Krungsri Star Plus Fund-I (KFSPLUS-I)

Old Name: AYF Star Plus Fund (AYFSPLUS)

Information as of Jan 30, 2026

Fund Type

Fixed Income Fund

Dividend Policy

None

Objective

To seek current income and consistent capital appreciation.

Inception Date

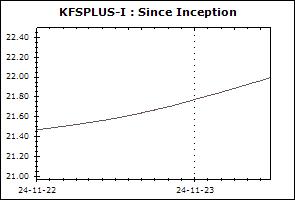

24 November 2022

Investment Policy

To invest in high quality fixed income securities.

Fund Manager

Theerapab Chirasakyakul, Porntipa Nungnamjai

Asset Allocation

74.41%

Fixed Income Instruments issued by Bank of Thailand

21.55%

Deposits and Fixed Income Instruments issued by Financial Institutions

3.16%

Fixed Income Instruments Issued by Corporates

1.95%

Other Assets

-1.07%

Other Liabilities

Transaction Details

Minimum Purchase Amount (Baht): None

Minimum Redemption Amount (Unit): None

Proceeds Payment Period: 1 business days after the execution (T+1)

Fund Subscription Period: Every dealing date of the fund by 15.30 hrs.

Fund Redemption Period: Every dealing date of the fund by 15.30 hrs.

Transaction Channel: Krungsri Asset Management,Online Service,ATM,AGENT

Asset Allocation (30 Jan 2026)

| Fixed Income Instruments issued by Bank of Thailand | 74.54% |

| Deposits and Fixed Income Instruments issued by Financial Institutions | 21.42% |

| Fixed Income Instruments Issued by Corporates | 3.65% |

| Other Assets | 0.70% |

| Other Liabilities | -0.31% |

Top Five Issuers/Guarantors (30 Jan 2026)

| Bank of Thailand | 74.54% |

| Doha Bank | 8.45% |

| The Saudi National Bank, Singapore Branch | 4.97% |

| Government Housing Bank | 4.30% |

| Home Product Center Plc. | 3.17% |

Top Five Securities

| Security Code | Issue / Issuer Rating | % of NAV |

|---|---|---|

| Bank of Thailand Bond 46/91/2025 | - | 11.11% |

| Bank of Thailand Bond 47/91/2025 | - | 9.41% |

| Bank of Thailand Bond 49/91/2025 | - | 8.73% |

| Bank of Thailand Bond 45/91/2025 | - | 8.70% |

| Bank of Thailand Bond 44/91/2025 | - | 8.03% |

Fixed Income Funds

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Medium Term Fixed Income Fund (KFMTFI) | +0.10% | -0.13% | -0.43% | +2.69% | +2.49% | +1.82% | +1.79% | +2.52% | 1,980 |

| Benchmark(4) | +0.29% | +0.50% | -0.04% | +1.87% | +1.62% | +1.01% | +2.05% | +3.01% | |

| Standard Deviation of Fund | +0.70% | +1.04% | +0.86% | +0.92% | +0.68% | +0.71% | +0.65% | +0.67% | |

| Standard Deviation of Benchmark | +0.23% | +0.25% | +0.24% | +0.24% | +0.21% | +0.25% | +0.78% | +1.15% | |

| Krungsri Medium Term Fixed Income Dividend Fund (KFMTFI-D) | -0.02% | -0.12% | -0.54% | +2.65% | +2.49% | +1.73% | +1.75% | +2.90% | 773 |

| Benchmark(4) | +0.29% | +0.50% | -0.04% | +1.87% | +1.62% | +1.01% | +2.05% | +3.51% | |

| Standard Deviation of Fund | +0.75% | +1.02% | +0.82% | +0.91% | +0.68% | +0.69% | +0.67% | +0.93% | |

| Standard Deviation of Benchmark | +0.23% | +0.25% | +0.24% | +0.24% | +0.21% | +0.25% | +0.84% | +1.28% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Star Plus Fund-A (KFSPLUS-A) | +0.25% | +0.56% | +0.08% | +1.37% | +1.71% | +1.20% | +1.25% | +2.95% | 62,956 |

| Benchmark(5) | +0.23% | +0.49% | +0.05% | +1.19% | +1.38% | +0.99% | +1.05% | +2.18% | |

| Standard Deviation of Fund | +0.04% | +0.04% | +0.05% | +0.06% | +0.07% | +0.07% | +0.06% | +0.84% | |

| Standard Deviation of Benchmark | +0.03% | +0.03% | +0.04% | +0.02% | +0.02% | +0.03% | +0.03% | +0.10% | |

