Provident Fund

Employee's choice

Employee’s choice concept responds to different preference in savings of each member based on age, expected return, risk appetite, and other factors such as duration of investment etc. and it enables employees to select their own investment policies that best suit their needs.

To adopt Employee’s Choice concept, it is necessary for employees to have sufficient knowledge in investment.

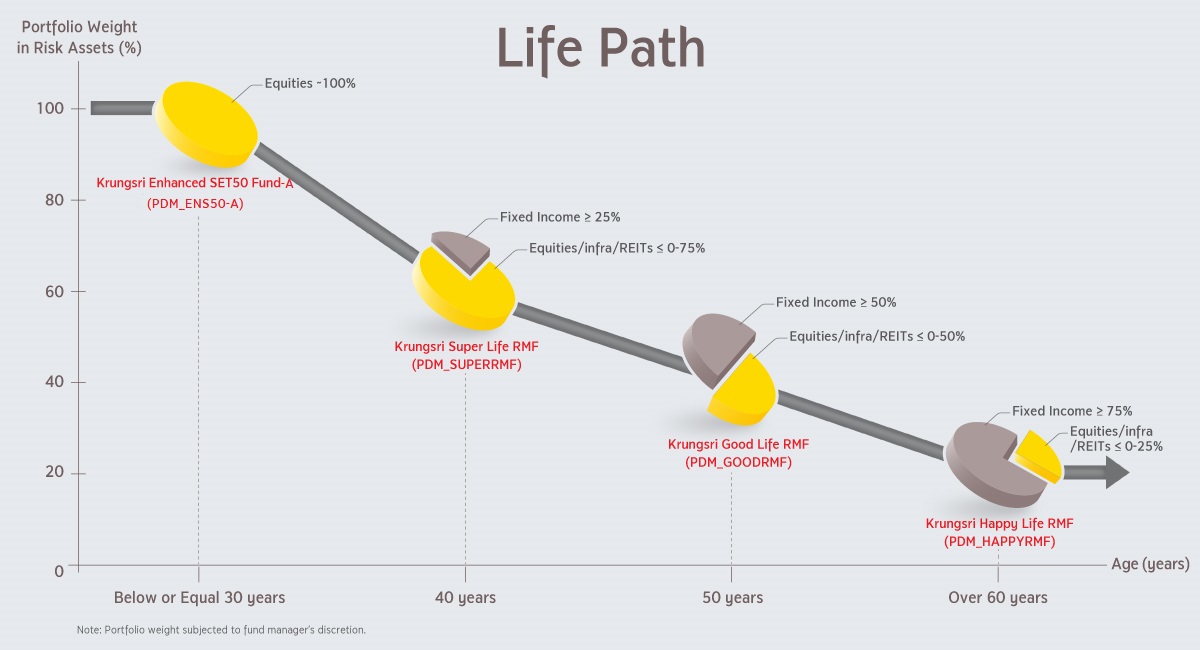

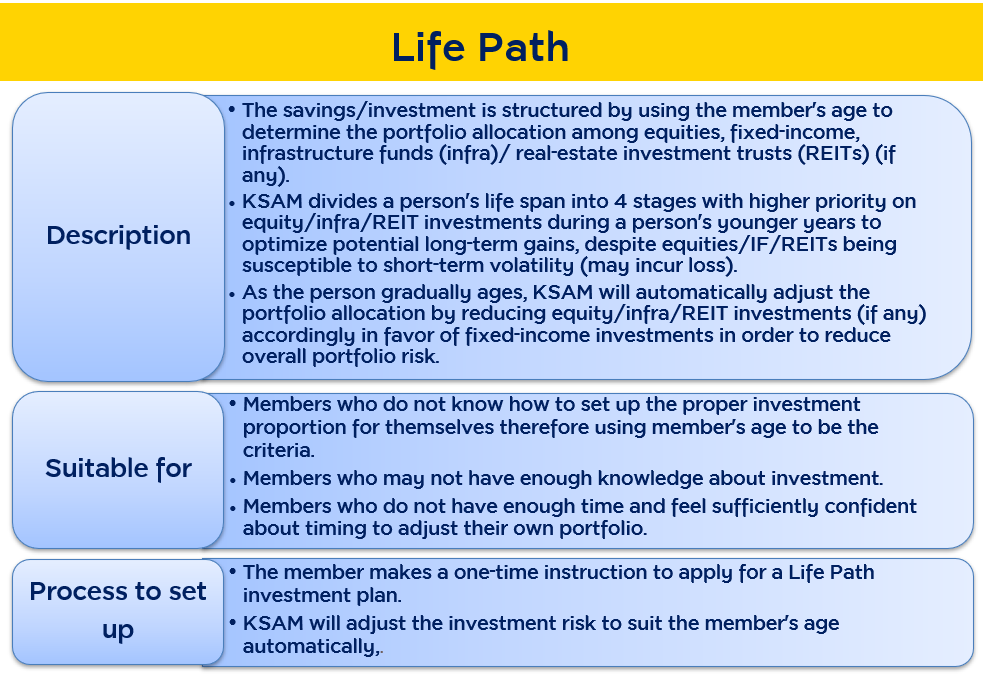

Krungsri Asset Management Ltd. registered “Ayudhya Master Fund Registered Provident Fund “ on 30 January 2009. This is a Master Pooled Fund with 22 policies. Members may choose investment portfolio that best suits their style based on age, risk appetite, and expected return within the investment framework set out by the fund committee or life path by using the member’s age to determine the portfolio allocation among equities, fixed-income, infrastructure funds (infra)/ real-estate investment trusts (REITs) (if any). Krungsri Asset will automatically adjust the portfolio allocation. Details of Ayudhya Master Fund Registered Provident Fund are as follows:

To adopt Employee’s Choice concept, it is necessary for employees to have sufficient knowledge in investment.

Krungsri Asset Management Ltd. registered “Ayudhya Master Fund Registered Provident Fund “ on 30 January 2009. This is a Master Pooled Fund with 22 policies. Members may choose investment portfolio that best suits their style based on age, risk appetite, and expected return within the investment framework set out by the fund committee or life path by using the member’s age to determine the portfolio allocation among equities, fixed-income, infrastructure funds (infra)/ real-estate investment trusts (REITs) (if any). Krungsri Asset will automatically adjust the portfolio allocation. Details of Ayudhya Master Fund Registered Provident Fund are as follows:

*Please click at fund name to view fund fact sheet

| Fund Type/ Fund name / Fund Fact Sheet | Risk Level | Investment Policies and Portfolio Management | Remark |

|---|---|---|---|

| Fixed Income | |||

| 1. PDM_CASHRMF | 1 Low |

| - |

| 2. PDM_MTFIRMF | 4 Low to moderate |

| - |

| 3. PDM_GOVRMF | 4 Low to moderate |

| - |

