News/Announcement

Promotions/Fund Highlight

Enjoy Extra Tax Deductions with Thai ESGX

Open for subscription/switching until 30 Jun 2025 only.

Maximize your tax deductions with 3 Thai ESGX Funds, accepting both new investments and LTF fund switching.

Why should invest in Thai ESGX?

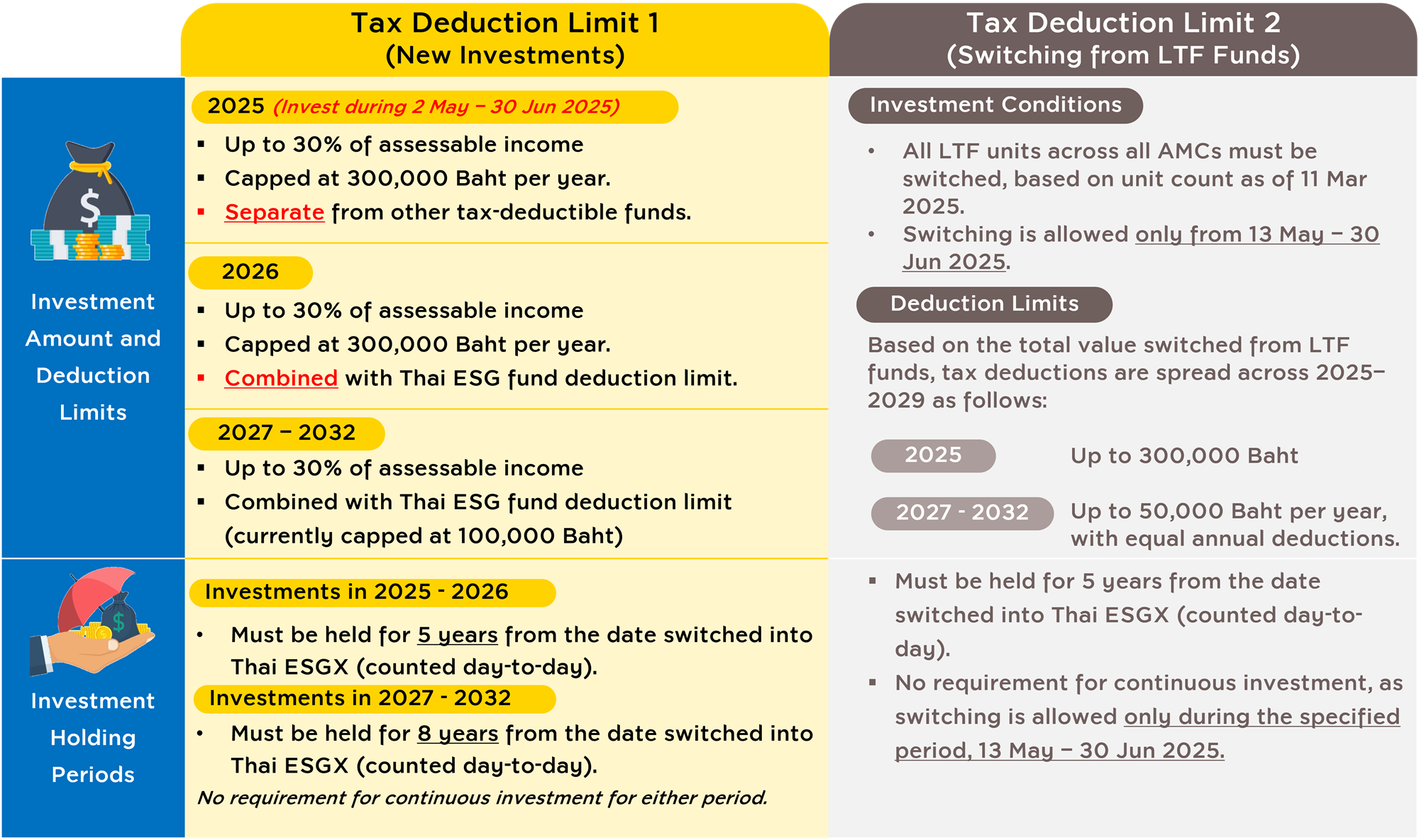

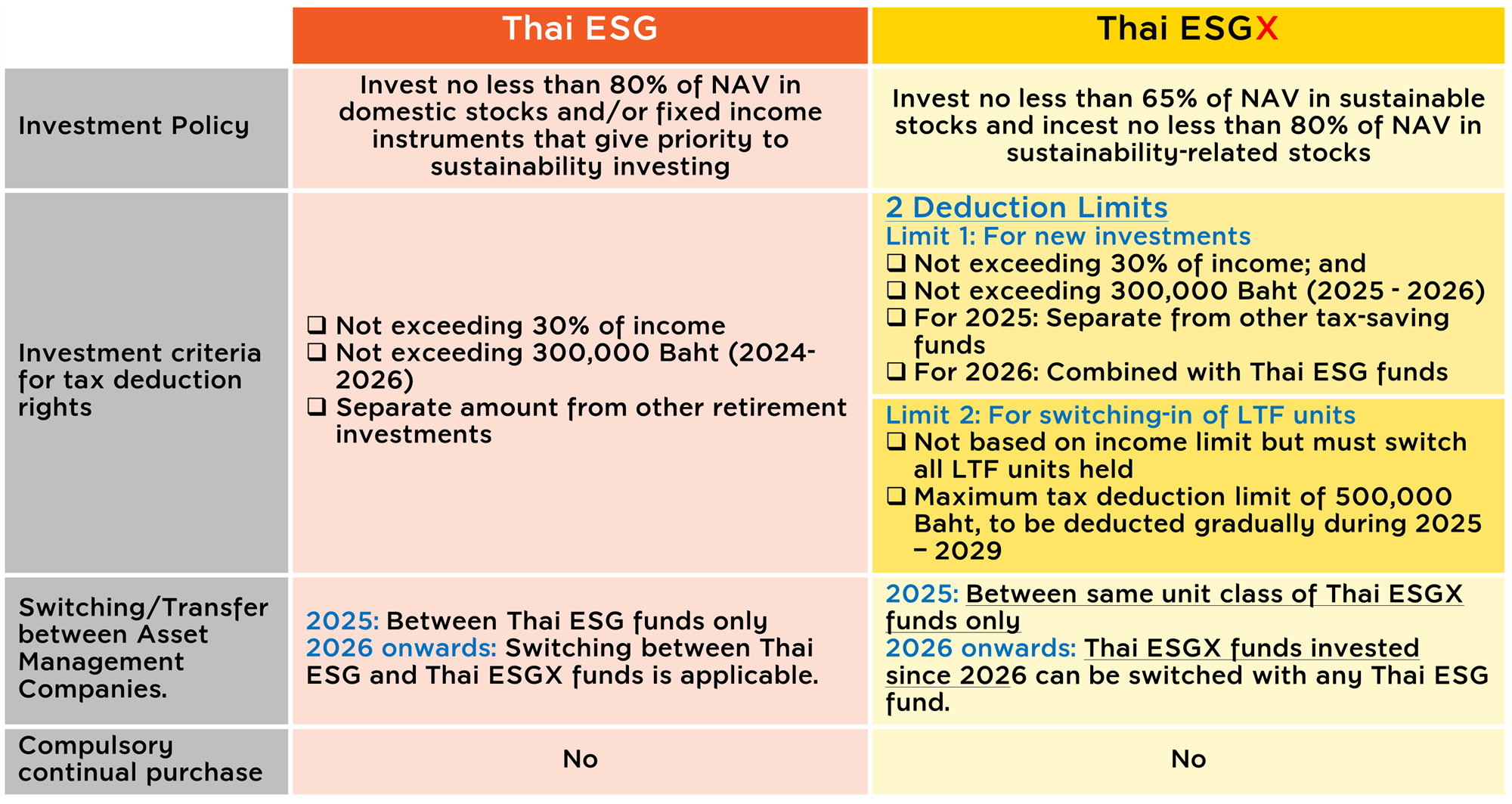

- Additional tax deduction opportunity: Two extra limits of tax deduction beyond RMF and Thai ESG tax-saving funds.

