Krungsri Cash Plus Fund (KFCASHPLUS)

Old Name: AYF Cash Plus Fund (AYFCASHPLS)

Information as of Jan 30, 2026

Fund Type

Money Market Fund

Dividend Policy

None

Objective

To create an opportunity to receive favorable returns in the form of capital gains from short-term investment.

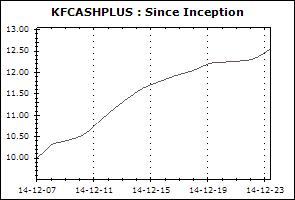

Inception Date

14 December 2007

Investment Policy

To invest in local and foreign short-term fixed income instrument, with time to matuirty of less than one year.

Fund Manager

Porntipa Nungnamjai, Theerapab Chirasakyakul

Asset Allocation

1.71%

Instruments issued by Sovereign or Supra-national organization

83.72%

Fixed Income Instruments issued by Bank of Thailand

13.74%

Deposits and Fixed Income Instruments issued by Financial Institutions

1.51%

Other Assets

-0.68%

Other Liabilities

Transaction Details

Minimum Purchase Amount (Baht): 500

Minimum Redemption Amount (Unit): 500 Baht or 50 units

Transaction Period: Every dealing date of the fund by 15.30 hrs.

Proceeds Payment Period: 1 business day after the execution (T+1)

Fund Redemption Period: Every dealing date of the fund by 15.30 hrs.

Transaction Channel: Krungsri Asset Management,Online Service,AGENT

Asset Allocation (30 Jan 2026)

| Instruments issued by Sovereign or Supra-national organization | 1.77% |

| Fixed Income Instruments issued by Bank of Thailand | 90.81% |

| Deposits and Fixed Income Instruments issued by Financial Institutions | 6.89% |

| Other Assets | 1.90% |

| Other Liabilities | -1.36% |

Top Five Issuers/Guarantors (30 Jan 2026)

| Bank of Thailand | 90.81% |

| Government Housing Bank | 3.43% |

| Tisco Financial Group Plc. | 2.96% |

| Government | 1.77% |

| United Overseas Bank (Thai) Plc. | 0.49% |

Top Five Securities

| Security Code | Issue / Issuer Rating | % of NAV |

|---|---|---|

| Bank of Thailand Bond 10/FRB363/2025 | - | 11.87% |

| Bank of Thailand Bond 52/86/2025 | - | 10.47% |

| Bank of Thailand Bond 8/FRB364/2025 | - | 10.42% |

| Bank of Thailand Bond 1/FRB182/2026 | - | 8.87% |

| Bank of Thailand Bond 7/FRB364/2025 | - | 6.33% |

Money Market Funds

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Cash Management Fund-A (KFCASH-A) | +0.21% | +0.47% | +0.07% | +1.19% | +1.50% | +1.00% | +0.92% | +1.55% | 23,597 |

| Benchmark(4) | +0.23% | +0.50% | +0.07% | +1.17% | +1.39% | +1.00% | +1.02% | +1.62% | |

| Standard Deviation of Fund | +0.03% | +0.04% | +0.04% | +0.05% | +0.07% | +0.07% | +0.05% | +0.10% | |

| Standard Deviation of Benchmark | +0.03% | +0.02% | +0.03% | +0.02% | +0.02% | +0.02% | +0.02% | +0.07% | |

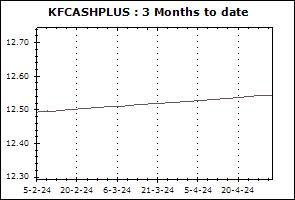

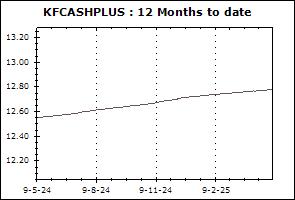

| Krungsri Cash Plus Fund (KFCASHPLUS) | +0.25% | +0.56% | +0.05% | +1.29% | +1.57% | +1.05% | +0.96% | +1.41% | 3,384 |

| Benchmark(5) | +0.24% | +0.51% | +0.07% | +1.21% | +1.38% | +0.99% | +1.05% | +1.42% | |

| Standard Deviation of Fund | +0.08% | +0.09% | +0.10% | +0.11% | +0.12% | +0.10% | +0.08% | +0.09% | |

| Standard Deviation of Benchmark | +0.03% | +0.02% | +0.03% | +0.02% | +0.02% | +0.03% | +0.03% | +0.05% | |

Remark