ข่าว/ประกาศกองทุน

Promotions/Fund Highlight

Tax Savings and More - Grow Your Potential Returns

Promo: Get extra KFCASH-A units when you invest as specified.*

Tax Savings and More — Grow Your Potential Returns

Thoughtfully selected funds for you… Global equities, ESG, gold, and bonds.

We’ve curated attractive assets across bonds, equities, and gold to meet your investment goals - whether you prioritize stability, seek higher return potential, or aim to strengthen your portfolio against uncertain global economic conditions:

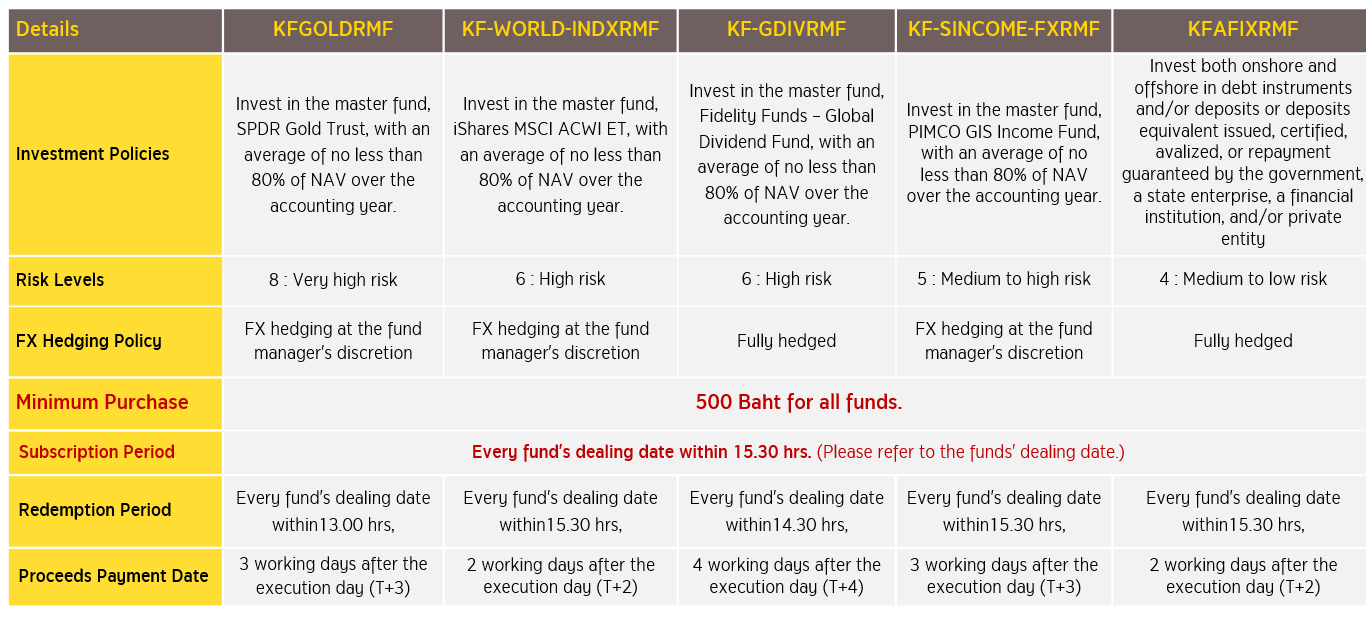

- KFGOLDRMF: Invest in gold, a store of value sought after as a safe haven during market uncertainty.

- KF-WORLD-INDXRMF: Access leading global companies with growth potential following the MSCI ACWI Index.

- KF-GDIVRMF: Select high-quality dividend stocks worldwide, aiming for returns from both dividends and capital appreciation.

- KF-SINCOME-FXRMF: Invest in a diversified range of global bonds through top-tier master funds.

- KFAFIXRMF: Focus on medium-term Thai bonds, both government and corporate, using an active and flexible strategy.

5 Recommended Funds

KFGOLDRMF (Krungsri Gold RMF)

Invests in gold, which tends to increase in value when investors seek safe havens.

