News/Announcement

Promotions/Fund Highlight

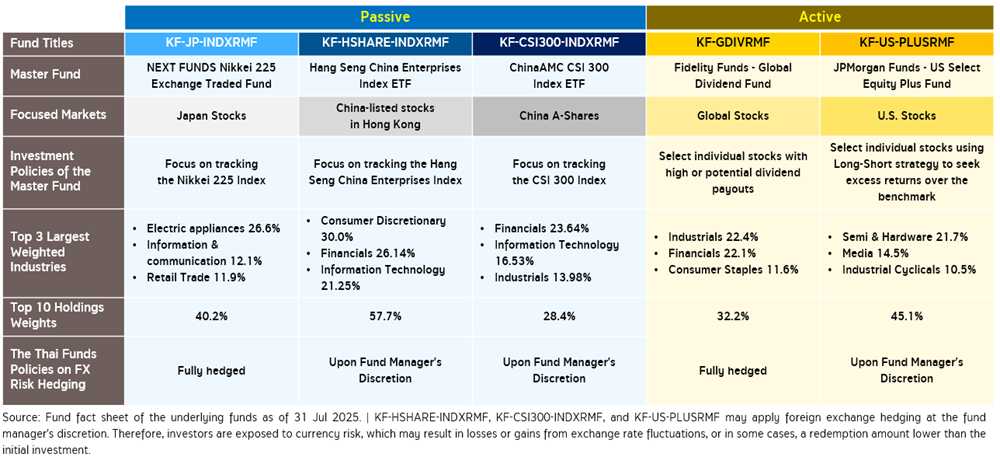

New RMF: Select Global Equity Trends for Focused Return Opportunities

Introducing 5 new RMFs, both Active and Passive Funds, designed to capture growth potential from promising global equity trends - giving you more than just tax-saving benefits.

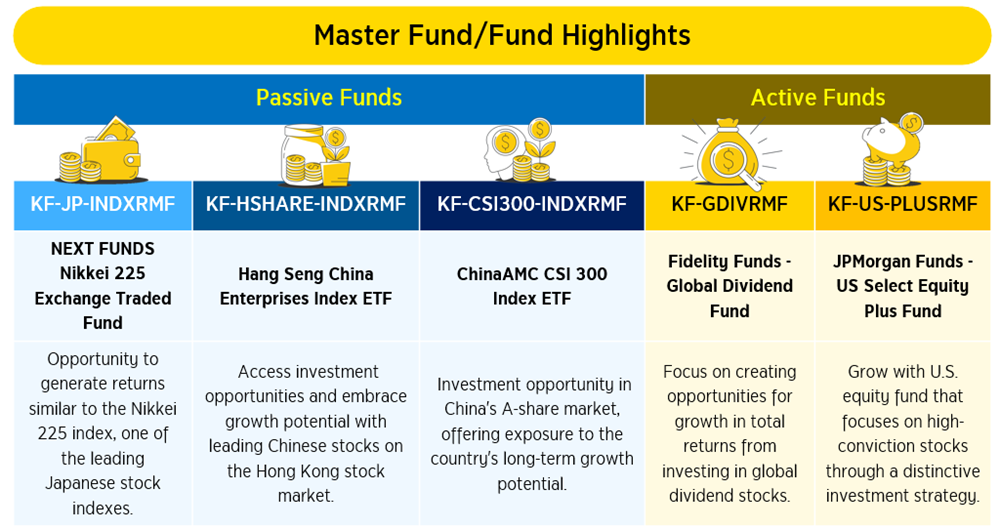

- KF-JP-INDXRMF: Opportunity to generate returns in line with the growth of Japan’s leading equity index, Nikkei 225

- KF-HSHARE-INDXRMF: Capture the growth potential of China’s leading companies represented in the Hang Seng China Enterprises Index listed on the Hong Kong Stock Exchange

- KF-CSI300-INDXRMF: Access China’s new economy through the top 300 A-share companies listed in Shanghai and Shenzhen, for returns aligned with the CSI 300 Index

- KF-GDIVRMF: Strengthen your portfolio with global dividend leaders - where consistent dividend income contributes to potential total returns and helps cushion downside risks

