Plan Your Investment

Navigating Global Fixed Income: Expert Perspectives by PIMCO & KSAM

Krungsri Asset Management Company Limited (Krungsri Asset Management), in collaboration with PIMCO, one of the world’s leading fixed income investment managers, recently hosted a seminar entitled “Navigating Global Fixed Income: Expert Perspectives by PIMCO & KSAM”, where experts from both companies were invited to share their insights into the outlook for global bond markets, the direction of U.S. monetary policy, and opportunities for Thai investors to access world-class strategies through the PIMCO GIS Income Fund, the master fund for Krungsri Asset Management’s foreign fixed income funds.

Deep Dive into Experts Insights

- Mr. Kiattisak Preecha-anusorn, CFA, Chief Alternative Investment, Krungsri Asset Management

- Ms. Lily Feng, Vice President, Product Strategist from PIMCO

- The present environment offers a compelling entry point into fixed income, supported by several factors that are broadening return opportunities.

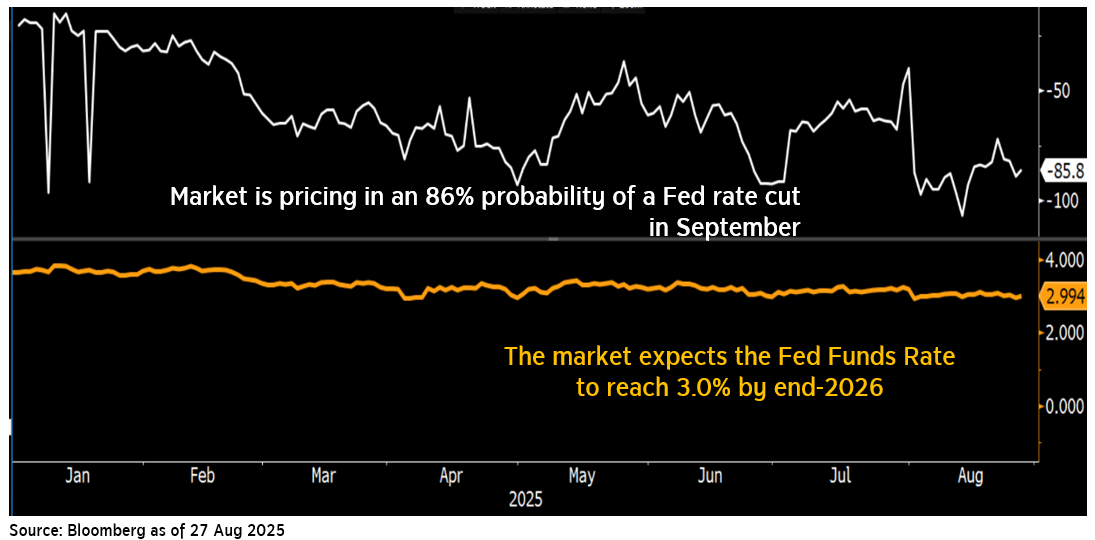

- We have seen significant shifts in U.S. monetary policy, with the Federal Reserve signaling potential interest rate cuts, market consensus indicating an 86% chance of easing by September 2025, with as many as six cuts expected through 2026; these factors would lower the Fed Funds Rate to around 3%, reflecting a cooling labor market, tariff-driven inflationary pressures, and a steepening U.S. Treasury yield curve. While these dynamics bring uncertainty, they also create attractive opportunities for fixed income investors.

