Krungsri Active Equity Thailand ESG Extra Fund-68 (KFAEQ-THAIESGX-68)

Information as of Dec 30, 2025

Fund Type

Equity Fund / SRI Fund / Thai ESGX Fund / Cross Investing Fund

Dividend Policy

Not more than 4 times per year

Inception Date

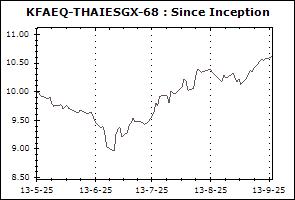

13 May 2025

Investment Policy

The Fund will invest in the stocks listed on the SET and/or MAI that have been selected by the SET as being outstanding in terms of environmental or ESG considerations and/or have disclosed information about greenhouse gas emissions, management plan to reduce greenhouse gas emissions and/or adhere to governance practices, with an average net exposure to the invested assets of not less than 80% of its NAV in each fiscal year. The Fund may have a foreign investment exposure of not exceeding 15% of NAV and the exchange rate risk is hedged upon Fund Manager’s discretion.

Fund Manager

Thalit Choktippattana, Akechai Boonyapongchai

Asset Allocation

-

Transaction Details

Minimum Purchase Amount (Baht): 500

Minimum Redemption Amount (Unit): None

Transaction Period: During IPO: 2 – 8 May 2025 until 15.30 hrs. of the last day. Subscription via cheque must be submitted until 8 May 2025 within clearing time of each branch. Switching transactions must be submitted by the last IPO date within 15.30 hrs. from KFCASH, KFCASHPLUS, KFSPLUS-A, KFSPLUS-I, KFSMART-A , and KFSMART-I only.

Proceeds Payment Period: Not exceed 5 working days after the execution day but in general practice, the payment date will be 3 working days after the execution day (T+3)

Fund Subscription Period: Every subscription date between 14 May – 30 June 2025.

Fund Redemption Period: Every Redemption date (start from 14 May 2025 onward)

Transaction Channel: Krungsri Asset Management,Online Service,AGENT

Top Five Sectors (30 Dec 2025)

| Energy & Utilities | 20.44% |

| Health Care Services | 14.67% |

| Commerce | 10.69% |

| Banking | 10.27% |

| Food & Beverage | 9.21% |

Top Five Holdings (30 Dec 2025)

| CP ALL Plc. | 5.83% |

| Bangkok Dusit Medical Services Plc. | 4.86% |

| Bumrungrad Hospital Plc. | 4.41% |

| Minor International Plc. | 4.18% |

| Bangkok Bank Plc. | 3.84% |

Thailand ESG Fund (Thai ESG)

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Government Bond Thailand ESG Fund-A (KFGBTHAIESG-A) | -3.10% | -1.17% | +8.87% | +8.87% | N/A | N/A | N/A | +9.16% | 2,808 |

| Benchmark(4) | -2.00% | -0.52% | +6.97% | +6.97% | N/A | N/A | N/A | +7.62% | |

| Standard Deviation of Fund | +4.94% | +5.85% | +5.15% | +5.15% | N/A | N/A | N/A | +4.55% | |

| Standard Deviation of Benchmark | +3.19% | +3.78% | +3.34% | +3.34% | N/A | N/A | N/A | +3.01% | |

| Krungsri Enhanced SET Thailand ESG Fund-A (KFTHAIESGA) | -0.45% | +16.82% | -4.57% | -4.57% | N/A | N/A | N/A | -4.31% | 749 |

| SETESG TRI | +0.39% | +17.32% | -3.21% | -3.21% | N/A | N/A | N/A | -2.53% | |

| Standard Deviation of Fund | +13.21% | +15.25% | +18.89% | +18.89% | N/A | N/A | N/A | +15.97% | |

| Standard Deviation of Benchmark | +12.72% | +14.47% | +18.32% | +18.32% | N/A | N/A | N/A | +15.50% | |

| Krungsri Enhanced SET Thailand ESG Fund-D (KFTHAIESGD) | -0.45% | +16.82% | -4.57% | -4.57% | N/A | N/A | N/A | -4.31% | 800 |

| SETESG TRI | +0.39% | +17.32% | -3.21% | -3.21% | N/A | N/A | N/A | -2.53% | |

| Standard Deviation of Fund | +13.21% | +15.25% | +18.89% | +18.89% | N/A | N/A | N/A | +15.97% | |