- KF-US-PLUSRMF: Invest in U.S. equities with a distinctive strategy combining core and extension portfolios, aiming for enhanced return potential

Receive additional KFCASH-A units worth THB 100 for every accumulated investment of THB 50,000 subject to T&Cs*

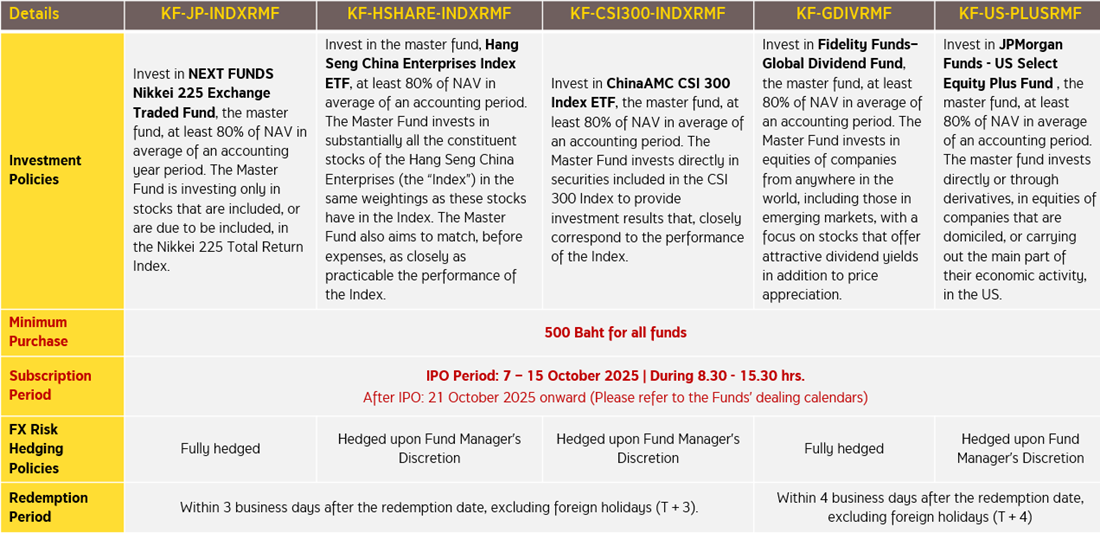

Minimum investment of 500 THB and can purchase with participating Krungsri credit cards.

(Fund purchases are not eligible for promotions or reward points.)

*For more details, please click here

Fund #1: KF-JP-INDXRMF (Krungsri Japan Equity Index RMF)

Offering opportunities to grow along with the recovery of the Japanese equity market and economy, supported by rising wages and stronger domestic consumption, alongside positive corporate earnings outlook.

