News/Announcement

Promotions/Fund Highlight

Krungsri Yenjai Fund (KFYENJAI) ...Resilient Through Market Volatility.

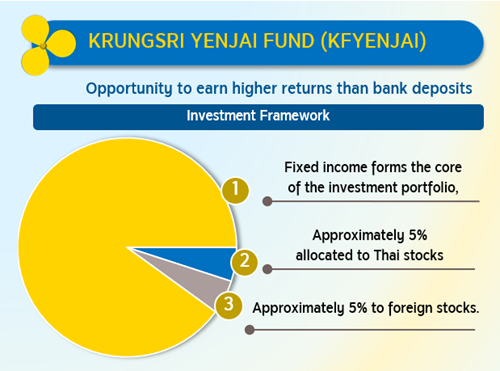

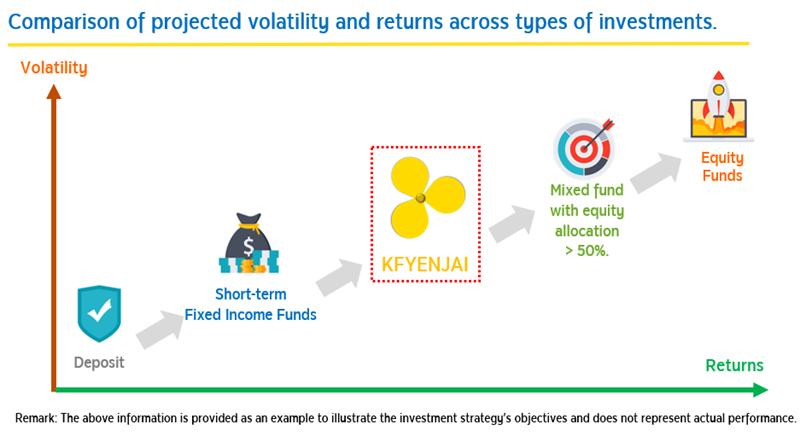

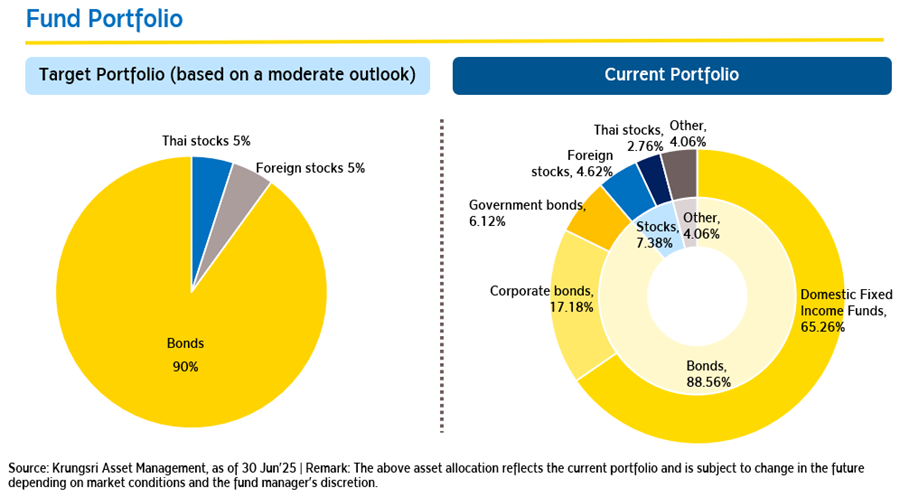

An opportunity to earn potentially higher returns than deposits while keeping volatility low. The fund blends fixed income, Thai equities, and global equities into a well-balanced portfolio - designed for investors seeking better returns than deposits with comfort and controlled risks.

-

Focus on fixed income for stability while applying active strategies to capture long-term return opportunities.

Add exposure to Thai and global equities to enhance wealth potential, creating an opportunity for excess returns without too much excessive risk.

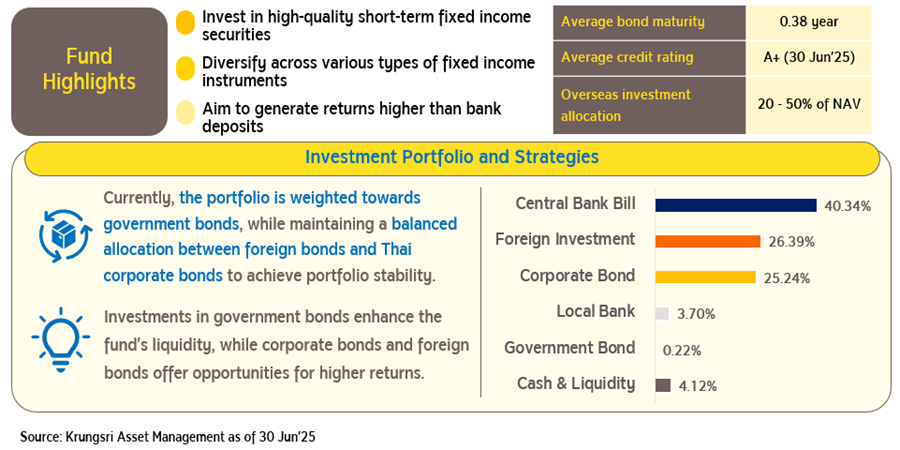

1. Fixed Income Strategy

- Currently, the fund focuses on direct investments in government bonds, with the largest allocation of 53.73% in Bank of Thailand bonds, followed by other government bonds and corporate bonds. The fund also holds a portion of domestic fixed income funds.