- Gold prices are expected to be supported by a weaker US dollar and potential interest rate cuts by the US Federal Reserve (Fed). Markets anticipate a rate cut at the September meeting, with the possibility of two more cuts later this year. (Source: Bloomberg, CNBC, as of 18 Sep 2025)

- Krungsri Asset Management believes that the trend of central banks worldwide increasing their gold reserves is another factor supporting gold prices in the medium to long term.

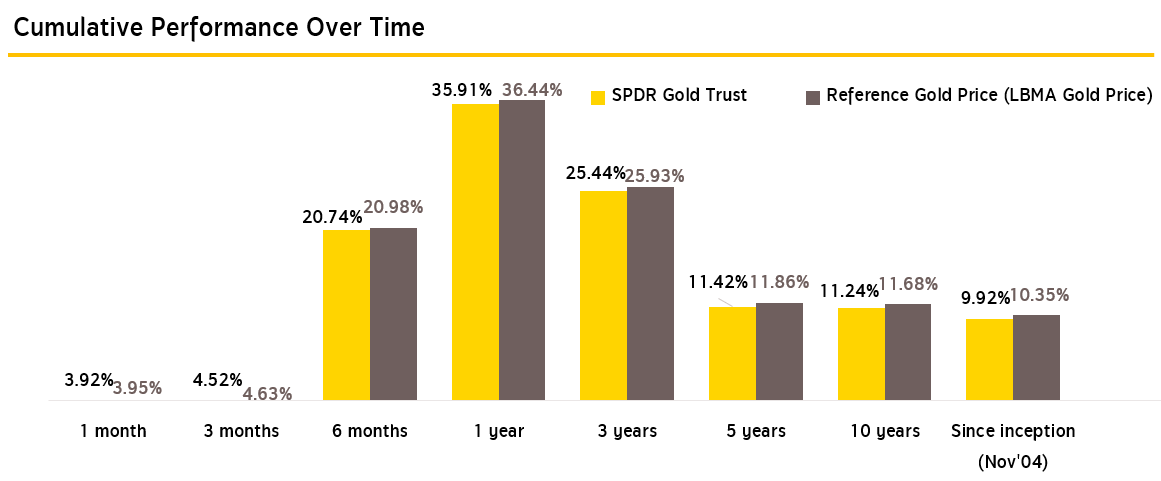

- The world’s largest gold ETF* and is highly popular among investors listed on the New York, Hong Kong, Tokyo, and Singapore stock exchanges. The fund focuses on investing in physical gold to closely track the performance of gold prices. (*Source: https://www.spdrgoldshares.com as of 30 Jun'25. | This ranking is independent and not affiliated with the Association of Investment Management Companies (AIMC))

- Historical performance aligns closely with gold bullion investing

Source: SPDR Gold Shares as of 31 Aug 2025 | Performance calculated based on net returns after fees (NAV to NAV) in USD | The performance shown reflects that of the master fund and does not follow the performance measurement standards of AIMC.

Source: SPDR Gold Shares as of 31 Aug 2025 | Performance calculated based on net returns after fees (NAV to NAV) in USD | The performance shown reflects that of the master fund and does not follow the performance measurement standards of AIMC.KF-WORLD-INDXRMF (Krungsri World Equity Index RMF)

Access global equities with growth potential, supported by a declining interest rate environment, through a diversified portfolio across both developed and emerging markets

- The Master Fund: iShares MSCI ACWI ETF tracks the widely recognized MSCI ACWI Index, the largest in the world with over USD 20 billion in assets. It is diversified across more than 2,000 companies spanning multiple regions and industries, reducing concentration risk in any single sector.

- The Master Fund has low expense ratio of 0.32%, supporting long-term index-tracking and potential returns.

- Performance reflects global equity market growth.

Source: iShares as of 30 Sep 2025 | Fund inception date: 26 Mar 2008 | Index: MSCI ACWI Index | The fund’s performance is based on NAV including dividend reinvestments. The performance shown reflects the performance of the underlying fund and does not follow the performance measurement standards of AIMC.