- Limit 1: Invest up to 30% of annual income, capped at 300,000 Baht per year.

- Limit 2: Switch LTF for a deduction up to 500,000 Baht (300,000 for 2025; 50,000 Baht per year on average for 2026 - 2029).

- Thai stock market recovery potential: Currently at its lowest valuation in years(1), while the PE ratio at its 10-year low(2), offering attractive investment timing. (Sources: (1)Krungsri Asset Management as of 1 Apr 2025; (2)Bloomberg as of 18 Apr 2025)

- Policy interest rate cuts could benefit fixed-income investments, helping Thai ESGX, which has a significant allocation in fixed income, achieve better returns while reducing portfolio volatility.

- Foreign equity exposure within Thai ESGX broadens return potential through diversification.

Introducing 3 Thai ESGX Funds by Krungsri Asset Management

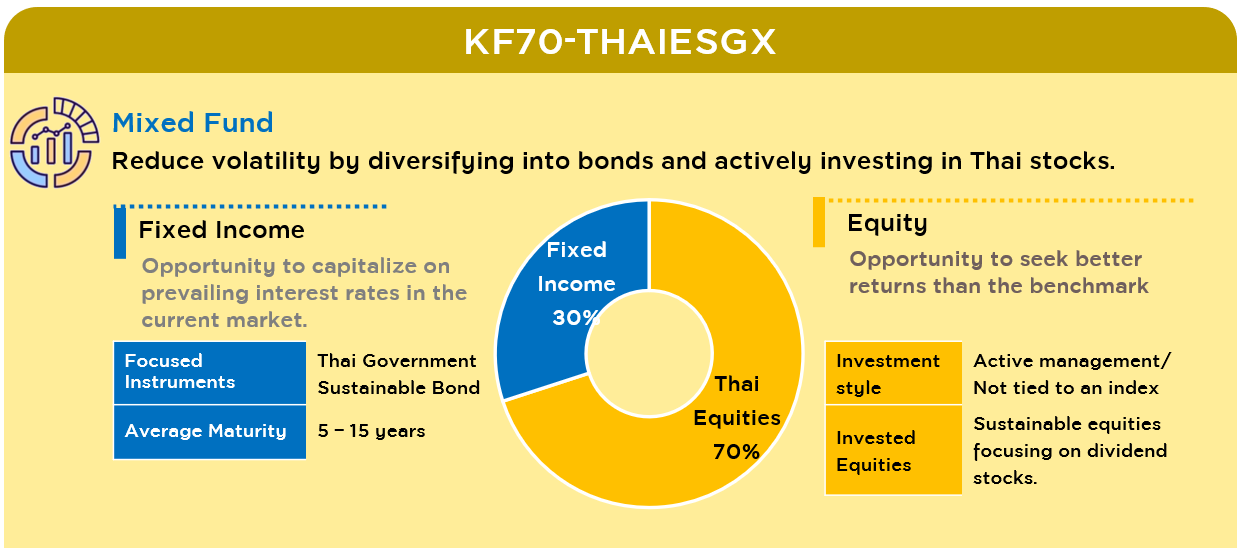

The 1st Fund: KF70-THAIESGX (Krungsri 70/30 Thailand ESG Extra Fund)

Two fund types available:

- KF70-THAIESGX-68 : For new investment / 2025 tax deduction

- KF70-THAIESGX-L : For a transfer of LTF units from KFLTFD70, KFLTFD70-D, and KFLTFEQ70D only.

