News/Announcement

Promotions/Fund Highlight

Krungsri Thai ESG Funds: Save Tax with Sustainable Return Potential

Get tax deductions up to 300,000 baht and enjoy special promotions.*

Krungsri Thai ESG Funds: Tax-saving opportunities with sustainable return potential

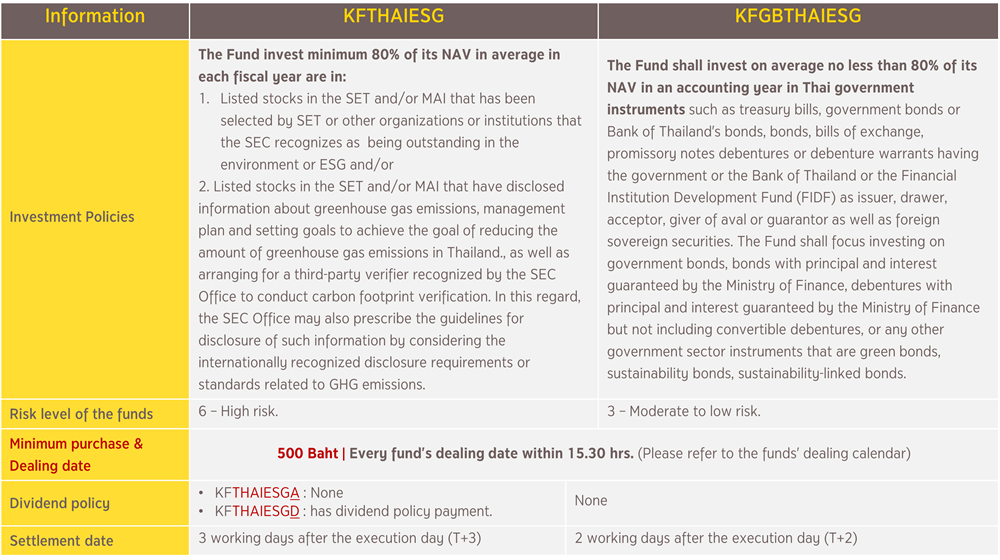

- KFTHAIESG (Krungsri Enhanced SET Thailand ESG Fund)

- KFGBTHAIESG (Krungsri Government Bond Thailand ESG Fund)

*Receive KFCASH-A units worth THB 100 for every THB 50,000 cumulative investment in participating funds under the terms and conditions.

Two investment options for sustainable growth

KFTHAIESG Grow with leading ESG-driven Thai equities and capture opportunities to outperform the benchmark.

- Integrates ESG factors across the investment process to support long-term sustainability.

- Focuses on leading Thai companies with outstanding ESG practices, aligned with the SETESG Index - the benchmark reflecting price movements of listed companies with high ESG ratings and liquidity.

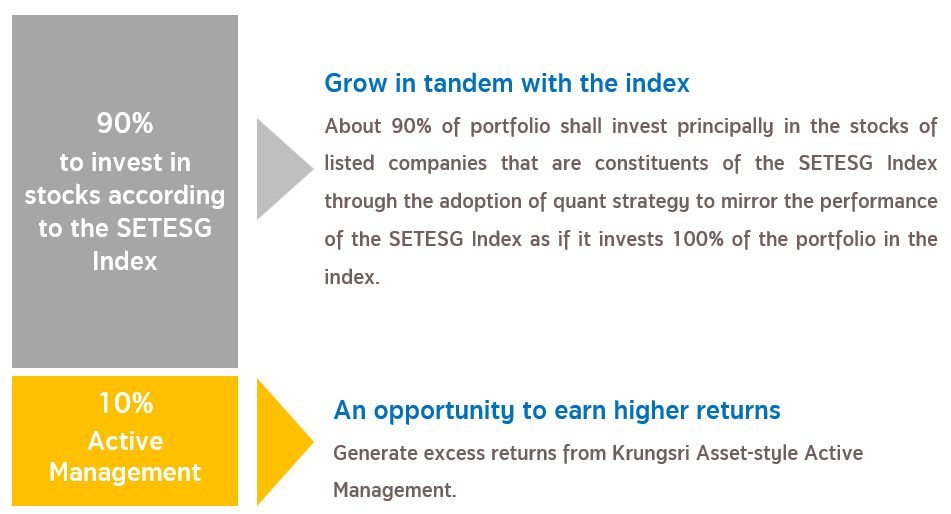

- Aims to deliver returns beyond the benchmark through an active strategy: About 90% of the portfolio mirrors the SETESG Index via quantitative strategy. The remaining 10% follows Krungsri’s active management approach to enhance return potential. (Source: Krungsri Asset Management, Oct 2025)

- KFTHAIESG offers two share classes: KFTHAIESGA (Accumulation class - No dividend payment) and KFTHAIESGD (Dividend paying unit).