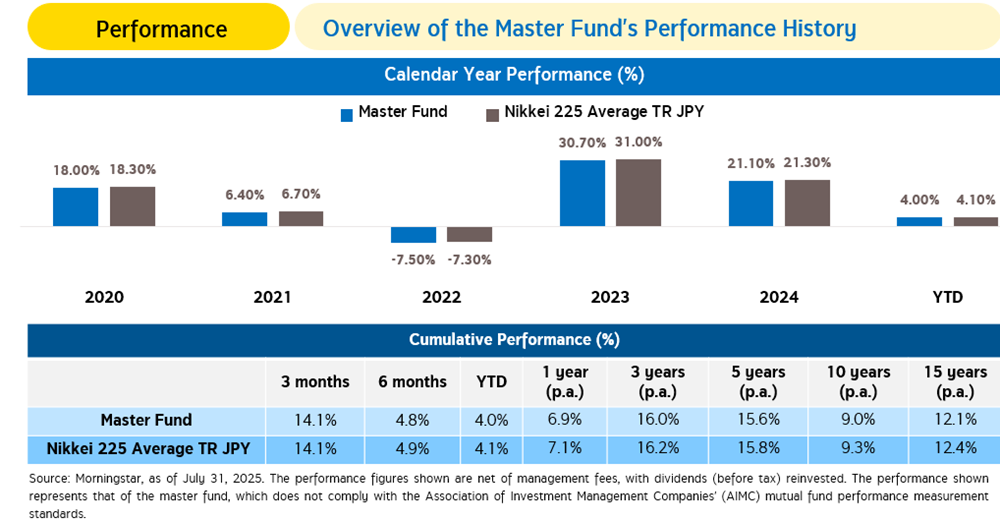

Master Fund: NEXT FUNDS Nikkei 225 Exchange Traded Fund

- One of Japan’s leading Nikkei 225 ETFs, managed by Nomura Asset Management, seeking to deliver returns closely aligned with the Nikkei 225 Index — Japan’s key benchmark of 225 highly liquid companies across diverse industries, including electronics, IT, retail, and pharmaceuticals, reflecting Japan’s overall economic momentum. (Source: Nomura Fact Sheet, as of 31 Jul 2025)

- Performance of the Master Fund

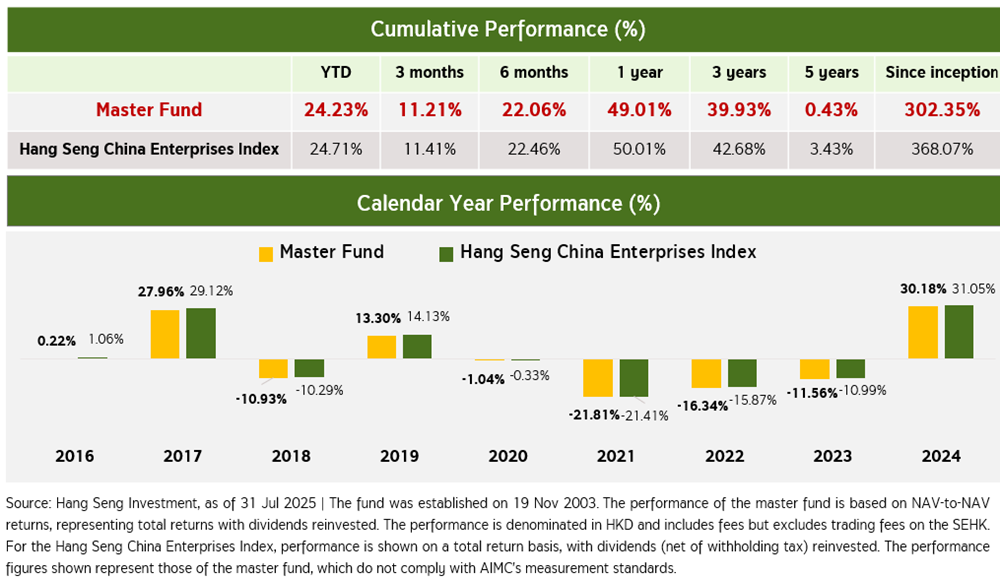

Fund #2: KF-HSHARE-INDXRMF (Krungsri China H Shares Equity Index RMF)

Capture growth potential from the expanding economies of China and Hong Kong, driven by China’s AI adoption plan aiming to integrate AI across key industries by 2030 to enhance efficiency and support new economic drivers. Additionally, Chinese listed companies have seen EPS reach record highs, underscoring the resilience of the corporate sector. (Source: Bloomberg, as of 17 Sep 2025)

Master Fund: Hang Seng China Enterprises Index ETF

- Seeks to replicate the performance of the Hang Seng China Enterprises Index, which represents 50 large and liquid Chinese enterprises listed in Hong Kong, spanning key sectors such as technology and finance. Its proven performance history demonstrates a close alignment with the benchmark index.

- The top five holdings are major global brands in the financial and technology sectors, namely Tencent Holdings (8.25%) / China Construction Bank (7.97%) / Alibaba Group Holding - W (7.69%) / Xiaomi - W (7.57%) / Meituan - W (6.12%) (Source: Hang Seng Investment, as of 31 Jul 2025)

