ファンドタイプ

ファンドタイプ

分配方針

ありません

設定日

8 June 2018

投資方針

本ファンドは、以下の資産に投資いたします。 1)国内外の債券、預金(同等の性質のものを含む) 2)上場株式、証券取引所に上場が予定されているIPO期間中の株式ならびに不動産投信のユニット、インフラファンドのユニット 3)本ファンドの運用はSECの基準等に則り運用会社が行い、本ファンドの純資産総額の100%を超えて投資することはありません 4)投資格付外の債券もしくは格付付与がない債券は本ファンドの純資産総額の20%以上の投資いたしません。また、未上場証券に投資することがございますが、本ファンドの純資産総額の20%以上の投資はいたしません。

ファンドマネージャー

Porntipa Nungnamjai, Thalit Choktippattana

Asset Allocation

18.39%

Instruments issued by Sovereign or Supra-national organization

11.79%

Fixed Income Instruments issued by Bank of Thailand

3.24%

Deposits and Fixed Income Instruments issued by Financial Institutions

26.49%

Fixed Income Instruments Issued by Corporates

2.48%

Other Assets

-0.68%

Other Liabilities

38.20%

Equity and Unit Trusts

0.07%

Foreign CIS - Equity

0.04%

Foreign CIS - Commodity

Transaction Details

最低購入金額 (バーツ): 500

Minimum Redemption Amount (Unit): 50 units or 500 Baht

解約資金受領日数: 解約日の3営業日後 (T+3)

Fund Subscription Period: 各営業日の15時30分まで

Fund Redemption Period: 各営業日の15時30分まで

販売会社 : Krungsri Asset Management,Online Service,AGENT

Asset Allocation (30 Jan 2026)

| Instruments issued by Sovereign or Supra-national organization | 18.16% |

| Fixed Income Instruments issued by Bank of Thailand | 10.92% |

| Deposits and Fixed Income Instruments issued by Financial Institutions | 3.27% |

| Fixed Income Instruments Issued by Corporates | 26.63% |

| Equity and Unit Trusts | 38.40% |

| Foreign CIS - Equity | 0.07% |

| Foreign CIS - Commodity | 0.05% |

| Other Assets | 3.12% |

| Other Liabilities | -0.64% |

Top Five Issuers/Guarantors

| Security Code | Issue / Issuer Rating | % of NAV |

|---|---|---|

| Debt Management Government Bond FY. B.E. 2567 NO.23 | - | 4.09% |

| Bank of Thailand Bond 7/FRB364/2025 | - | 3.95% |

| Government Housing Bank | AAA | 3.24% |

| Bank of Thailand Bond 11/364/2025 | - | 3.16% |

| PTT Plc. | AAA | 3.13% |

Mixed Funds

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Flexible Fund (KFFLEX) | -1.53% | +1.90% | +3.27% | -4.52% | -8.96% | -3.79% | -1.47% | +2.86% | 93 |

| Benchmark(4) | +0.97% | +3.91% | +2.57% | +4.72% | -0.25% | +1.23% | +2.85% | +5.30% | |

| Standard Deviation of Fund | +11.40% | +12.29% | +12.52% | +15.53% | +13.20% | +12.36% | +13.69% | +17.90% | |

| Standard Deviation of Benchmark | +5.69% | +5.49% | +6.60% | +6.62% | +5.56% | +5.27% | +6.29% | +7.95% | |

| Krungsri Flexible Dividend Fund (KFFLEX-D) | -1.69% | +2.00% | +3.24% | -3.55% | -8.52% | -3.48% | -1.29% | +5.68% | 736 |

| Benchmark(4) | +0.97% | +3.91% | +2.57% | +4.72% | -0.25% | +1.23% | +2.85% | +7.29% | |

| Standard Deviation of Fund | +11.46% | +12.36% | +12.45% | +15.18% | +12.99% | +12.21% | +13.56% | +17.79% | |

| Standard Deviation of Benchmark | +5.69% | +5.49% | +6.60% | +6.62% | +5.56% | +5.27% | +6.71% | +9.74% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Star Multiple Fund (KFSMUL) | +0.05% | -0.14% | -0.55% | +2.68% | +2.55% | +1.81% | +1.85% | +2.75% | 1,402 |

