Fund Type

Fixed Income Fund

Dividend Policy

None

Inception Date

21 October 2016

Investment Policy

Invest both onshore and offshore in debt instruments and/or deposits or deposits equivalent issued by the government, a state enterprise, a financial institution, and/or private entity

Fund Manager

Theerapab Chirasakyakul, Porntipa Nungnamjai

Asset Allocation

14.45%

Instruments issued by Sovereign or Supra-national organization

15.06%

Fixed Income Instruments issued by Bank of Thailand

21.57%

Deposits and Fixed Income Instruments issued by Financial Institutions

45.89%

Fixed Income Instruments Issued by Corporates

0.37%

Other Assets

-0.59%

Other Liabilities

3.25%

Foreign CIS - Fixed income

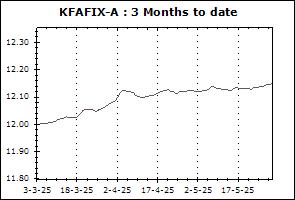

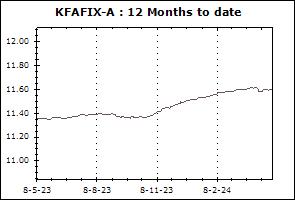

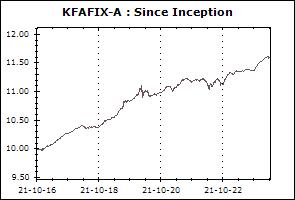

Return Chart

NAV Movement

- 3 Months

- 12 Months

- Since inception

Transaction Details

Minimum Purchase Amount (Baht): 500

Minimum Redemption Amount (Unit): 500 Baht or 50 units

Proceeds Payment Period: 2 business days after the execution (T+2)

Fund Subscription Period: Every dealing date of the fund by 15.30 hrs.

Fund Redemption Period: Every dealing date of the fund by 15.30 hrs.

Transaction Channel: Krungsri Asset Management,Online Service,AGENT

Asset Allocation (27 Feb 2026)

| Instruments issued by Sovereign or Supra-national organization | 11.72% |

| Fixed Income Instruments issued by Bank of Thailand | 15.91% |

| Deposits and Fixed Income Instruments issued by Financial Institutions | 24.11% |

| Fixed Income Instruments Issued by Corporates | 46.55% |

| Foreign CIS - Fixed income | 3.34% |

| Other Assets | 3.34% |

| Other Liabilities | -4.96% |

Top Five Issuers/Guarantors (27 Feb 2026)

| Bank of Thailand | 15.91% |

| Government | 11.72% |

| Doha Bank | 8.11% |

| Gulf Development Plc. | 5.30% |

| Commercial Bank | 4.37% |

Top Five Securities

| Security Code | Issue / Issuer Rating | % of NAV |

|---|---|---|

| Fixed Deposit Doha Bank | A | 6.18% |

| BONDS OF GULF DEVELOPMENT PUBLIC COMPANY LIMITED NO. 1/2568 SERIES 2 | AA- | 4.48% |

| Sustainability-Linked Bond FY. B.E. 2568 | - | 4.02% |

| Savings Deposit-United Overseas Bank (Thai) Plc. | AAA | 3.53% |

| Bank of Thailand Bond 6/FRB364/2025 | - | 3.29% |

Fixed Income Funds

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Medium Term Fixed Income Fund (KFMTFI) | +0.10% | -0.13% | -0.43% | +2.69% | +2.49% | +1.82% | +1.79% | +2.52% | 1,980 |

| Benchmark(4) | +0.29% | +0.50% | -0.04% | +1.87% | +1.62% | +1.01% | +2.05% | +3.01% | |

| Standard Deviation of Fund | +0.70% | +1.04% | +0.86% | +0.92% | +0.68% | +0.71% | +0.65% | +0.67% | |

| Standard Deviation of Benchmark | +0.23% | +0.25% | +0.24% | +0.24% | +0.21% | +0.25% | +0.78% | +1.15% | |

| Krungsri Medium Term Fixed Income Dividend Fund (KFMTFI-D) | -0.02% | -0.12% | -0.54% | +2.65% | +2.49% | +1.73% | +1.75% | +2.90% | 773 |

| Benchmark(4) | +0.29% | +0.50% | -0.04% | +1.87% | +1.62% | +1.01% | +2.05% | +3.51% | |

| Standard Deviation of Fund | +0.75% | +1.02% | +0.82% | +0.91% | +0.68% | +0.69% | +0.67% | +0.93% | |

| Standard Deviation of Benchmark | +0.23% | +0.25% | +0.24% | +0.24% | +0.21% | +0.25% | +0.84% | +1.28% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Star Plus Fund-A (KFSPLUS-A) | +0.25% | +0.56% | +0.08% | +1.37% | +1.71% | +1.20% | +1.25% | +2.95% | 62,956 |