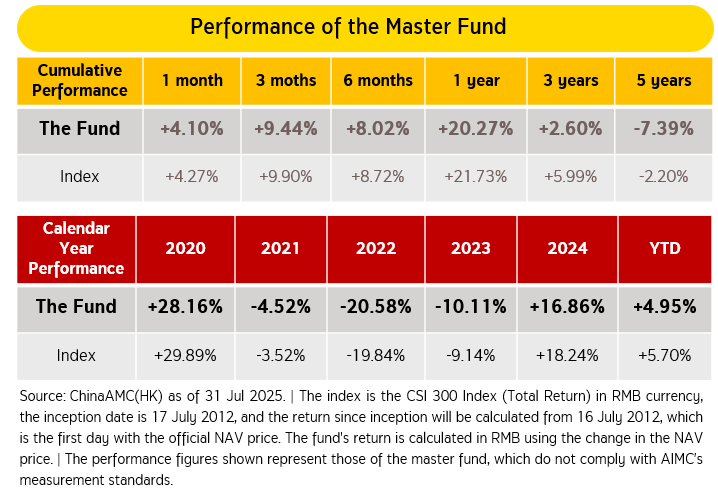

Fund # 3 KF-CSI300-INDXRMF (Krungsri China Equity CSI 300 RMF)

Tap into future growth potential from China’s evolving economy - supported by slowing bond yields attracting investors back to equities, expectations of further economic stimulus measures improving investment sentiment, and continued share buybacks signaling confidence in corporate value.

Master Fund: ChinaAMC CSI 300 Index ETF

- One of the world’s largest ETFs focusing on China A-shares, comprising the top 300 largest and most liquid companies listed on the Shanghai and Shenzhen Stock Exchanges. It represents a broad range of industries, reflecting China’s long-term growth potential and the rise of its “New Economy” sectors.

- The master fund diversifies its investments across various industries, including financials, IT, industrials, and consumer goods, with major holdings such as Kweichow Moutai, Contemporary Amperex Technology (CATL), Ping An Insurance Group, and CHINA MERCHANTS BANK.

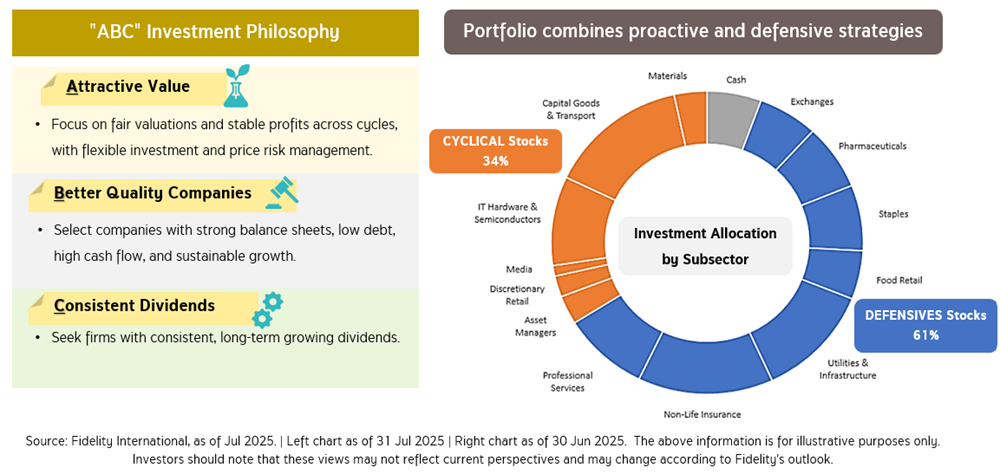

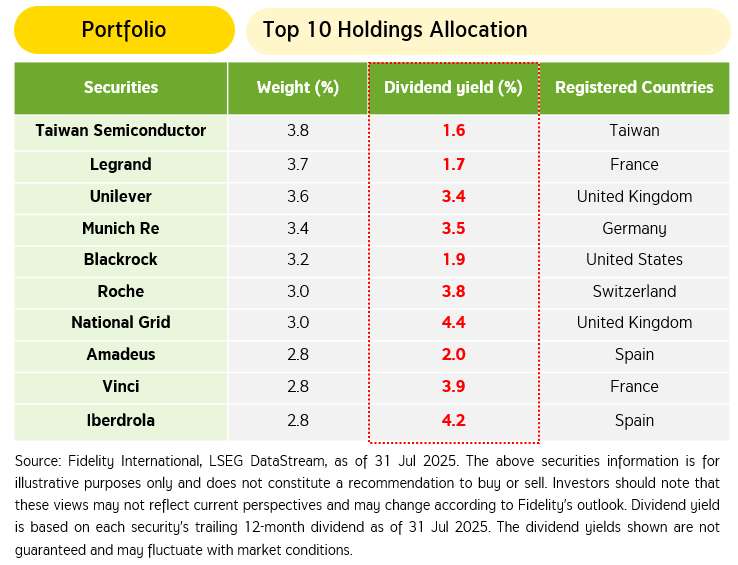

Fund # 4 KF-GDIVRMF (Krungsri Global Dividend RMF)

