ข่าว/ประกาศกองทุน

Promotions/Fund Highlight

Maximize Your Tax Savings with Thai ESG & Thai ESGX

Invest in Fixed Income/Sustainable Equity Funds | Enjoy tax deductions of up to 300,000 Baht & promotion*

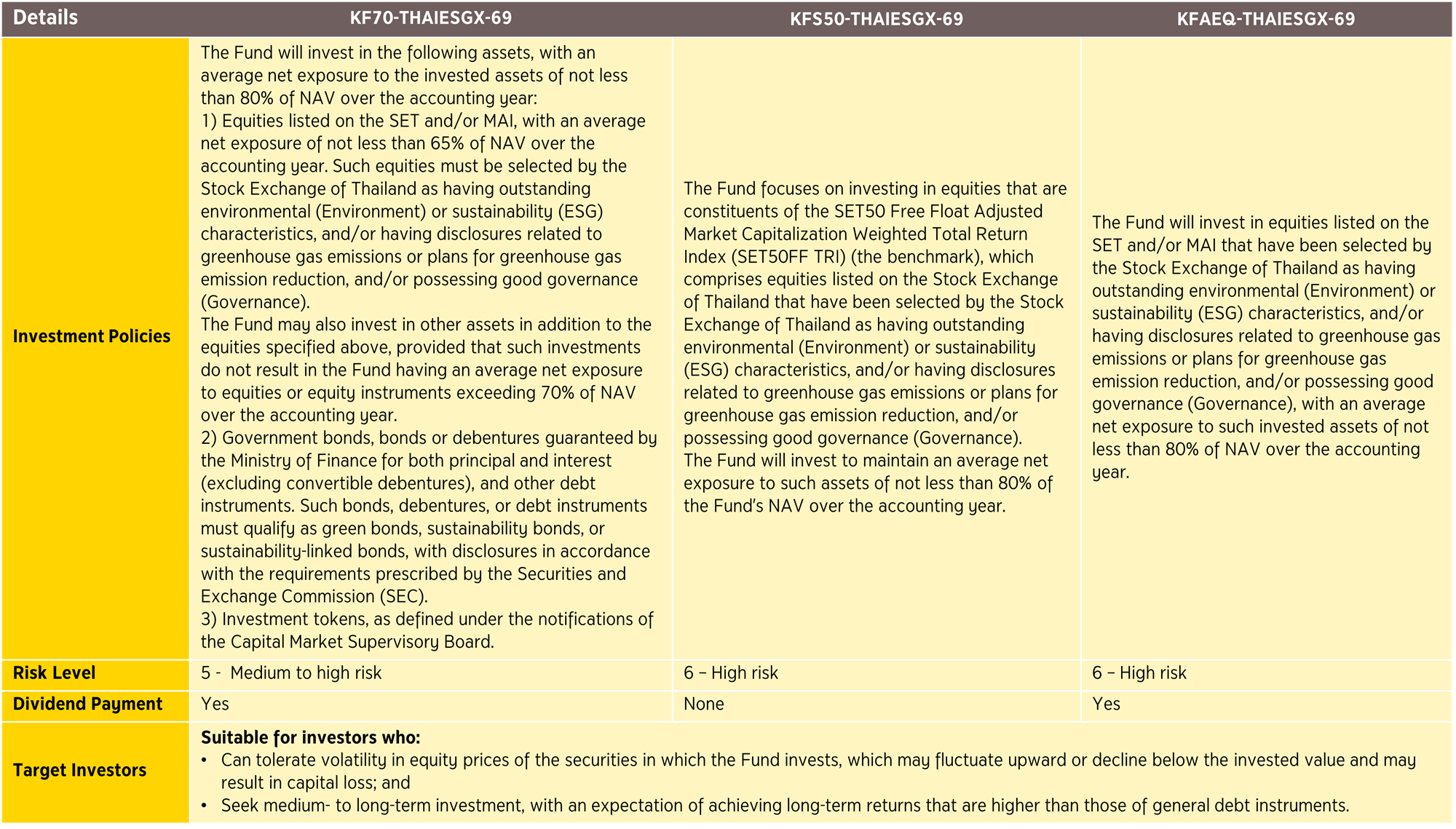

3 Thai ESGX Funds

KF70-THAIESGX-69 | KFS50-THAIESGX-69 | KFAEQ-THAIESGX-69 Available for subscription from 5 January onwards