| Benchmark(5) | +0.47% | +0.65% | -0.07% | +2.83% | +2.08% | +1.15% | +2.02% | +5.06% | |

| Standard Deviation of Fund | +0.91% | +1.11% | +0.96% | +0.97% | +0.72% | +0.74% | +0.77% | +3.33% | |

| Standard Deviation of Benchmark | +0.41% | +0.47% | +0.33% | +0.47% | +0.41% | +0.50% | +1.22% | +8.72% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Happy Life Fund-A (KFHAPPY-A) | +0.86% | +1.55% | +0.18% | +3.66% | +1.64% | +1.34% | N/A | +1.05% | 515 |

| Benchmark(6) | +0.60% | +2.09% | +1.01% | +2.70% | +0.69% | +1.20% | N/A | +1.33% | |

| Standard Deviation of Fund | +1.86% | +2.03% | +2.04% | +2.51% | +2.20% | +2.11% | N/A | +2.56% | |

| Standard Deviation of Benchmark | +2.36% | +2.32% | +2.69% | +2.88% | +2.29% | +2.12% | N/A | +2.47% | |

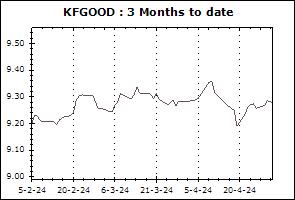

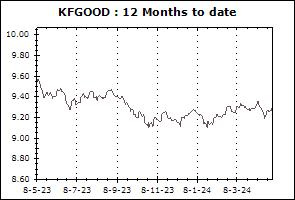

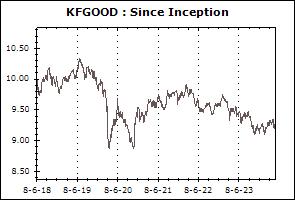

| Krungsri Good Life Fund (KFGOOD) | +1.29% | +2.66% | +0.98% | +3.40% | +0.02% | +0.77% | N/A | -0.46% | 313 |

| Benchmark(7) | +0.85% | +3.62% | +2.06% | +3.37% | -0.43% | +1.22% | N/A | +0.70% | |

| Standard Deviation of Fund | +3.81% | +4.02% | +4.24% | +5.30% | +4.60% | +4.36% | N/A | +5.08% | |

| Standard Deviation of Benchmark | +4.55% | +4.38% | +5.31% | +5.21% | +4.33% | +4.10% | N/A | +4.80% | |

| Krungsri Super Life Fund (KFSUPER) | +1.81% | +3.79% | +2.28% | +3.47% | -1.84% | -0.21% | N/A | -2.80% | 109 |

| Benchmark(8) | +1.09% | +5.16% | +3.12% | +4.05% | -1.60% | +1.23% | N/A | +0.63% | |

| Standard Deviation of Fund | +6.33% | +6.63% | +6.96% | +8.79% | +7.54% | +7.05% | N/A | +8.74% | |

| Standard Deviation of Benchmark | +6.91% | +6.69% | +7.98% | +8.08% | +6.62% | +6.20% | N/A | +7.53% | |

| Krungsri Yenjai Fund-A (KFYENJAI-A) | -0.10% | -0.04% | -0.48% | +1.75% | +1.40% | N/A | N/A | +1.40% | 5,995 |

| Benchmark(9) | +0.70% | +1.60% | +0.33% | +3.60% | +1.92% | N/A | N/A | +1.96% | |

| Standard Deviation of Fund | +1.25% | +1.20% | +1.42% | +1.14% | +1.08% | N/A | N/A | +1.04% | |

| Standard Deviation of Benchmark | +0.70% | +0.75% | +0.68% | +0.95% | +0.81% | N/A | N/A | +0.79% | |

| Krungsri The One Mild Fund-A (KF1MILD-A) | +1.65% | +4.14% | +1.11% | +5.37% | N/A | N/A | N/A | +2.89% | 228 |