A quality-driven global dividend strategy focused on consistent performance and attractive total return potential.

The Master Fund: Fidelity Funds - Global Dividend Fund

- A blended active and passive portfolio investing in companies with consistent and rising dividend payouts and low earnings volatility, helping protect capital during downturns while offering opportunities for steady total returns.

- As a result, KF-GDIVRMF stands out from other global dividend funds:

- Diversified exposure to high-quality cyclical stocks (approx. 30%) to broaden investment opportunities

- Avoids value traps - low-priced stocks with limited appreciation potential

- Focuses on companies with moderate dividend yields today but strong dividend growth prospects

- Ensures the overall portfolio dividend yield exceeds the global average by at least 25%, emphasizing resilient businesses at attractive valuations

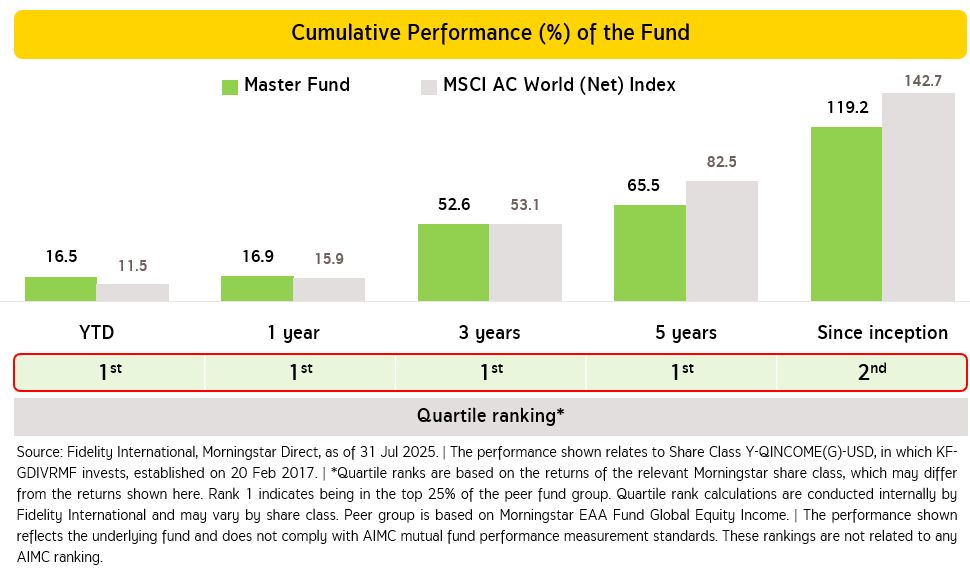

- The Master Fund’s performance reflects its strong potential for sustainable long-term growth.

Fund # 5 KF-US-PLUSRMF (Krungsri US Select Equity Plus RMF)