| Standard Deviation of Benchmark | +12.72% | +14.47% | +18.32% | +18.32% | N/A | N/A | N/A | +15.50% | |

| Krungsri 70/30 Thailand ESG Extra Fund-68 (KF70-THAIESGX-68) | -1.86% | +8.02% | N/A | N/A | N/A | N/A | N/A | +1.85% | 304 |

| Benchmark(5) | -0.76% | +12.10% | N/A | N/A | N/A | N/A | N/A | +4.61% | |

| Standard Deviation of Fund | +8.10% | +9.39% | N/A | N/A | N/A | N/A | N/A | +10.14% | |

| Standard Deviation of Benchmark | +8.10% | +8.59% | N/A | N/A | N/A | N/A | N/A | +8.90% | |

| Krungsri 70/30 Thailand ESG Extra Fund-L (KF70-THAIESGX-L) | -1.86% | +8.02% | N/A | N/A | N/A | N/A | N/A | +3.45% | 490 |

| Benchmark(5) | -0.76% | +12.10% | N/A | N/A | N/A | N/A | N/A | +5.62% | |

| Standard Deviation of Fund | +8.10% | +9.39% | N/A | N/A | N/A | N/A | N/A | +10.07% | |

| Standard Deviation of Benchmark | +8.10% | +8.59% | N/A | N/A | N/A | N/A | N/A | +8.90% | |

| Krungsri SET50 Thailand ESG Extra Fund-68 (KFS50-THAIESGX-68) | +1.73% | +16.95% | N/A | N/A | N/A | N/A | N/A | +6.05% | 197 |

| Benchmark(6) | +2.06% | +17.81% | N/A | N/A | N/A | N/A | N/A | +6.96% | |

| Standard Deviation of Fund | +12.55% | +13.68% | N/A | N/A | N/A | N/A | N/A | +14.52% | |

| Standard Deviation of Benchmark | +12.59% | +13.70% | N/A | N/A | N/A | N/A | N/A | +14.77% | |

| Krungsri SET50 Thailand ESG Extra Fund-L (KFS50-THAIESGX-L) | +1.73% | +16.95% | N/A | N/A | N/A | N/A | N/A | +7.44% | 554 |

| Benchmark(6) | +2.06% | +17.81% | N/A | N/A | N/A | N/A | N/A | +8.41% | |

| Standard Deviation of Fund | +12.55% | +13.68% | N/A | N/A | N/A | N/A | N/A | +14.55% | |

| Standard Deviation of Benchmark | +12.59% | +13.70% | N/A | N/A | N/A | N/A | N/A | +14.77% | |

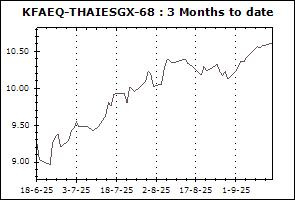

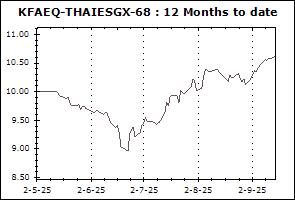

| Krungsri Active Equity Thailand ESG Extra Fund-68 (KFAEQ-THAIESGX-68) | -1.17% | +10.62% | N/A | N/A | N/A | N/A | N/A | +2.76% | 114 |

| SET TRI | -0.59% | +17.33% | N/A | N/A | N/A | N/A | N/A | +5.71% | |

| Standard Deviation of Fund | +9.79% | +11.94% | N/A | N/A | N/A | N/A | N/A | +12.92% | |

| Standard Deviation of Benchmark | +14.18% | +15.05% | N/A | N/A | N/A | N/A | N/A | +15.75% | |

| Krungsri Active Equity Thailand ESG Extra Fund-L (KFAEQ-THAIESGX-L) | -1.18% | +10.62% | N/A | N/A | N/A | N/A | N/A | +3.59% | 3,228 |

| SET TRI | -0.59% | +17.33% | N/A | N/A | N/A | N/A | N/A | +7.10% | |

| Standard Deviation of Fund | +9.79% | +11.94% | N/A | N/A | N/A | N/A | N/A | +13.02% | |

| Standard Deviation of Benchmark | +14.18% | +15.05% | N/A | N/A | N/A | N/A | N/A | +15.75% | |

Remark