Fund Type

Retirement Mutual Fund (Equity Fund)

Dividend Policy

None

Objective

To promote long term investment as a retirement planning for investors.

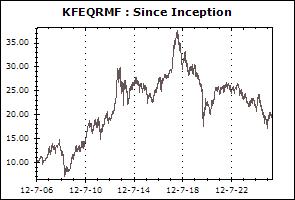

Inception Date

12 July 2006

Investment Policy

To invest at least 80% in listed stocks with sustainable earnings growth potential.

Fund Manager

Peeti Pratipatpong, Thalit Choktippattana

Asset Allocation

-

Transaction Details

Minimum Purchase Amount (Baht): 500

Minimum Redemption Amount (Unit): None (Investors can only redeem the units of RMF and get exemption on the capital gains when they have held the units for more than 5 years and are at least 55 years old. The exceptions are when they die or become disable.)

Transaction Period: Every fund`s dealing date within 15.30 hrs.

Proceeds Payment Period: 3 business days after the redemption date (T+3)

Fund Redemption Period: Every fund`s dealing date within 15.30 hrs.

Transaction Channel: Krungsri Asset Management,Online Service,AGENT

Top Five Sectors (30 Dec 2025)

| Energy & Utilities | 18.08% |

| Banking | 11.64% |

| Commerce | 9.56% |

| Health Care Services | 9.35% |

| Information & Communication Technology | 7.71% |

Top Five Holdings (30 Dec 2025)

| Thanachart Capital Plc. | 7.08% |

| PTT Plc. | 5.33% |

| Gulf Development Plc. | 4.37% |

| Advanced Info Service Plc. | 4.11% |

| MBK Plc. | 4.11% |

Retirement Mutual Funds (RMF: All funds support PVD transfers)

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Cash RMF (KFCASHRMF) | +0.30% | +0.62% | +1.46% | +1.46% | +1.65% | +1.09% | +0.97% | +1.59% | 10,947 |

| Benchmark(4) | +0.24% | +0.53% | +1.22% | +1.22% | +1.40% | +1.03% | +1.16% | +1.67% | |

| Standard Deviation of Fund | +0.06% | +0.07% | +0.09% | +0.09% | +0.09% | +0.08% | +0.07% | +0.11% | |

| Standard Deviation of Benchmark | 0.00% | +0.01% | +0.01% | +0.01% | +0.01% | +0.02% | +0.02% | +0.04% | |

| Krungsri Government Bond RMF (KFGOVRMF) | -0.18% | +0.58% | +3.25% | +3.25% | +2.36% | +1.24% | +1.38% | +2.04% | 8,352 |

| Benchmark(5) | +0.32% | +0.86% | +2.28% | +2.28% | +1.87% | +1.25% | +2.29% | +2.99% | |

| Standard Deviation of Fund | +1.07% | +1.21% | +1.10% | +1.10% | +0.76% | +0.71% | +0.65% | +1.96% | |

| Standard Deviation of Benchmark | +0.23% | +0.25% | +0.24% | +0.24% | +0.21% | +0.25% | +0.85% | +1.29% | |

| Krungsri Medium Term Fixed Income RMF (KFMTFIRMF) | +0.07% | +1.00% | +3.82% | +3.82% | +2.98% | +2.03% | +2.02% | +1.92% | 5,831 |

| Benchmark(6) | +0.48% | +1.02% | +2.45% | +2.45% | +1.93% | +1.28% | +2.31% | +2.97% | |

| Standard Deviation of Fund | +0.93% | +1.06% | +0.94% | +0.94% | +0.67% | +0.73% | +0.71% | +0.57% | |

| Standard Deviation of Benchmark | +0.35% | +0.31% | +0.27% | +0.27% | +0.23% | +0.26% | +0.85% | +1.29% | |

| Krungsri Long Term Government Bond RMF (KFLTGOVRMF) | -1.16% | +0.13% | +4.95% | +4.95% | +3.25% | +1.63% | +2.09% | +2.01% | 1,902 |

| Benchmark(7) | +0.18% | +0.92% | +3.08% | +3.08% | +2.35% | +1.38% | +2.42% | +3.02% | |