| Foreign Fixed Income | |||

| 1. PDM_CSINCOME | 5 Moderate to high |

| The exchange rate risk is hedged at least 90% of the foreign investment value |

| Mixed | |||

| 1. PDM_FLEX2RMF | 5 Moderate to high |

| - |

| Thai Equity | |||

| 1. PDM_S100RMF | 6 High |

| - |

| 2. PDM_ENS50-A | 6 High |

| - |

| 3. PDM_SDIV | 6 High |

| - |

| 4. PDM_TSTAR-A | 6 High |

| - |

| 5. PDM_SEQ | 6 High |

| - |

| 6. PDM_DYNAMIC | 6 High |

| - |

| Foreign Equity | |||

| 1. PDM_GBRANRMF | 6 High |

| The exchange rate risk is hedged upon Fund manager’s discretion |

| 2. PDM_ESG-A | 6 High |

| The exchange rate risk is hedged at least 90% of the foreign investment value |

| 3. PDM_USINDX-A | -6 High |

| The exchange rate risk is hedged at least 90% of the foreign investment value |

| 4. PDM_NDQ-A | -6 High |

| The exchange rate risk is hedged upon Fund manager’s discretion |

| 5. PDM_HEUROPE-A | 6 High |

| The exchange rate risk is hedged at least 90% of the foreign investment value |

| 6. PDM_JPINDX-A | 6 High |

| The exchange rate risk is hedged at least 90% of the foreign investment value |

| 7. PDM_HASIA-A | 6 High |

| The exchange rate risk is hedged at least 90% of the foreign investment value |

| 8. PDM_ACHINA-A | 6 High |

| The exchange rate risk is hedged upon Fund manager’s discretion |

| 9. PDM_INDIARMF | 6 High |

| The exchange rate risk is hedged upon Fund manager’s discretion |

| 10. PDM_VIET-A | 6 High |

| The exchange rate risk is hedged upon Fund manager’s discretion |

| 11. PDM_HCARERMF | 7 High |

| The exchange rate risk is hedged upon Fund manager’s discretion |

| 12. PDM_HTECH-A | 7 High |

| The exchange rate risk is hedged at least 90% of the foreign investment value |

| Alternative Investment | |||

| 1. PDM_GOLD | 8 Very high |

| Not hedging foreign exchange |

| Life Path | |||

| Equity | |||

| 1. PDM_ENS50-A | 6 High |

| - |

| Mixed | |||

| 2. PDM_SUPERRMF | 5 Moderate to high |

| The exchange rate risk is hedged at least 90% of the foreign investment value |

| 3. PDM_GOODRMF | 5 Moderate to high |

| The exchange rate risk is hedged at least 90% of the foreign investment value |

| 4. PDM_HAPPYRMF | 5 Moderate to high |

| The exchange rate risk is hedged at least 90% of the foreign investment value |