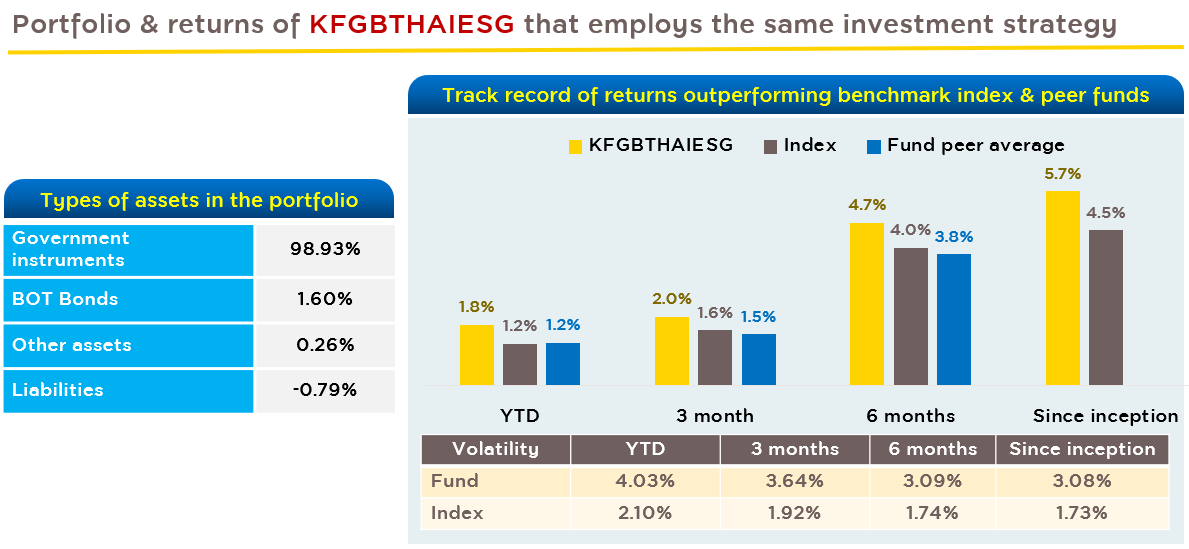

Source: Krungsri Asset Management as of Apr 2025. | Investment strategy framework shown above may differ from the actual investment portfolio and be adjusted upon fund manager’s discretion.

Source: Krungsri Asset Management as of Apr 2025. | Investment strategy framework shown above may differ from the actual investment portfolio and be adjusted upon fund manager’s discretion.Investment Strategy of the Funds

