Fund Type

Mixed Fund / SRI Fund / Thai ESGX Fund / Cross Investing Fund

Dividend Policy

Not more than 4 times per year

Inception Date

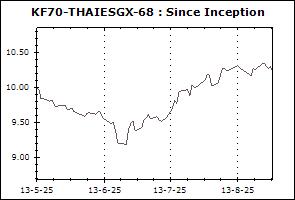

13 May 2025

Investment Policy

The Fund will invest in the following assets, with an average net exposure to the invested assets of not less than 80% of its NAV on average in each fiscal year:

1) Stocks listed on the SET and/or MAI that have been selected by the SET as being outstanding in terms of environmental or ESG considerations and/or have disclosed information about greenhouse gas emissions, management plans to reduce greenhouse gas emissions and/or adhere to governance practices, in aggregate not less than 65% of NAV on average in each fiscal year. The Fund may invest in assets other than stocks as specified in item 1) above in a manner that does not result in the Fund having a net exposure to stocks or equity securities exceeding 70% of NAV on average in each fiscal year.

2) Thai government bonds, bonds or debentures with principal and interest guaranteed by the Ministry of Finance excluding convertible debentures, and other fixed income instruments. Such bonds, debentures or fixed income instruments must be green bonds, sustainability bonds or sustainability-linked bonds with information disclosure as required by the SEC Office.

3) Investment tokens with the features as stipulated in the Notification of the Capital Market Supervisory Board

The Fund may have a foreign investment exposure of not exceeding 15% of NAV and the exchange rate risk is hedged upon Fund Manager’s discretion.

Fund Manager

Thalit Choktippattana, Satit Buachoo

Asset Allocation

30.04%

Instruments issued by Sovereign or Supra-national organization

2.02%

Deposits and Fixed Income Instruments issued by Financial Institutions

0.93%

Other Assets

-0.17%

Other Liabilities

67.18%

Equity and Unit Trusts

Transaction Details

Minimum Purchase Amount (Baht): 500

Minimum Redemption Amount (Unit): None

Transaction Period: During IPO: 2 – 8 May 2025 until 15.30 hrs. of the last day. Subscription via cheque must be submitted until 8 May 2025 within clearing time of each branch. Switching transactions must be submitted by the last IPO date within 15.30 hrs. from KFCASH, KFCASHPLUS, KFSPLUS-A, KFSPLUS-I, KFSMART-A , and KFSMART-I only.

Proceeds Payment Period: Not exceed 5 working days after the execution day but in general practice, the payment date will be 3 working days after the execution day (T+3)

Fund Subscription Period: Every subscription date between 14 May – 30 June 2025.

Fund Redemption Period: Every Redemption date (start from 14 May 2025 onward)

Transaction Channel: Krungsri Asset Management,Online Service,AGENT

Asset Allocation (30 Dec 2025)

| Instruments issued by Sovereign or Supra-national organization | 30.04% |

| Deposits and Fixed Income Instruments issued by Financial Institutions | 2.02% |

| Equity and Unit Trusts | 67.18% |

| Other Assets | 0.93% |

| Other Liabilities | -0.17% |

Top Five Issuers/Guarantors

| Security Code | Issue / Issuer Rating | % of NAV |

|---|---|---|

| Sustainability-Linked Bond FY. B.E. 2568 | - | 22.28% |

| TLOAN63/01/15.34Y | - | 7.76% |

| Advanced Info Service Plc. | AAA | 4.54% |

| SCB X Plc. | AA+ | 4.51% |

| PTT Plc. | AAA | 3.60% |

Thailand ESG Fund (Thai ESG)

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Government Bond Thailand ESG Fund-A (KFGBTHAIESG-A) | -3.10% | -1.17% | +8.87% | +8.87% | N/A | N/A | N/A | +9.16% | 2,808 |

| Benchmark(4) | -2.00% | -0.52% | +6.97% | +6.97% | N/A | N/A | N/A | +7.62% | |

| Standard Deviation of Fund | +4.94% | +5.85% | +5.15% | +5.15% | N/A | N/A | N/A | +4.55% | |

| Standard Deviation of Benchmark | +3.19% | +3.78% | +3.34% | +3.34% | N/A | N/A | N/A | +3.01% | |

| Krungsri Enhanced SET Thailand ESG Fund-A (KFTHAIESGA) | -0.45% | +16.82% | -4.57% | -4.57% | N/A | N/A | N/A | -4.31% | 749 |

| SETESG TRI | +0.39% | +17.32% | -3.21% | -3.21% | N/A | N/A | N/A | -2.53% | |

| Standard Deviation of Fund | +13.21% | +15.25% | +18.89% | +18.89% | N/A | N/A | N/A | +15.97% | |

| Standard Deviation of Benchmark | +12.72% | +14.47% | +18.32% | +18.32% | N/A | N/A | N/A | +15.50% | |

| Krungsri Enhanced SET Thailand ESG Fund-D (KFTHAIESGD) | -0.45% | +16.82% | -4.57% | -4.57% | N/A | N/A | N/A | -4.31% | 800 |

| SETESG TRI | +0.39% | +17.32% | -3.21% | -3.21% | N/A | N/A | N/A | -2.53% | |

| Standard Deviation of Fund | +13.21% | +15.25% | +18.89% | +18.89% | N/A | N/A | N/A | +15.97% | |

| Standard Deviation of Benchmark | +12.72% | +14.47% | +18.32% | +18.32% | N/A | N/A | N/A | +15.50% | |