2 Thai ESG Funds

KFGBTHAIESG | KFTHAIESG

*Promotion: Receive additional KFCASH-A fund units worth 100 Baht for every 50,000 Baht of accumulated investment in participating Thai ESGX / Thai ESGX and RMF funds, from 5 January – 30 December 2026, subject to terms and conditions (please refer to details below).

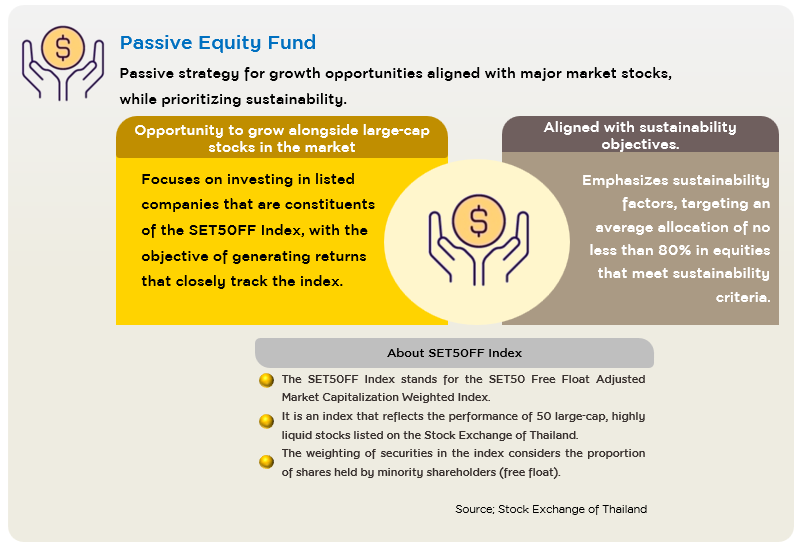

Thai ESGX Funds

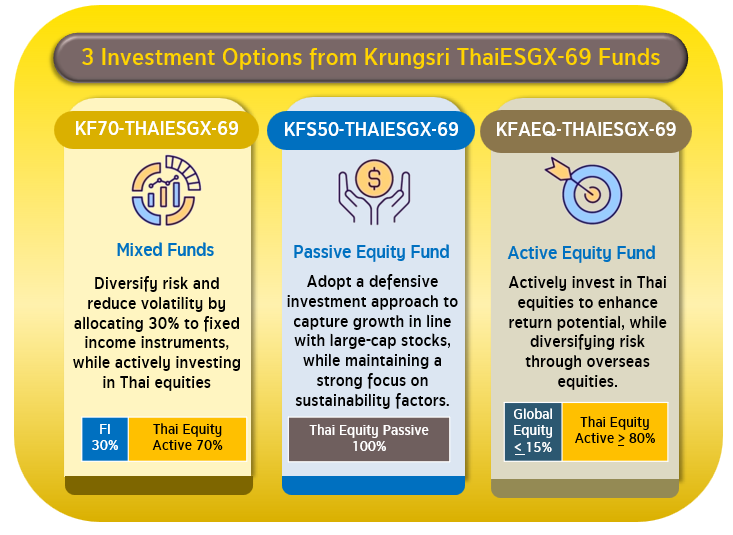

KF70-THAIESGX-69 (Krungsri 70/30 Thailand ESG Extra Fund-69)

A mixed fund focusing on risk diversification and volatility reduction by investing 30% in fixed income instruments and actively investing in Thai equities.