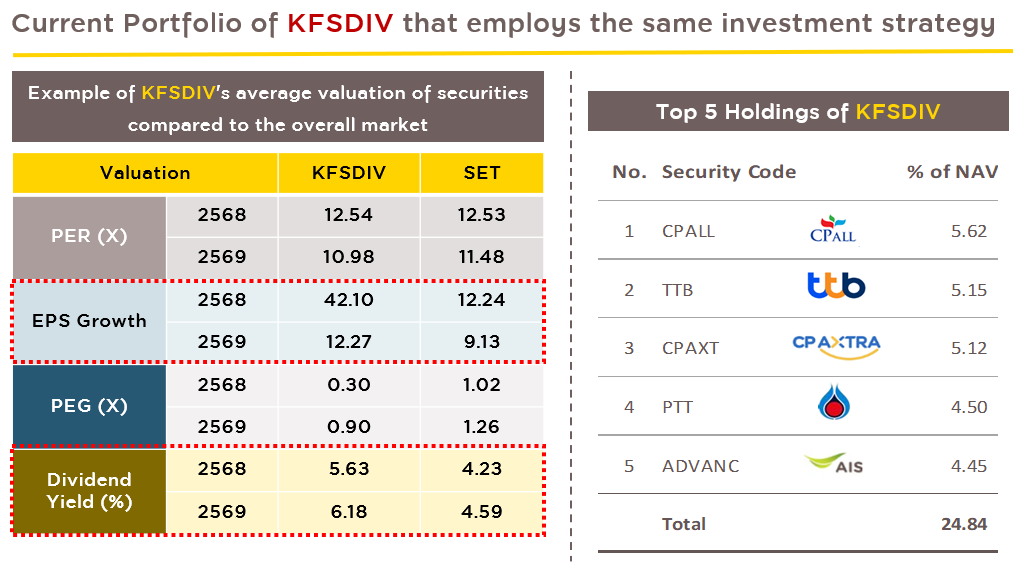

- Equity: Focus on high-potential dividend stocks aligned with sustainability criteria, emphasizing fundamental stock analysis and sustainability.

Source: Krungsri Asset Management as of 31 Mar 2025. | Above information is for illustration purpose only.

- Fixed Income: Invest in high-quality bonds to diversify risks.

Source: Krungsri Asset Management as of 28 Feb 2025. | Performance shown above is in accordance with the measurement standards of AIMC.

The 2nd Fund: KFS50-THAIESGX (Krungsri SET50 Thailand ESG Extra Fund)

Two fund types available:

- KFS50-THAIESGX-68 : For new investment / 2025 tax deduction.

- KFS50-THAIESGX-L : For a transfer of LTF units from KFLTF50 and KFLTF50-A only.

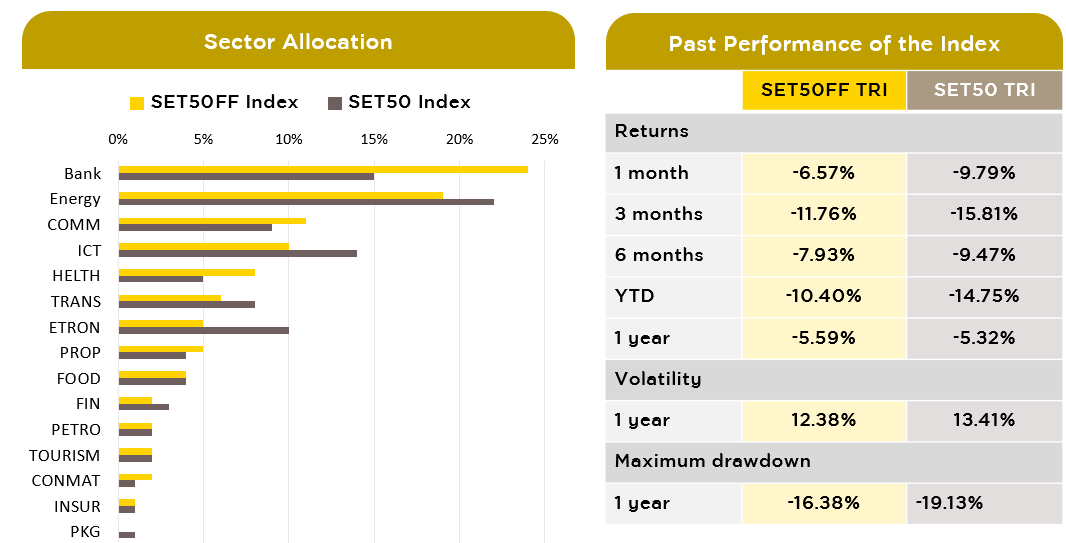

Source: Krungsri Asset Management as of Apr 2025 | Investment strategy framework shown above may differ from the actual investment portfolio and be adjusted upon fund manager’s discretion.

SET50FF Index's composition and performance

Source: SET50 Index Highlight Monthly Report as of Feb 2025.