| Standard Deviation of Fund | +2.26% | +2.74% | +2.37% | +2.37% | +1.70% | +1.63% | +1.57% | +1.11% | |

| Standard Deviation of Benchmark | +0.52% | +0.57% | +0.54% | +0.54% | +0.51% | +0.68% | +1.01% | +1.34% | |

| Krungsri Active Fixed Income RMF (KFAFIXRMF) | +0.01% | +0.89% | +3.61% | +3.61% | +3.00% | +2.07% | N/A | +2.47% | 3,898 |

| Benchmark(8) | +0.32% | +1.32% | +4.08% | +4.08% | +3.09% | +2.03% | N/A | +2.55% | |

| Standard Deviation of Fund | +1.01% | +1.12% | +0.98% | +0.98% | +0.72% | +0.78% | N/A | +1.02% | |

| Standard Deviation of Benchmark | +0.73% | +0.80% | +0.76% | +0.76% | +0.72% | +0.95% | N/A | +0.99% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Taweesap RMF (KFTSRMF) | -3.89% | +8.52% | -13.28% | -13.28% | -9.94% | -4.48% | -2.04% | +6.73% | 1,589 |

| Standard Deviation of Fund | +11.82% | +13.39% | +15.70% | +15.70% | +13.13% | +12.34% | +13.68% | +18.24% | |

| Krungsri Flexible 2 RMF (KFFLEX2RMF) | -3.88% | +8.60% | -13.23% | -13.23% | -9.97% | -4.49% | -2.07% | +5.76% | 615 |

| Standard Deviation of Fund | +11.85% | +13.43% | +15.71% | +15.71% | +13.11% | +12.32% | +13.62% | +17.53% | |

| Benchmark(9) | -0.67% | +8.90% | -0.81% | -0.81% | -0.92% | +0.97% | +2.70% | N/A | |

| Standard Deviation of Benchmark | +9.39% | +9.91% | +11.54% | +11.54% | +9.20% | +8.70% | +9.83% | N/A | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Happy Life RMF (KFHAPPYRMF) | +0.31% | +3.08% | +3.02% | +3.02% | +1.62% | +1.14% | N/A | +0.58% | 1,243 |

| (1)2-year Zero Rate Return (ZRR) Index 40% (2)An average 1-year fixed deposit rate for individuals of Bangkok Bank, Kasikorn Bank and Siam Commercial Bank 40% (3)SET Total Return Index (SET TRI) 20% | +0.13% | +4.14% | +0.62% | +0.62% | +0.37% | +1.10% | N/A | +1.02% | |

| Standard Deviation of Fund | +1.74% | +2.08% | +2.48% | +2.48% | +2.12% | +2.07% | N/A | +2.50% | |

| Standard Deviation of Benchmark | +2.33% | +2.52% | +2.88% | +2.88% | +2.26% | +2.13% | N/A | +2.49% | |

| Krungsri Good Life RMF (KFGOODRMF) | +0.42% | +5.16% | +1.25% | +1.25% | -0.17% | +0.41% | N/A | -0.62% | 340 |

| (1)2-year Zero Rate Return (ZRR) Index 30% (2)An average 1-year fixed deposit rate for individuals of Bangkok Bank, Kasikorn Bank and Siam Commercial Bank 30% (3)SET Total Return Index (SET TRI) 40% | -0.05% | +7.44% | -1.03% | -1.03% | -1.13% | +0.94% | N/A | +0.80% | |

| Standard Deviation of Fund | +3.65% | +4.20% | +5.23% | +5.23% | +4.45% | +4.27% | N/A | +5.00% | |

| Standard Deviation of Benchmark | +4.35% | +4.51% | +5.16% | +5.16% | +4.25% | +4.09% | N/A | +4.83% | |

| Krungsri Super Life RMF (KFSUPERRMF) | +0.03% | +7.24% | -1.08% | -1.08% | -2.50% | -0.72% | N/A | -3.10% | 136 |

| Benchmark(14) | -0.23% | +10.74% | -2.69% | -2.69% | -2.63% | +0.79% | N/A | +0.20% | |