2. Thai & Global Equity Strategy

- Thai Equities: Passive investment approach, aiming to achieve returns close to the SET50FF TRI index. Current key sector allocations include Bank (26%), Energy (20%), and Electronics (9%).

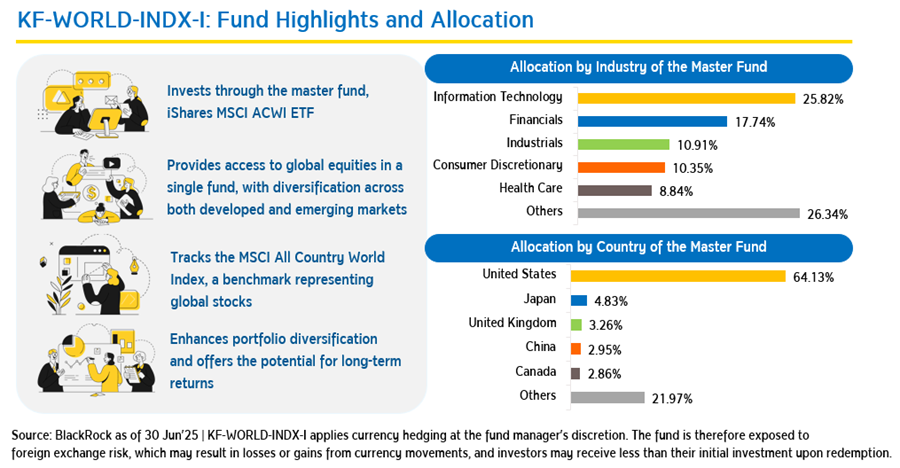

- Global Equities: Invests via Thai-domiciled funds with global mandates, across both passive and active styles, with flexible allocation based on changing market outlook.

- Top holding is Krungsri World Equity Index Fund – I (KF-WORLD-INDX-I), followed by Thai equities: DELTA, PTT, KBANK, and SCB*

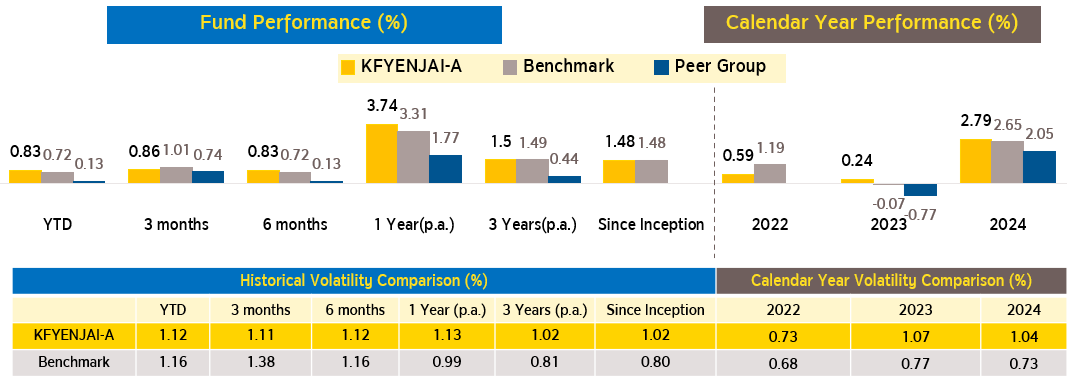

Fund Performance: KFYENJAI-A

Source: Krungsri Asset Management, as of June 30, 2025 | Quartile rank data from Morningstar, within the Conservative Allocation category | The Morningstar rating is not related to the mutual fund ratings provided by the Association of Investment Management Companies (AIMC) | KFYENJAI-A was incepted on June 29, 2022 | For the inception year, performance is presented from the inception date until the end of that calendar year | The Fund’s benchmark consists of: 1) ZRR Bond Index with an average maturity of 2 years, 45.00%. 2) 1-year fixed deposit rate (individual, THB 1 million) average of Bangkok Bank, Kasikorn Bank, and Siam Commercial Bank, net of tax, 45.00%. 3) SET50 Free Float Total Return Index (SET50FFTRI), 5%. 4) Morningstar DM TME NR USD Index (in USD) 5%, adjusted for hedging costs to THB at the return calculation date. | Peer group: Average return of funds within the Conservative Allocation category | This fund performance report has been prepared in accordance with the mutual fund performance measurement standards of the Association of Investment Management Companies (AIMC).

Investment Policy: KFYENJAI-A

- May invest in a combination of the following:

- Invest in debt instruments, deposits or deposit-equivalent instruments both local and foreign in average of fund accounting year totaling at least 70% of NAV.

- Invest no more than 15% of NAV in average of fund accounting year in listed stock

- Invest no more than 15% of NAV in average of fund accounting year in REIT and/or Property Fund or Foreign REIT.

- The fund may invest no more than 79% of NAV in average of fund accounting year in other units of mutual funds under management of the Company.

- Minimum subscription: 500 Baht.

- Risk level: 5 – Medium to High. | FX risk: Fully hedged (>90% of overseas investments).

For more information or fund prospectus: Krungsri Asset Management Co., Ltd. Tel: 02-657-5757 press 2 | Email: krungsriasset.mktg@krungsri.com