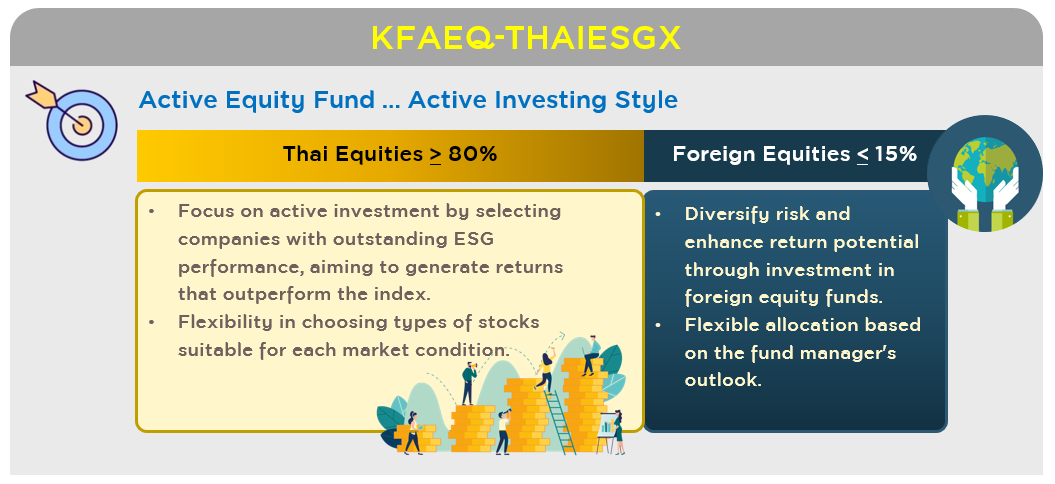

Source: SET50 Index Highlight Monthly Report as of Feb 2025.The 3rd Fund: KFAEQ-THAIESGX (Krungsri Active Equity Thailand ESG Extra Fund)

Two fund types available:

- KFAEQ-THAIESGX-68 : For new investment / 2025 tax deduction

- KFAEQ-THAIESGX-L : For a transfer of LTF units from all Krungsri Asset LTF funds, except KFLTF50 and KFLTF50-A.

Source: Krungsri Asset Management as of Apr 2025 | Investment strategy framework shown above may differ from the actual investment portfolio and be adjusted upon fund manager’s discretion.

Thai Equity Investment Strategy

Source: Krungsri Asset Management as of Apr 2025. | Investment strategy framework shown above may differ from the actual investment portfolio and be adjusted upon fund manager’s discretion.