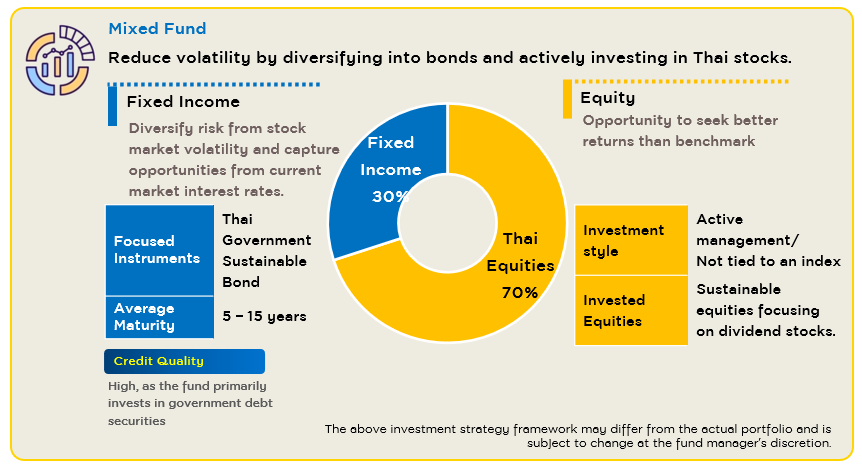

KFS50-THAIESGX-69 (Krungsri SET50 Thailand ESG Extra Fund-69)

A passive equity fund focusing on defensive investment to capture growth in line with large-cap Thai equities, while emphasizing sustainability factors.

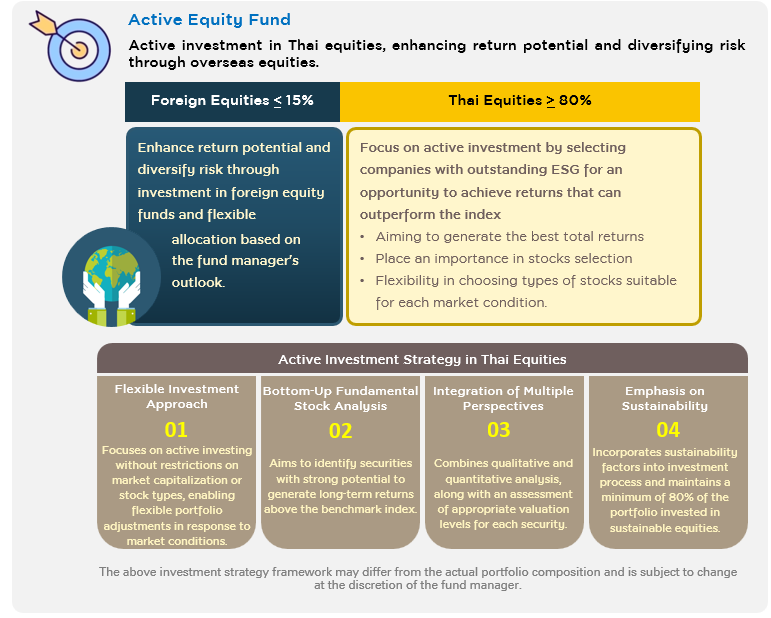

KFAEQ-THAIESGX-69 (Krungsri Active Equity Thailand ESG Extra Fund-69)

An active equity fund focusing on active investment in Thai equities, offering opportunities for return enhancement and diversification through foreign equity investments.

Summary of Tax-Deductible Investment Conditions for Thai ESG & Thai ESGX-69 Funds

- The tax-deductible amount for Thai ESG and Thai ESGX-69 funds is combined.

- Investment is limited to no more than 30% of assessable income, capped at 300,000 Baht per year.

- A 5-year holding period, calculated on a day-to-day basis.

- Continuous annual investment is not required.

- Investors may switch between Thai ESG and Thai ESGX-69 funds, which will be considered a continuation of investment (not a new investment).

- Thai ESG / Thai ESGX are funds that promote long-term savings and support sustainable investment for Thailand | RMF for retirement investment. Past performance of a mutual fund is not a guarantee of future performance.

