News/Announcement

Promotions/Fund Highlight

KFCHINA-T10PLUS ... Powering Growth with China's Top Tech Companies

Krungsri China Tech 10 Plus (KFCHINA-T10PLUS)

IPO: 14 – 23 July 2025.

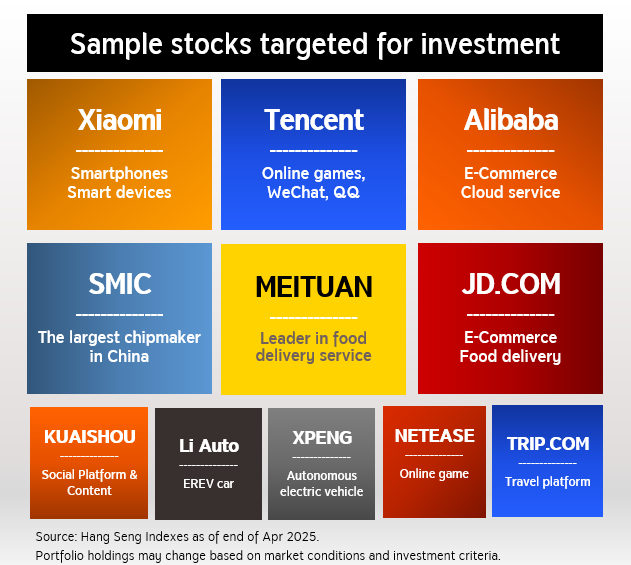

Focused investment in top Chinese tech stocks from the Hang Seng Tech Index - just 10 - 11 leading companies with equal weighting. This approach helps diversify risk while capturing growth potential from major tech names of the era such as Xiaomi, Tencent, Alibaba, SMIC, Meituan, and JD.com. The portfolio is rebalanced quarterly to align with index reviews, ensuring exposure to top-performing, trend-relevant stocks is consistently maintained.

Top 10 Securities in Hang Seng Tech Index

A Deep Dive into 3 Investment Strategies

1. High Conviction: Identifying High-Growth Potential Stocks

- Focuses on stocks included in the Hang Seng Tech Index, a key benchmark for China's tech sector, featuring 30 leading large-cap technology companies listed in Hong Kong.

- Offers growth opportunities across multiple transformative technologies, including Autonomous systems, Cloud, Digital, E-Commerce, FinTech, Internet, and Communications.

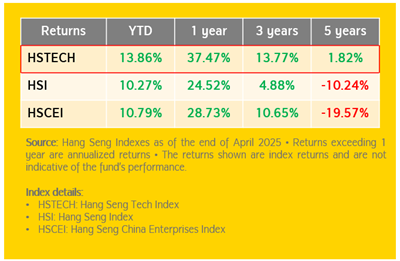

- Delivers a history of outperforming both the broader Chinese stock market (as measured by the Hang Seng Index) and large-cap Chinese H-Shares.

2. Rule-based Portfolio: Selection of Top-Ranked Stocks

- Rank and select approximately 10 - 11 most attractive securities based on predefined criteria, with market capitalization being the primary factor - except for cases where stocks fail to meet certain evaluation standards.

- Maintain individual stock weights close to the target portfolio allocation.

- Rebalance the portfolio quarterly, in line with the review schedule of the reference index.

Remark: The fund will invest in at least 10 securities in the portfolio.

3. Equal-weight Strategy and Growth Potential

- Unlike typical indices that weight constituents by market capitalization (giving large-cap stocks greater influence), this strategy assigns equal weights to all holdings.

- Enhances exposure to high-potential stocks, thereby increasing return opportunities.

- Reduces reliance on any single stock, improving risk diversification.

China Tech Stocks... A Proven Compelling Opportunity

1. Attractive Valuations Compared to U.S. Tech Stocks

- Since early 2022, the P/E ratio of Chinese tech stocks has consistently declined relative to U.S. tech stocks, while the Hang Seng Tech Index is trading at around 16x P/E—near its 5-year low and approximately 44% lower than that of U.S. tech stocks.