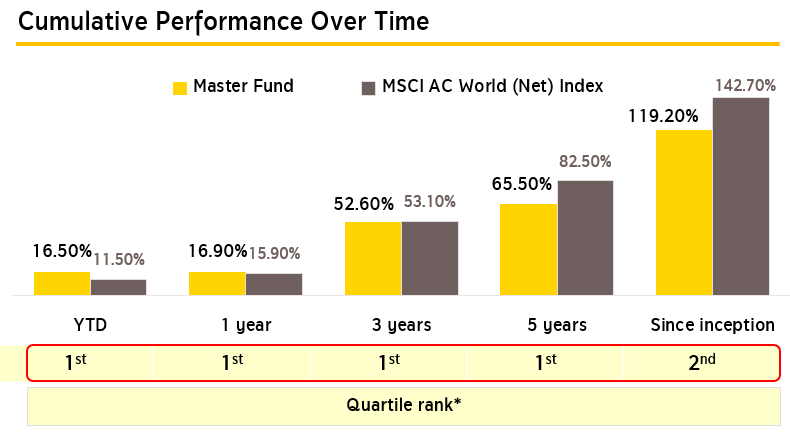

KF-GDIVRMF (Krungsri Global Dividend RMF)

- Invests in high-quality global dividend-paying stocks to protect capital while aiming for potentially attractive total returns.

- The portfolio combines active and passive investment strategies, selecting companies that can pay dividends consistently and with a growing trend, while maintaining low earnings volatility. This approach helps protect capital in a down market while offering opportunities for attractive total returns.

- Key features that differentiate KF-GDIVRMF from other global dividend equity funds

- Diversifies into high-quality cyclicals (~30%) to expand investment opportunities.

- Avoids “value traps” of cheap stocks with no price growth.

- Selects stocks with growing, sustainable dividends rather than high current yield.

- The overall portfolio targets a Dividend Yield at least 25% higher than the global market, with an emphasis on businesses that offer resilience at attractive price levels.

Source: Fidelity International, Morningstar Direct as of 31 Jul 2025 | The performance shown refers to the Share Class Y-QINCOME(G)-USD in which KF-GDIVRMF invests, established on 20 Feb 2017 | The Quartile rank information is based on the performance of the main share class as reported by Morningstar, which may differ from the performance shown in this document. Quartile 1 indicates the fund is among the top 25% of its peer group | The Quartile rank calculation is internal to Fidelity International and may vary by share class | Peer group reference: Morningstar EAA Fund Global Equity Income | The performance shown refers to the performance of the underlying fund and does not follow AIMC mutual fund performance measurement standards | The ranking has no affiliation with AIMC’s rankings.

Source: Fidelity International, Morningstar Direct as of 31 Jul 2025 | The performance shown refers to the Share Class Y-QINCOME(G)-USD in which KF-GDIVRMF invests, established on 20 Feb 2017 | The Quartile rank information is based on the performance of the main share class as reported by Morningstar, which may differ from the performance shown in this document. Quartile 1 indicates the fund is among the top 25% of its peer group | The Quartile rank calculation is internal to Fidelity International and may vary by share class | Peer group reference: Morningstar EAA Fund Global Equity Income | The performance shown refers to the performance of the underlying fund and does not follow AIMC mutual fund performance measurement standards | The ranking has no affiliation with AIMC’s rankings.KF-SINCOME-FXRMF (Krungsri Global Smart Income FX RMF)