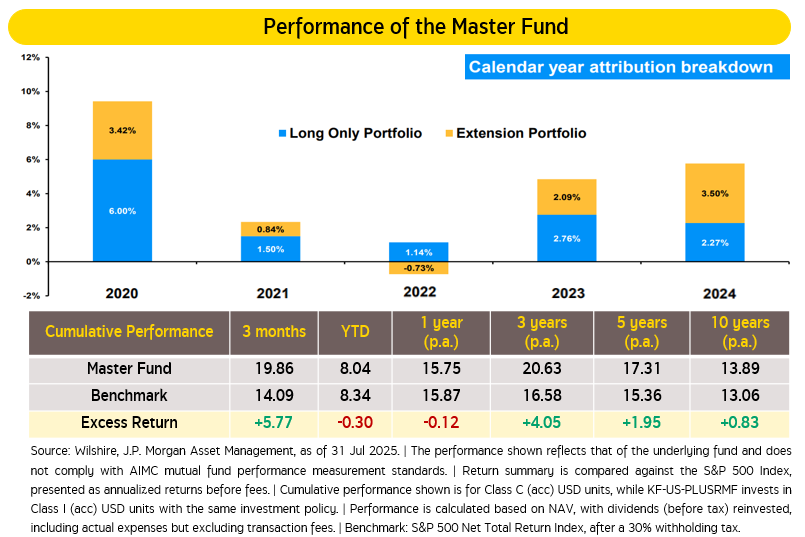

Invest comprehensively in U.S. equities through a fund designed to move broadly in line with the market - yet with more potential to generate excess returns.

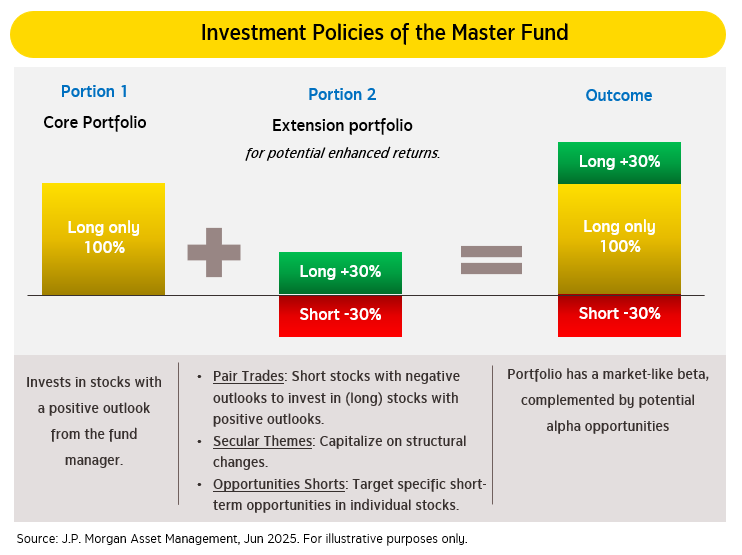

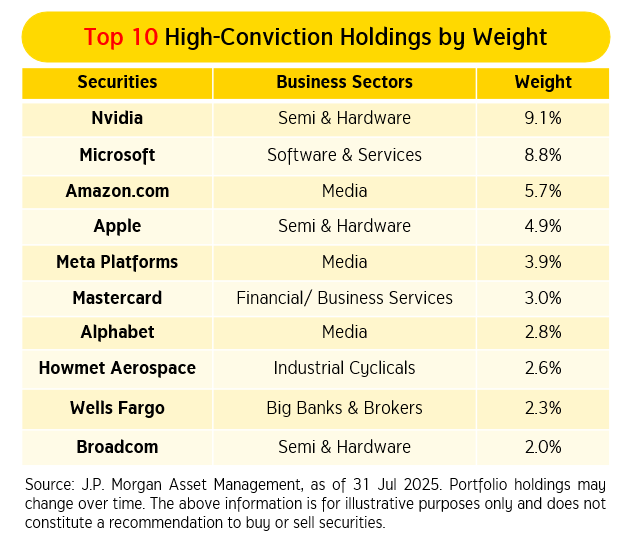

The Master Fund: JPMorgan Funds - US Select Equity Plus Fund

- Aims to outperform the benchmark with market-like volatility, differing from traditional active funds through its core portfolio of high-conviction equities and the extention portfolio using long-short strategy applied within each industry.

- The Master Fund provides diversified exposure across all major sectors, offering multiple return opportunities.

- Rated 5 stars by Morningstar, with a proven performance record exceeding both the market and peer group averages. (Source: J.P. Morgan Asset Management, Morningstar, as of 31 Jul 2025. Morningstar rating is independent of AIMC ranking.)

- RMFs are long-term retirement-oriented funds. Investors should understand the product features, returns, risks, and tax benefits in the investment prospectus before making an investing decision. Past performance does not guarantee future results.

- This material is based on reliable sources as of the date shown. Krungsri Asset Management cannot guarantee the accuracy, reliability, or completeness of the information and reserves the right to change information without prior notice.