- While Chinese tech companies previously faced earnings pressure from regulatory tightening, they are now showing strong recovery. Earnings per share (EPS) have reached new highs and continue on a growth trajectory, though the index itself remains 54% below its 2021 peak.

Source: Bloomberg as of 20 Jun 2025.

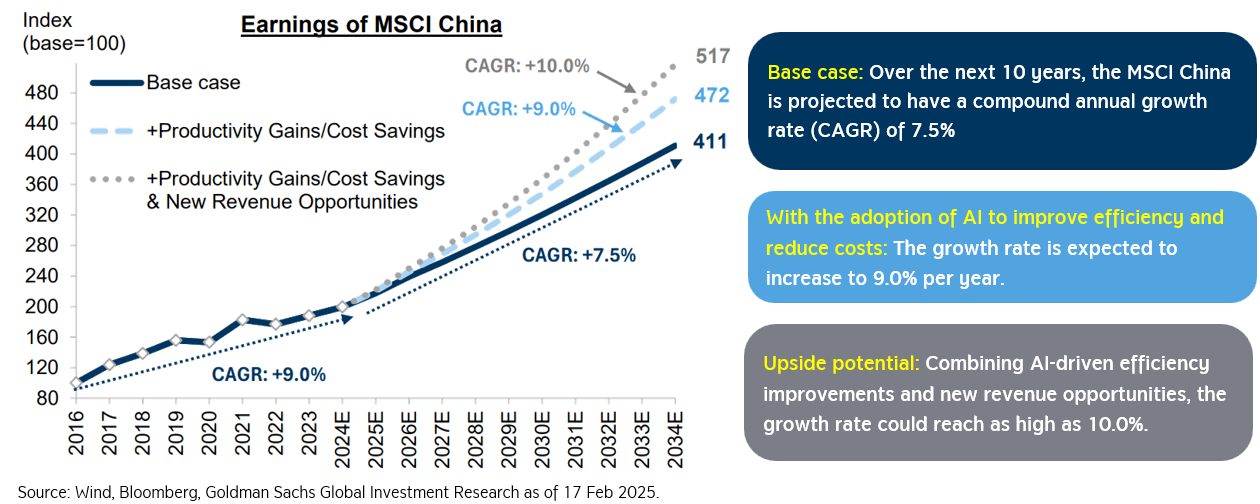

2. AI Expected to Boost Chinese Tech Earnings by at Least 2.5% Annually

2. AI Expected to Boost Chinese Tech Earnings by at Least 2.5% Annually

- Chinese tech firms are gaining access to powerful AI technologies at lower costs, helping them cut expenses, enhance efficiency, and unlock new revenue streams—significantly benefiting the broader tech sector in China.

3. Chinese AI Stocks: A New Opportunity in the Global Tech Market

4. China's Tech Giants Ramp Up Share Buybacks, Setting New Record in 2024

- The share buyback value has surged from under RMB 20 billion in 2019 to nearly RMB 300 billion in 2024.

- More Chinese tech firms are expected to follow suit, signaling confidence to investors, with total announced buybacks exceeding USD 64.2 billion. Source: Company Filings, Bloomberg Intelligence ณ 13 พ.ค. 68

5. Most analysts still recommend ‘buying’ Chinese tech stocks

Remark: This information is provided for explanatory purposes only and does not constitute investment advice or a recommendation to buy or sell any securities.

