News/Announcement

Promotions/Fund Highlight

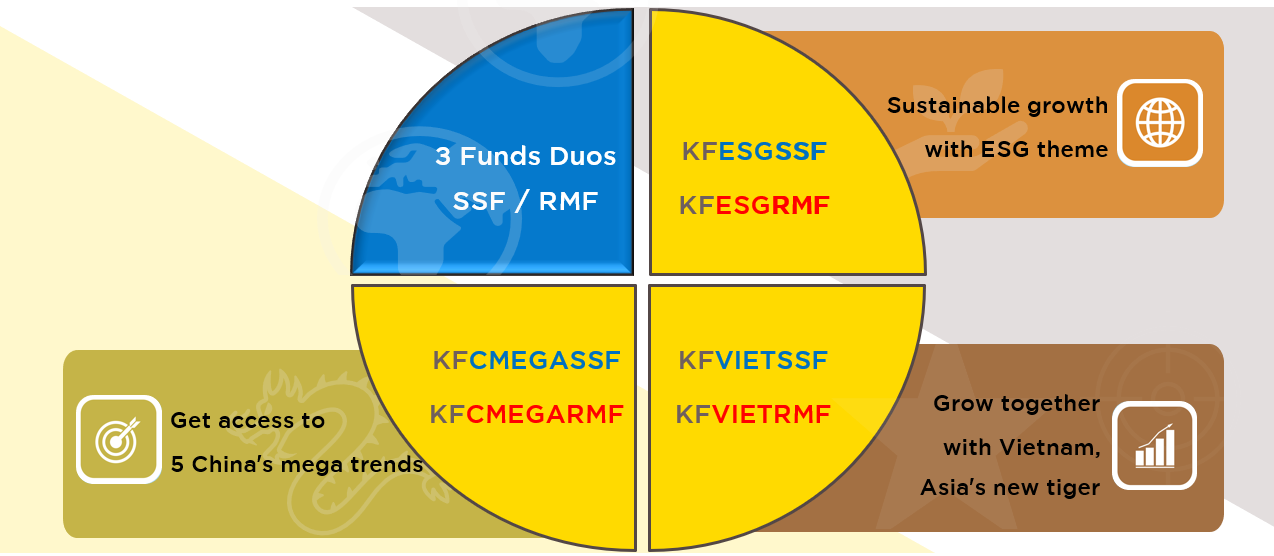

Drive your target growth with new SSF | RMF

Special promotion applied according to Terms & Conditions*

Krungsri Asset Management selects three new SSF | RMF duos, focusing on rising-star businesses with long-term growth potentials

Fund Insights: Unique characters & Investment Strategies

Krungsri China Megatrends SSF (KFCMEGASSF)

Krungsri China Megatrends RMF (KFCMEGARMF)

