Plan Your Investment

Seminar Highlights: "Dragon Tech: Investing Where the Future Roars"

Highlights of the Fund KFCHINA-T10PLUS

Seminar "Dragon Tech: Investing Where the Future Roars" (15 July 2025)

Speaker: Mr. Kiattisak Preecha-anusorn, Chief Alternative Investment Officer, Alternative Investment Department, Krungsri Asset Management Company Limited

Why must be the China Tech Equity Fund: KFCHINA-T10PLUS?

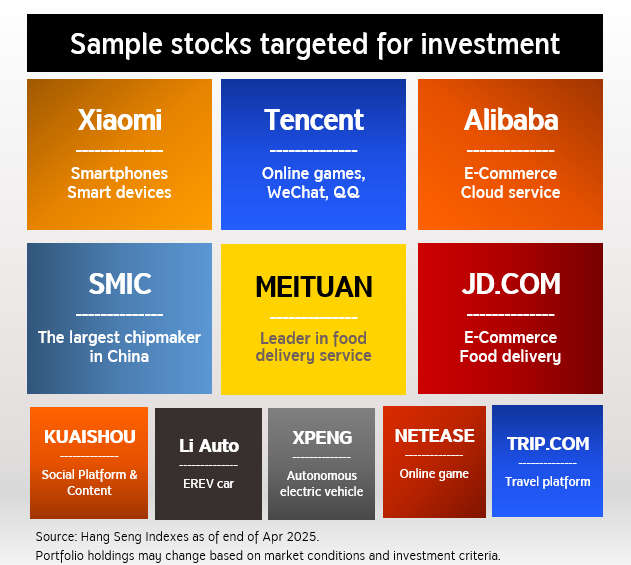

- Investment Theme: Leading Chinese Tech Stocks with the Highest Growth Potential of This Era: A curated portfolio of top-tier Chinese technology leaders listed in the Hang Seng Tech Index, which spans a wide range of technologies—including AI, EV, E-Commerce, Cloud, Social Media, and digital platforms. (Source: Hang Seng Indexes, as of 30 Apr 2025)

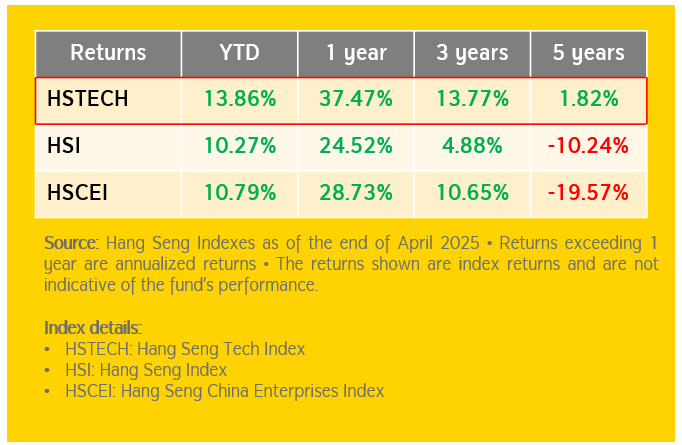

- Now is a compelling time to invest, as Chinese tech stocks are trading at multi-year low valuations - clearly below their long-term potential. The Hang Seng Tech Index is trading at a P/E ratio of just 16x, which is significantly lower than its 5-year average and 43% below U.S. tech valuations. The index also remains more than 50% below its 2021 peak, signaling substantial upside potential for investors seeking long-term exposure to China's technology sector. (Source: Bloomberg, as of 11 and 4 June 2025)

Chinese tech stocks... temporary rebound or a long-term recovery?

- A key driver behind the potential strong rebound of Chinese tech stocks lies in record-high corporate earnings that have yet to be priced in. Sectors such as tourism, e-commerce, cloud computing, and electric vehicles are regaining momentum.

- The adoption of AI technologies like DeepSeek across Chinese enterprises is enhancing efficiency, lowering costs, and boosting revenue. As a result, it is expected that AI will help push the net profits of listed companies to grow by an average of more than 2.5% annually. (Source: Wind, Bloomberg, Goldman Sachs Global Investment Research, 17 Feb 2025)

- In addition, major corporations have shown confidence in their fundamentals by executing share buybacks totaling over RMB 300 billion in 2024, representing a 15-fold increase from 2019. These developments suggest that previous headwinds may be giving way to a strong recovery, particularly for innovation-led companies with global competitiveness. (Source: Company Filings, Bloomberg Intelligence, 13 May 2025)