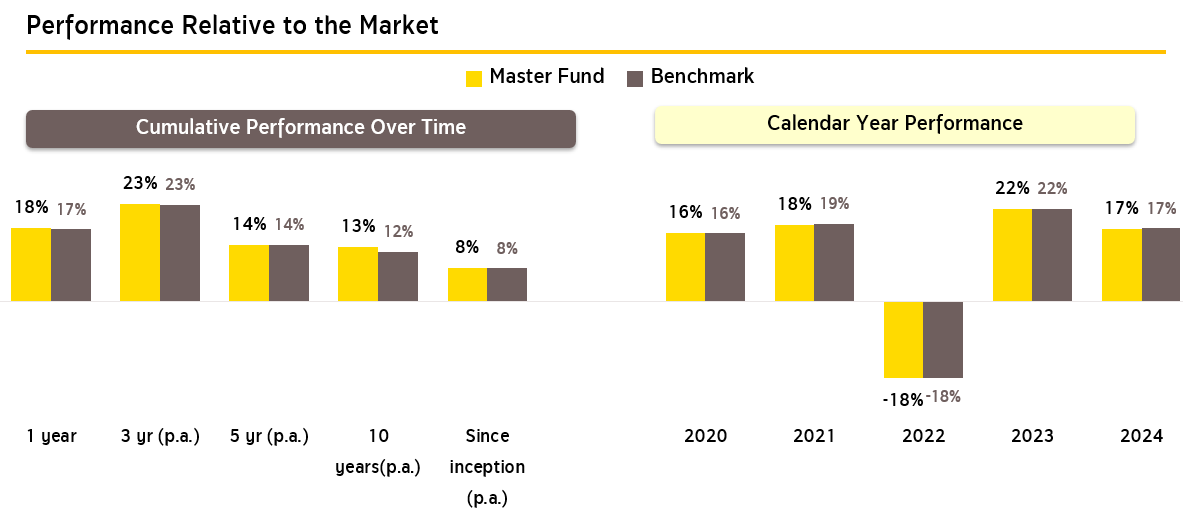

A solution for fixed income investing, aiming to deliver consistent and attractive returns - especially when falling interest rates provide a supportive environment to enhance potential gains.

- The Master Fund: PIMCO GIS Income Fund, a 5-star Morningstar rated fund*, was managed by PIMCO - a global asset manager with over 50 years of expertise in fixed income investing. (*Source: PIMCO as of 31 Aug 2025. Morningstar ratings are independent of AIMC rankings.)

- The Master Fund has consistently outperformed the market historically, thanks to flexible portfolio adjustments across various fixed income securities to adapt to changing market conditions.

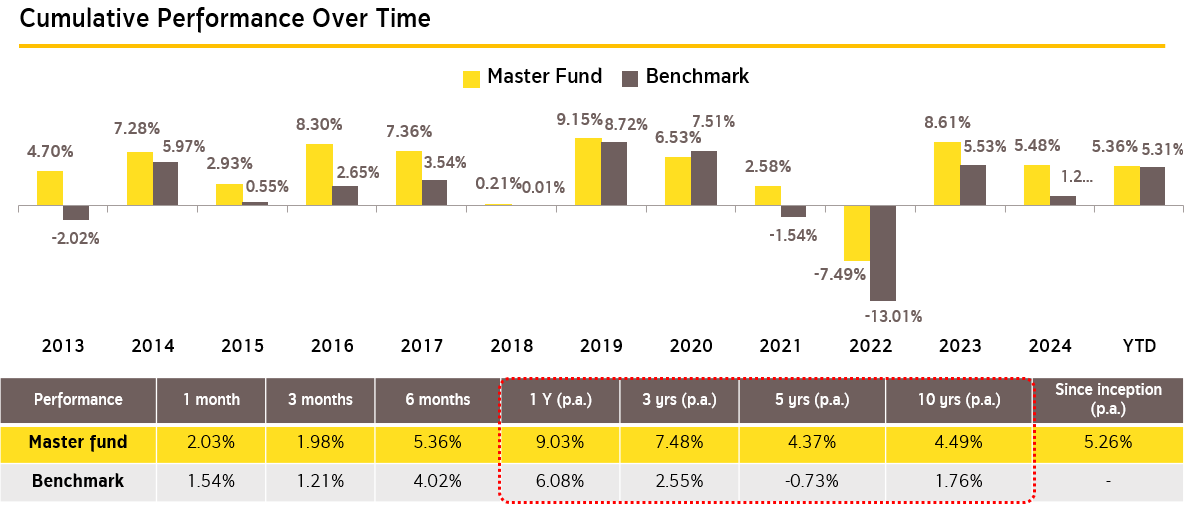

Source: PIMCO as of 30 Jun 2025 | Benchmark: Bloomberg U.S. Aggregate Index | Fund inception date: 30 Nov 2012 | Performance shown is net of management fees and expressed in USD | The performance presented reflects that of the underlying fund and is not prepared in accordance with the standard performance measurement of AIMC.