| Standard Deviation of Fund | +6.10% | +7.04% | +8.69% | +8.69% | +7.29% | +6.90% | N/A | +8.59% | |

| Standard Deviation of Benchmark | +6.65% | +6.95% | +8.00% | +8.00% | +6.48% | +6.18% | N/A | +7.49% | |

| Krungsri The One Mild RMF (KF1MILDRMF) | +0.63% | +3.51% | +4.19% | +4.19% | N/A | N/A | N/A | +3.44% | 55 |

| Benchmark(15) | +1.31% | +6.01% | +6.87% | +6.87% | N/A | N/A | N/A | +6.60% | |

| Standard Deviation of Fund | +2.75% | +2.54% | +3.77% | +3.77% | N/A | N/A | N/A | +3.51% | |

| Standard Deviation of Benchmark | +2.91% | +2.86% | +3.62% | +3.62% | N/A | N/A | N/A | +3.06% | |

| Krungsri The One Mean RMF (KF1MEANRMF) | +0.40% | +4.09% | +3.33% | +3.33% | N/A | N/A | N/A | +2.98% | 34 |

| Benchmark(16) | +1.60% | +8.96% | +8.03% | +8.03% | N/A | N/A | N/A | +8.28% | |

| Standard Deviation of Fund | +3.99% | +3.63% | +5.62% | +5.62% | N/A | N/A | N/A | +5.04% | |

| Standard Deviation of Benchmark | +4.68% | +4.75% | +6.29% | +6.29% | N/A | N/A | N/A | +5.32% | |

| Krungsri The One Max RMF (KF1MAXRMF) | +0.52% | +5.19% | +4.67% | +4.67% | N/A | N/A | N/A | +4.24% | 40 |

| Benchmark(17) | +2.45% | +12.83% | +12.07% | +12.07% | N/A | N/A | N/A | +12.55% | |

| Standard Deviation of Fund | +5.41% | +4.94% | +7.46% | +7.46% | N/A | N/A | N/A | +6.64% | |

| Standard Deviation of Benchmark | +7.24% | +7.14% | +9.91% | +9.91% | N/A | N/A | N/A | +8.33% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Dividend Stock RMF (KFDIVRMF) | -1.55% | +13.25% | -9.01% | -9.01% | -8.22% | -3.56% | -1.62% | +4.00% | 6,060 |

| Standard Deviation of Fund | +11.54% | +13.23% | +16.96% | +16.96% | +13.80% | +12.94% | +14.59% | +15.51% | |

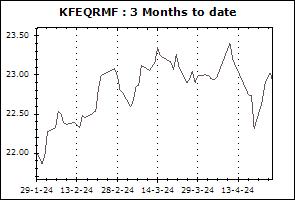

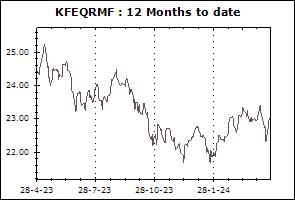

| Krungsri Equity RMF (KFEQRMF) | -2.14% | +10.18% | -10.93% | -10.93% | -9.28% | -2.62% | -1.89% | +3.49% | 1,139 |

| Standard Deviation of Fund | +10.48% | +13.48% | +17.10% | +17.10% | +13.87% | +12.80% | +14.96% | +18.71% | |

| Krungsri Thai All Stars Equity RMF (KFSTARRMF) | -1.14% | +10.75% | -3.88% | -3.88% | -7.57% | -1.86% | N/A | -6.24% | 474 |

| Standard Deviation of Fund | +9.92% | +12.11% | +16.04% | +16.04% | +13.59% | +12.77% | N/A | +15.13% | |

| Krungsri Dynamic RMF (KFDNMRMF) | -6.99% | +4.95% | -20.76% | -20.76% | -10.83% | +0.21% | N/A | -2.45% | 342 |

| Standard Deviation of Fund | +13.81% | +15.95% | +18.91% | +18.91% | +14.94% | +13.95% | N/A | +16.61% | |

