News/Announcement

Promotions/Fund Highlight

KF-EUROPE: Broader Access to Europe’s Equity Gems, Greater Return Potential

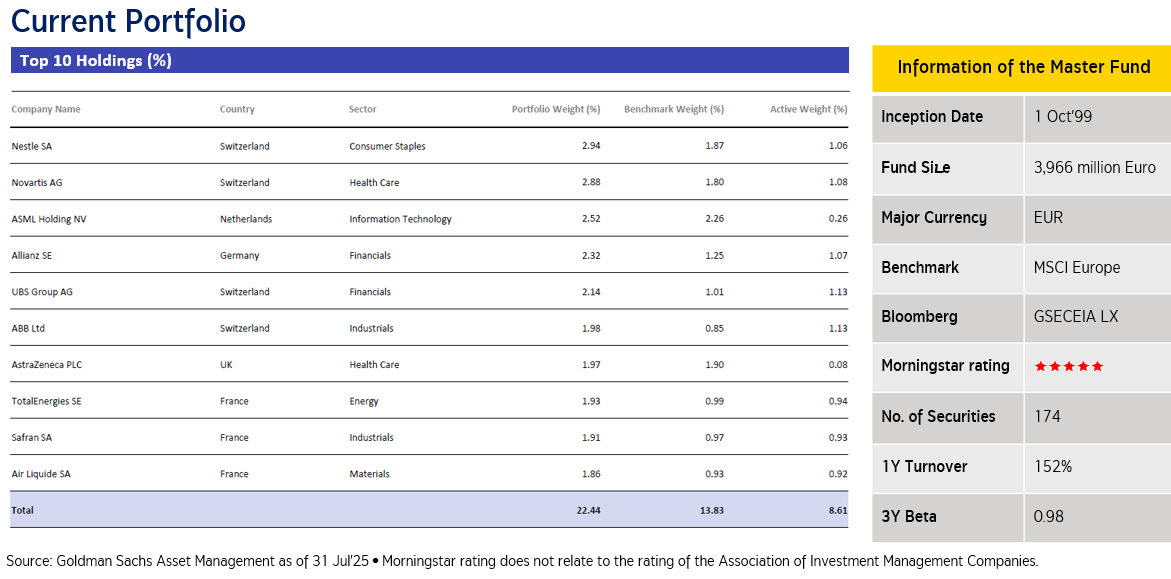

Europe … a region full of diverse investment opportunities across stock markets in more than 20 countries. KF-EUROPE / KF-HEUROPE / KFEURORMF provide investors access to high-quality European equities through the new master fund, Goldman Sachs Europe CORE® Equity Portfolio, which has been awarded a 5-star Morningstar rating* and demonstrates an outstanding performance track record. Leveraging advanced AI-driven data analysis, the fund identifies wider investment opportunities, diversifies portfolios, and enhances the potential to generate above-market returns across multiple sources while adapting swiftly to changing market conditions. (*Source: Goldman Sachs Asset Management as of 31 July 2025. Morningstar ratings are independent and not related to any rankings of Association of Investment Management Companies (AIMC))

Remark: The master fund change will take effect on 26 September 2025.

Why Krungsri Asset Management chose Goldman Sachs Europe CORE® Equity Portfolio?

