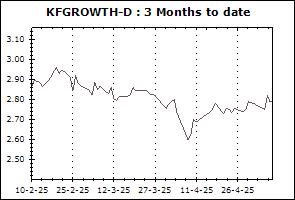

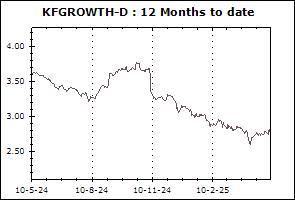

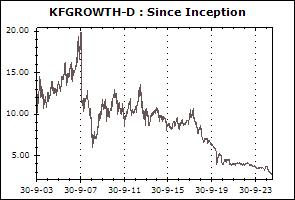

Krungsri Growth Equity Fund-D (KFGROWTH-D)

Old Name: Krungsri Tuntawee Fund 5 (KFTW5)

Information as of Jan 30, 2026

Fund Type

Equity Fund

Dividend Policy

Maximum 4 times a year at the minimum 90% of fund`s net profit and/or accrued profit. In the event that the dividend payment is less than 0.25 baht per unit, the Fund reserves the right not to pay. For further detail pertaining to dividend payment, please study Fund Prospectus and Fund Project and Commitment.

Inception Date

30 September 2003

Investment Policy

The Fund will invest in domestic equities no less than 80% of NAV. The remaining fund assets are invested in debt instruments of government sector, financial institutions, private companies or bank deposits. (please see details in prospectus summary)

Fund Manager

Peeti Pratipatpong, Thalit Choktippattana

Asset Allocation

-

Transaction Details

Minimum Purchase Amount (Baht): 500

Minimum Redemption Amount (Unit): 500 Baht or 50 units

Transaction Period: Every fund`s dealing date within 15.30 hrs.

Proceeds Payment Period: 3 business days after the execution (T+3)

Fund Redemption Period: Every bank working day within 15:30 hrs.

Transaction Channel: Krungsri Asset Management,Online Service,AGENT

Top Five Sectors (30 Jan 2026)

| Energy & Utilities | 22.27% |

| Banking | 10.49% |

| Health Care Services | 10.26% |

| Commerce | 9.59% |

| Information & Communication Technology | 9.41% |

Top Five Holdings (30 Jan 2026)

| Thanachart Capital Plc. | 7.09% |

| Gulf Development Plc. | 6.18% |

| PTT Plc. | 5.94% |

| MBK Plc. | 4.59% |

| Advanced Info Service Plc. | 4.48% |

Dividend Payment History (Last 10 times or last 5 years)

(Note : Paid 25 times, totalling 24.1900 Baht.)

(Note : Paid 25 times, totalling 24.1900 Baht.)

| 18 Nov 2025 | 0.3000 Bt./unit |

| 19 Nov 2024 | 0.2600 Bt./unit |

| 25 May 2021 | 0.5600 Bt./unit |

| 22 Feb 2021 | 0.3700 Bt./unit |

| 24 Aug 2020 | 0.6900 Bt./unit |

| 24 May 2019 | 0.2800 Bt./unit |

| 19 Nov 2018 | 0.7900 Bt./unit |

| 20 Feb 2018 | 0.8000 Bt./unit |

| 15 Nov 2017 | 0.7500 Bt./unit |

| 23 Aug 2017 | 0.3500 Bt./unit |

Equity Funds

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Dividend Stock Fund (KFSDIV) | +1.62% | +2.33% | +3.12% | -0.88% | -7.44% | -3.11% | -1.48% | +4.97% | 6,396 |

| Standard Deviation of Fund | +10.38% | +11.81% | +12.52% | +16.18% | +13.54% | +12.68% | +14.63% | +15.42% | |

| Krungsri Dividend Stock Fund 2-D (KFSDIV2-D) | +2.26% | +5.58% | +4.32% | +0.89% | -6.71% | -2.71% | N/A | -0.67% | 6 |

| Standard Deviation of Fund | +12.14% | +12.46% | +13.16% | +16.86% | +14.06% | +13.04% | N/A | +13.69% | |

