A | N/A | +5.07% | |

| Standard Deviation of Fund | +7.49% | +7.75% | +7.68% | +11.63% | +11.63% | N/A | N/A | +13.54% | |

| Standard Deviation of Benchmark | +7.65% | +7.89% | +7.97% | +11.93% | +11.89% | N/A | N/A | +13.78% | |

| Krungsri Next Generation Infrastructure Fund-I (KFINFRA-I) | +6.04% | +4.35% | +4.36% | +12.31% | +5.59% | N/A | N/A | +0.81% | 51 |

| Benchmark(9) | +7.59% | +6.96% | +4.90% | +17.88% | +10.37% | N/A | N/A | +5.34% | |

| Standard Deviation of Fund | +7.49% | +7.75% | +7.68% | +11.63% | +11.63% | N/A | N/A | +13.90% | |

| Standard Deviation of Benchmark | +7.65% | +7.89% | +7.97% | +11.93% | +11.89% | N/A | N/A | +14.16% | |

| Krungsri ESG Climate Tech Fund-A (KFCLIMA-A) | +1.13% | +5.46% | +3.93% | +17.42% | +4.67% | N/A | N/A | +0.59% | 238 |

| Standard Deviation of Fund | +15.34% | +14.26% | +12.12% | +17.07% | +16.10% | N/A | N/A | +18.72% | |

| Krungsri ESG Climate Tech Fund-I (KFCLIMA-I) | +1.13% | +5.46% | +3.93% | +17.42% | +4.67% | N/A | N/A | +4.58% | 0 |

| Standard Deviation of Fund | +15.34% | +14.26% | +12.12% | +17.07% | +16.10% | N/A | N/A | +16.32% | |

| Krungsri Disruptive Innovation Fund-A (KFINNO-A) | -15.37% | -2.16% | -4.35% | +10.13% | +17.14% | N/A | N/A | -13.14% | 746 |

| Benchmark(9) | -14.85% | -0.38% | -4.23% | +14.09% | +24.06% | N/A | N/A | -8.76% | |

| Standard Deviation of Fund | +30.28% | +30.97% | +26.33% | +40.74% | +37.51% | N/A | N/A | +44.62% | |

| Standard Deviation of Benchmark | +32.04% | +31.67% | +27.07% | +40.38% | +37.40% | N/A | N/A | +45.31% | |

| Krungsri Disruptive Innovation Fund-I (KFINNO-I) | -15.37% | -2.16% | -4.35% | +10.12% | +17.47% | N/A | N/A | +19.08% | 0 |

| Benchmark(9) | -14.85% | -0.38% | -4.23% | +14.09% | +24.06% | N/A | N/A | +26.42% | |

| Standard Deviation of Fund | +30.28% | +30.97% | +26.34% | +40.72% | +37.59% | N/A | N/A | +38.17% | |

| Standard Deviation of Benchmark | +32.04% | +31.67% | +27.07% | +40.38% | +37.40% | N/A | N/A | +38.15% | |

| Krungsri China Megatrends Fund-A (KFCMEGA-A) | -4.52% | +3.33% | +1.54% | +13.56% | -4.52% | N/A | N/A | -12.12% | 1,219 |

| Benchmark(11) | -1.29% | +7.88% | +4.25% | +28.27% | +7.19% | N/A | N/A | -1.72% | |

| Standard Deviation of Fund | +18.74% | +21.58% | +25.06% | +27.89% | +30.56% | N/A | N/A | +34.69% | |

| Standard Deviation of Benchmark | +15.75% | +16.71% | +14.93% | +22.96% | +22.30% | N/A | N/A | +25.26% | |

| Krungsri China Megatrends Fund-I (KFCMEGA-I) | -4.52% | +3.33% | +1.55% | +13.56% | -4.52% | N/A | N/A | -2.71% | 249 |

| Benchmark(11) | -1.29% | +7.88% | +4.25% | +28.27% | +7.19% | N/A | N/A | +6.67% | |

| Standard Deviation of Fund | +18.74% | +21.58% | +25.06% | +27.89% | +30.56% | N/A | N/A | +31.77% | |

| Standard Deviation of Benchmark | +15.75% | +16.71% | +14.93% | +22.96% | +22.30% | N/A | N/A | +23.53% | |

| Krungsri Equity Sustainable Global Growth Fund-A (KFESG-A) | -4.38% | -1.39% | -0.50% | -1.25% | +2.36% | N/A | N/A | -3.96% | 803 |

| Benchmark(9) | -3.23% | +1.02% | -0.09% | +3.38% | +7.36% | N/A | N/A | -0.12% | |

| Standard Deviation of Fund | +12.38% | +12.41% | +10.97% | +18.47% | +15.26% | N/A | N/A | +18.41% | |

| Standard Deviation of Benchmark | +12.90% | +12.70% | +11.81% | +18.55% | +15.48% | N/A | N/A | +18.74% | |

| Krungsri Equity Sustainable Global Growth Fund-I (KFESG-I) | -4.38% | -1.39% | -0.50% | -1.25% | +2.36% | N/A | N/A | -3.96% | 33 |

