News/Announcement

Promotions/Fund Highlight

KF-SINCOME-USD: A Leading Foreign Fixed Income Fund in USD

New! KF-SINCOME-USD: A USD-denominated fixed income fund offering you the potential for attractive returns closely aligned with the 5-star rated* master fund, PIMCO GIS Income Fund. This fund helps reduce currency fluctuation risk and hedging costs - making it a smart option amid global economic volatility.

IPO Period: 30 July – 7 August 2025 - Enjoy a Special Promotion when you invest: For every USD 5,000 invested, get KF-SINCOME-USD units worth USD 5 (Terms & conditions apply)

(Click here to learn how to open an account and subscribe.)

KF-SINCOME-USD (Krungsri Global Smart Income Fund – USD)

The only fund that invests in the PIMCO GIS Income Fund in US dollars — a currency held globally.

Ideal for investors seeking to diversify their fixed income portfolio and enhance overall portfolio yield.

Source: Morningstar rating as of June 2025. Awards and ratings are independent and not related to any rankings by the Association of Investment Management Companies.

Source: Morningstar rating as of June 2025. Awards and ratings are independent and not related to any rankings by the Association of Investment Management Companies.Positive Outlook for Fixed Income Fund

In an era of a fragmented global economy, returns from fixed income investment can still help navigate volatility in a divided world - supported by potential Fed rate cuts, attractive valuations, and a recovery in yields. Compared to historical levels, global fixed income instruments now offer compelling return opportunities and portfolio diversification.

Why the Master Fund – PIMCO GIS Income Fund – Stands Out

Three Key Strategies

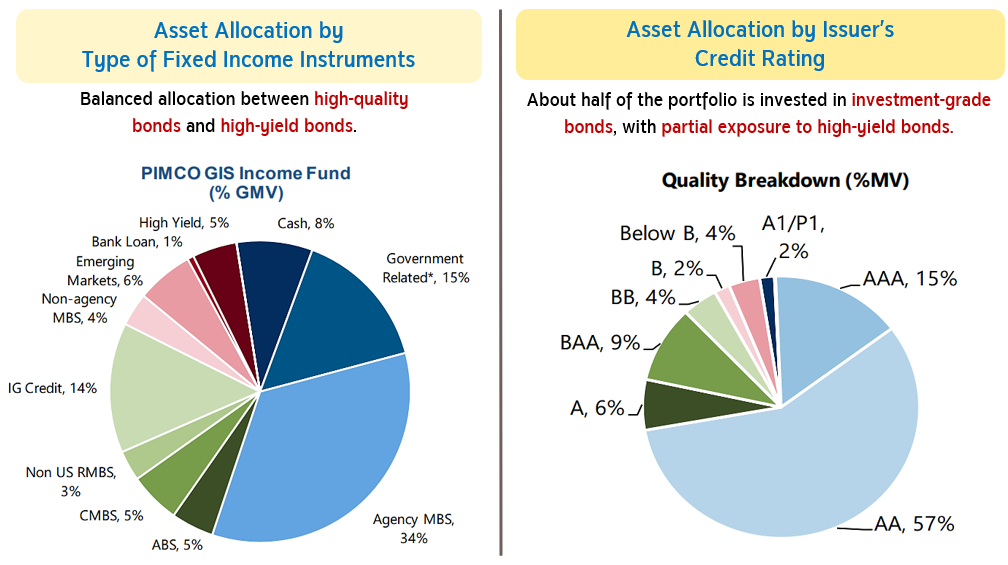

Current Portfolio Allocation

Diversified and focused on high-quality bonds.

Source: PIMCO as of 30 June 2025. “Government Related” includes sovereign bonds, inflation-linked bonds, government agency bonds, and FDIC/government-guaranteed bonds issued by the U.S., Japan, UK, Australia, Canada, and the EU. This category excludes interest rate derivatives used for managing portfolio duration. Derivatives include interest rate swaps, futures, and swap options. ABS includes traditional ABS, CLOs, and CDOs. “Other” includes municipal bonds, preferred shares, and equities acquired through restructuring opportunities.