| SET TRI | -0.59% | +17.33% | -5.99% | -5.99% | -5.63% | +0.47% | +3.05% | N/A | |

| Standard Deviation of Benchmark | +14.18% | +15.05% | +17.77% | +17.77% | +13.89% | +13.01% | +14.88% | N/A | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri SET100 RMF (KFS100RMF) | +0.98% | +19.05% | -5.16% | -5.16% | -4.52% | +0.39% | +2.48% | +5.73% | 3,717 |

| Standard Deviation of Fund | +14.29% | +15.71% | +19.31% | +19.31% | +14.92% | +13.88% | +16.33% | +20.01% | |

| SET100 TRI | +1.34% | +20.00% | -4.63% | -4.63% | -4.22% | +0.57% | +2.98% | +6.68% | |

| Standard Deviation of Benchmark | +14.24% | +15.72% | +19.29% | +19.29% | +14.99% | +13.95% | +16.46% | +20.26% | |

| Tracking Difference (TD) | N/A | N/A | N/A | -0.53% | N/A | N/A | N/A | N/A | |

| Tracking Error (TE) | N/A | N/A | N/A | +1.99% | N/A | N/A | N/A | N/A | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Gold RMF (KFGOLDRMF) | +12.49% | +28.11% | +57.39% | +57.39% | +26.78% | +13.65% | +9.32% | +6.11% | 3,395 |

| Benchmark(10) | +11.07% | +27.81% | +53.81% | +53.81% | +29.29% | +19.10% | +13.11% | +8.83% | |

| Standard Deviation of Fund | +23.57% | +19.19% | +18.03% | +18.03% | +15.30% | +14.83% | +13.85% | +14.92% | |

| Standard Deviation of Benchmark | +24.89% | +20.08% | +17.88% | +17.88% | +16.78% | +15.56% | +15.25% | +16.90% | |

| Krungsri Global Core Allocation RMF (KFCORERMF) | +3.06% | +7.70% | +7.84% | +7.84% | N/A | N/A | N/A | +8.10% | 59 |

| Standard Deviation of Fund | +7.72% | +6.90% | +8.61% | +8.61% | N/A | N/A | N/A | +7.74% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Europe Equity RMF (KFEURORMF) | +5.82% | +0.82% | +2.37% | +2.37% | +5.71% | +1.41% | +3.48% | +4.94% | 377 |

| Benchmark(10) | +5.18% | +1.89% | +8.15% | +8.15% | +7.75% | +2.46% | +4.33% | +5.25% | |

| Standard Deviation of Fund | +9.93% | +11.82% | +16.66% | +16.66% | +16.38% | +20.07% | +18.83% | +18.46% | |

| Standard Deviation of Benchmark | +11.05% | +12.80% | +16.81% | +16.81% | +17.40% | +21.20% | +19.55% | +19.28% | |

| Krungsri Global Healthcare Equity RMF (KFHCARERMF) | +11.53% | +13.69% | +10.58% | +10.58% | +0.70% | +0.32% | +2.12% | +3.34% | 2,313 |

| Benchmark(10) | +10.09% | +13.00% | +6.98% | +6.98% | +2.22% | +4.45% | +5.12% | +5.67% | |

| Standard Deviation of Fund | +12.32% | +11.58% | +14.74% | +14.74% | +13.35% | +15.26% | +15.98% | +16.23% | |

| Standard Deviation of Benchmark | +13.22% | +12.61% | +15.74% | +15.74% | +14.58% | +15.86% | +16.49% | +16.71% | |

| Krungsri Japan RMF (KFJAPANRMF) | +3.90% | +10.33% | +19.83% | +19.83% | +23.78% | +9.25% | +6.56% | +6.28% | 371 |

| Benchmark(10) | +0.59% | +3.92% | +18.66% | +18.66% | +15.75% | +2.71% | +5.02% | +4.49% | |

| Standard Deviation of Fund | +21.01% | +18.28% | +21.51% | +21.51% | +19.53% | +20.05% | +20.62% | +20.58% | |

| Standard Deviation of Benchmark | +19.43% | +18.27% | +20.47% | +20.47% | +18.82% | +20.03% | +20.53% | +20.50% | |

| Krungsri Global Brands Equity RMF (KFGBRANRMF) | -3.34% | -7.16% | -2.95% | -2.95% | +3.73% | +1.83% | N/A | +5.54% | 4,040 |

