Fund Type

Equity Fund/ SRI Fund/ Thai ESG Fund/ Cross Investing Fund

Dividend Policy

Yes

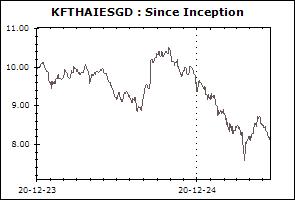

Inception Date

20 December 2023

Investment Policy

The Fund invest minimum 80% of its NAV in average in each fiscal year are in listed stocks in the SET and/or MAI that has been selected by SET as being outstanding in the environment or ESG and/or have disclosed information about greenhouse gas emissions, management plan and setting goals to achieve the goal of reducing the amount of greenhouse gas emissions in Thailand and/or shares of companies that have enhanced their corporate governance in alignment with the conditions stipulated in the Notification of the Capital Market Supervisory Board. The remaining portion may be invested in other securities or assets permitted by the SEC Office including the investment tokens issued under the Emergency Decree on Digital Asset Businesses that are green-project tokens and/or sustainability-project tokens and/or sustainability-linked tokens of which information have been disclosed in the registration statement for offering for sale of digital tokens as prescribed by the SEC Office. The fund may invest no more than 20% of NAV in average of fund accounting year in other units of mutual funds under management of the Company.

Fund Manager

Satit Buachoo, Thalit Choktippattana

Asset Allocation

-

Transaction Details

Minimum Purchase Amount (Baht): 500

Minimum Redemption Amount (Unit): Not specified

Transaction Period: Every subscription date within 15.30 hrs.

Proceeds Payment Period: Not exceed 5 working days after the execution day but in general practice, the payment date will be 3 working days after the execution day (T+3).

Fund Redemption Period: Every redemption date within 15.30 hrs.

Transaction Channel: Krungsri Asset Management,Online Service,AGENT

Top Five Sectors (30 Jan 2026)

| Energy & Utilities | 23.18% |

| Banking | 19.07% |

| Commerce | 9.61% |

| Transportation & Logistics | 7.18% |

| Property Development | 6.45% |

Top Five Holdings (30 Jan 2026)

| Gulf Development Plc. | 5.79% |

| PTT Exploration and Production Plc. | 5.23% |

| Kasikorn Bank Plc. | 5.13% |

| Krung Thai Bank Plc. | 4.71% |

| CP ALL Plc. | 4.50% |

Thailand ESG Fund (Thai ESG)

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Government Bond Thailand ESG Fund-A (KFGBTHAIESG-A) | -3.71% | -6.08% | -4.51% | +3.89% | N/A | N/A | N/A | +5.28% | 2,879 |

| Benchmark(4) | -2.25% | -3.76% | -2.99% | +3.70% | N/A | N/A | N/A | +4.97% | |

| Standard Deviation of Fund | +5.02% | +6.22% | +5.37% | +5.41% | N/A | N/A | N/A | +4.70% | |

| Standard Deviation of Benchmark | +3.19% | +3.96% | +3.49% | +3.44% | N/A | N/A | N/A | +3.07% | |

| Krungsri Enhanced SET Thailand ESG Fund-A (KFTHAIESGA) | +2.24% | +5.69% | +3.47% | +4.36% | N/A | N/A | N/A | -2.58% | 809 |

| SETESG TRI | +2.98% | +6.56% | +3.36% | +5.38% | N/A | N/A | N/A | -0.90% | |

| Standard Deviation of Fund | +12.18% | +13.27% | +12.31% | +18.70% | N/A | N/A | N/A | +15.84% | |

| Standard Deviation of Benchmark | +11.62% | +12.65% | +11.61% | +18.10% | N/A | N/A | N/A | +15.37% | |

