Krungsri Value Stock Fund-I (KFVALUE-I)

Old Name: Krungsri-Primavest Value Fund (KPV)

Information as of Jan 30, 2026

Fund Type

Equity Fund

Dividend Policy

None

Objective

To generate the return from medium term to long term investment of listed stock.

Inception Date

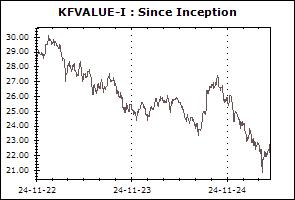

24 November 2022

Investment Policy

To invest at least 80% of its net asset value on average in listed stocks and mainly invest in stocks that potentially pays consistent dividends.

Fund Manager

Satit Buachoo, Thalit Choktippattana

Asset Allocation

-

Transaction Details

Minimum Purchase Amount (Baht): None

Minimum Redemption Amount (Unit): None

Proceeds Payment Period: 3 business days after the execution (T+3)

Fund Subscription Period: Every dealing date of the fund by 15.30 hrs.

Fund Redemption Period: Every dealing date of the fund by 15.30 hrs.

Transaction Channel: Krungsri Asset Management,Online Service,AGENT

Top Five Sectors (30 Jan 2026)

| Energy & Utilities | 21.41% |

| Banking | 16.57% |

| Property Development | 9.18% |

| Food & Beverage | 7.07% |

| Health Care Services | 6.86% |

Top Five Holdings (30 Jan 2026)

| PTT Plc. | 5.63% |

| Advanced Info Service Plc. | 5.31% |

| SCB X Plc. | 5.14% |

| MBK Plc. | 4.46% |

| Gulf Development Plc. | 3.30% |

Equity Funds

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Dividend Stock Fund (KFSDIV) | +1.62% | +2.33% | +3.12% | -0.88% | -7.44% | -3.11% | -1.48% | +4.97% | 6,396 |

| Standard Deviation of Fund | +10.38% | +11.81% | +12.52% | +16.18% | +13.54% | +12.68% | +14.63% | +15.42% | |

| Krungsri Dividend Stock Fund 2-D (KFSDIV2-D) | +2.26% | +5.58% | +4.32% | +0.89% | -6.71% | -2.71% | N/A | -0.67% | 6 |

| Standard Deviation of Fund | +12.14% | +12.46% | +13.16% | +16.86% | +14.06% | +13.04% | N/A | +13.69% | |

| Krungsri Value Stock Fund-A (KFVALUE-A) | +1.61% | +2.24% | +3.17% | -0.70% | -7.24% | -3.00% | -1.37% | +3.99% | 489 |

| Standard Deviation of Fund | +10.21% | +11.68% | +12.29% | +16.03% | +13.42% | +12.58% | +14.57% | +17.69% | |

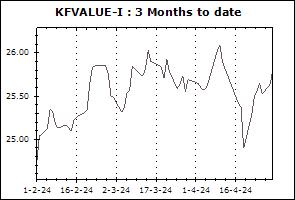

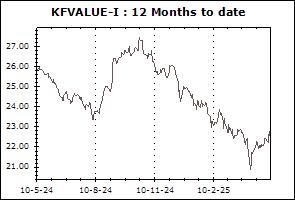

| Krungsri Value Stock Fund-I (KFVALUE-I) | +1.61% | +2.24% | +3.17% | -0.70% | -7.24% | N/A | N/A | -6.18% | 0 |

| Standard Deviation of Fund | +10.21% | +11.68% | +12.29% | +16.03% | +13.42% | N/A | N/A | +13.16% | |

| Krungsri Star Equity Dividend Fund (KFSEQ-D) | +2.46% | +2.99% | +3.54% | -1.49% | -8.32% | -1.87% | -1.32% | +6.93% | 781 |

| Standard Deviation of Fund | +11.05% | +12.33% | +13.39% | +17.07% | +14.12% | +12.92% | +15.13% | +21.67% | |

| Krungsri Star Equity Fund (KFSEQ) | +2.42% | +2.90% | +3.55% | -1.57% | -8.33% | -1.90% | -1.37% | +3.00% | 700 |

| Standard Deviation of Fund | +10.96% | +12.18% | +13.29% | +16.88% | +13.99% | +12.84% | +15.04% | +19.00% | |

| Krungsri Star Equity Fund 2-A (KFSEQ2-A) | +2.65% | +3.15% | +3.64% | -1.83% | -8.50% | -1.91% | N/A | -0.08% | 0 |

| Standard Deviation of Fund | +11.36% | +12.74% | +13.74% | +17.36% | +14.28% | +13.03% | N/A | +13.36% | |

| Krungsri Dynamic Dividend Fund (KFDNM-D) | -2.11% | -3.36% | +1.42% | -14.10% | -10.87% | -0.19% | +2.34% | +4.78% | 311 |

| Standard Deviation of Fund | +14.27% | +15.11% | +16.25% | +19.10% | +15.22% | +14.12% | +16.20% | +19.17% | |

| Krungsri Financial Focus Dividend Fund (KFFIN-D) | +2.71% | +11.15% | +0.31% | +10.70% | +2.46% | +5.76% | +5.33% | +7.40% | 1,588 |

| Standard Deviation of Fund | +8.64% | +9.80% | +9.61% | +13.17% | +12.72% | +13.03% | +16.67% | +20.83% | |

| Krungsri Dynamic Fund (KFDYNAMIC) | -2.05% | -3.29% | +1.41% | -14.24% | -11.02% | -0.31% | +2.35% | +4.89% | 708 |