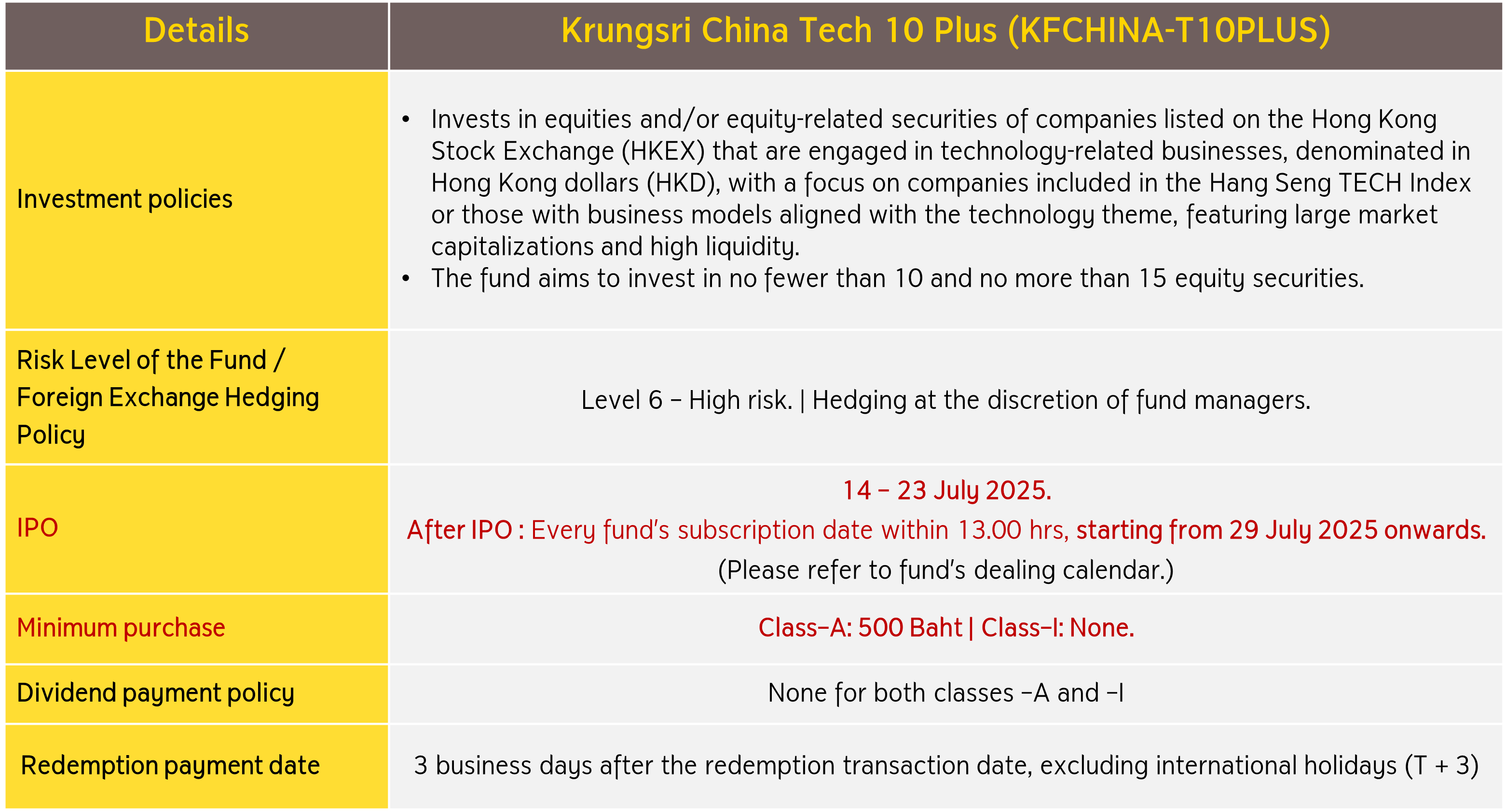

Highlights of the Fund

Krungsri China Tech 10 Plus (KFCHINA-T10PLUS) is divided into two share classes

- Krungsri China Tech 10 Plus-A (KFCHINA-T10PLUS-A)

- Krungsri China Tech 10 Plus-I (KFCHINA-T10PLUS-I)

For more information or to request a fund prospectus,

please contact Krungsri Asset Management Company Limited at 0 2657 5757 ext. 2.

- This document is prepared based on various reliable sources available at the time of publication. However, the Company cannot guarantee the accuracy, reliability, or completeness of all information provided. The Company reserves the right to change any information without prior notice.

- KFCHINA-T10PLUS Fund employs currency hedging at the fund manager’s discretion. Therefore, the fund is exposed to exchange rate risk, which may result in a loss or gain from currency fluctuations, and investors may receive a redemption amount lower than the initial investment.

- Investors should thoroughly understand the product features, return conditions, and associated risks before making an investment decision. Past performance of the mutual fund is not indicative of future results