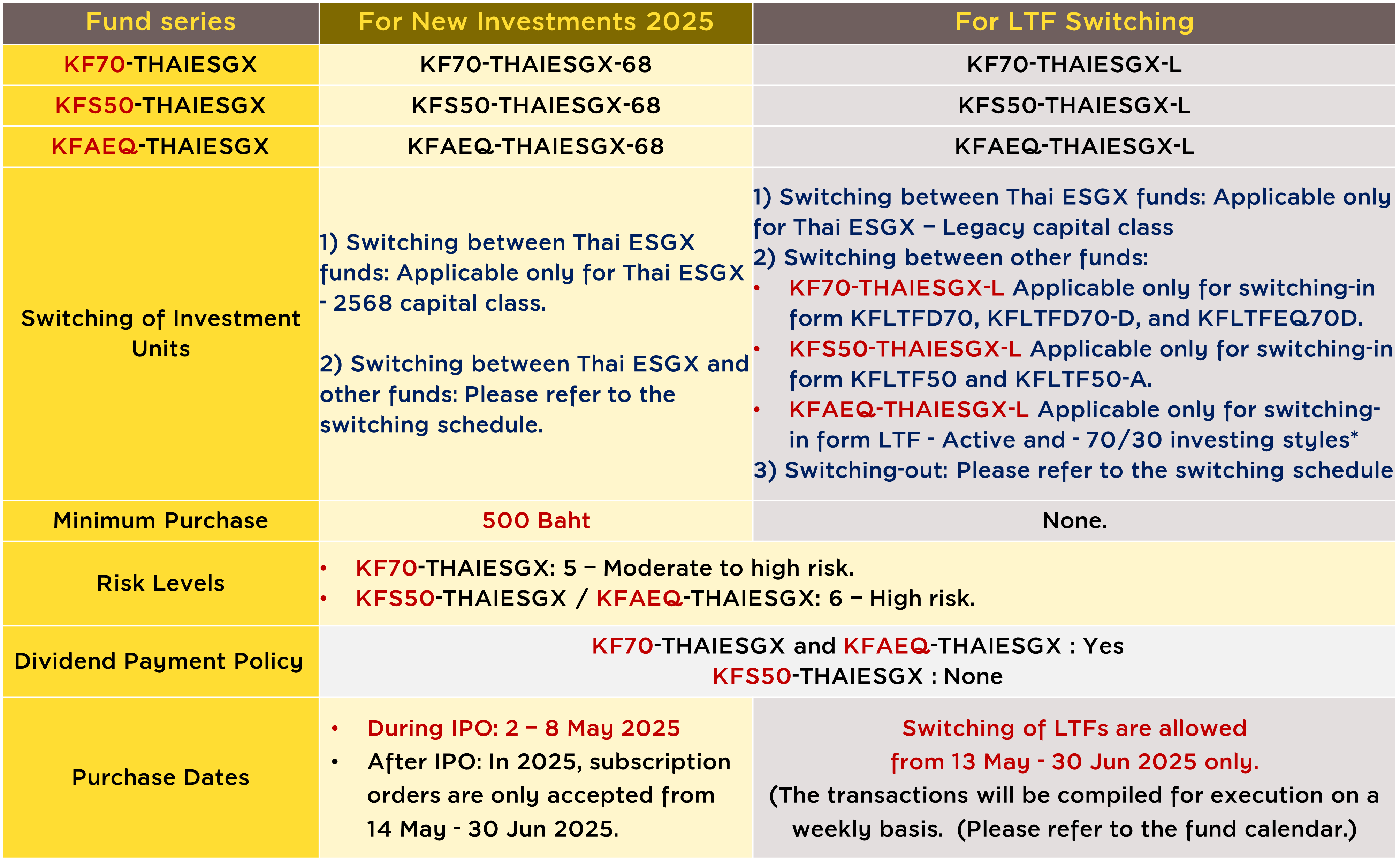

Source: Krungsri Asset Management as of Apr 2025. | Investment strategy framework shown above may differ from the actual investment portfolio and be adjusted upon fund manager’s discretion.Investment Terms & Conditions: Krungsri Asset's Thai ESGX

Source: Krungsri Asset Management as of Apr 2025. | *KFAEQ-THAIESGX-L accepts the transfer of these LTF funds only: KFLTFDIV, KFLTFEQ, KFLTFA50-D, KFLTFAST-D, KFLTFTSM-D, KFLTFSTARD, KFLTFDNM-D, KFLTFDIV-D, KFLTFEQ-A, KFLTFD70, KFLTFEQ70D, and KFLTFD70-D.

Easily check all your LTF unit holdings through the FundConnext system—free of charge.

For more details, click here (Thai only)

Krungsri Asset's Thai ESGX funds promotions & entitlement terms & conditions

categorized by deduction limit tiers as follows:

- Promotion for Thai ESGX - new investments (during 2 May – 30 Jun 2025) includes the investment amount in KF70-THAIESGX-68/ KFAEQ-THAIESGX-68/ KFS50-THAIESGX-68. Eligible investors* will receive KFCASH-A units worth 100 Baht for every 50,000 Baht invested (combined with eligible RMF and Thai ESG investments).

- Promotion for Thai ESGX - LTF funds switching (during 13 May - 30 Jun 2025) includes the investment amount in KF70-THAIESGX-L/ KFAEQ-THAIESGX-L/ KFS50-THAIESGX-L. Eligible investors* will receive KFCASH-A units worth 0.2% of total switched value (up to 1,000 Baht).