Insights from Krungsri Asset Management

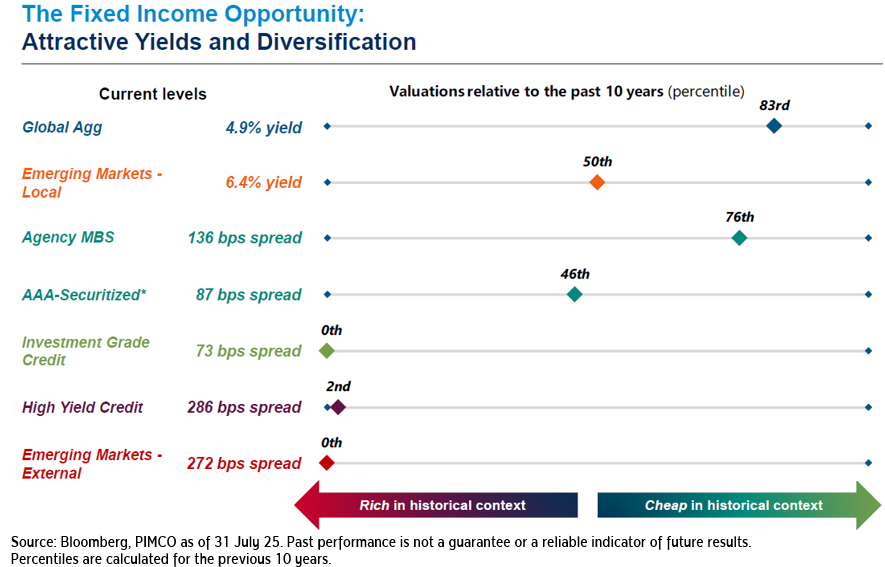

- High-quality bonds are now yielding 4 – 5%(1) with relatively low credit risk, while potential rate cuts could also unlock capital gains ((1)Source: Bloomberg, as of 15 Jul 2020 – 26 Aug 2025.).

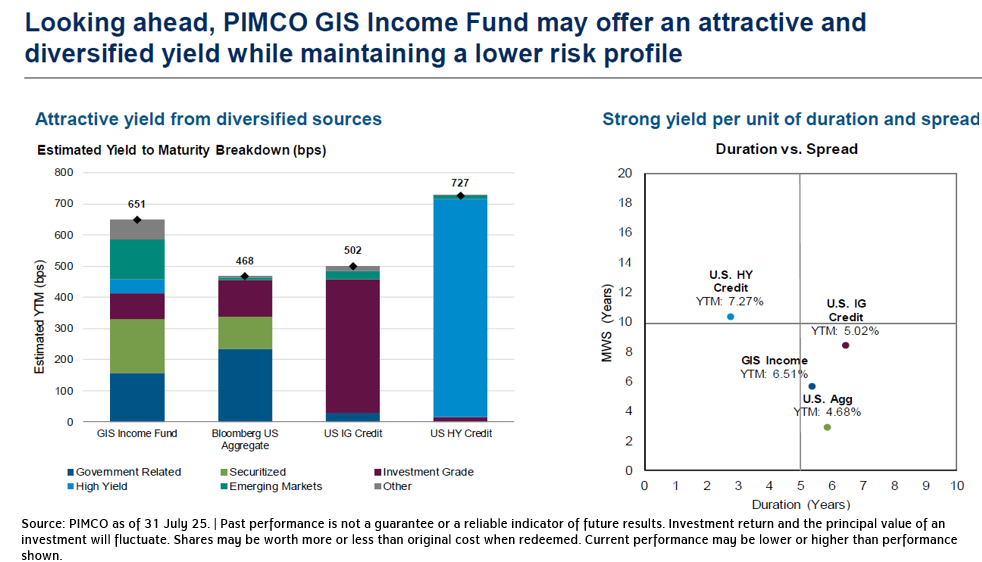

- Although inflation risks could slow monetary easing, Mr. Kiattisak viewed these as short-term concerns, emphasizing that fixed income continues to provide both attractive yields and essential diversification. He also highlighted PIMCO’s proven ability to manage volatility, citing that over the past two years, despite the 10-year U.S. Treasury yield hovering around 4.2% with flat prices, PIMCO delivered a return of 18.5%. Compared with benchmarks such as the U.S. Aggregate Index and U.S. High Yield Bonds, PIMCO’s funds consistently outperformed with lower risk, thanks to its active management and tactical allocation.

Insights from PIMCO

- PIMCO GIS Income Fund’s flexible strategy is currently tilted toward higher-quality fixed income, particularly government bonds and agency mortgage-backed securities (Agency MBS), which remains attractively priced, sustaining yields of around 6%, while benefiting from the backing of the U.S. government in case of default. Compared to Treasuries yielding about 4%, Agency MBS also provides an additional spread of 130 -150 bps while maintaining liquidity. With an average portfolio credit rating of AA- and yields above 6%, Agency MBS represent both quality and depth, being the second-largest fixed income market after Treasuries.

- Talking about PIMCO’s disciplined valuation framework, which avoids overstretched sectors and instead targets areas with more attractive pricing and room for capital appreciation, its selective approach, combined with duration management and active selection of fixed income instruments, has enabled the fund to deliver steady returns for investors, even amid market uncertainty.