- KF-HSHARE-INDXRMF, KF-CSI300-INDXRMF, and KF-US-PLUSRMF employ foreign exchange risk hedging at the fund manager’s discretion. Investors are therefore exposed to FX risk, which may result in gains, losses, or redemption proceeds lower than the original investment amount.

For more information or to request fund prospectuses, please contact: Krungsri Asset Management Co., Ltd. Tel: 02-657-5757 (Press 2)

*Annual RMF / Thai ESG Promotion 2025

Special promotion: For every 50,000 Baht of investment in Krungsri Asset's participating RMF and Thai ESG funds,

receive KFCASH-A valued at 100 Baht with terms and conditions applied*

A blend of various investment options across complete asset classes seizing all trends and growth potentials for your tax deduction benefits with an opportunity for long-term returns.

*Investment conditions & entitlement to annual investing promotion

For investment manual of RMF/ Thai ESG, click here

receive KFCASH-A valued at 100 Baht with terms and conditions applied*

A blend of various investment options across complete asset classes seizing all trends and growth potentials for your tax deduction benefits with an opportunity for long-term returns.

- For info of RMF, click here

- For info of Thai ESG funds, click here

- Investors can use Krungsri participating credit cards to purchase RMF / Thai ESG (except KFCASHRMF, KFAFIXRMF, KFGOVRMF, KFLTGOVRMF, KFMTFIRMF, KFGBTHAIESG-A, and any new RMF/ Thai ESG in 2025 according to the Company’s announcement for exemption. Please see more details on the terms and conditions stated below.)

- And now you can redeem your credit card points of all Krungsri credit card types (except Krungsri Corporate Card) to invest in any RMF/ Thai ESG through @ccess Mobile Application and @ccess Online Service on a condition that 1,000 points = 100 Baht of fund units. | See terms and conditions, click here.

*Investment conditions & entitlement to annual investing promotion

- This promotional campaign does apply only to individual investors who invest in RMF/ Thai ESG funds managed by Krungsri Asset Management Co., Ltd. (“the Company”), except KFCASHRMF and any other RMF/ Thai ESG funds 2025 according to the Company's announcement for exemption. The eligible accumulated investment amount must be proceeded during 2 Jan. - 30 Dec'25.

- Investors must hold investment units invested during this promotion period until 31 Mar'26, which is the date the Management Company will calculate the net accumulated investment for KFCASH-A units’ entitlement.

- The net accumulated investment amount consists of (1) a total investment amount of subscription and switch-in transactions from other non-RMF, non-Thai ESG of the Management Company and (2) transfers of RMF/ Thai ESG from other management companies, excluding the transfers from PVD to RMF, being deducted with the total investment amount of redemption, switch-out transactions to RMF/ Thai ESG not participating in this promotion or other fund of the Management Company, and transfers from RMF/ Thai ESG units of the Management Company to other companies. The exception will be allowed only when the redemption, switch-out and transfer are made from the outstanding balances on 30 Dec'24 calculated with FIFO basis by the Management Company, according to tax benefit conditions specified by the Revenue Department.

- For investors having more than one fund account, the Management Company will count the net accumulated investment amount from all their accounts by considering the ID Card number.

- The Management Company will transfer KFCASH-A units according to the investment and entitlement conditions to investors within 30 Apr'26. KFCASH-A units will be calculated at its NAV price on the allocation date.

- Net eligible investment units from RMF/ Thai ESG Regular Investment Promotion for 12 consecutive months from Jan. – Dec'25 (including other new promotion as announced from the Company) will be not considered for entitlement of this above-mentioned promotion.

- RMF units transferred from PVD will be eligible only for RMF-for-PVD promotion, but not for this promotion mentioned above.

- The switched amount from all LTF funds will not be counted as an investment eligible for this promotional offer, as it already qualifies for the LTF-to-Thai ESG/RMF 2568 switching promotion.

- This promotional campaign is not applicable to the investments made by juristic/ institutional investors and provident funds.

- The Management Company reserves the rights to change the promotional conditions without giving prior notice. In case of any dispute, the Management Company’s decision shall be deemed final.

For investment manual of RMF/ Thai ESG, click here