Source: PIMCO as of 30 Jun 2025 | Benchmark: Bloomberg U.S. Aggregate Index | Fund inception date: 30 Nov 2012 | Performance shown is net of management fees and expressed in USD | The performance presented reflects that of the underlying fund and is not prepared in accordance with the standard performance measurement of AIMC.KFAFIXRMF (Krungsri Active Fixed Income RMF)

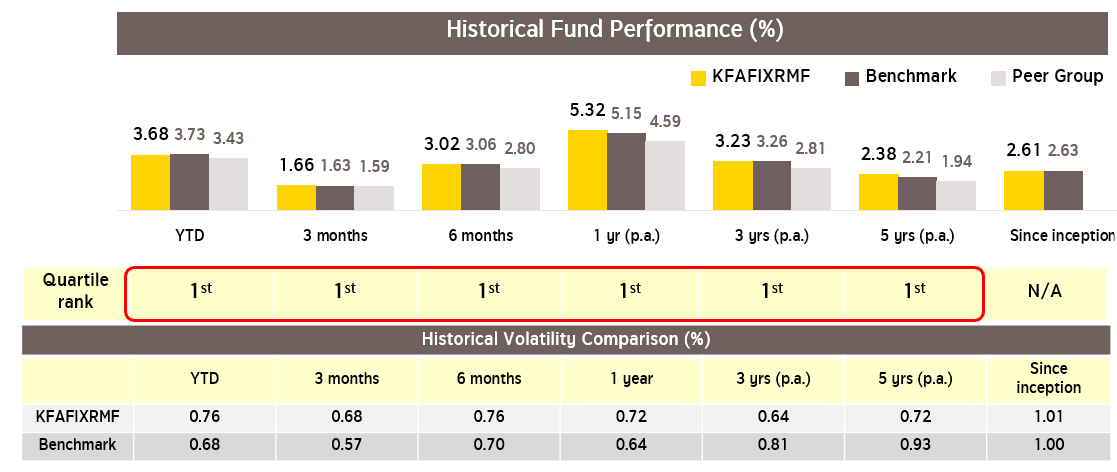

Actively investing in medium-term bonds with a flexible portfolio strategy to capture every opportunity for returns

- Invests in medium-term bonds, including government, corporate, and international bonds, with a focus on high-quality corporate bonds. Managed actively with flexibility in portfolio allocation to adapt to market conditions.

- Seeks attractive incremental returns to help reduce portfolio volatility, supported by the global trend of declining policy interest rates - led by developed markets - which also encourages capital flows into emerging markets.

- KFAFIXRMF is suitable for investors looking for returns higher than short-term bonds and who can tolerate moderate volatility

Source: Krungsri Asset Management, as of 30 Jun 2025 | Quartile rank data from Morningstar for the Mid-Term General Bond category | Morningstar rankings are independent and not related to the Association of Investment Management Companies (AIMC) rankings | KFAFIX-A fund was established on 21 Oct 2016. Benchmark indices and allocation (%): Net total return of the Thai Government Bond Index (maturity ≤ 10 years) – 50.00%/ Net total return of the Thai Corporate Bond Index (Mark-to-market) with issuer credit rating of BBB+ or higher, maturity 1–3 years – 30.00%/ Average 1-year fixed deposit rate of three major commercial banks (Bangkok Bank, Kasikornbank, and Siam Commercial Bank), after tax – 10.00%/ THOR reference interest rate index, after tax – 10.00%/ The fund has adopted the new post-tax performance benchmark (Net TRN Index) effective from October 31, 2019./ Peer group: Average of funds in the Mid-Term General Bond category./ Performance is presented in accordance with the AIMC fund performance measurement standards.

Enhance your tax-saving and return potential with 2 Thai ESG Funds - no long-term investment required

- KFTHAIESG (Krungsri Enhanced SET Thailand ESG Fund): Opportunity to grow with ESG equities while aiming for returns above the benchmark.