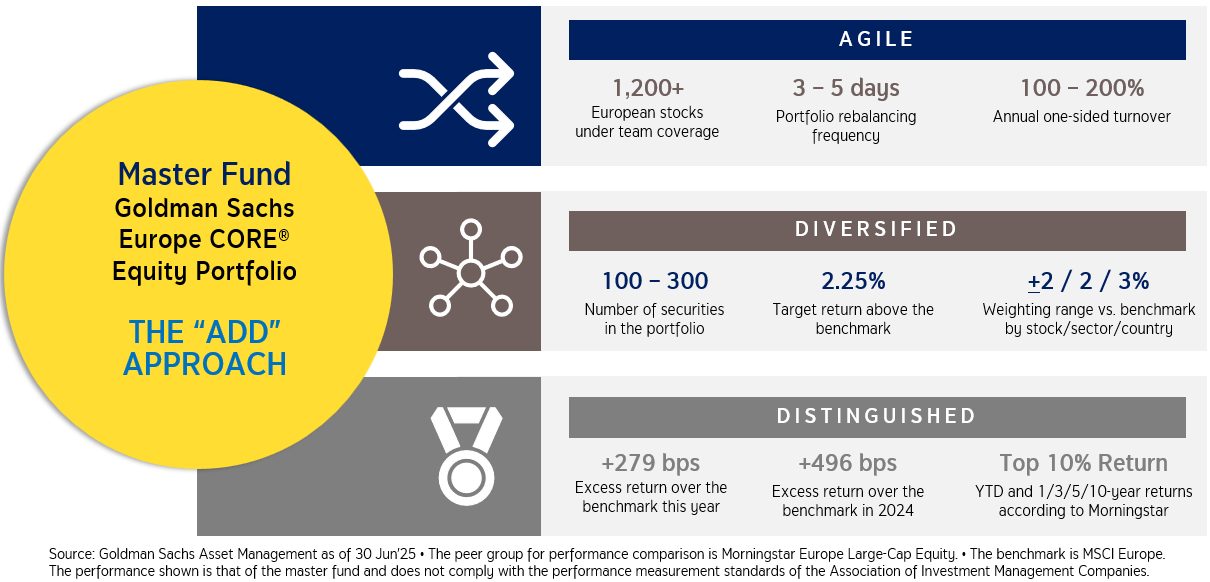

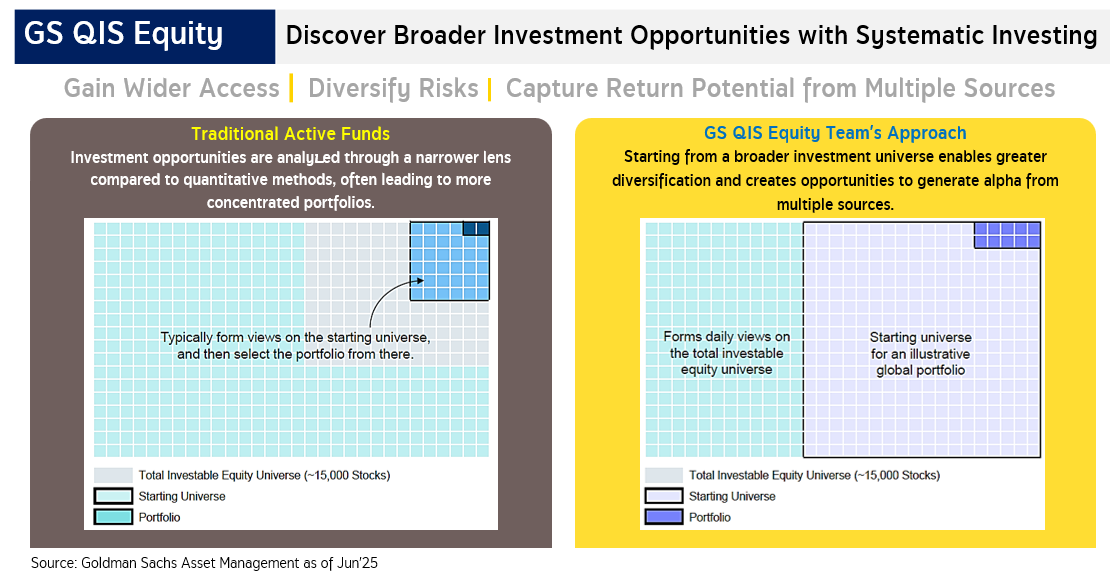

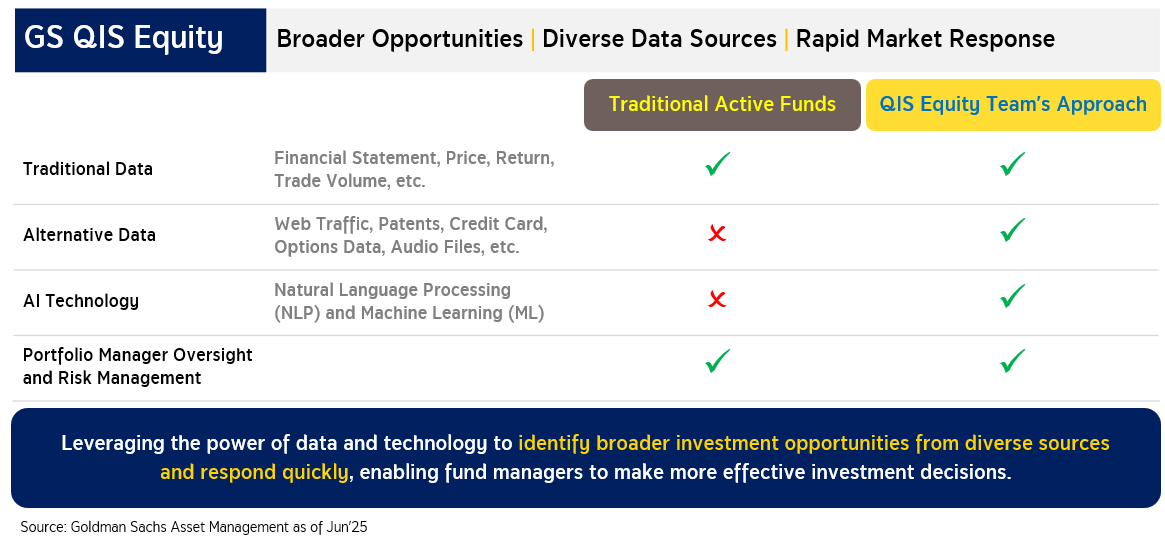

1. Investment Philosophy: The fund is managed by the Quantitative Investment Strategies (QIS) Equity Alpha team, combining Systemic Investing with continuous innovation. Their data advantage enables the fund to uncover market opportunities yet to be discovered - particularly suitable for European equities, which are widely dispersed, have slower information dissemination, and a quantitative-friendly environment—allowing managers to make effective investment decisions.

2. Balanced Portfolio: The fund blends high-Growth and Value Stocks, aligning with European markets where returns often rotate between these two segments, unlike U.S. markets where Growth stocks tend to dominate consistently.