| Standard Deviation of Fund | +14.49% | +15.24% | +16.53% | +19.24% | +15.39% | +14.27% | +16.27% | +19.53% | |

| Krungsri Growth Equity Fund-A (KFGROWTH-A) | +2.46% | +3.05% | +3.51% | -1.23% | -8.36% | -1.99% | N/A | -7.03% | 6 |

| Standard Deviation of Fund | +11.28% | +12.32% | +13.49% | +16.63% | +13.98% | +12.79% | N/A | +15.64% | |

| Krungsri Growth Equity Fund-D (KFGROWTH-D) | +2.46% | +3.05% | +3.52% | -1.23% | -8.36% | -1.99% | -1.25% | +4.99% | 376 |

| Standard Deviation of Fund | +11.28% | +12.32% | +13.49% | +16.63% | +13.99% | +12.79% | +15.00% | +19.01% | |

| Krungsri Enhanced SET50 Fund-A (KFENS50-A) | +3.12% | +8.45% | +5.64% | +5.94% | -2.58% | +0.77% | +3.16% | +4.79% | 2,161 |

| Standard Deviation of Fund | +14.41% | +14.51% | +15.28% | +19.78% | +15.47% | +14.16% | +16.56% | +20.42% | |

| Krungsri Thai Small-Mid Cap Equity Fund (KFTHAISM) | +0.02% | +0.32% | +1.93% | -7.67% | -15.49% | -3.96% | N/A | -1.41% | 121 |

| Standard Deviation of Fund | +12.15% | +12.83% | +15.40% | +17.89% | +15.04% | +14.44% | N/A | +15.78% | |

| Krungsri Thai All Stars Equity Fund-D (KFTSTAR-D) | +5.02% | +5.07% | +4.17% | +6.39% | -6.15% | -1.03% | N/A | -3.99% | 529 |

| Standard Deviation of Fund | +11.66% | +11.51% | +14.68% | +15.95% | +13.74% | +12.82% | N/A | +14.94% | |

| Krungsri Thai All Stars Equity Fund-A (KFTSTAR-A) | +5.02% | +5.07% | +4.17% | +6.39% | -6.15% | -1.03% | N/A | -5.98% | 483 |

| Standard Deviation of Fund | +11.66% | +11.51% | +14.69% | +15.95% | +13.74% | +12.82% | N/A | +15.32% | |

| Krungsri Thai Equity CG Fund (KFTHAICG) | +2.62% | +4.52% | +3.14% | +3.78% | -5.01% | +0.89% | N/A | -1.27% | 57 |

| Standard Deviation of Fund | +9.49% | +11.05% | +10.40% | +15.89% | +13.56% | +12.54% | N/A | +14.83% | |

| Krungsri SET100 Fund-A (KFS100-A) | +3.14% | +9.02% | +5.52% | +6.57% | -2.53% | +1.21% | N/A | +2.78% | 147 |

| Standard Deviation of Fund | +14.40% | +14.25% | +15.63% | +19.25% | +15.07% | +13.75% | N/A | +14.72% | |

| Tracking Error (TE) | N/A | N/A | N/A | +2.00% | N/A | N/A | N/A | N/A | |

| Tracking Difference (TD) | N/A | N/A | N/A | -0.52% | N/A | N/A | N/A | N/A | |

| Krungsri SET100 Fund-I (KFS100-I) | +3.07% | +9.49% | +5.52% | +7.03% | N/A | N/A | N/A | +0.01% | 0 |

| Standard Deviation of Fund | +14.61% | +14.47% | +15.63% | +19.34% | N/A | N/A | N/A | +15.38% | |

| Tracking Error (TE) | N/A | N/A | N/A | +2.10% | N/A | N/A | N/A | N/A | |

| Tracking Difference (TD) | N/A | N/A | N/A | -0.06% | N/A | N/A | N/A | N/A | |

| SET TRI | +1.56% | +8.28% | +5.24% | +5.39% | -4.08% | +1.25% | +3.47% | N/A | |

| Standard Deviation of Benchmark | +14.70% | +14.20% | +16.58% | +17.92% | +14.12% | +13.00% | +14.83% | N/A | |

| SET50 TRI | +3.91% | +9.95% | +5.62% | +7.71% | -0.51% | +2.39% | +3.81% | N/A | |

| Standard Deviation of Benchmark | +13.94% | +13.99% | +14.95% | +19.25% | +15.10% | +13.88% | +16.53% | N/A | |

| SET100 TRI | +3.48% | +9.60% | +5.37% | +7.09% | -2.30% | +1.39% | +3.40% | N/A | |

| Standard Deviation of Benchmark | +14.22% | +14.19% | +15.40% | +19.27% | +15.15% | +13.85% | +16.35% | N/A | |

| Krungsri SET50 Fund-A (KF-SET50-A) | +2.60% | +8.25% | +4.48% | +5.58% | -1.83% | +1.53% | N/A | +4.23% | 17 |

| Benchmark(4) | +2.92% | +8.91% | +4.65% | +6.69% | -0.82% | +2.20% | N/A | +5.18% | |

| Standard Deviation of Fund | +13.51% | +13.75% | +13.83% | +19.20% | +15.04% | +13.81% | N/A | +14.89% | |

| Standard Deviation of Benchmark | +13.56% | +13.81% | +14.02% | +19.19% | +15.07% | +13.86% | N/A | +14.92% | |

| Tracking Difference (TD) | N/A | N/A | N/A | -1.10% | N/A | N/A | N/A | N/A | |

| Tracking Error (TE) | N/A | N/A | N/A | +1.92% | N/A | N/A | N/A | N/A | |

Remark