- Investors should understand the product characteristics, return conditions, risks, and review the tax benefits specified in the Investment Guide before making an investment decision.

- Unitholders will not be entitled to tax benefits if they fail to comply with the investment conditions, and must return any tax benefits previously received within the prescribed period. Otherwise, additional payments and/or penalties may be imposed in accordance with the Revenue Code.

- This document is prepared based on information from reliable sources as of the date shown; however, the Company cannot guarantee the accuracy, reliability, or completeness of all information contained herein.

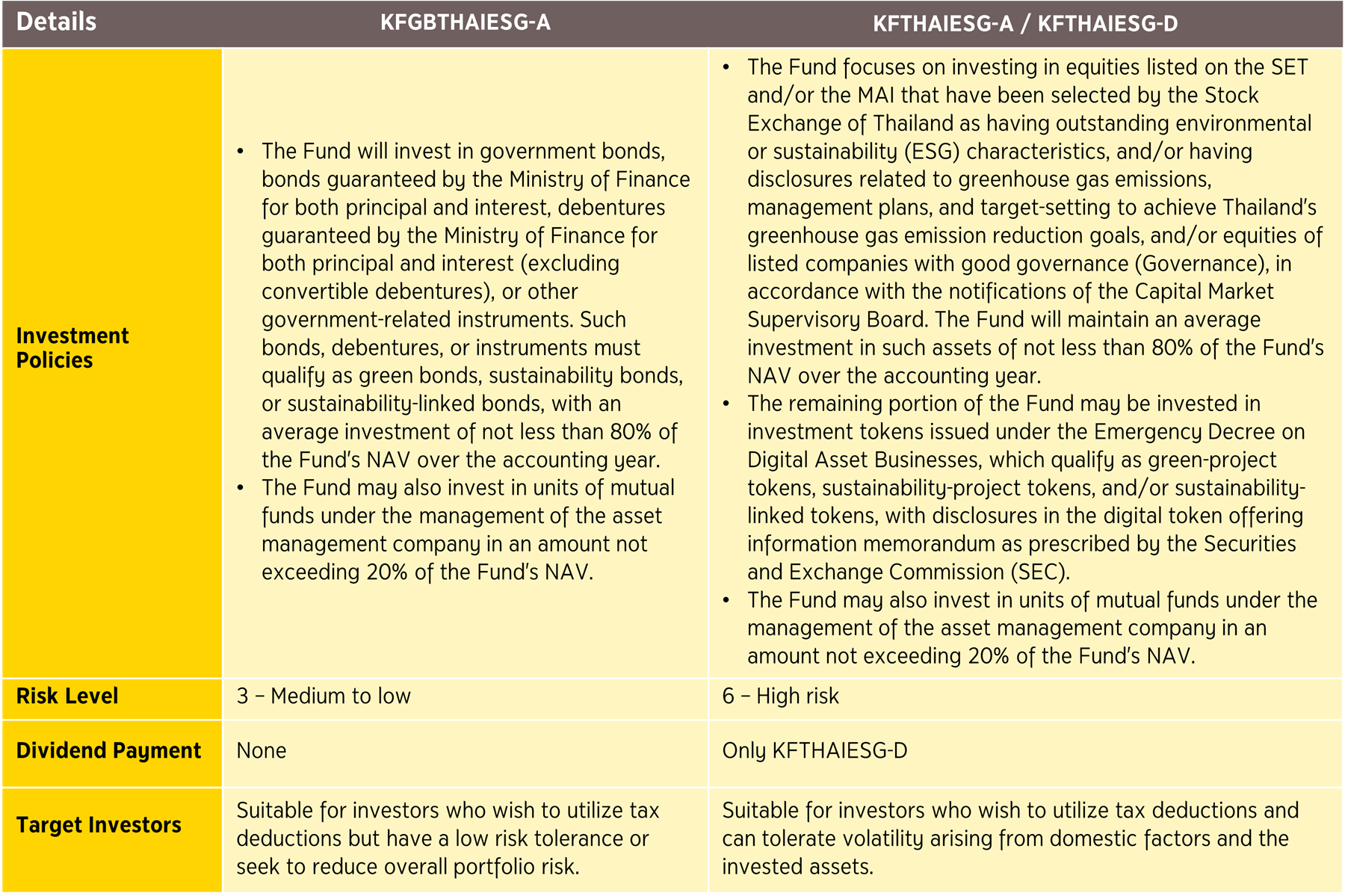

Investment Policies of 2 Thai ESG Funds

Investment Limitations / Risks of KFGBTHAIESG

- Investment Limitations: Due to the investment framework focusing on government bonds, bonds guaranteed by the Ministry of Finance (principal and interest), or debentures guaranteed by the Ministry of Finance (excluding convertible debentures), which qualify as green bonds, sustainability bonds, or sustainability-linked bonds, the fund’s investment universe is limited.

- Risks Related to Sustainable Mutual Fund Investments

- Risk from concentration in government and government-guaranteed bonds, which may result in missed opportunities to invest in general fixed income instruments offering potentially higher returns.

- Risk from reliance on ESG data sourced from external providers, which may be incomplete or inaccurate. The asset management company will seek additional sources to enhance data reliability.

- Risk of investment in instruments that may not fully comply with the fund’s sustainability framework, such as issuers lacking full control or cases where counterparties (e.g., suppliers, contractors, service providers) do not comply with sustainability standards beyond the company’s awareness.

- Liquidity risk, where the fund may be unable to buy or sell securities at appropriate prices or within suitable timeframes due to sustainability-related investment conditions.

*Details of Conditions for 2026 Accumulated Investment Promotion

Special Promotion for Full-Year Investment in 2026: Accumulate investments throughout 2026 in participating RMF and Thai ESG/ Thai ESGX funds by Krungsri Asset Management and receive additional KFCASH-A fund units worth 100 Baht for every 50,000 Baht of cumulative investment, subject to terms and conditions.*

Enjoy a wide range of fund options across all asset classes, capturing every trend and growth opportunity - while benefiting from tax deductions and the potential for attractive long-term returns.