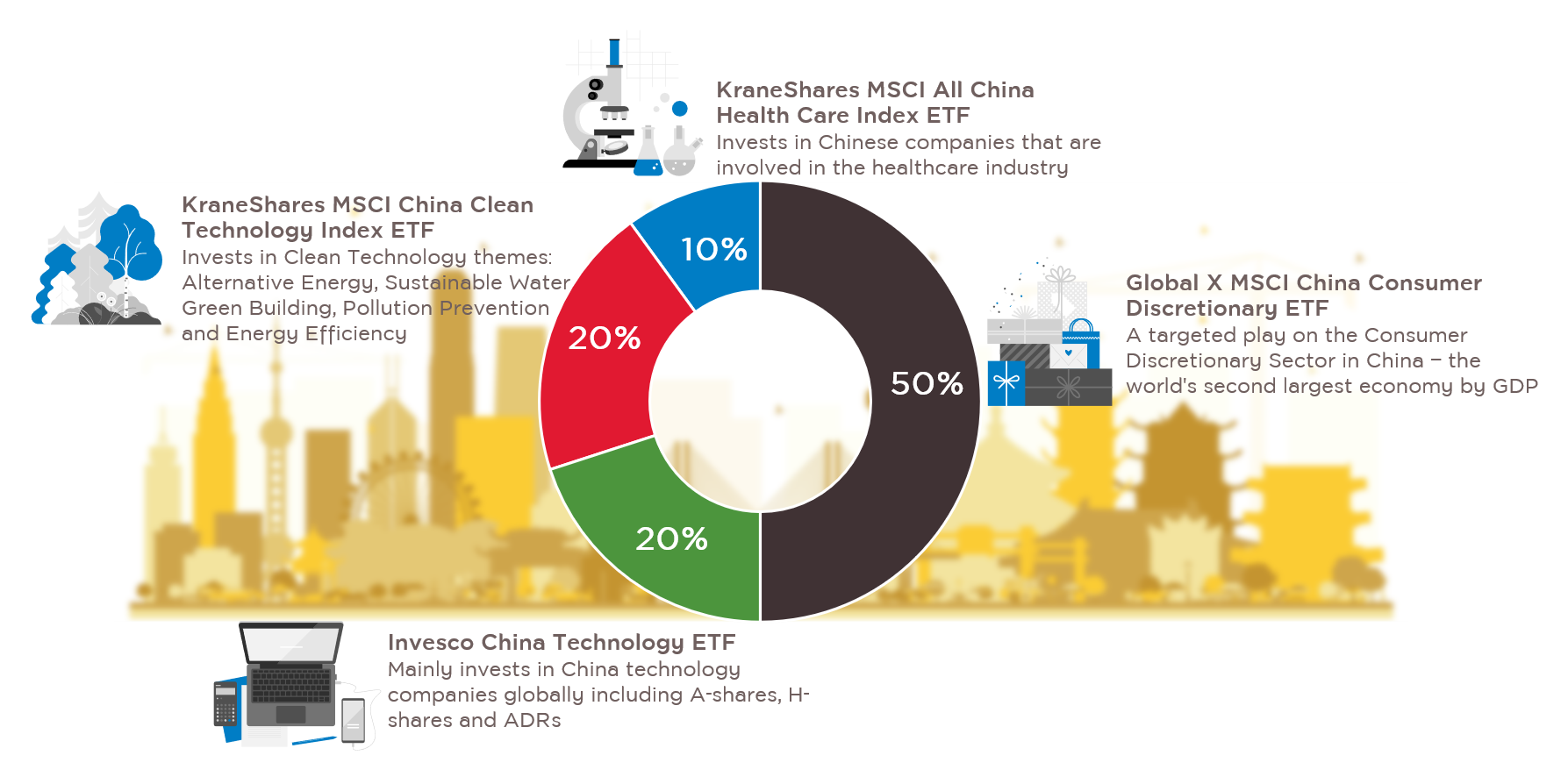

- Fund highlights/Support factors: Get access to five China’s mega trends in one fund: Consumption, Technology, Healthcare, Clean energy, and New transportation

- Investment strategy: Invest through the master fund titled Krungsri China Mega Trend (KFCMEGA) with portfolio diversifying in 4 ETF to access China’s five mega trends based on initial asset allocation as shown below. In this respect, the Fund’s asset exposure will be adjusted upon fund manager’s discretion to suit the market situation in the future.

For fund details, click: KFCMEGASSF | KFCMEGARMF

Krungsri Equity Sustainable Global Growth SSF (KFESGSSF)

Krungsri Equity Sustainable Global Growth RMF (KFESGRMF)

- Fund highlights/Support factors:

- Focusing on three key investment themes investment themes expected to persist, irrespective of changing geopolitical or economic factors such as Climate, Health, and Empowerment, which will offer differentiated opportunities for secular growth through an investment in the Master Fund titled AB Sustainable Global Thematic Portfolio.

- The Master Fund has the portfolio with a high-conviction strategy, informed by in-depth long-term research with an aim to generate superior financial returns than benchmark through investments that contribute to positive social and environmental outcomes backed with an outstanding track record of performance compared with benchmark.

- Investment Strategy: Focusing to invest in the high-quality companies being aligned with sustainable themes.

- Holdings having alignment with SDGs are key factor to long-term secular tailwinds

- Strong financial returns help create competitive advantages.

- Positive valuation case is essential to achieving dual goals of financial and social outcomes.

- Companies where management is aligned with stakeholders are best positioned to deliver sustainable and long-term growth

Source: AB as of 30 June 22

Krungsri Vietnam Equity SSF (KFVIETSSF)

Krungsri Vietnam Equity RMF (KFVIETRMF)

- Fund highlights/Support factors:

- An emerging nation with progressive economy and remarkable growth amidst Covid-19 situation.

- FDI-driven growth with sustainable cycles of loans

- Thanks to shining exports, Vietnam posted the highest record of trade surplus and foreign exchange reserves.