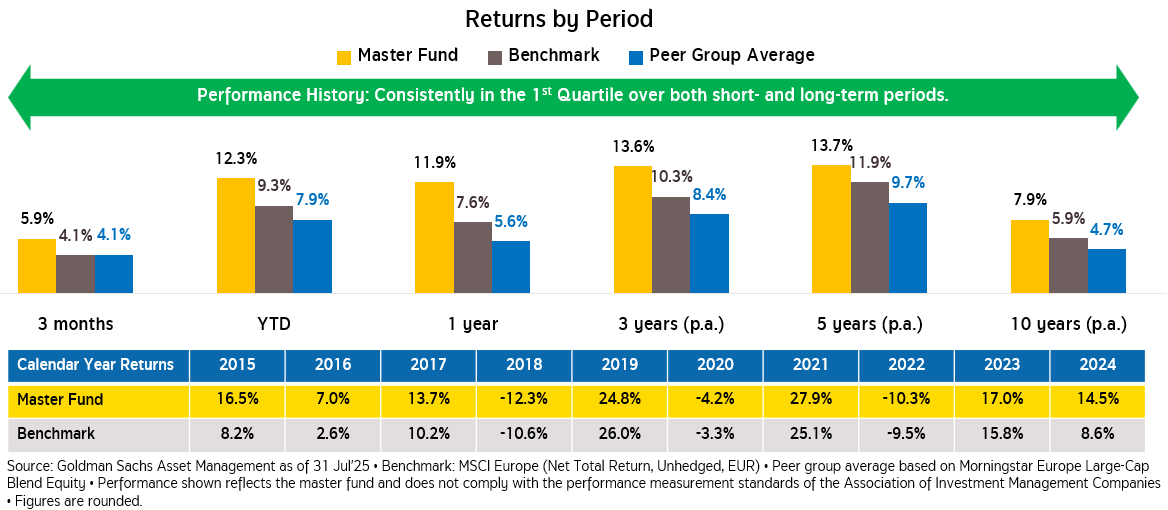

3. Strong and Consistent Track Record: Historical performance demonstrates superior and stable returns.

Supportive Factors for European Stocks

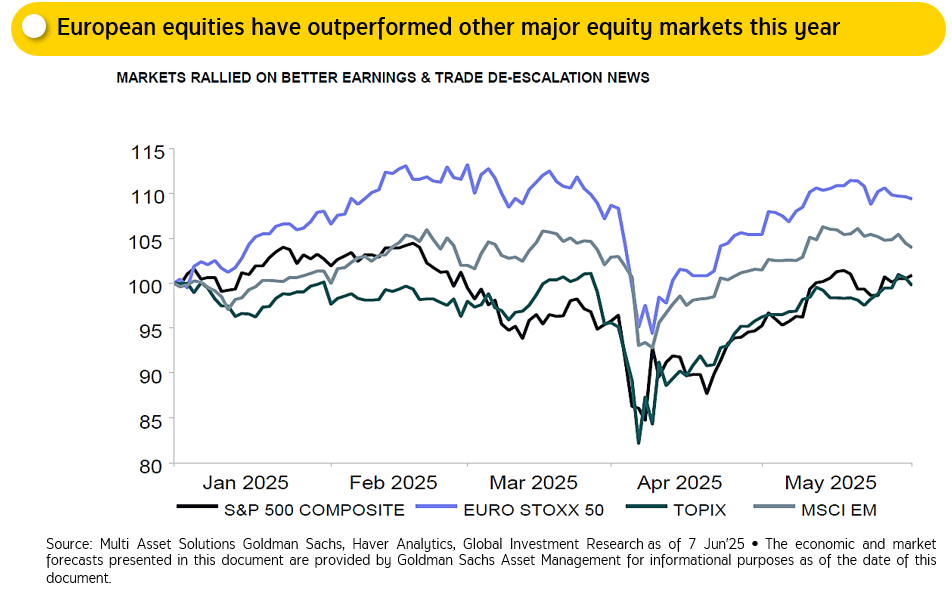

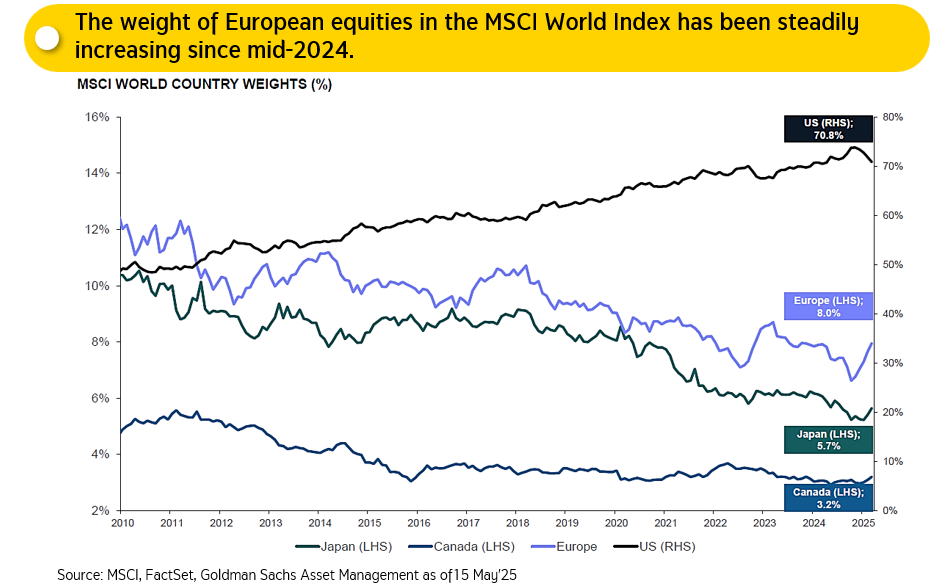

- European equities have outperformed other major markets this year. The weighting of European stocks in the MSCI World Index has steadily increased since mid-2024.

- Slowing inflation may support monetary easing. Europe’s policy interest rates are at their lowest compared with the U.S. and U.K., with potential further reductions, conducive to economic growth.

- Fiscal policies aim to restore confidence in medium- to long-term economic growth, e.g., European defense spending under the ReArm Europe Plan 2030, Germany’s infrastructure and energy investment plans, and potential EU defense spending increasing to 3% of GDP within five years.

- Attractive valuations: European stocks are cheaper than U.S. equities and comparable to Japanese equities, offering appealing opportunities from a valuation perspective.