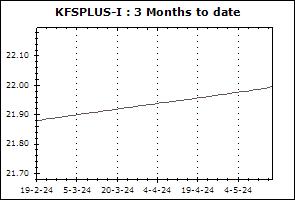

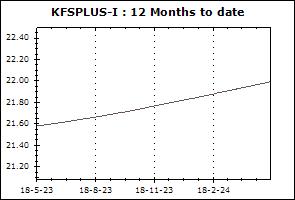

| Krungsri Star Plus Fund-I (KFSPLUS-I) | +0.25% | +0.56% | +0.08% | +1.37% | +1.71% | N/A | N/A | +1.67% | 0 |

| Benchmark(5) | +0.23% | +0.49% | +0.05% | +1.19% | +1.38% | N/A | N/A | +1.33% | |

| Standard Deviation of Fund | +0.04% | +0.04% | +0.05% | +0.06% | +0.07% | N/A | N/A | +0.07% | |

| Standard Deviation of Benchmark | +0.03% | +0.03% | +0.04% | +0.02% | +0.02% | N/A | N/A | +0.03% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Smart Fixed Income Fund-A (KFSMART-A) | +0.34% | +0.74% | +0.08% | +1.83% | +2.08% | +1.53% | N/A | +1.52% | 122,160 |

| Benchmark(6) | +0.32% | +0.70% | +0.09% | +1.67% | +1.94% | +1.43% | N/A | +1.42% | |

| Standard Deviation of Fund | +0.14% | +0.14% | +0.15% | +0.12% | +0.12% | +0.15% | N/A | +0.14% | |

| Standard Deviation of Benchmark | +0.06% | +0.07% | +0.07% | +0.08% | +0.09% | +0.08% | N/A | +0.08% | |

| Krungsri Smart Fixed Income Fund-I (KFSMART-I) | +0.34% | +0.74% | +0.07% | +1.83% | +2.08% | N/A | N/A | +2.03% | 151 |

| Benchmark(6) | +0.32% | +0.70% | +0.09% | +1.67% | +1.94% | N/A | N/A | +1.90% | |

| Standard Deviation of Fund | +0.14% | +0.14% | +0.15% | +0.12% | +0.12% | N/A | N/A | +0.13% | |

| Standard Deviation of Benchmark | +0.06% | +0.07% | +0.07% | +0.08% | +0.09% | N/A | N/A | +0.09% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Active Fixed Income Fund-A (KFAFIX-A) | -0.01% | -0.17% | -0.50% | +2.79% | +2.77% | +2.03% | N/A | +2.23% | 52,283 |

| Benchmark(7) | +0.32% | +0.40% | -0.35% | +3.24% | +2.61% | +1.62% | N/A | +2.06% | |

| Standard Deviation of Fund | +0.77% | +1.01% | +0.87% | +0.92% | +0.69% | +0.81% | N/A | +0.86% | |

| Standard Deviation of Benchmark | +0.76% | +0.85% | +0.84% | +0.80% | +0.73% | +0.95% | N/A | +0.91% | |

| Krungsri Active Fixed Income Fund-C (KFAFIX-C) | +0.03% | -0.09% | -0.49% | +2.95% | +2.93% | N/A | N/A | +2.20% | 199 |

| Benchmark(7) | +0.32% | +0.40% | -0.35% | +3.24% | +2.61% | N/A | N/A | +1.74% | |

| Standard Deviation of Fund | +0.76% | +1.01% | +0.87% | +0.92% | +0.69% | N/A | N/A | +0.79% | |

| Standard Deviation of Benchmark | +0.76% | +0.85% | +0.84% | +0.80% | +0.73% | N/A | N/A | +0.95% | |

| Krungsri Active Fixed Income Fund-I (KFAFIX-I) | -0.01% | -0.17% | -0.50% | +2.79% | +2.77% | N/A | N/A | +2.83% | 150 |

| Benchmark(7) | +0.32% | +0.40% | -0.35% | +3.24% | +2.61% | N/A | N/A | +2.72% | |

| Standard Deviation of Fund | +0.77% | +1.01% | +0.87% | +0.92% | +0.69% | N/A | N/A | +0.69% | |

| Standard Deviation of Benchmark | +0.76% | +0.85% | +0.84% | +0.80% | +0.73% | N/A | N/A | +0.74% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Enhanced Active Fixed Income Fund (KFENFIX) | -0.43% | -0.87% | -1.17% | +3.39% | +2.96% | +1.97% | N/A | +2.01% | 6,748 |

| Benchmark(8) | +0.28% | +0.24% | -0.53% | +3.68% | +2.78% | +1.55% | N/A | +1.82% | |

| Standard Deviation of Fund | +1.62% | +2.13% | +1.79% | +1.86% | +1.37% | +1.45% | N/A | +1.63% | |

| Standard Deviation of Benchmark | +0.90% | +0.95% | +1.05% | +0.88% | +0.80% | +1.05% | N/A | +1.26% | |

Remark