| Benchmark(9) | -3.23% | +1.02% | -0.09% | +3.38% | +7.36% | N/A | N/A | -0.12% | |

| Standard Deviation of Fund | +12.37% | +12.41% | +10.96% | +18.47% | +15.26% | N/A | N/A | +18.41% | |

| Standard Deviation of Benchmark | +12.90% | +12.70% | +11.81% | +18.55% | +15.48% | N/A | N/A | +18.74% | |

| Krungsri Global Growth Fund-A (KFGG-A) | -10.22% | -5.13% | -4.03% | -0.62% | +13.59% | N/A | N/A | -5.37% | 2,237 |

| Benchmark(9) | -9.34% | -2.92% | -3.86% | +4.09% | +19.62% | N/A | N/A | -0.92% | |

| Standard Deviation of Fund | +18.75% | +17.04% | +16.96% | +22.47% | +21.19% | N/A | N/A | +28.64% | |

| Standard Deviation of Benchmark | +20.44% | +18.51% | +18.40% | +26.40% | +22.95% | N/A | N/A | +29.90% | |

| Krungsri Global Growth Fund-I (KFGG-I) | -10.22% | -5.14% | -4.04% | -0.62% | +13.59% | N/A | N/A | -3.01% | 30 |

| Benchmark(9) | -9.34% | -2.92% | -3.86% | +4.09% | +19.62% | N/A | N/A | +0.78% | |

| Standard Deviation of Fund | +18.75% | +17.04% | +16.96% | +22.47% | +21.19% | N/A | N/A | +28.79% | |

| Standard Deviation of Benchmark | +20.44% | +18.51% | +18.40% | +26.40% | +22.95% | N/A | N/A | +30.08% | |

| Krungsri Global Future Generations Equity Fund-A (KFFUTUREGEN-A) | -5.16% | +0.36% | -2.60% | +3.59% | +10.50% | N/A | N/A | -3.03% | 543 |

| Benchmark(9) | -4.12% | +2.77% | -2.36% | +8.49% | +15.77% | N/A | N/A | +1.08% | |

| Standard Deviation of Fund | +14.30% | +14.51% | +9.49% | +19.17% | +17.09% | N/A | N/A | +21.70% | |

| Standard Deviation of Benchmark | +15.22% | +15.23% | +10.22% | +20.60% | +18.00% | N/A | N/A | +22.69% | |

| Krungsri Global Future Generations Equity Fund-I (KFFUTUREGEN-I) | -5.16% | +0.36% | -2.60% | +3.59% | +10.51% | N/A | N/A | +11.99% | 0 |

| Benchmark(9) | -4.12% | +2.77% | -2.36% | +8.49% | +15.77% | N/A | N/A | +17.75% | |

| Standard Deviation of Fund | +14.31% | +14.51% | +9.49% | +19.17% | +17.10% | N/A | N/A | +17.41% | |

| Standard Deviation of Benchmark | +15.22% | +15.23% | +10.22% | +20.60% | +18.00% | N/A | N/A | +18.47% | |

| Krungsri Cyber Security Fund-A (KFCYBER-A) | -14.62% | -12.33% | -7.61% | -7.61% | +15.61% | N/A | N/A | +0.77% | 676 |

| Benchmark(9) | -14.45% | -11.05% | -7.47% | -3.41% | +21.33% | N/A | N/A | +4.72% | |

| Standard Deviation of Fund | +23.51% | +22.69% | +25.52% | +27.73% | +24.69% | N/A | N/A | +28.70% | |

| Standard Deviation of Benchmark | +25.22% | +24.18% | +25.43% | +30.16% | +25.98% | N/A | N/A | +29.73% | |

| Krungsri Cyber Security Fund-I (KFCYBER-I) | -14.62% | -12.34% | -7.61% | -7.61% | +15.61% | N/A | N/A | +13.69% | 0 |

| Benchmark(9) | -14.45% | -11.05% | -7.47% | -3.41% | +21.33% | N/A | N/A | +19.97% | |

| Standard Deviation of Fund | +23.51% | +22.69% | +25.52% | +27.73% | +24.69% | N/A | N/A | +24.73% | |

| Standard Deviation of Benchmark | +25.22% | +24.18% | +25.43% | +30.16% | +25.98% | N/A | N/A | +26.02% | |

| Krungsri World Equity Index Fund-A (KF-WORLD-INDX-A) | +2.32% | +9.77% | +1.77% | +15.70% | N/A | N/A | N/A | +15.81% | 1,719 |

| Benchmark(7) | +0.83% | +8.66% | +1.85% | +13.97% | N/A | N/A | N/A | +16.64% | |

| Standard Deviation of Fund | +10.88% | +10.76% | +10.00% | +17.11% | N/A | N/A | N/A | +14.40% | |

| Standard Deviation of Benchmark | +13.46% | +12.33% | +14.14% | +17.78% | N/A | N/A | N/A | +15.14% | |