For RMF / Thai ESG/ Thai ESGX investment manual, click

For further information about the funds or to request a prospectus, please contact Krungsri Asset Management at 02-657-5757, press 2.

Enjoy a wide range of fund options across all asset classes, capturing every trend and growth opportunity - while benefiting from tax deductions and the potential for attractive long-term returns.

- For RMF funds info, click here

- For Thai ESG/ Thai ESGX funds, click here

- This promotion is applicable only to individual investors investing in funds under the RMF, and Thai ESG / Thai ESGX fund categories managed by Krungsri Asset Management Company Limited (“the Company”), excluding KFCASHRMF and any other RMF / Thai ESG / Thai ESGX funds that the Company may later announce as excluded. Eligible investments must have a net accumulated investment amount during the period from 5 January – 30 December 2026 only.

- Investors must hold the investment units purchased during the promotional period until 31 March 2027, which is the date on which the Company will calculate the net accumulated investment amount to determine eligibility for receiving KFCASH-A fund units.

- Net accumulated investment amount refers to the total investment amount from purchases and switches into eligible funds from non-RMF/ non-Thai ESG/ non-Thai ESGX funds of the Company, as well as transfers into RMF/ Thai ESG funds from other asset management companies, excluding transfers from PVD to RMF, minus the total amount of redemptions, switches out to RMF/ Thai ESG/ Thai ESGX funds not participating in this promotion or to any funds of the Company, and transfers out to other asset management companies. An exception applies to redemptions, switches out, and transfers out of investment units held as of 30 December 2025, which will be calculated using the First-In, First-Out (FIFO) method, in accordance with tax regulations prescribed by the Revenue Department.

- If an investor holds more than one mutual fund account, the Company will aggregate the net accumulated investment amount across all accounts, based on the investor’s national ID number

The Company will transfer KFCASH-A fund units in accordance with the investment and entitlement conditions by 30 April 2027, based on the net asset value on the transfer date. - Investment units eligible under the promotion for regular monthly RMF/ Thai ESG/ Thai ESGX investments with equal amounts for 12 consecutive months (January – December 2026) - including any other promotions that the Company may announce later - will not be eligible for this promotion.