*Please review full investment and promotion conditions carefully.

Krungsri Asset’s Thai ESGX funds information

For Thai ESGX - 2568 capital class | Thai ESGX - Legacy capital class, click:

- KF70-THAIESGX-68 | KF70-THAIESGX-L

- KFS50-THAIESGX-68 | KFS50-THAIESGX-L

- KFAEQ-THAIESGX-68 | KFAEQ-THAIESGX-L

- RMF funds are for retirement savings. Thai ESG and Thai ESGX promote long-term savings and sustainable investment in Thailand. Investors should understand fund features, return conditions, risks, and tax benefits before investing. Past performance is not indicative of future results.

- Information is based on credible sources as of release date; however, Krungsri Asset Management makes no guarantees and may update data without notice.

- Credit card subscriptions are excluded from promotion eligibility.

- Investors failing to meet tax benefit conditions must return any tax benefits and may be subject to penalties.

*Thai ESGX Promotion Details and Conditions

1. Promotion for Thai ESGX - new investments

- This promotional campaign is intended for individual investors who invest in the Thai ESGX funds – 2568 capital class, managed by Krungsri Asset Management Co., Ltd. (“the Company”), under the specified conditions, and who have a net accumulated investment during the period from 2 May – 30 Jun 2025, only.

- The net accumulated investment refers to the total investment amount from subscriptions of the Company’s Thai ESGX fund, deducted by any redemption and fund switching transactions out of the Thai ESGX funds – 2568 capital class units, into any other funds of the Company or other asset management companies.

- The aforementioned investment amount will be combined with the net accumulated investment amount in participating RMF and Thai ESG funds managed by Krungsri Asset Management throughout 2025 to qualify for the promotion.

- Investors must hold their investment units in the Thai ESGX funds throughout the promotional period until 31 March 2026, which is the date the Company will calculate the net accumulated investment for the entitlement to receive KFCASH-A units.

- If investors have more than one fund account, the Company will combine the net accumulated investments from all accounts, based primarily on the national ID number.

- The Company will transfer the KFCASH-A units according to the investment and entitlement conditions by 30 Apr 2026, based on the unit value as of the transfer date.

- Investments made by corporate and institutional investors are not eligible for this promotional campaign.

- The Company reserves the right to amend the terms and conditions of this promotional campaign without prior notice. In case of any disputes, the Company’s decision shall be final.

- This promotional campaign is intended for individual investors who switch their investment units from Krungsri Asset Management’s LTF funds ("the Company") to the Thai ESGX Fund – Legacy capital class under the specified conditions* during the period from 13 May – 30 Jun 2025 only. The switched-in amounts for each fund will be aggregated to calculate eligibility for the promotion during the promotional period.

- The total sum of net switched amount means the total switched amount from LTF into Thai ESGX - Legacy capital class of the Company deducted by any redemption and fund switching transactions out of the Thai ESGX funds – Legacy capital class units, into any other funds of the Company or other asset management companies.

- Investors must hold the Thai ESGX Fund units switched from LTF until 31 Mar 2026, which is the date the Company will calculate the net accumulated switching amount to determine eligibility for receiving KFCASH-A fund units.

- In cases where investors have more than one fund account, the Company will aggregate the net switched amounts from all accounts based on the investor’s national ID number.

- The Company will transfer the KFCASH-A fund units in accordance with the switching and eligibility conditions by 30 April 2026, based on the value of KFCASH-A units on the date of transfer.

- Investment units awarded through this promotional campaign are not eligible for participation in other promotional campaigns organized by the Company during 2025.

- Switching transactions made by corporate and institutional investors are not eligible for this promotion.

- The Company reserves the right to change the terms and conditions of this promotion without prior notice. In the event of a dispute, the Company’s decision shall be final.