| Krungsri World Equity Index Fund-I (KF-WORLD-INDX-I) | +2.32% | +9.77% | +1.77% | +15.70% | N/A | N/A | N/A | +15.81% | 979 |

| Benchmark(7) | +0.83% | +8.66% | +1.85% | +13.97% | N/A | N/A | N/A | +16.64% | |

| Standard Deviation of Fund | +10.88% | +10.76% | +10.00% | +17.11% | N/A | N/A | N/A | +14.41% | |

| Standard Deviation of Benchmark | +13.46% | +12.33% | +14.14% | +17.78% | N/A | N/A | N/A | +15.14% | |

| Krungsri Global Unconstrained Equity Fund-A (KFGLOBAL-A) | -1.11% | +1.50% | +1.46% | +3.91% | N/A | N/A | N/A | +1.12% | 196 |

| Benchmark(7) | -2.34% | +0.41% | +1.73% | +2.46% | N/A | N/A | N/A | -1.95% | |

| Standard Deviation of Fund | +17.80% | +15.48% | +14.88% | +21.20% | N/A | N/A | N/A | +18.76% | |

| Standard Deviation of Benchmark | +19.47% | +16.45% | +16.74% | +22.08% | N/A | N/A | N/A | +19.82% | |

| Krungsri Global Unconstrained Equity Fund-I (KFGLOBAL-I) | -1.11% | +1.51% | +1.46% | +3.91% | N/A | N/A | N/A | +1.12% | 0 |

| Benchmark(7) | -2.34% | +0.41% | +1.73% | +2.46% | N/A | N/A | N/A | -1.95% | |

| Standard Deviation of Fund | +17.80% | +15.49% | +14.87% | +21.21% | N/A | N/A | N/A | +18.77% | |

| Standard Deviation of Benchmark | +19.47% | +16.45% | +16.74% | +22.08% | N/A | N/A | N/A | +19.82% | |

| Krungsri Global Unconstrained Equity FX Fund-A (KFGLOBFX-A) | -2.70% | -0.45% | +1.57% | +0.41% | N/A | N/A | N/A | -0.57% | 18 |

| Benchmark(7) | -2.34% | +0.41% | +1.73% | +2.46% | N/A | N/A | N/A | -0.13% | |

| Standard Deviation of Fund | +18.80% | +15.78% | +16.40% | +22.05% | N/A | N/A | N/A | +19.77% | |

| Standard Deviation of Benchmark | +19.47% | +16.45% | +16.74% | +22.08% | N/A | N/A | N/A | +19.79% | |

| Krungsri Global Unconstrained Equity FX Fund-I (KFGLOBFX-I) | -2.70% | -0.45% | +1.57% | +0.42% | N/A | N/A | N/A | -0.57% | 0 |

| Benchmark(7) | -2.34% | +0.41% | +1.73% | +2.46% | N/A | N/A | N/A | -0.13% | |

| Standard Deviation of Fund | +18.80% | +15.78% | +16.40% | +22.05% | N/A | N/A | N/A | +19.77% | |

| Standard Deviation of Benchmark | +19.47% | +16.45% | +16.74% | +22.08% | N/A | N/A | N/A | +19.79% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Global Property Fund-A (KFGPROP-A) | +0.94% | +2.62% | +0.66% | +3.19% | -0.31% | +0.18% | N/A | +0.10% | 485 |

| Benchmark(7) | -0.73% | +1.11% | +0.72% | +0.92% | +2.61% | +4.74% | N/A | +4.04% | |

| Standard Deviation of Fund | +9.00% | +10.38% | +9.71% | +14.80% | +15.25% | +16.33% | N/A | +20.11% | |

| Standard Deviation of Benchmark | +11.97% | +12.55% | +14.25% | +15.80% | +16.27% | +17.21% | N/A | +20.70% | |

| Krungsri Global Property Fund-D (KFGPROP-D) | +0.94% | +2.62% | +0.66% | +3.19% | -0.31% | +0.18% | N/A | +0.90% | 250 |

| Benchmark(7) | -0.73% | +1.11% | +0.72% | +0.92% | +2.61% | +4.74% | N/A | +2.96% | |

| Standard Deviation of Fund | +9.00% | +10.38% | +9.72% | +14.80% | +15.25% | +16.33% | N/A | +17.22% | |

| Standard Deviation of Benchmark | +11.97% | +12.55% | +14.25% | +15.80% | +16.27% | +17.21% | N/A | +17.75% | |

| Krungsri Global Property Fund-I (KFGPROP-I) | +0.94% | +2.62% | +0.66% | +3.19% | -0.31% | N/A | N/A | +1.33% | 19 |

| Benchmark(7) | -0.73% | +1.11% | +0.72% | +0.92% | +2.61% | N/A | N/A | +2.22% | |

| Standard Deviation of Fund | +9.00% | +10.38% | +9.71% | +14.80% | +15.25% | N/A | N/A | +15.40% | |

| Standard Deviation of Benchmark | +11.97% | +12.55% | +14.25% | +15.80% | +16.27% | N/A | N/A | +16.48% | |

Remark