| Benchmark(5) | +0.23% | +0.49% | +0.05% | +1.19% | +1.38% | +0.99% | +1.05% | +2.18% | |

| Standard Deviation of Fund | +0.04% | +0.04% | +0.05% | +0.06% | +0.07% | +0.07% | +0.06% | +0.84% | |

| Standard Deviation of Benchmark | +0.03% | +0.03% | +0.04% | +0.02% | +0.02% | +0.03% | +0.03% | +0.10% | |

| Krungsri Star Plus Fund-I (KFSPLUS-I) | +0.25% | +0.56% | +0.08% | +1.37% | +1.71% | N/A | N/A | +1.67% | 0 |

| Benchmark(5) | +0.23% | +0.49% | +0.05% | +1.19% | +1.38% | N/A | N/A | +1.33% | |

| Standard Deviation of Fund | +0.04% | +0.04% | +0.05% | +0.06% | +0.07% | N/A | N/A | +0.07% | |

| Standard Deviation of Benchmark | +0.03% | +0.03% | +0.04% | +0.02% | +0.02% | N/A | N/A | +0.03% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Smart Fixed Income Fund-A (KFSMART-A) | +0.34% | +0.74% | +0.08% | +1.83% | +2.08% | +1.53% | N/A | +1.52% | 122,160 |

| Benchmark(6) | +0.32% | +0.70% | +0.09% | +1.67% | +1.94% | +1.43% | N/A | +1.42% | |

| Standard Deviation of Fund | +0.14% | +0.14% | +0.15% | +0.12% | +0.12% | +0.15% | N/A | +0.14% | |

| Standard Deviation of Benchmark | +0.06% | +0.07% | +0.07% | +0.08% | +0.09% | +0.08% | N/A | +0.08% | |

| Krungsri Smart Fixed Income Fund-I (KFSMART-I) | +0.34% | +0.74% | +0.07% | +1.83% | +2.08% | N/A | N/A | +2.03% | 151 |

| Benchmark(6) | +0.32% | +0.70% | +0.09% | +1.67% | +1.94% | N/A | N/A | +1.90% | |

| Standard Deviation of Fund | +0.14% | +0.14% | +0.15% | +0.12% | +0.12% | N/A | N/A | +0.13% | |

| Standard Deviation of Benchmark | +0.06% | +0.07% | +0.07% | +0.08% | +0.09% | N/A | N/A | +0.09% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Active Fixed Income Fund-A (KFAFIX-A) | -0.01% | -0.17% | -0.50% | +2.79% | +2.77% | +2.03% | N/A | +2.23% | 52,283 |

| Benchmark(7) | +0.32% | +0.40% | -0.35% | +3.24% | +2.61% | +1.62% | N/A | +2.06% | |

| Standard Deviation of Fund | +0.77% | +1.01% | +0.87% | +0.92% | +0.69% | +0.81% | N/A | +0.86% | |

| Standard Deviation of Benchmark | +0.76% | +0.85% | +0.84% | +0.80% | +0.73% | +0.95% | N/A | +0.91% | |

| Krungsri Active Fixed Income Fund-C (KFAFIX-C) | +0.03% | -0.09% | -0.49% | +2.95% | +2.93% | N/A | N/A | +2.20% | 199 |

| Benchmark(7) | +0.32% | +0.40% | -0.35% | +3.24% | +2.61% | N/A | N/A | +1.74% | |

| Standard Deviation of Fund | +0.76% | +1.01% | +0.87% | +0.92% | +0.69% | N/A | N/A | +0.79% | |

| Standard Deviation of Benchmark | +0.76% | +0.85% | +0.84% | +0.80% | +0.73% | N/A | N/A | +0.95% | |

| Krungsri Active Fixed Income Fund-I (KFAFIX-I) | -0.01% | -0.17% | -0.50% | +2.79% | +2.77% | N/A | N/A | +2.83% | 150 |

| Benchmark(7) | +0.32% | +0.40% | -0.35% | +3.24% | +2.61% | N/A | N/A | +2.72% | |

| Standard Deviation of Fund | +0.77% | +1.01% | +0.87% | +0.92% | +0.69% | N/A | N/A | +0.69% | |

| Standard Deviation of Benchmark | +0.76% | +0.85% | +0.84% | +0.80% | +0.73% | N/A | N/A | +0.74% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Enhanced Active Fixed Income Fund (KFENFIX) | -0.43% | -0.87% | -1.17% | +3.39% | +2.96% | +1.97% | N/A | +2.01% | 6,748 |

| Benchmark(8) | +0.28% | +0.24% | -0.53% | +3.68% | +2.78% | +1.55% | N/A | +1.82% | |

| Standard Deviation of Fund | +1.62% | +2.13% | +1.79% | +1.86% | +1.37% | +1.45% | N/A | +1.63% | |

| Standard Deviation of Benchmark | +0.90% | +0.95% | +1.05% | +0.88% | +0.80% | +1.05% | N/A | +1.26% | |

Remark