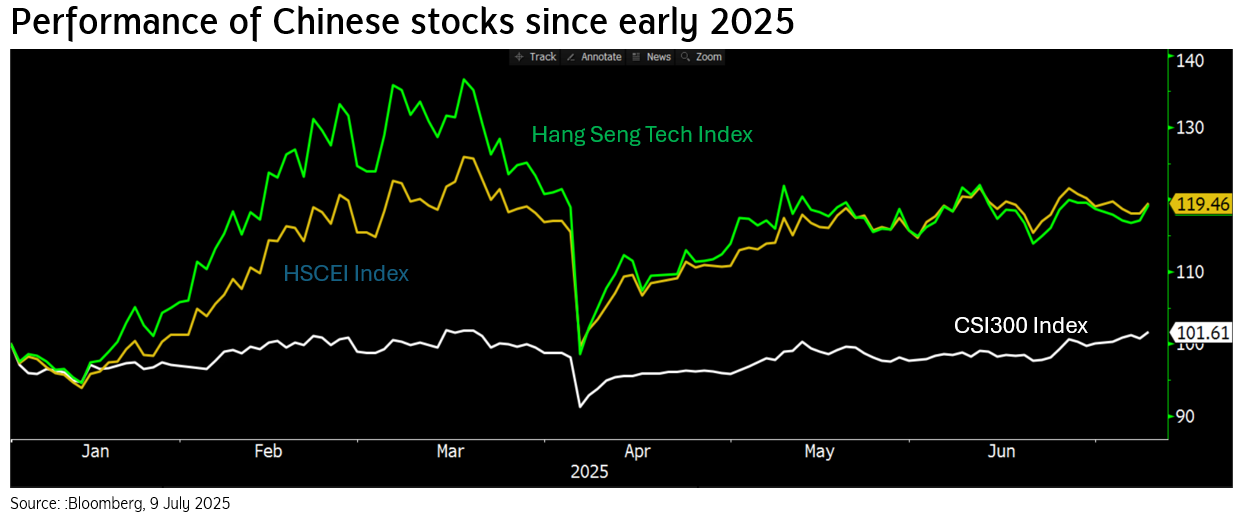

- Chinese tech stocks are rebounding more strongly than other domestic sectors, which remain under pressure by trade tensions, U.S. tariffs, and persistent weakness in the property market. These challenges have kept A-shares relatively flat, pending more aggressive economic stimulus, while H-shares have shown steady improvement. Key growth drivers include the normalization of online consumption, record-breaking EV sales for four consecutive years*, and continued expansion in gaming and cloud services despite previous regulatory pressures. Additionally, the launch of China’s own AI model, DeepSeek, further underscores the country’s readiness to compete on the global stage. (*Source: CAAM, CLSA, 21 Jan 2025)

Invest in Chinese tech stocks with a superior strategy through KFCHINA-T10PLUS

- The Fund focuses on investing in 10–11 fundamentally strong Chinese tech companies with solid cash flows and industry-leading positions across diverse sectors. Most of these stocks still trade at a P/E ratio below 20, indicating significant upside potential. Most analysts currently maintain a “Buy” recommendation for these tech stocks. (Source: Bloomberg, 2 Jul 2025)

- The Fund is currently diversified across top-tier companies, including Xiaomi, which is expanding in smartphones, IoT devices, and entering the EV market; Tencent and NetEase, global leaders in gaming; Alibaba and JD.com, e-commerce giants integrating AI and cloud services; SMIC, a government-supported semiconductor manufacturer; Meituan, a dominant online platform in food delivery and fresh retail; and premium EV manufacturers XPeng and Li Auto.

For informational and explanatory purposes only and should not be considered as investment advice or a recommendation to buy or sell securities.

- The Fund is designed to capture potentially strong growth opportunities from Chinese tech stocks through a Rule-based selection strategy. It focuses on identifying the highest-potential leaders in the index—not merely large-cap stocks, but those with quality, growth prospects, and long-term competitiveness.

- In addition, the Fund enhances portfolio management with its “PLUS” strategy, offering greater flexibility by expanding holdings to 11 stocks. This reduces concentration risk and increases return potential by partially investing in the Hang Seng Tech ETF instead of holding cash. The portfolio is consistently rebalanced using an Equal-weighted and cash flow rebalance approach, ensuring alignment with investment goals under all market conditions.

- Each stock is held at a comparable weight to diversify growth opportunities and avoid overreliance on any single asset. The fund also rebalances quarterly to maintain strategic stability, and may utilize ETFs to boost liquidity when needed.

- A key advantage of KFCHINA-T10PLUS over investing directly in H-Shares is its focused allocation to top-tier tech companies—large-cap firms with strong capital and resources, offering greater growth opportunities. In a back-tested model portfolio with quarterly rebalancing, KFCHINA-T10PLUS delivered over 40% returns, significantly outperforming the Hang Seng Tech Index, which returned approximately 27% over the same period.

KFCHINA-T10PLUS is thus ideal for investors seeking growth opportunities from Chinese tech stocks. It also serves as a timely alternative for those currently invested in A-share equity funds that are still waiting for clearer economic catalysts. Switching into KFCHINA-T10PLUS could also offer a faster growth potential, as the sector shows strong momentum and remains well-positioned for further expansion in the years ahead.

KFCHINA-T10PLUS IPO during 14 - 23 Jul 2025.

Fore more information, click here

For more information or to request a fund prospectus, please contact

Krungsri Asset Management Company Limited at 0 2657 5757 ext. 2

- This document has been prepared based on sources believed to be reliable as of the date of publication. However, the Company makes no representation or warranty as to the accuracy, reliability, or completeness of the information. The Company reserves the right to amend any information without prior notice.

- KFCHINA-T10PLUS employs exchange rate hedging at the fund manager’s discretion. As such, it is subject to exchange rate risk, which may result in losses or gains from currency movements, and the redemption amount may be lower than the initial investment.

- Investors should thoroughly understand fund features, return conditions, and associated risks before making an investment decision. Past performance of the fund does not guarantee future results.