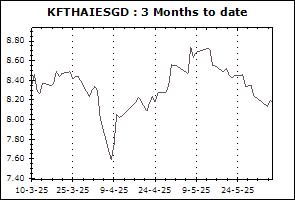

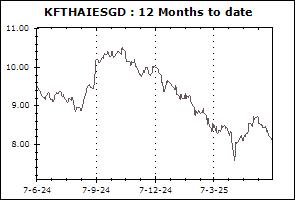

| Krungsri Enhanced SET Thailand ESG Fund-D (KFTHAIESGD) | +2.24% | +5.69% | +3.47% | +4.36% | N/A | N/A | N/A | -2.58% | 859 |

| SETESG TRI | +2.98% | +6.56% | +3.36% | +5.38% | N/A | N/A | N/A | -0.90% | |

| Standard Deviation of Fund | +12.18% | +13.27% | +12.31% | +18.70% | N/A | N/A | N/A | +15.84% | |

| Standard Deviation of Benchmark | +11.62% | +12.65% | +11.61% | +18.10% | N/A | N/A | N/A | +15.37% | |

| Krungsri 70/30 Thailand ESG Extra Fund-68 (KF70-THAIESGX-68) | +0.54% | +1.57% | +1.45% | N/A | N/A | N/A | N/A | +3.33% | 308 |

| Benchmark(5) | +0.70% | +5.14% | +3.11% | N/A | N/A | N/A | N/A | +7.91% | |

| Standard Deviation of Fund | +8.08% | +8.56% | +8.79% | N/A | N/A | N/A | N/A | +9.98% | |

| Standard Deviation of Benchmark | +8.35% | +8.14% | +9.46% | N/A | N/A | N/A | N/A | +8.96% | |

| Krungsri 70/30 Thailand ESG Extra Fund-L (KF70-THAIESGX-L) | +0.54% | +1.57% | +1.45% | N/A | N/A | N/A | N/A | +4.96% | 496 |

| Benchmark(5) | +0.70% | +5.14% | +3.11% | N/A | N/A | N/A | N/A | +8.97% | |

| Standard Deviation of Fund | +8.08% | +8.56% | +8.80% | N/A | N/A | N/A | N/A | +9.91% | |

| Standard Deviation of Benchmark | +8.35% | +8.14% | +9.46% | N/A | N/A | N/A | N/A | +8.96% | |

| Krungsri SET50 Thailand ESG Extra Fund-68 (KFS50-THAIESGX-68) | +3.00% | +8.54% | +4.46% | N/A | N/A | N/A | N/A | +10.78% | 207 |

| Benchmark(6) | +3.43% | +9.33% | +4.65% | N/A | N/A | N/A | N/A | +11.94% | |

| Standard Deviation of Fund | +12.50% | +12.69% | +13.77% | N/A | N/A | N/A | N/A | +14.42% | |

| Standard Deviation of Benchmark | +12.58% | +12.76% | +14.02% | N/A | N/A | N/A | N/A | +14.67% | |

| Krungsri SET50 Thailand ESG Extra Fund-L (KFS50-THAIESGX-L) | +3.00% | +8.54% | +4.46% | N/A | N/A | N/A | N/A | +12.23% | 580 |

| Benchmark(6) | +3.43% | +9.33% | +4.65% | N/A | N/A | N/A | N/A | +13.46% | |

| Standard Deviation of Fund | +12.50% | +12.69% | +13.77% | N/A | N/A | N/A | N/A | +14.45% | |

| Standard Deviation of Benchmark | +12.58% | +12.76% | +14.02% | N/A | N/A | N/A | N/A | +14.67% | |

| Krungsri Active Equity Thailand ESG Extra Fund-68 (KFAEQ-THAIESGX-68) | +5.14% | +5.33% | +4.42% | N/A | N/A | N/A | N/A | +7.30% | 119 |

| SET TRI | +1.56% | +8.28% | +5.24% | N/A | N/A | N/A | N/A | +11.25% | |

| Standard Deviation of Fund | +11.77% | +11.60% | +15.04% | N/A | N/A | N/A | N/A | +13.17% | |

| Standard Deviation of Benchmark | +14.70% | +14.20% | +16.58% | N/A | N/A | N/A | N/A | +15.84% | |

| Krungsri Active Equity Thailand ESG Extra Fund-L (KFAEQ-THAIESGX-L) | +5.14% | +5.33% | +4.42% | N/A | N/A | N/A | N/A | +8.18% | 3,368 |

| SET TRI | +1.56% | +8.28% | +5.24% | N/A | N/A | N/A | N/A | +12.71% | |

| Standard Deviation of Fund | +11.77% | +11.60% | +15.04% | N/A | N/A | N/A | N/A | +13.26% | |

| Standard Deviation of Benchmark | +14.70% | +14.20% | +16.58% | N/A | N/A | N/A | N/A | +15.84% | |

Remark