Source: PIMCO as of 30 June 2025. “Government Related” includes sovereign bonds, inflation-linked bonds, government agency bonds, and FDIC/government-guaranteed bonds issued by the U.S., Japan, UK, Australia, Canada, and the EU. This category excludes interest rate derivatives used for managing portfolio duration. Derivatives include interest rate swaps, futures, and swap options. ABS includes traditional ABS, CLOs, and CDOs. “Other” includes municipal bonds, preferred shares, and equities acquired through restructuring opportunities.Flexible Investment Strategy

Active management across various fixed income sectors and durations. The fund seeks a balance between return generation and capital preservation, with a track record of recovering strongly post-crisis—evidenced by long-term performance.

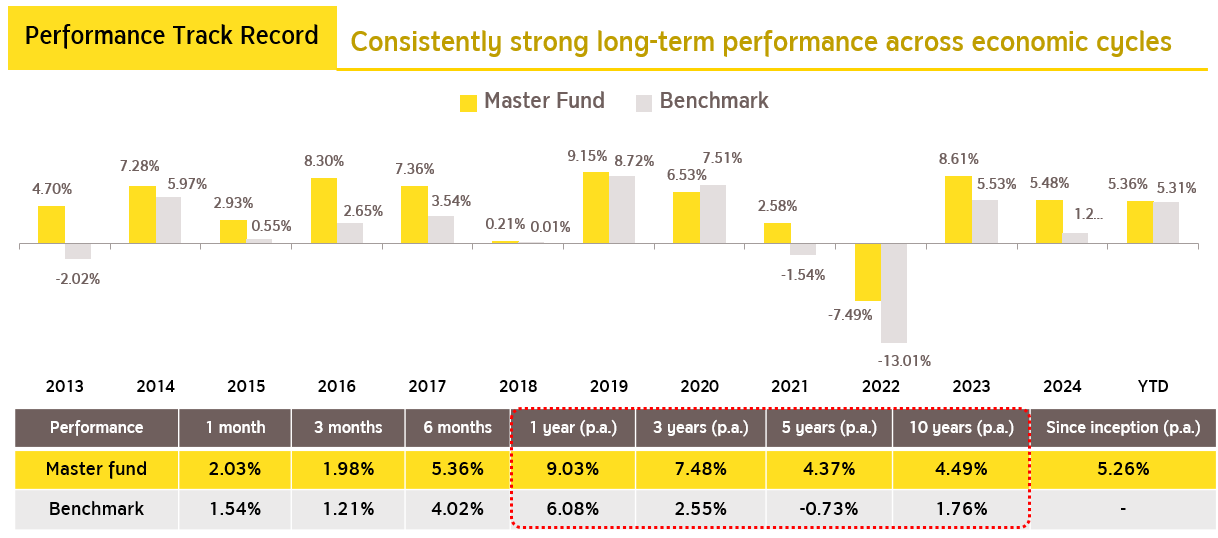

Proven Long-Term Performance

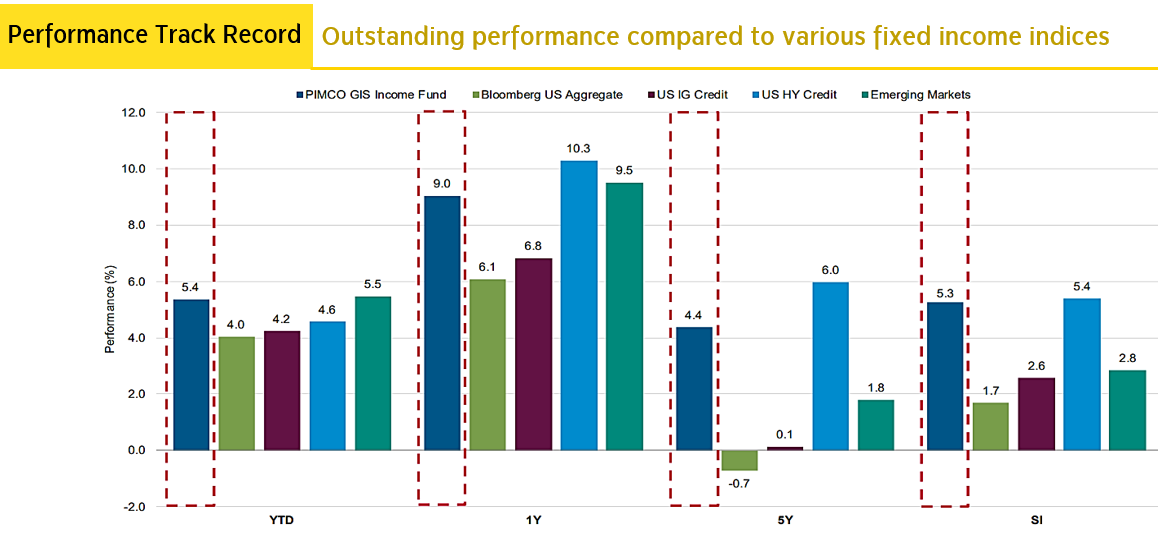

The master fund has demonstrated strong returns throughout multiple economic cycles and outperformed various fixed income benchmarks.

Source: PIMCO as of 30 June 2025. Benchmark: Bloomberg U.S. Aggregate Index. Inception date: 30 November 2012. Performance shown is net of management fees and in USD. The performance of the master fund is not in accordance with AIMC performance measurement standards.

Source: Bloomberg, PIMCO as of 30 June 2025. Benchmarks: Bloomberg U.S. Aggregate Index, Bloomberg U.S. Credit Index (IG), Bloomberg U.S. High Yield Index (HY), J.P. Morgan EMBI Global Composite Index (EM). For illustrative purposes only. Institutional share class performance shown. Performance is based on the master fund and not in accordance with AIMC standards.

Source: Bloomberg, PIMCO as of 30 June 2025. Benchmarks: Bloomberg U.S. Aggregate Index, Bloomberg U.S. Credit Index (IG), Bloomberg U.S. High Yield Index (HY), J.P. Morgan EMBI Global Composite Index (EM). For illustrative purposes only. Institutional share class performance shown. Performance is based on the master fund and not in accordance with AIMC standards.Explore the PIMCO GIS Income Fund Universe

And New Fund Highlight Summary: KF-SINCOME-USD

Suitable Investors for KF-SINCOME-USD

- Investors with assets or expenses in US dollars

- Those seeking returns similar to the master fund without incurring currency hedging costs

- Those looking to diversify from Thai baht exposure or who have a positive outlook on the US dollar