- KFGBTHAIESG (Krungsri Government Bond Thailand ESG Fund): Stable growth potential with Thai ESG government bonds.

For more information on Thai ESG funds/ Promotions, click here

To request fund prospectuses or further details, contact Krungsri Asset Management Co., Ltd. at 02-657-5757, press 2.

- Thai ESG funds encourage long-term savings and support sustainable investment in Thailand. RMF funds promote long-term retirement savings. Investors should understand the product features, return conditions, risks, and tax benefits in the investment guide before making investment decisions. Past fund performance does not guarantee future results.

- This document is prepared using reliable sources as of the date shown, but the company does not guarantee the accuracy, reliability, or completeness of the information and reserves the right to make changes without prior notice.

- For KFGOLDRMF, investors should seek additional advice before investing.

- KFGOLDRMF / KF-WORLD-INDXRMF / KF-SINCOME-FXRMF may involve foreign exchange risk depending on the fund manager’s discretion, which could result in gains or losses from currency fluctuations or receiving less than the original investment.

- Investments made via credit card are not eligible for credit card promotions.

- Investors should review tax benefits as outlined in the investment guide. Tax benefits will not apply if investment conditions are not met, and previously received benefits must be returned within the prescribed period, otherwise additional payments and/or penalties under the Revenue Code may apply.

*Conditions for Annual Accumulated Investment Promotion

- This promotion is only available for individual investors who invest in RMF, Thai ESG , and Thai ESGX-68* funds managed by Krungsri Asset Management (“the Company”), excluding KFCASHRMF and any new RMF/ Thai ESG funds in 2025 that the Company may announce as exempt. Eligible investments must be made between 2 Jan – 30 Dec 2025. (*Thai ESGX-68 is open for investment only from 2 May - 30 Jun 2025)

- Investors must hold the fund units purchased during the promotion period until 31 Mar 2026, which is the date the Company calculates the accumulated net investment to determine eligibility for KFCASH-A units.

- Accumulated net investment refers to the total investment from purchases and switches from non-RMF/ Thai ESG/ Thai ESGX-68 funds, and transfers from other AMCs’ RMF/Thai ESG funds, excluding transfers from PVD to RMF, minus redemptions, switches to non-participating RMF/Thai ESG funds, or transfers to other AMCs. For redemptions, switches, and transfers from units held as of 30 Dec 2024, the Company uses a FIFO method, in line with Revenue Department tax rules.

- If an investor has multiple accounts, the Company will combine the accumulated net investment from all accounts based on the national ID number.

- The Company will transfer KFCASH-A units according to the investment and eligibility conditions by 30 Apr 2026, based on the unit value on the transfer date.

- Units received from monthly RMF/Thai ESG investments over 12 consecutive months in 2025 (including other promotions announced by the Company) are not eligible for this promotion.

- RMF units transferred from PVD are eligible under the PVD-to-RMF promotion but not under this promotion.

- Switches from all LTF funds do not count towards this promotion, as they are eligible under the LTF-to-Thai ESG/RMF 2025 promotion.

- Investments by corporate investors, institutions, and provident funds are not eligible for this promotion.

- The Company reserves the right to change the promotion conditions without prior notice. In case of dispute, the Company’s decision is final.

- Investors can use eligible Krungsri Consumer credit cards, including: Krungsri Credit Cards (all types), HomePro Visa Platinum, Manchester United Credit Card, AIA Visa, Siam Takashimaya Credit Card, Krungsri NOW Platinum, Central The 1 Credit Card, Lotus Credit Card, Krungsri First Choice Visa, and XU Digital Credit Card, to purchase **RMF/Thai ESG fund units (excluding KFCASHRMF, KFAFIXRMF, KFGOVRMF, KFLTGOVRMF, KFMTFIRMF, KFGBTHAIESG-A, and any RMF/Thai ESG 2025 funds that may be announced as exempt).

- Purchases using credit cards are not eligible for the promotion and do not earn credit card reward points.

- Credit card usage is subject to the terms and conditions set by the Company and the credit card issuer.

- The Company reserves the right to change credit card purchase conditions without prior notice. In case of dispute, the Company’s decision is final.