| Benchmark(10) | -4.69% | -7.96% | -6.26% | -6.26% | +5.49% | +6.35% | N/A | +8.72% | |

| Standard Deviation of Fund | +9.20% | +8.59% | +12.59% | +12.59% | +11.58% | +14.22% | N/A | +14.26% | |

| Standard Deviation of Benchmark | +11.22% | +11.19% | +15.59% | +15.59% | +13.63% | +14.92% | N/A | +14.73% | |

| Krungsri Global Smart Income RMF (KF-SINCOMERMF) | +1.28% | +2.84% | +6.20% | +6.20% | +3.66% | +0.56% | N/A | +1.84% | 1,462 |

| Benchmark(11) | +2.46% | +5.03% | +10.66% | +10.66% | +8.22% | +3.78% | N/A | +4.72% | |

| Standard Deviation of Fund | +2.40% | +2.87% | +3.88% | +3.88% | +4.27% | +4.44% | N/A | +4.18% | |

| Standard Deviation of Benchmark | +2.22% | +2.80% | +3.60% | +3.60% | +4.22% | +4.43% | N/A | +4.21% | |

| Krungsri Global Smart Income FX RMF (KF-SINCOME-FXRMF) | -0.55% | +1.28% | +1.32% | +1.32% | N/A | N/A | N/A | +2.00% | 119 |

| Benchmark(10) | -0.27% | +1.89% | +2.28% | +2.28% | N/A | N/A | N/A | +3.32% | |

| Standard Deviation of Fund | +6.21% | +6.45% | +8.10% | +8.10% | N/A | N/A | N/A | +8.00% | |

| Standard Deviation of Benchmark | +7.55% | +6.55% | +8.57% | +8.57% | N/A | N/A | N/A | +8.58% | |

| Krungsri Greater China Equity Hedged FX RMF (KF-GCHINARMF) | -2.94% | +7.38% | +10.97% | +10.97% | -0.07% | -5.44% | N/A | +0.59% | 1,120 |

| Benchmark(11) | -1.94% | +9.81% | +15.82% | +15.82% | +4.60% | -2.02% | N/A | +4.01% | |

| Standard Deviation of Fund | +15.53% | +14.36% | +19.44% | +19.44% | +19.50% | +21.38% | N/A | +20.70% | |

| Standard Deviation of Benchmark | +15.56% | +14.23% | +20.34% | +20.34% | +20.02% | +21.65% | N/A | +20.99% | |

| Krungsri Global Technology Equity RMF (KFGTECHRMF) | +1.16% | +12.33% | +20.62% | +20.62% | +31.16% | +0.83% | N/A | +7.50% | 3,983 |

| Benchmark(10) | -0.30% | +11.83% | +17.79% | +17.79% | +34.34% | +5.56% | N/A | +12.14% | |

| Standard Deviation of Fund | +26.58% | +23.32% | +28.54% | +28.54% | +25.47% | +34.52% | N/A | +30.54% | |

| Standard Deviation of Benchmark | +27.31% | +24.21% | +29.24% | +29.24% | +26.07% | +33.94% | N/A | +30.36% | |

| Krungsri Emerging Markets ex China Index RMF (KF-EMXCN-INDXRMF) | +5.75% | +12.18% | +21.47% | +21.47% | N/A | N/A | N/A | +17.08% | 60 |

| Benchmark(10) | +6.89% | +13.91% | +24.85% | +24.85% | N/A | N/A | N/A | +19.08% | |

| Standard Deviation of Fund | +14.86% | +12.63% | +16.24% | +16.24% | N/A | N/A | N/A | +16.05% | |

| Standard Deviation of Benchmark | +16.74% | +13.86% | +16.24% | +16.24% | N/A | N/A | N/A | +16.28% | |

| Krungsri India Equity RMF (KFINDIARMF) | -0.28% | -8.14% | -9.50% | -9.50% | +7.21% | +6.80% | N/A | +5.84% | 555 |

| Benchmark(10) | -1.80% | -9.09% | -12.40% | -12.40% | +8.89% | +11.11% | N/A | +9.06% | |