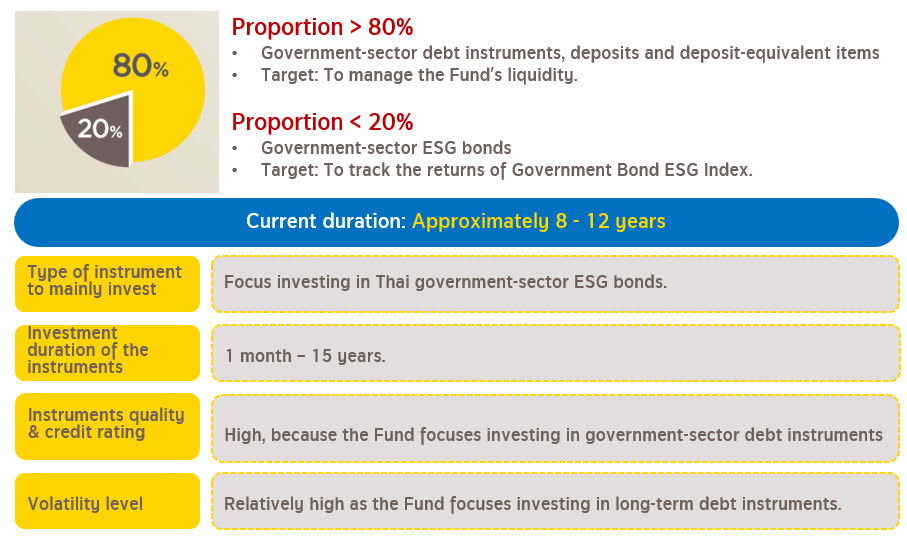

KFGBTHAIESG A stable path to growth with Thai government ESG bonds.

- Factors Supporting Investment in Thai Bonds: Thailand’s bond market stands to benefit from the global and domestic downtrend in interest rates. The U.S. Federal Reserve has already entered a monetary easing cycle and is expected to cut rates two more times this year. Domestically, Thailand’s economic growth is showing signs of slowing, while inflation remains negative - conditions that support a continued accommodative stance by the Bank of Thailand. Krungsri Asset Management expects the policy rate to be reduced by another 2–3 times to a range of 0.75% – 1.00% by 2026. (Source: Krungsri Asset Management, Oct'25)

- Promote portfolio and global sustainability through investment in high-credit-quality government sustainability bonds.

- Diversify away from equity volatility while capturing potential benefits from the current interest rate environment.

- Suitable for tax-saving investors with low risk tolerance or those looking to lower overall portfolio risk.

- Investment Outlook and Strategy Framework

Source: Krungsri Asset Management, Oct'25 The investment strategy framework above may differ from the fund’s actual portfolio and is subject to change depending on market conditions, available securities, and the fund manager’s discretion.

Summary of Krungsri Thai ESG Funds

Enhance your tax-saving and retirement return potential with our top RMF Funds, click here for more info

For More Information / Fund Prospectus: Contact Krungsri Asset Management Company Limited at 0 2657 5757, press 2.

- Thai ESG Funds promote long-term savings and support sustainable investment in Thailand. Investors should understand the product features, expected returns, risks, and review the tax benefits outlined in the investment handbook before making investment decisions. Past performance does not guarantee future results.

- This document is based on reliable sources as of the date shown, but the Company does not guarantee the accuracy, reliability, or completeness of the information and reserves the right to make changes without prior notice.

- Investors must study the tax benefit conditions in the investment handbook. Unitholders will not receive tax benefits if investment conditions are not met and must return any tax benefits received within the specified period, otherwise additional payments and/or penalties may apply under the Revenue Code.