Experts’ Summary

- With global monetary policy entering a new phase, KSAM and PIMCO believe this is a highly opportune time for investors to consider fixed income. By combining PIMCO’s global expertise with Krungsri Asset Management’s local market insight, Thai investors can gain access to institutional-grade fixed income strategies designed to balance income, risk management, and long-term growth.

- Looking ahead, Ms. Feng expects that the master fund will continue to deliver solid returns, and if interest rates are cut, investors may also gain from additional price appreciation.

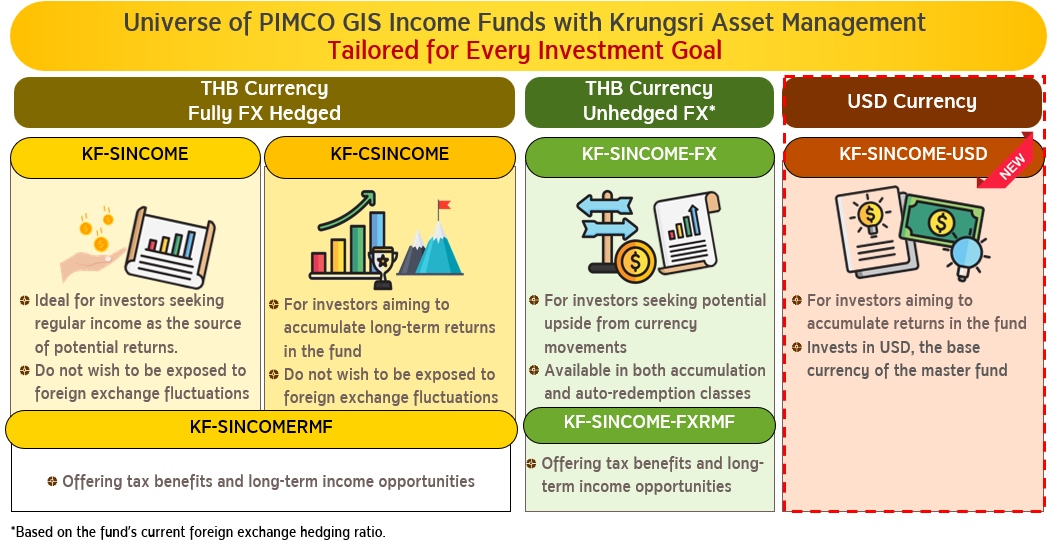

- According to the fixed income funds offered by Krungsri Asset Management, there are seven fixed income funds investing in the PIMCO GIS Income Fund, catering to a full range of investor needs:

- KF-CSINCOME : suitable for investors seeking to accumulate returns within the fund.

- KF-SINCOME: designed for those looking for regular income through the fund’s automatic redemption policy; and additional choices for investors seeking potential extra returns from currency movements, namely the accumulation share class, KF-SINCOME-FX-A and the automatic redemption share class, KF-SINCOME-FX-R

- The latest addition! KF-SINCOME-USD allowing direct investment in U.S. dollars, the same currency as the master fund, making it ideal for investors who already save in USD.

- KF-SINCOMERMF and KF-SINCOME-FXRMF offering both long-term return opportunities and tax benefits.

For interested investors, they can purchase these funds with a minimum subscription of only 500 Baht, through a variety of Krungsri Asset Management’s subscription channels; either online (@ccess Mobile/ @ccess Online) or on-ground (Krungsri Asset Management head office).

To require additional information or request a prospectus, please contact Krungsri Asset Management at 2657 5757 press 2.

Disclaimer

- RMF is intended for retirement investment. Investors will not be entitled to tax benefits if investment conditions are not met.

- Investors should fully understand product features, return conditions, risks, and tax benefits in the investment guide before making an investment decision. Past performance is not indicative of future results.

- KF-SINCOME-FX and KF-SINCOME-FXRMF: Currency risk is managed at the fund manager’s discretion. Investors are therefore exposed to exchange rate risk, which may result in losses, gains, or a redemption value lower than the initial investment.

- KF-SINCOME and KF-SINCOME-FX-R: Distribution of income depends on the master fund’s performance, and there may be periods when no income is paid.

- KF-SINCOME-USD: In cases where investments are made in non-USD assets, currency risk is managed at the fund manager’s discretion. Investors are therefore exposed to exchange rate risk, which may result in losses, gains, or a redemption value lower than the initial investment.

- This document is prepared based on the information compiled from various reliable sources as of the date of publication. However, Krungsri Asset Management cannot guarantee the accuracy, reliability, and completeness of all information. The Company reserves the right to change the information without any prior notice.