| Benchmark(10) | +1.94% | +5.14% | +1.44% | +8.29% | N/A | N/A | N/A | +6.03% | |

| Standard Deviation of Fund | +3.00% | +2.88% | +3.46% | +3.85% | N/A | N/A | N/A | +3.43% | |

| Standard Deviation of Benchmark | +2.80% | +2.79% | +2.93% | +3.65% | N/A | N/A | N/A | +2.91% | |

| Krungsri The One Mild Fund-I (KF1MILD-I) | +1.65% | +4.14% | +1.11% | +5.37% | N/A | N/A | N/A | +2.99% | 121 |

| Benchmark(10) | +1.94% | +5.14% | +1.44% | +8.29% | N/A | N/A | N/A | +6.00% | |

| Standard Deviation of Fund | +3.00% | +2.89% | +3.46% | +3.85% | N/A | N/A | N/A | +3.47% | |

| Standard Deviation of Benchmark | +4.53% | +4.60% | +4.89% | +6.31% | N/A | N/A | N/A | +5.10% | |

| Krungsri The One Mean Fund-A (KF1MEAN-A) | +1.59% | +4.48% | +1.24% | +4.86% | N/A | N/A | N/A | +1.90% | 76 |

| Benchmark(11) | +2.33% | +7.23% | +2.15% | +10.56% | N/A | N/A | N/A | +7.44% | |

| Standard Deviation of Fund | +4.03% | +4.01% | +4.19% | +5.81% | N/A | N/A | N/A | +5.06% | |

| Standard Deviation of Benchmark | +4.53% | +4.60% | +4.89% | +6.31% | N/A | N/A | N/A | +5.07% | |

| Krungsri The One Mean Fund-I (KF1MEAN-I) | +1.58% | +4.48% | +1.24% | +4.85% | N/A | N/A | N/A | +1.98% | 197 |

| Benchmark(11) | +2.33% | +7.23% | +2.15% | +10.56% | N/A | N/A | N/A | +7.46% | |

| Standard Deviation of Fund | +4.03% | +4.01% | +4.19% | +5.81% | N/A | N/A | N/A | +5.09% | |

| Standard Deviation of Benchmark | +2.80% | +2.79% | +2.93% | +3.65% | N/A | N/A | N/A | +2.93% | |

| Krungsri The One Max Fund-A (KF1MAX-A) | +1.87% | +5.72% | +1.50% | +6.27% | N/A | N/A | N/A | +2.31% | 50 |

| Benchmark(12) | +3.53% | +10.92% | +3.24% | +15.49% | N/A | N/A | N/A | +11.57% | |

| Standard Deviation of Fund | +5.39% | +5.38% | +5.39% | +7.76% | N/A | N/A | N/A | +6.76% | |

| Standard Deviation of Benchmark | +6.75% | +6.99% | +7.10% | +9.92% | N/A | N/A | N/A | +7.93% | |

| Krungsri The One Max Fund-I (KF1MAX-I) | +1.87% | +5.72% | +1.50% | +6.27% | N/A | N/A | N/A | +2.39% | 222 |

| Benchmark(12) | +3.53% | +10.92% | +3.24% | +15.49% | N/A | N/A | N/A | +11.70% | |

| Standard Deviation of Fund | +5.39% | +5.38% | +5.39% | +7.76% | N/A | N/A | N/A | +6.78% | |

| Standard Deviation of Benchmark | +6.75% | +6.99% | +7.10% | +9.92% | N/A | N/A | N/A | +7.97% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Dividend Balance 70/30 Fund-D (KF-DB70-D) | +1.61% | +4.20% | +3.10% | +1.13% | -4.46% | -1.62% | N/A | -0.03% | 3 |

| Benchmark(13) | -0.06% | +6.55% | +3.69% | +3.71% | -4.60% | +0.92% | N/A | +4.18% | |

| Standard Deviation of Fund | +8.51% | +8.74% | +9.40% | +11.90% | +9.89% | +9.14% | N/A | +9.59% | |

| Standard Deviation of Benchmark | +12.98% | +13.37% | +11.68% | +17.59% | +13.98% | +12.91% | N/A | +13.63% | |

Remark