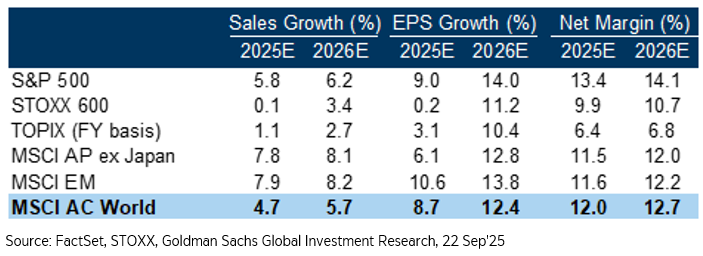

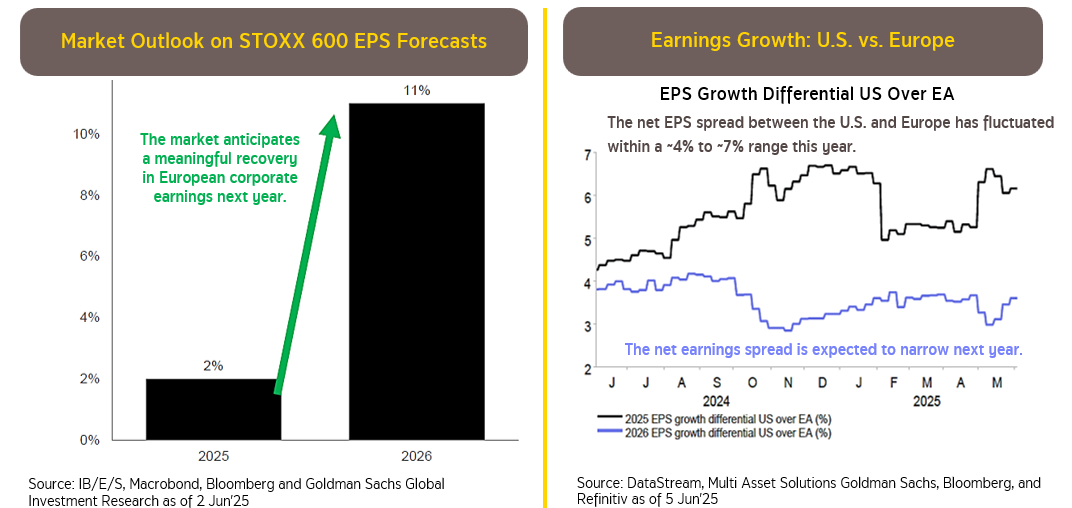

- European corporate earnings are expected to recover next year.

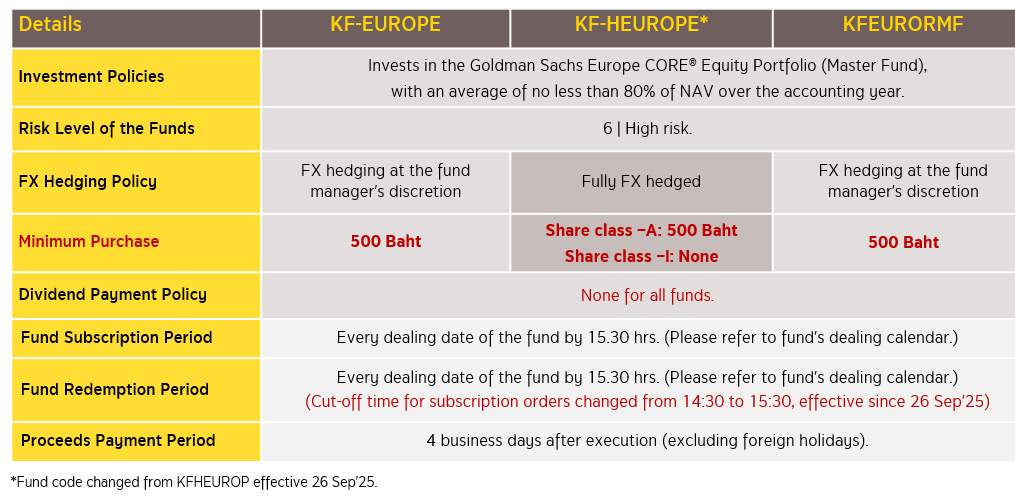

Summary of Krungsri Asset Management Funds

- Krungsri Europe Equity Fund (KF-EUROPE)

- Krungsri Europe Equity Hedged Fund (KF-HEUROPE)

- Krungsri Europe Equity RMF (KFEURORMF)

For more information or to request a prospectus, contact Krungsri Asset Management Co., Ltd. at 02-657-5757, press 2

Disclaimers

- RMFs are long-term retirement-oriented funds. Investors should understand the product features, returns, risks, and tax benefits in the investment prospectus before investing. Past performance does not guarantee future results.

- This material is based on reliable sources as of the date shown. Krungsri Asset Management cannot guarantee the accuracy, reliability, or completeness of the information and reserves the right to change information without prior notice.

- KF-EUROPE and KFEURORMF may use foreign exchange hedging at the fund manager’s discretion, and investors are exposed to FX risk, which could result in gains or losses or returns below the initial investment.

- Credit card purchases are not eligible for promotions.

- Investors should review the tax benefits specified in the investment guide. Unitholders will not be entitled to such tax benefits if they fail to comply with the investment conditions, and they must return any tax benefits previously received within the prescribed period. Otherwise, they will be subject to additional payments and/or penalties under the Revenue Code.