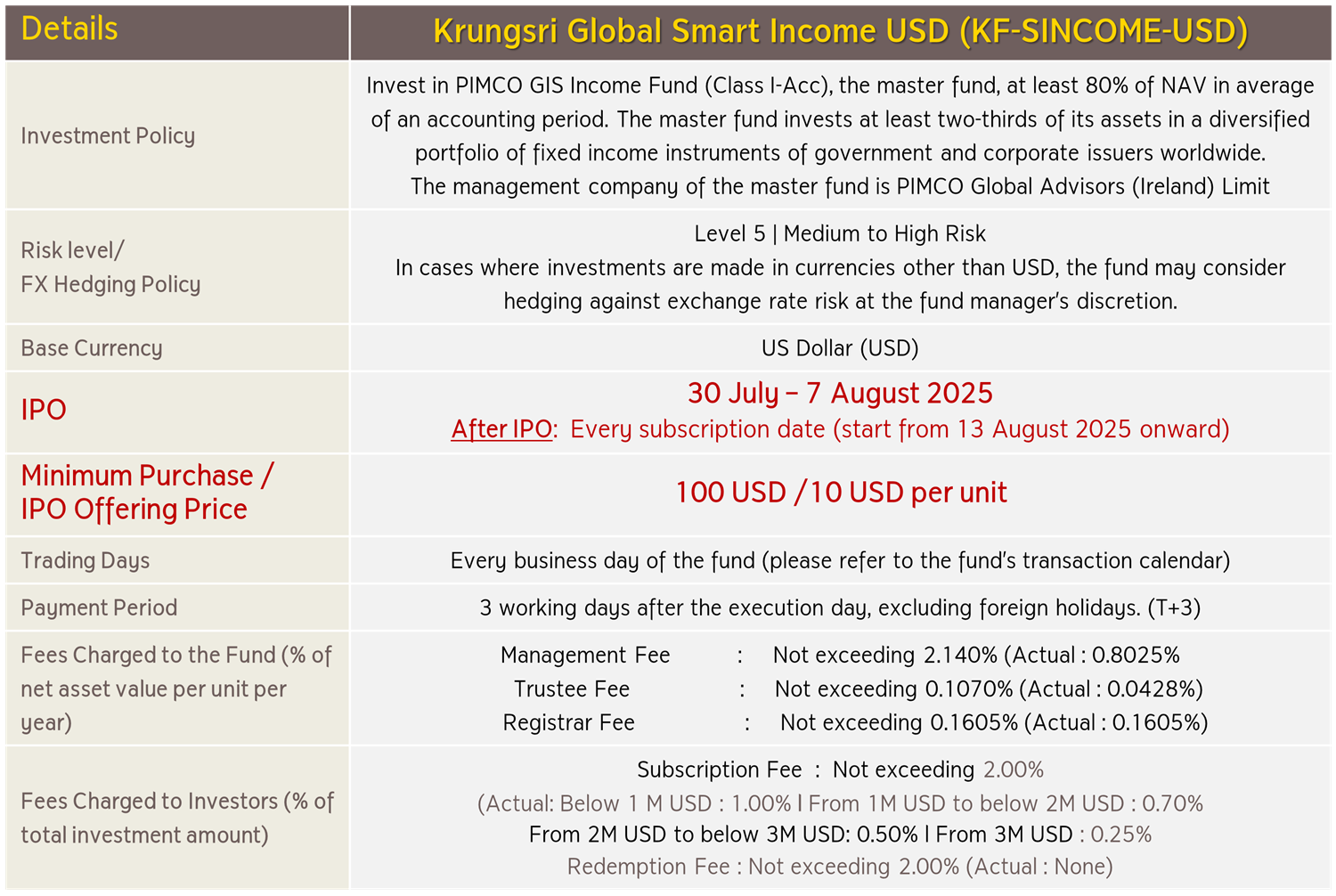

Key Fund Information

For more details or to request a prospectus, contact: Krungsri Asset Management Co., Ltd.

Tel: 02-657-5757 (Press 2)

- This document is prepared from reliable sources as of the publication date. However, the company does not guarantee the accuracy, reliability, or completeness of all information and reserves the right to change it without prior notice.

- KF-SINCOME-FX applies FX hedging at the fund manager's discretion and may be exposed to currency risk, potentially causing gains/losses or returns lower than the initial investment.

- For KF-SINCOME-USD, in cases of investment in non-USD currencies, the fund may also hedge FX risk at the manager's discretion and therefore is subject to currency fluctuations.

- Investors should understand the product features, return conditions, and associated risks before investing. Past performance does not guarantee future results.

Details of Special Promotion during IPO

For every 5,000 USD investment in KF-SINCOME-USD

during the IPO period: 30 July – 7 August 2025

Receive additional KF-SINCOME-USD units worth 5 USD

during the IPO period: 30 July – 7 August 2025

Receive additional KF-SINCOME-USD units worth 5 USD

Promotion Entitlement Terms & Conditions:

- This promotion applies exclusively to net investment amounts in Krungsri Global Smart Income Fund USD (KF-SINCOME-USD) made during the initial public offering (IPO) period. Net investment is defined as the purchase amount minus any redemption amount.

- Unitholders must hold their investment until 8 December 2025. Eligibility will be determined based on the number of fund units held as of 7 August 2025. Any redemption or switching out of units between 8 August and 8 December 2025, regardless of the amount or number of units, will result in disqualification from this promotion.

- If there is any transfer of units to another individual during 8 August to 8 December 2025, regardless of amount or number of units, the investor will be disqualified from this promotion. For transfers to or from anonymous (non-disclosed) accounts, the investor must notify and provide confirmation to the management company that both accounts belong to the same unitholder in order to remain eligible.