| Krungsri Value Stock Fund-A (KFVALUE-A) | +1.61% | +2.24% | +3.17% | -0.70% | -7.24% | -3.00% | -1.37% | +3.99% | 489 |

| Standard Deviation of Fund | +10.21% | +11.68% | +12.29% | +16.03% | +13.42% | +12.58% | +14.57% | +17.69% | |

| Krungsri Value Stock Fund-I (KFVALUE-I) | +1.61% | +2.24% | +3.17% | -0.70% | -7.24% | N/A | N/A | -6.18% | 0 |

| Standard Deviation of Fund | +10.21% | +11.68% | +12.29% | +16.03% | +13.42% | N/A | N/A | +13.16% | |

| Krungsri Star Equity Dividend Fund (KFSEQ-D) | +2.46% | +2.99% | +3.54% | -1.49% | -8.32% | -1.87% | -1.32% | +6.93% | 781 |

| Standard Deviation of Fund | +11.05% | +12.33% | +13.39% | +17.07% | +14.12% | +12.92% | +15.13% | +21.67% | |

| Krungsri Star Equity Fund (KFSEQ) | +2.42% | +2.90% | +3.55% | -1.57% | -8.33% | -1.90% | -1.37% | +3.00% | 700 |

| Standard Deviation of Fund | +10.96% | +12.18% | +13.29% | +16.88% | +13.99% | +12.84% | +15.04% | +19.00% | |

| Krungsri Star Equity Fund 2-A (KFSEQ2-A) | +2.65% | +3.15% | +3.64% | -1.83% | -8.50% | -1.91% | N/A | -0.08% | 0 |

| Standard Deviation of Fund | +11.36% | +12.74% | +13.74% | +17.36% | +14.28% | +13.03% | N/A | +13.36% | |

| Krungsri Dynamic Dividend Fund (KFDNM-D) | -2.11% | -3.36% | +1.42% | -14.10% | -10.87% | -0.19% | +2.34% | +4.78% | 311 |

| Standard Deviation of Fund | +14.27% | +15.11% | +16.25% | +19.10% | +15.22% | +14.12% | +16.20% | +19.17% | |

| Krungsri Financial Focus Dividend Fund (KFFIN-D) | +2.71% | +11.15% | +0.31% | +10.70% | +2.46% | +5.76% | +5.33% | +7.40% | 1,588 |

| Standard Deviation of Fund | +8.64% | +9.80% | +9.61% | +13.17% | +12.72% | +13.03% | +16.67% | +20.83% | |

| Krungsri Dynamic Fund (KFDYNAMIC) | -2.05% | -3.29% | +1.41% | -14.24% | -11.02% | -0.31% | +2.35% | +4.89% | 708 |

| Standard Deviation of Fund | +14.49% | +15.24% | +16.53% | +19.24% | +15.39% | +14.27% | +16.27% | +19.53% | |

| Krungsri Growth Equity Fund-A (KFGROWTH-A) | +2.46% | +3.05% | +3.51% | -1.23% | -8.36% | -1.99% | N/A | -7.03% | 6 |

| Standard Deviation of Fund | +11.28% | +12.32% | +13.49% | +16.63% | +13.98% | +12.79% | N/A | +15.64% | |

| Krungsri Growth Equity Fund-D (KFGROWTH-D) | +2.46% | +3.05% | +3.52% | -1.23% | -8.36% | -1.99% | -1.25% | +4.99% | 376 |

| Standard Deviation of Fund | +11.28% | +12.32% | +13.49% | +16.63% | +13.99% | +12.79% | +15.00% | +19.01% | |

| Krungsri Enhanced SET50 Fund-A (KFENS50-A) | +3.12% | +8.45% | +5.64% | +5.94% | -2.58% | +0.77% | +3.16% | +4.79% | 2,161 |

| Standard Deviation of Fund | +14.41% | +14.51% | +15.28% | +19.78% | +15.47% | +14.16% | +16.56% | +20.42% | |

| Krungsri Thai Small-Mid Cap Equity Fund (KFTHAISM) | +0.02% | +0.32% | +1.93% | -7.67% | -15.49% | -3.96% | N/A | -1.41% | 121 |