*Conditions for Annual Accumulated Investment Promotion

- This promotion is only available for individual investors who invest in RMF and Thai ESG funds managed by Krungsri Asset Management (“the Company”), excluding KFCASHRMF and any new RMF/Thai ESG funds in 2025 that the Company may announce as exempt. Eligible investments must be made between 2 Jan – 30 Dec 2025.

- Investors must hold the fund units purchased during the promotion period until 31 Mar 2026, which is the date the Company calculates the accumulated net investment to determine eligibility for KFCASH-A units.

- Accumulated net investment refers to the total investment from purchases and switches from non-RMF/Thai ESG funds, and transfers from other AMCs’ RMF/Thai ESG funds, excluding transfers from PVD to RMF, minus redemptions, switches to non-participating RMF/Thai ESG funds, or transfers to other AMCs. For redemptions, switches, and transfers from units held as of 30 Dec 2024, the Company uses a FIFO method, in line with Revenue Department tax rules.

- If an investor has multiple accounts, the Company will combine the accumulated net investment from all accounts based on the national ID number.

- The Company will transfer KFCASH-A units according to the investment and eligibility conditions by 30 Apr 2026, based on the unit value on the transfer date.

- Units received from monthly RMF/Thai ESG investments over 12 consecutive months in 2025 (including other promotions announced by the Company) are not eligible for this promotion.

RMF units transferred from PVD are eligible under the PVD-to-RMF promotion but not under this promotion. - Switches from all LTF funds do not count towards this promotion, as they are eligible under the LTF-to-Thai ESG/RMF 2025 promotion.

- Investments by corporate investors, institutions, and provident funds are not eligible for this promotion.

- The Company reserves the right to change the promotion conditions without prior notice. In case of dispute, the Company’s decision is final.

- Conditions for Fund Purchases Using Credit Cards

- Investors can use eligible Krungsri Consumer credit cards, including: Krungsri Credit Cards (all types), HomePro Visa Platinum, Manchester United Credit Card, AIA Visa, Siam Takashimaya Credit Card, Krungsri NOW Platinum, Central The 1 Credit Card, Lotus Credit Card, Krungsri First Choice Visa, and XU Digital Credit Card, to purchase **RMF/Thai ESG fund units (excluding KFCASHRMF, KFAFIXRMF, KFGOVRMF, KFLTGOVRMF, KFMTFIRMF, KFGBTHAIESG-A, and any RMF/Thai ESG 2025 funds that may be announced as exempt).

- Purchases using credit cards are not eligible for the promotion and do not earn credit card reward points.

- Credit card usage is subject to the terms and conditions set by the Company and the credit card issuer.

- The Company reserves the right to change credit card purchase conditions without prior notice. In case of dispute, the Company’s decision is final.

Investment restrictions & risks associated for KFGBTHAIESG

Investment restrictions

Risks associated with investment of an ESG fund

- Since the investment framework of the Fund focuses investing in government bonds, bonds with principal and interest guaranteed by the Ministry of Finance or debentures with principal and interest guaranteed by the Ministry of Finance but not including convertible debentures, that are green bonds, sustainability bonds or sustainability-linked bonds, the scope of investment of the Fund is therefore limited.

Risks associated with investment of an ESG fund

- The risk arises from investing mainly in government bonds, bonds with principal and interest guaranteed by the Ministry of Finance or debentures with principal and interest guaranteed by the Ministry of Finance but not including convertible debentures, that are green bonds, sustainability bonds or sustainability-linked bonds, which causes the fund to lose the opportunity to invest in general debt instruments that may offer better returns.

- The risk arises from relying the ESG data on third party’s sources for analyzing and selecting the securities which may be incomplete or inaccurate. In this regard, the Management Company will search for additional data from various sources to ensure more accuracy of the data used in the analysis.

- The risk arises from investing in instruments that may not in accordance with the ESG investment framework as determined by the Fund. For example, investing in the instrument over which the issuer does not have controlling power or in the case where the counterparties of the issuer (such as venders, contractors and/or service providers) may not comply with the ESG investing framework that is beyond the recognition of the Management Company.

- Liquidity risk may arise from the Fund’s inability to buy or sell instruments at the appropriate prices or timing due to the ESG criteria conditions set by the Fund.