- Investment amounts will be calculated on a per-account basis. If the investor holds more than one mutual fund account with the company, units in separate accounts will not be combined to meet the promotion criteria.

- Total investments below USD 5,000 will not be eligible for the promotional bonus units.

- The bonus KF-SINCOME-USD units will be allocated and transferred to eligible investors by 31 January 2026, calculated based on the fund’s unit price on the date of allocation. The company will waive the front-end fee for these promotional bonus units.

- Investments made through unit-linked insurance policies or provident funds are not eligible for this promotion.

- Investments made through omnibus accounts (non-disclosed unitholder accounts) may be subject to additional conditions. Investors are advised to check with their selling agents for further details.

- The management company reserves the right to substitute the bonus units with other benefits of equivalent value and to change the terms and conditions of this promotion without prior notice, at its sole discretion.

- All promotional expenses will be borne entirely by the management company and will not be charged to the fund in any way.

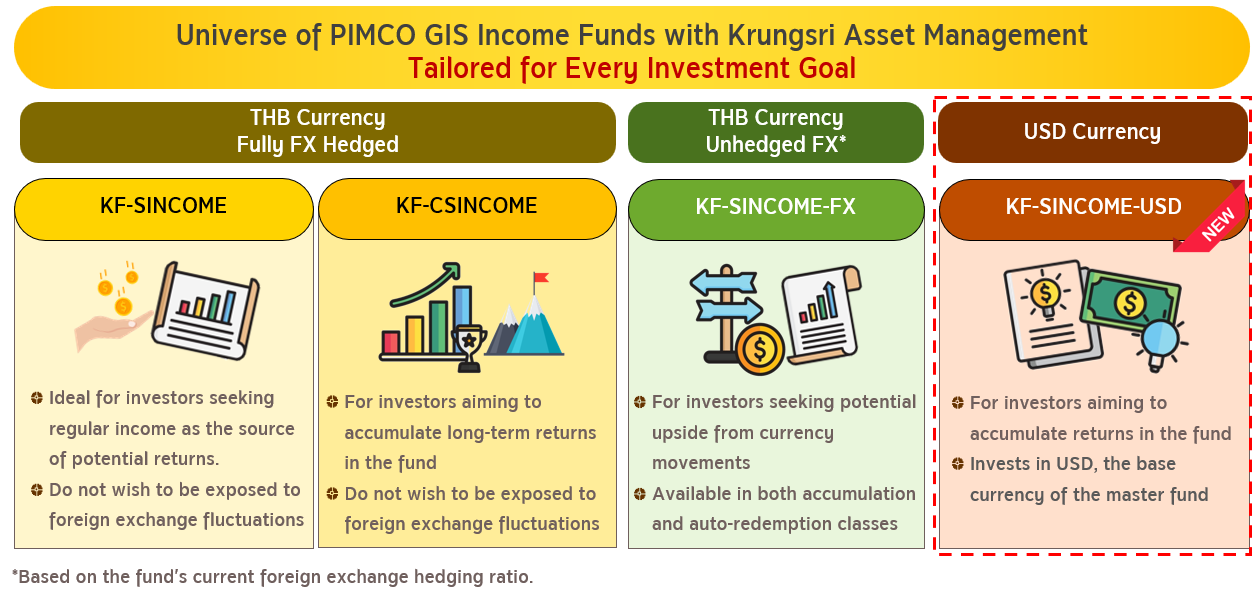

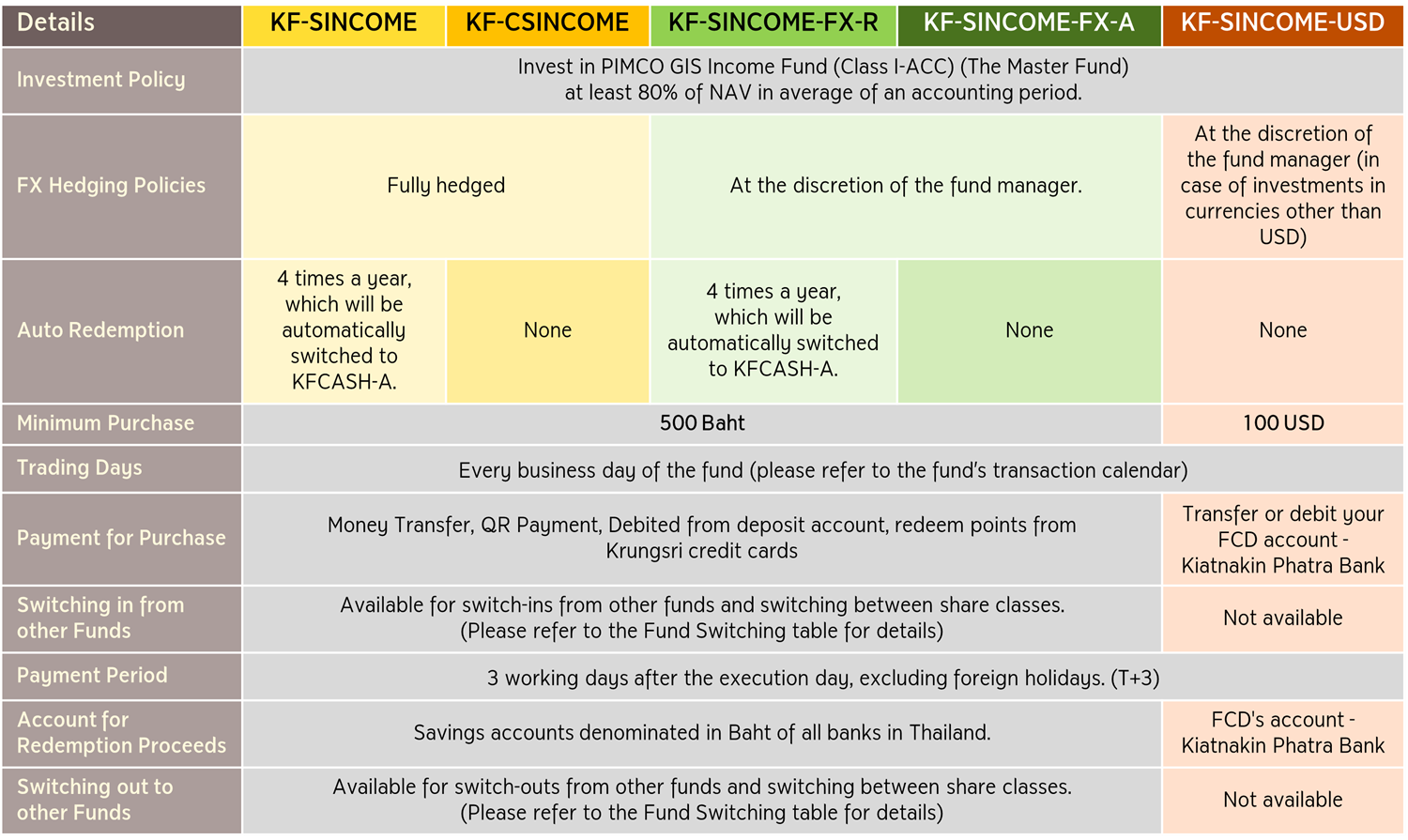

Funds Comparison: PIMCO GIS Income Fund Universe

The automatic redemption of fund units will reduce the number of units held by each unitholder. KF-SINCOME-FX Fund employs foreign exchange hedging at the discretion of the fund manager and is therefore exposed to exchange rate risk, which may result in a loss or gain from currency fluctuations and/or a redemption value lower than the initial investment.

The automatic redemption of fund units will reduce the number of units held by each unitholder. KF-SINCOME-FX Fund employs foreign exchange hedging at the discretion of the fund manager and is therefore exposed to exchange rate risk, which may result in a loss or gain from currency fluctuations and/or a redemption value lower than the initial investment.For the KF-SINCOME-USD Fund, in cases where investments are made in currencies other than USD, the fund may consider currency hedging at the discretion of the fund manager. As such, the fund is exposed to exchange rate risk, which may result in a loss or gain from currency fluctuations and/or a redemption value lower than the initial investment.