Krungsri Cash Management Fund-A (KFCASH-A)

Old Name: AYF Cash Management Fund (AYFCASH)

Information as of Jan 30, 2026

Fund Type

Money Market Fund

Dividend Policy

None

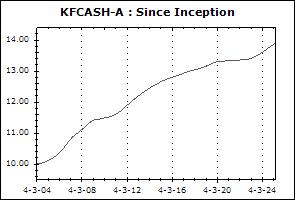

Inception Date

4 March 2004

Investment Policy

1. Minimum 70% of fund assets are invested in debt instruments of government sector.

2. The remaining is invested in debt instruments of private sector, financial institutions or bank deposits.

- The above instruments are assigned the top two ratings for short-term credit rating or equivalent long-term credit rating or the top three ratings for long-term credit rating except for government instruments with duration not exceeding 397 days since the fund incepted.

- The fund’s portfolio duration at any point in time is not over 92 days.

Fund Manager

Theerapab Chirasakyakul, Porntipa Nungnamjai

Asset Allocation

98.83%

Fixed Income Instruments issued by Bank of Thailand

0.87%

Deposits and Fixed Income Instruments issued by Financial Institutions

0.52%

Other Assets

-0.22%

Other Liabilities

Transaction Details

Minimum Purchase Amount (Baht): 500

Minimum Redemption Amount (Unit): 500 Baht or 50 Units

Transaction Period: Every dealing date of the fund by 15.30 hrs

Proceeds Payment Period: 1 business day after the execution (T+1)

Fund Redemption Period: Every dealing date of the fund by 15.30 hrs

Transaction Channel: Krungsri Asset Management,Online Service,AGENT

Asset Allocation (30 Jan 2026)

| Fixed Income Instruments issued by Bank of Thailand | 98.83% |

| Deposits and Fixed Income Instruments issued by Financial Institutions | 0.87% |

| Other Assets | 0.52% |

| Other Liabilities | -0.22% |

Top Five Issuers/Guarantors (30 Jan 2026)

| Bank of Thailand | 98.83% |

| United Overseas Bank (Thai) Plc. | 0.87% |

Top Five Securities

| Security Code | Issue / Issuer Rating | % of NAV |

|---|---|---|

| Bank of Thailand Bond 47/91/2025 | - | 10.85% |

| Bank of Thailand Bond 46/91/2025 | - | 10.33% |

| Bank of Thailand Bond 51/91/2025 | - | 10.32% |

| Bank of Thailand Bond 2/91/2026 | - | 8.54% |

| Bank of Thailand Bond 45/91/2025 | - | 8.27% |

Money Market Funds

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

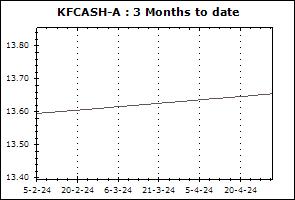

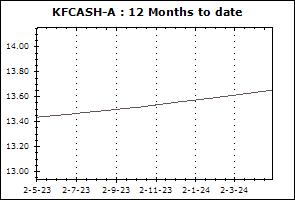

| Krungsri Cash Management Fund-A (KFCASH-A) | +0.21% | +0.47% | +0.07% | +1.19% | +1.50% | +1.00% | +0.92% | +1.55% | 23,597 |

| Benchmark(4) | +0.23% | +0.50% | +0.07% | +1.17% | +1.39% | +1.00% | +1.02% | +1.62% | |

| Standard Deviation of Fund | +0.03% | +0.04% | +0.04% | +0.05% | +0.07% | +0.07% | +0.05% | +0.10% | |

| Standard Deviation of Benchmark | +0.03% | +0.02% | +0.03% | +0.02% | +0.02% | +0.02% | +0.02% | +0.07% | |

| Krungsri Cash Plus Fund (KFCASHPLUS) | +0.25% | +0.56% | +0.05% | +1.29% | +1.57% | +1.05% | +0.96% | +1.41% | 3,384 |

| Benchmark(5) | +0.24% | +0.51% | +0.07% | +1.21% | +1.38% | +0.99% | +1.05% | +1.42% | |

| Standard Deviation of Fund | +0.08% | +0.09% | +0.10% | +0.11% | +0.12% | +0.10% | +0.08% | +0.09% | |

| Standard Deviation of Benchmark | +0.03% | +0.02% | +0.03% | +0.02% | +0.02% | +0.03% | +0.03% | +0.05% | |

Remark