| Standard Deviation of Fund | +12.15% | +12.83% | +15.40% | +17.89% | +15.04% | +14.44% | N/A | +15.78% | |

| Krungsri Thai All Stars Equity Fund-D (KFTSTAR-D) | +5.02% | +5.07% | +4.17% | +6.39% | -6.15% | -1.03% | N/A | -3.99% | 529 |

| Standard Deviation of Fund | +11.66% | +11.51% | +14.68% | +15.95% | +13.74% | +12.82% | N/A | +14.94% | |

| Krungsri Thai All Stars Equity Fund-A (KFTSTAR-A) | +5.02% | +5.07% | +4.17% | +6.39% | -6.15% | -1.03% | N/A | -5.98% | 483 |

| Standard Deviation of Fund | +11.66% | +11.51% | +14.69% | +15.95% | +13.74% | +12.82% | N/A | +15.32% | |

| Krungsri Thai Equity CG Fund (KFTHAICG) | +2.62% | +4.52% | +3.14% | +3.78% | -5.01% | +0.89% | N/A | -1.27% | 57 |

| Standard Deviation of Fund | +9.49% | +11.05% | +10.40% | +15.89% | +13.56% | +12.54% | N/A | +14.83% | |

| Krungsri SET100 Fund-A (KFS100-A) | +3.14% | +9.02% | +5.52% | +6.57% | -2.53% | +1.21% | N/A | +2.78% | 147 |

| Standard Deviation of Fund | +14.40% | +14.25% | +15.63% | +19.25% | +15.07% | +13.75% | N/A | +14.72% | |

| Tracking Error (TE) | N/A | N/A | N/A | +2.00% | N/A | N/A | N/A | N/A | |

| Tracking Difference (TD) | N/A | N/A | N/A | -0.52% | N/A | N/A | N/A | N/A | |

| Krungsri SET100 Fund-I (KFS100-I) | +3.07% | +9.49% | +5.52% | +7.03% | N/A | N/A | N/A | +0.01% | 0 |

| Standard Deviation of Fund | +14.61% | +14.47% | +15.63% | +19.34% | N/A | N/A | N/A | +15.38% | |

| Tracking Error (TE) | N/A | N/A | N/A | +2.10% | N/A | N/A | N/A | N/A | |

| Tracking Difference (TD) | N/A | N/A | N/A | -0.06% | N/A | N/A | N/A | N/A | |

| SET TRI | +1.56% | +8.28% | +5.24% | +5.39% | -4.08% | +1.25% | +3.47% | N/A | |

| Standard Deviation of Benchmark | +14.70% | +14.20% | +16.58% | +17.92% | +14.12% | +13.00% | +14.83% | N/A | |

| SET50 TRI | +3.91% | +9.95% | +5.62% | +7.71% | -0.51% | +2.39% | +3.81% | N/A | |

| Standard Deviation of Benchmark | +13.94% | +13.99% | +14.95% | +19.25% | +15.10% | +13.88% | +16.53% | N/A | |

| SET100 TRI | +3.48% | +9.60% | +5.37% | +7.09% | -2.30% | +1.39% | +3.40% | N/A | |

| Standard Deviation of Benchmark | +14.22% | +14.19% | +15.40% | +19.27% | +15.15% | +13.85% | +16.35% | N/A | |

| Krungsri SET50 Fund-A (KF-SET50-A) | +2.60% | +8.25% | +4.48% | +5.58% | -1.83% | +1.53% | N/A | +4.23% | 17 |

| Benchmark(4) | +2.92% | +8.91% | +4.65% | +6.69% | -0.82% | +2.20% | N/A | +5.18% | |

| Standard Deviation of Fund | +13.51% | +13.75% | +13.83% | +19.20% | +15.04% | +13.81% | N/A | +14.89% | |

| Standard Deviation of Benchmark | +13.56% | +13.81% | +14.02% | +19.19% | +15.07% | +13.86% | N/A | +14.92% | |

| Tracking Difference (TD) | N/A | N/A | N/A | -1.10% | N/A | N/A | N/A | N/A | |

| Tracking Error (TE) | N/A | N/A | N/A | +1.92% | N/A | N/A | N/A | N/A | |

Remark