| Standard Deviation of Fund | +9.54% | +9.76% | +13.05% | +13.05% | +11.79% | +13.81% | N/A | +15.72% | |

| Standard Deviation of Benchmark | +12.02% | +12.01% | +15.83% | +15.83% | +14.21% | +15.16% | N/A | +17.06% | |

| Krungsri China A Shares Equity RMF (KF-ACHINARMF) | -2.53% | +8.23% | +9.97% | +9.97% | -1.79% | -10.74% | N/A | -10.74% | 1,021 |

| Benchmark(10) | -4.16% | +7.26% | +5.69% | +5.69% | -0.71% | -7.14% | N/A | -6.93% | |

| Standard Deviation of Fund | +10.86% | +11.21% | +12.06% | +12.06% | +15.31% | +19.38% | N/A | +19.36% | |

| Standard Deviation of Benchmark | +12.41% | +12.54% | +13.51% | +13.51% | +16.76% | +20.06% | N/A | +20.06% | |

| Krungsri US Equity Index FX RMF (KFUSINDFXRMF) | +0.25% | +7.47% | +7.51% | +7.51% | N/A | N/A | N/A | +10.97% | 311 |

| Benchmark(10) | +0.70% | +8.50% | +9.28% | +9.28% | N/A | N/A | N/A | +13.82% | |

| Standard Deviation of Fund | +12.87% | +11.13% | +19.48% | +19.48% | N/A | N/A | N/A | +18.23% | |

| Standard Deviation of Benchmark | +13.88% | +12.11% | +19.75% | +19.75% | N/A | N/A | N/A | +18.74% | |

| Krungsri NDQ Index RMF (KFNDQRMF) | +2.02% | +9.67% | +14.93% | +14.93% | N/A | N/A | N/A | +14.51% | 170 |

| Benchmark(10) | +0.59% | +9.22% | +11.66% | +11.66% | N/A | N/A | N/A | +11.78% | |

| Standard Deviation of Fund | +17.56% | +14.41% | +23.45% | +23.45% | N/A | N/A | N/A | +23.03% | |

| Standard Deviation of Benchmark | +18.85% | +15.70% | +23.81% | +23.81% | N/A | N/A | N/A | +23.55% | |

| Krungsri US Equity RMF (KFUSRMF) | -2.71% | -4.75% | -11.71% | -11.71% | +12.00% | N/A | N/A | -12.78% | 145 |

| Benchmark(10) | -4.05% | -5.54% | -14.50% | -14.50% | +14.62% | N/A | N/A | -9.75% | |

| Standard Deviation of Fund | +10.34% | +9.19% | +14.12% | +14.12% | +22.46% | N/A | N/A | +33.64% | |

| Standard Deviation of Benchmark | +11.81% | +11.17% | +15.58% | +15.58% | +23.26% | N/A | N/A | +33.46% | |

| Krungsri Next Generation Infrastructure RMF (KFINFRARMF) | -0.58% | -1.84% | +9.05% | +9.05% | +4.93% | N/A | N/A | -0.36% | 72 |

| Benchmark(11) | +0.70% | +0.48% | +14.42% | +14.42% | +10.10% | N/A | N/A | +4.32% | |

| Standard Deviation of Fund | +7.48% | +7.59% | +12.17% | +12.17% | +11.72% | N/A | N/A | +13.89% | |

| Standard Deviation of Benchmark | +7.64% | +7.78% | +12.49% | +12.49% | +12.03% | N/A | N/A | +14.22% | |

| Krungsri World Equity Index RMF (KF-WORLD-INDXRMF) | +2.32% | +8.61% | +16.18% | +16.18% | N/A | N/A | N/A | +12.73% | 416 |

| Benchmark(10) | +1.16% | +8.38% | +13.56% | +13.56% | N/A | N/A | N/A | +12.37% | |

| Standard Deviation of Fund | +12.09% | +10.37% | +16.98% | +16.98% | N/A | N/A | N/A | +16.16% | |

| Standard Deviation of Benchmark | +13.47% | +11.53% | +17.68% | +17.68% | N/A | N/A | N/A | +17.19% | |

