News/Announcement

Promotions/Fund Highlight

KFDIVERSE ... Opportunity for Attractive Returns through Global Diversified Fixed Income

KFDIVERSE ... Opportunity for Attractive Returns through Global Diversified Fixed Income

Invest in the master fund PIMCO GIS Diversified Income Fund

5-star fund by Morningstar in the category of private sector's fixed income instrument*

*Source: Morningstar Rating from PIMCO as of 31 Mar. 2020 | The above ranking is not relevant to the AIMC.

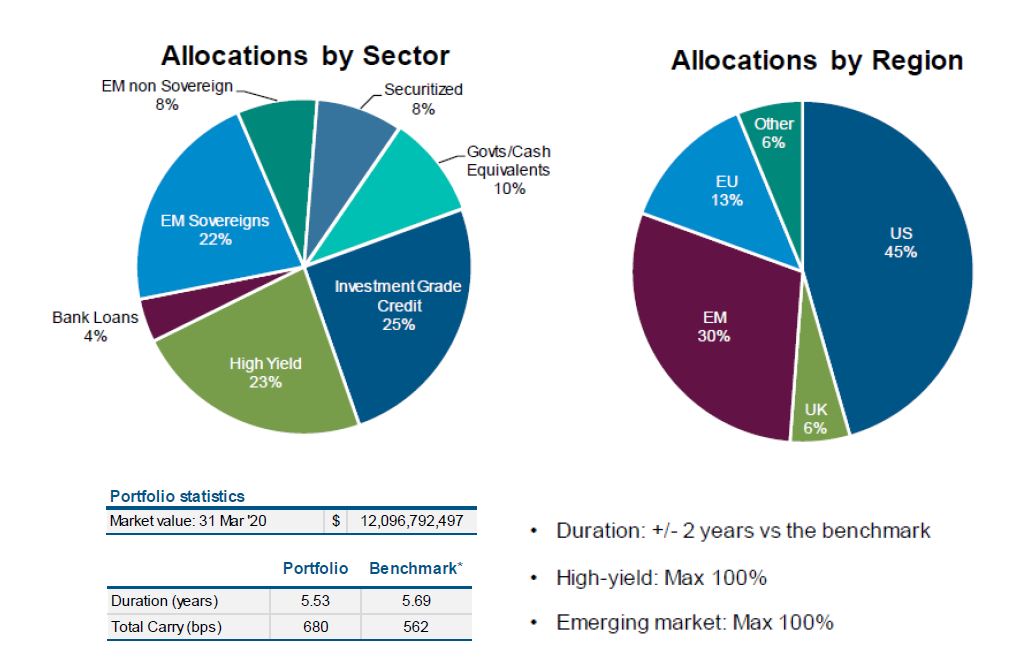

Current Portfolio Positioning of the Master Fund

Source: PIMCO as of 31 March 2020. All allocations are quoted in percentage market value. Other Regions includes Non EMU European countries as well as Developed Asia.

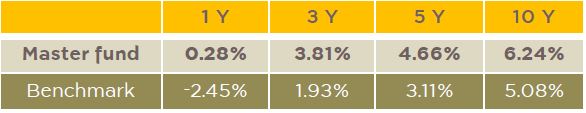

Past Performance of the Master Fund (annualized)

Source: PIMCO as of 31 March 2020. This shows the performance of the master fund, so it is not complied to AIMC’s standard

Target Investors for KFDIVERSE

-

Investors looking for higher returns: Through a diversification in global fixed income instruments issued by private sector under a selection by experienced fund manager teams

-

Investors needing to avoid stock market volatility: Amidst uncertainty in the global market, investment in fixed income instrument will help reduce volatility in portfolio.

-

Investors focusing on a balanced investment strategy: Recommended period to invest is two years onwards.

Fund Policy of KFDIVERSE (Krungsri Diversified Income Fund)

divided into two share classes:

KFDIVERS-A: Krungsri Diversified Income Fund-A

KFDIVERS-R: Krungsri Diversified Income Fund-R

Investment Policy |

Invest in PIMCO GIS Diversified Income Fund (Institutional – Income (USD) (The master fund), on average in an accounting year, of not less than 80% of fund’s NAV. |

Risk Level |

5 – Moderate to high risk / Fully hedge against foreign exchange rate risk |

Dealing Date |

Daily (Please refer to Fund’s Non-Dealing Calendar) |

Auto Switching |

KFDIVERS-A: No auto-switching policy

|

Minimum Investment |

2,000 Baht |

IPO |

19 - 26 May 2020

|

**Automatic switching transaction will cause the decrease in outstanding units.

Disclaimer

- Please study fund features, performance, and risk before investing. Past performance is not an indicative of future performance.

- The fund may invest in non-investment grade or unrated debt securities, so investors may be exposed to risk which result in loss of investment return and principal.

- The funds will enter into a forward contract to fully hedge against the exchange rate risk, in which case, it may incur costs for risk hedging transaction and the increased costs may reduce overall return.

- The fund and/or master fund may invest in or make available a forward contract to enhance efficiency in investment management. This means the fund may contain higher risks than other funds and therefore the fund is suitable for investors who prefer higher return with higher risk tolerance than general investors.