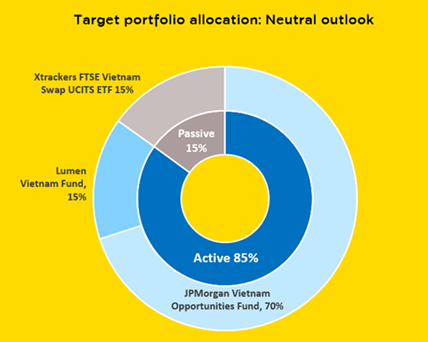

- Investment Strategy: Invest through the master fund, Krungsri Vietnam Equity (KFVIET) that has applied the Fund-of-Funds investment policy combined with an opportunistic approach by taking advantage of Active and Passive styles for the best outcome.

- Active style: JPMorgan Vietnam Opportunities Fund: Active investment style to seek long-term investment opportunities/ Lumen Vietnam Fund: Active investment style in growth stocks who are leaders in each sector, being difficult for new players to enter.

- Passive style: Xtrackers FTSE Vietnam Swap UCITS ETF: Passive fund to generate returns in related to FTSE Vietnam Index.

Minimum purchase: 500 Baht only for all funds. | SSF has a dividend payment policy.

Can purchase through participating Krungsri credit cards

(Fund subscription will be not eligible for promotional programs and reward points accumulation.)

Now you can redeem your credit card points of all Krungsri credit card types (except Krungsri Corporate Card) to invest in any SSF / RMF through @ccess Mobile Application and @ccess Online Service on a condition that 1,000 points = 100 Baht of fund units.

For terms and conditions, click here

Promotion: When investing in participating SSF /RMF 2022 according to terms & conditions*,

receive KFCASH-A units valued at 100 Baht for every investment of 50,000 Baht

*For promotion details, click here

For SSF & RMF investment manuals, click here

Investment Strategies of the Funds

KFCMEGASSF/ KFCMEGARMF

KFESGSSF/ KFESGRMF

KFVIETSSF/ KFVIETRMF

- Invests in only one CIS unit. Minimum 80% of NAV in average of fund accounting year are invested in the Master Fund named, Krungsri China Megatrends Fund-I (KFCMEGA-I) which managed by Krungsri Asset Management Co., Ltd. The Master Fund will invest in the investment units of foreign equity funds and/or exchange traded funds (ETFs) which have the investment policy of investing in the securities of listed companies in China and/or companies having established a major presence or deriving a majority of their revenues from business operations in China. These companies are related to or beneficiaries of the rise of mega trends. The fund may invest no more than 100% of fund assets in units of mutual funds under management of the Company..

Risk level: 6 – high risk | Hedge against currency risk upon fund manager’s discretion.

KFESGSSF/ KFESGRMF

- Minimum 80% of NAV in average of fund accounting year are invested in the Master Fund named, AB Sustainable Global Thematic Portfolio, Class S1 USD which managed by AllianceBernstein (Luxembourg) S.à r.l. The Master Fund will invest in the global equity securities of companies that have a focus on the ESG (environmental, social, and corporate governance) principles which are the most attractive securities fitting into sustainable investment themes.

- Risk level: 6 – High risk | Fully hedge against foreign exchange rate risk (Hedge against the exchange rate risk at a particular time for the value of at least 90% of the foreign investment value)

KFVIETSSF/ KFVIETRMF

- Invest in only one CIS unit. Minimum 80% of NAV in average of fund accounting year are invested in the Master Fund named, Krungsri Vietnam Equity Fund-I (KFVIET-I) which managed by Krungsri Asset Management Co., Ltd. The Master Fund will invest in the investment units of foreign equity funds and/or exchange traded funds (ETFs) which have the investment policy of investing in the securities of listed companies in Vietnam and/or whose business or interest from business in Vietnam. The fund may invest no more than 100% of fund assets in units of mutual funds under management of the Company.

- Risk level: 6 – high risk | Hedge against currency risk upon fund manager’s discretion.

Disclaimers

- SSF are the funds aimed to promote savings. | RMF are for retirement investment.

Investors will be not entitled to any tax privileges if they do not comply with the investment conditions - KFCMEGASSF, KFCMEGARMF, KFVIETSSF, and KFVIETRMF may enter into a currency swap within discretion of fund manager. Thus, the funds are exposed to exchange rate risk, which may cause investors to lose or gain lower return than the amount initially invested.

- Investors should understand fund feature, returns, risk, and tax privileges in the investment manual before making investment decision. Past performance is not an indicative of future performance.

.aspx)

.aspx)

.aspx)