| Krungsri Global Unconstrained Equity RMF (KFGLOBALRMF) | +0.98% | +2.43% | +7.73% | +7.73% | N/A | N/A | N/A | +5.06% | 15 |

| Benchmark(10) | -0.48% | +1.74% | +5.32% | +5.32% | N/A | N/A | N/A | +6.02% | |

| Standard Deviation of Fund | +16.97% | +14.47% | +21.06% | +21.06% | N/A | N/A | N/A | +20.24% | |

| Standard Deviation of Benchmark | +17.93% | +15.70% | +21.93% | +21.93% | N/A | N/A | N/A | +21.39% | |

| Krungsri Global Unconstrained Equity FX RMF (KFGLOBFXRMF) | -0.92% | +0.75% | +3.08% | +3.08% | N/A | N/A | N/A | +2.72% | 9 |

| Benchmark(10) | -0.48% | +1.74% | +5.32% | +5.32% | N/A | N/A | N/A | +6.02% | |

| Standard Deviation of Fund | +17.62% | +15.02% | +21.92% | +21.92% | N/A | N/A | N/A | +21.11% | |

| Standard Deviation of Benchmark | +17.93% | +15.70% | +21.93% | +21.93% | N/A | N/A | N/A | +21.39% | |

| Krungsri Global Growth RMF (KFGGRMF) | -6.84% | +1.27% | +9.84% | +9.84% | +19.59% | N/A | N/A | -3.57% | 1,498 |

| Benchmark(11) | -5.72% | +3.89% | +15.90% | +15.90% | +26.54% | N/A | N/A | +1.47% | |

| Standard Deviation of Fund | +18.78% | +16.86% | +23.21% | +23.21% | +21.36% | N/A | N/A | +28.92% | |

| Standard Deviation of Benchmark | +20.28% | +18.19% | +27.03% | +27.03% | +23.13% | N/A | N/A | +30.29% | |

| Krungsri China Megatrends RMF (KFCMEGARMF) | -9.98% | +3.61% | +16.17% | +16.17% | -1.77% | N/A | N/A | -3.54% | 205 |

| Benchmark(12) | -8.82% | +9.08% | +21.77% | +21.77% | +7.83% | N/A | N/A | +5.50% | |

| Standard Deviation of Fund | +19.77% | +19.52% | +27.01% | +27.01% | +29.55% | N/A | N/A | +30.49% | |

| Standard Deviation of Benchmark | +17.07% | +16.18% | +23.06% | +23.06% | +22.39% | N/A | N/A | +23.71% | |

| Krungsri Equity Sustainable Global Growth RMF (KFESGRMF) | -3.60% | -1.88% | +1.20% | +1.20% | +4.15% | N/A | N/A | +3.04% | 87 |

| Benchmark(11) | -2.37% | +0.47% | +6.56% | +6.56% | +9.63% | N/A | N/A | +8.49% | |

| Standard Deviation of Fund | +13.97% | +12.10% | +18.85% | +18.85% | +15.32% | N/A | N/A | +16.50% | |

| Standard Deviation of Benchmark | +13.98% | +12.24% | +18.78% | +18.78% | +15.57% | N/A | N/A | +16.97% | |

| Krungsri Vietnam Equity RMF (KFVIETRMF) | -0.83% | +16.45% | +11.47% | +11.47% | +6.50% | N/A | N/A | -0.47% | 478 |

| Benchmark(13) | +6.00% | +32.11% | +36.19% | +36.19% | +20.29% | N/A | N/A | +8.47% | |

| Standard Deviation of Fund | +20.60% | +19.32% | +19.99% | +19.99% | +16.68% | N/A | N/A | +17.43% | |

| Standard Deviation of Benchmark | +25.20% | +24.66% | +24.22% | +24.22% | +20.48% | N/A | N/A | +22.78% | |

| Krungsri ESG Climate Tech RMF (KFCLIMARMF) | -0.63% | +3.96% | +17.14% | +17.14% | +5.45% | N/A | N/A | -2.41% | 161 |

| Standard Deviation of Fund | +16.19% | +14.17% | +17.56% | +17.56% | +16.33% | N/A | N/A | +19.17% | |

Remark