- RMF units transferred from PVD will be eligible for promotions related to RMF for PVD transfers but will not be eligible for this promotion.

- Investments made by juristic persons, institutions, and provident funds are not eligible for this promotion.

- The Company reserves the right to change the terms and conditions of this promotion with prior notice. In the event of any dispute, the Company’s decision shall be final.

- @ccess Mobile App, click | @ccess Online Service, click

- krungsri App (for customers who opened mutual fund accounts via Krungsri Bank), click

For RMF / Thai ESG/ Thai ESGX investment manual, click

For further information about the funds or to request a prospectus, please contact Krungsri Asset Management at 02-657-5757, press 2.

- Thai ESG / Thai ESGX are funds that promote long-term savings and support sustainable investment in Thailand, while RMF is designed to promote long-term investing for retirement purposes. Investors should carefully understand the product features, return conditions, risks, and review tax benefits stated in the investment guide before making an investment. Past performance of mutual funds is not a guarantee of future results.

- This document has been prepared based on information obtained from reliable sources as of the date shown. However, the Company cannot guarantee the accuracy, reliability, or completeness of all information and reserves the right to change any information with prior notice.

- For KFGOLDRMF, investors should seek additional advice prior to making an investment.

- KFGOLDRMF, KF-WORLD-INDXRMF, KF-SINCOME-FXRMF, and KF-US-PLUSRMF may hedge foreign exchange risk at the fund manager’s discretion. As a result, investors remain exposed to foreign exchange risk, which may cause gains or losses from currency fluctuations or result in a return lower than the initial investment.

- Purchases of mutual fund units via credit cards are not eligible for credit card promotional campaigns.

Investors should study the tax benefits specified in the investment manual. Unit holders will not be entitled to tax benefits if they fail to comply with the investment conditions and will be required to return any tax benefits previously received within the prescribed period. Otherwise, additional payments and/or penalties may apply in accordance with the Revenue Code.

Terms and Conditions for Purchasing Mutual Funds via Credit Card

- Investors may use participating Krungsri Bank credit cards to purchase units of funds in the Company’s RMF/ Thai ESG/ Thai ESGX funds, excluding KFCASHRMF, KFAFIXRMF, KFGOVRMF, KFLTGOVRMF, KFMTFIRMF, KFGBTHAIESG-A, and any other RMF/ Thai ESG/ Thai ESGX funds that the Company may announce as excluded in the future. Please review additional terms and conditions below.

- Krungsri credit card reward points (all types, excluding Krungsri Corporate Card) may be redeemed as cash to purchase units of RMF/ Thai ESG / Thai ESGX funds via @ccess Mobile Application and @ccess Online Service. Every 1,000 points may be redeemed as THB 100 for investment. | For details and terms & conditions, click here

- Eligible credit cards include participating cards under Krungsri Consumer, namely: all types of Krungsri credit cards, HomePro Visa Platinum, Manchester United Credit Card, AIA Visa Credit Card, Siam Takashimaya Credit Card, Krungsri Now Platinum Credit Card, Central The 1 Credit Card, Lotus’s Credit Card, Krungsri First Choice Visa Credit Card, and XU Digital Credit Card, for purchasing units of RMF / Thai ESG funds, except for KFCASHRMF, KFAFIXRMF, KFGOVRMF, KFLTGOVRMF, KFMTFIRMF, KFGBTHAIESG-A, and other RMF / Thai ESG/ Thai ESGX funds in 2026 as may be announced for exclusion by the Company in the future.

- Purchases of fund units are not eligible for credit card promotions or reward points.

- Credit card usage terms and conditions are subject to those specified by the Company and the credit card issuers.

- The Company reserves the right to amend the terms and conditions for credit card purchases with prior notice. In the event of any dispute, the Company’s decision shall be final.