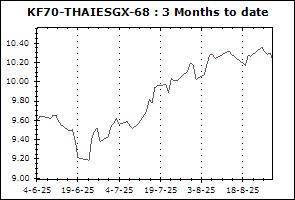

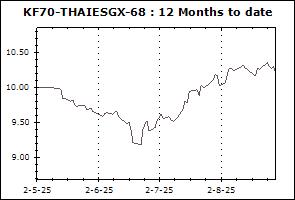

| Krungsri 70/30 Thailand ESG Extra Fund-68 (KF70-THAIESGX-68) | -1.86% | +8.02% | N/A | N/A | N/A | N/A | N/A | +1.85% | 304 |

| Benchmark(5) | -0.76% | +12.10% | N/A | N/A | N/A | N/A | N/A | +4.61% | |

| Standard Deviation of Fund | +8.10% | +9.39% | N/A | N/A | N/A | N/A | N/A | +10.14% | |

| Standard Deviation of Benchmark | +8.10% | +8.59% | N/A | N/A | N/A | N/A | N/A | +8.90% | |

| Krungsri 70/30 Thailand ESG Extra Fund-L (KF70-THAIESGX-L) | -1.86% | +8.02% | N/A | N/A | N/A | N/A | N/A | +3.45% | 490 |

| Benchmark(5) | -0.76% | +12.10% | N/A | N/A | N/A | N/A | N/A | +5.62% | |

| Standard Deviation of Fund | +8.10% | +9.39% | N/A | N/A | N/A | N/A | N/A | +10.07% | |

| Standard Deviation of Benchmark | +8.10% | +8.59% | N/A | N/A | N/A | N/A | N/A | +8.90% | |

| Krungsri SET50 Thailand ESG Extra Fund-68 (KFS50-THAIESGX-68) | +1.73% | +16.95% | N/A | N/A | N/A | N/A | N/A | +6.05% | 197 |

| Benchmark(6) | +2.06% | +17.81% | N/A | N/A | N/A | N/A | N/A | +6.96% | |

| Standard Deviation of Fund | +12.55% | +13.68% | N/A | N/A | N/A | N/A | N/A | +14.52% | |

| Standard Deviation of Benchmark | +12.59% | +13.70% | N/A | N/A | N/A | N/A | N/A | +14.77% | |

| Krungsri SET50 Thailand ESG Extra Fund-L (KFS50-THAIESGX-L) | +1.73% | +16.95% | N/A | N/A | N/A | N/A | N/A | +7.44% | 554 |

| Benchmark(6) | +2.06% | +17.81% | N/A | N/A | N/A | N/A | N/A | +8.41% | |

| Standard Deviation of Fund | +12.55% | +13.68% | N/A | N/A | N/A | N/A | N/A | +14.55% | |

| Standard Deviation of Benchmark | +12.59% | +13.70% | N/A | N/A | N/A | N/A | N/A | +14.77% | |

| Krungsri Active Equity Thailand ESG Extra Fund-68 (KFAEQ-THAIESGX-68) | -1.17% | +10.62% | N/A | N/A | N/A | N/A | N/A | +2.76% | 114 |

| SET TRI | -0.59% | +17.33% | N/A | N/A | N/A | N/A | N/A | +5.71% | |

| Standard Deviation of Fund | +9.79% | +11.94% | N/A | N/A | N/A | N/A | N/A | +12.92% | |

| Standard Deviation of Benchmark | +14.18% | +15.05% | N/A | N/A | N/A | N/A | N/A | +15.75% | |

| Krungsri Active Equity Thailand ESG Extra Fund-L (KFAEQ-THAIESGX-L) | -1.18% | +10.62% | N/A | N/A | N/A | N/A | N/A | +3.59% | 3,228 |

| SET TRI | -0.59% | +17.33% | N/A | N/A | N/A | N/A | N/A | +7.10% | |

| Standard Deviation of Fund | +9.79% | +11.94% | N/A | N/A | N/A | N/A | N/A | +13.02% | |

| Standard Deviation of Benchmark | +14.18% | +15.05% | N/A | N/A | N/A | N/A | N/A | +15.75% | |

Remark