News/Announcement

Promotions/Fund Highlight

KF-GEI: Global Stock Selection & A Distinct Strategy for Outstanding Results.

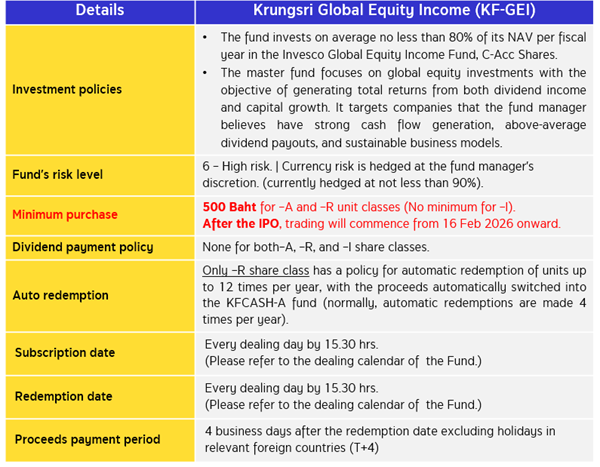

IPO: 4 – 11 February 2026.

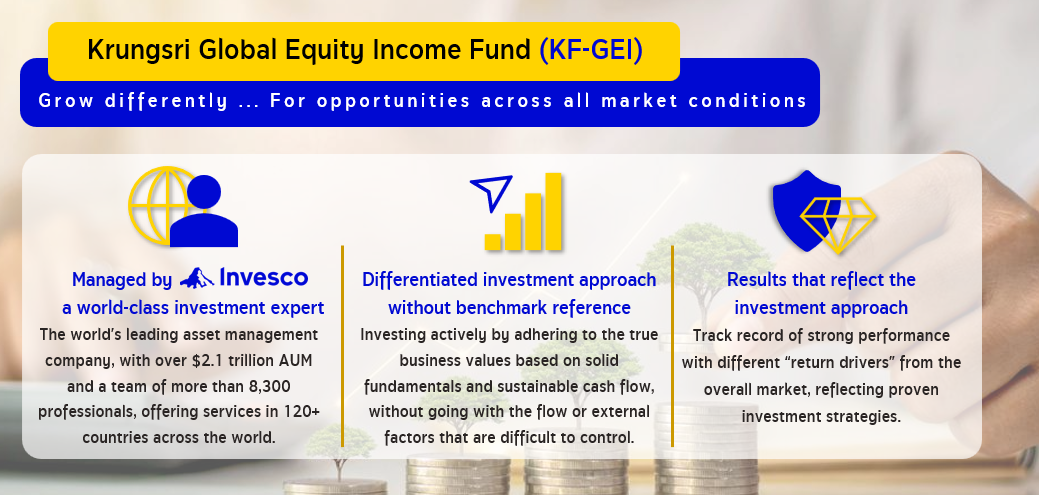

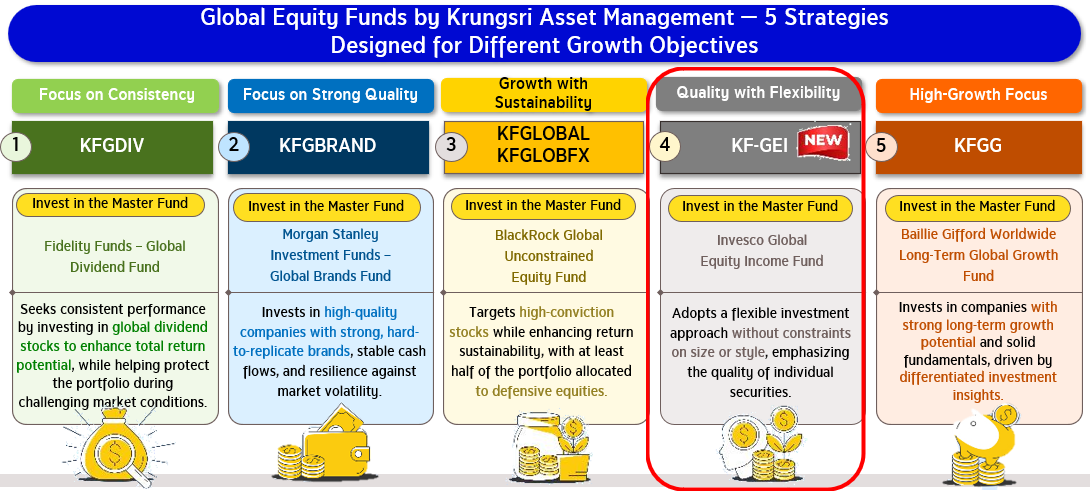

New! Krungsri Global Equity Income Fund (KF-GEI) offers a differentiated approach to global equity investing, aiming to deliver sustainable income alongside long-term capital appreciation through its master fund, the Invesco Global Equity Income Fund – the winner of the Fund Selector Asia Awards 2026 in the Global Equity category*. Thus, investors can be confident and rest assured that they have access to quality, differentiated growth potential, creating opportunities to generate returns across various market conditions.

IPO: 4 – 11 February 2026. | Minimum purchase: 500 Baht.

*Source: Invesco as of 31 Dec 2025 and Fund Selector Asia as of 25 Nov 2025. | The Fund Selector Asia awards are not related to the rankings of the Association of Investment Management Companies (AIMC). | Performance shown is that of the master fund and is not calculated in accordance with AIMC performance standards.

Highlights of the Master Fund: Invesco Global Equity Income Fund

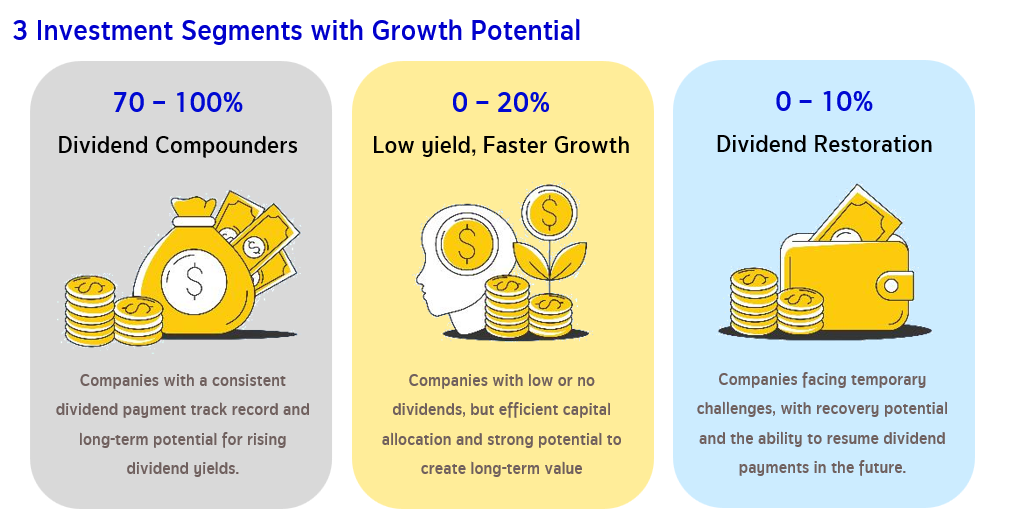

- The Dividend-Driven Return Strategy is designed to use dividend income as a key driver of total return by focusing on companies with the potential to deliver sustainable dividend growth over the long term, representing more than 70% of the portfolio.

Source: Invesco as of 31 Dec 2025. For illustrative purposes only.

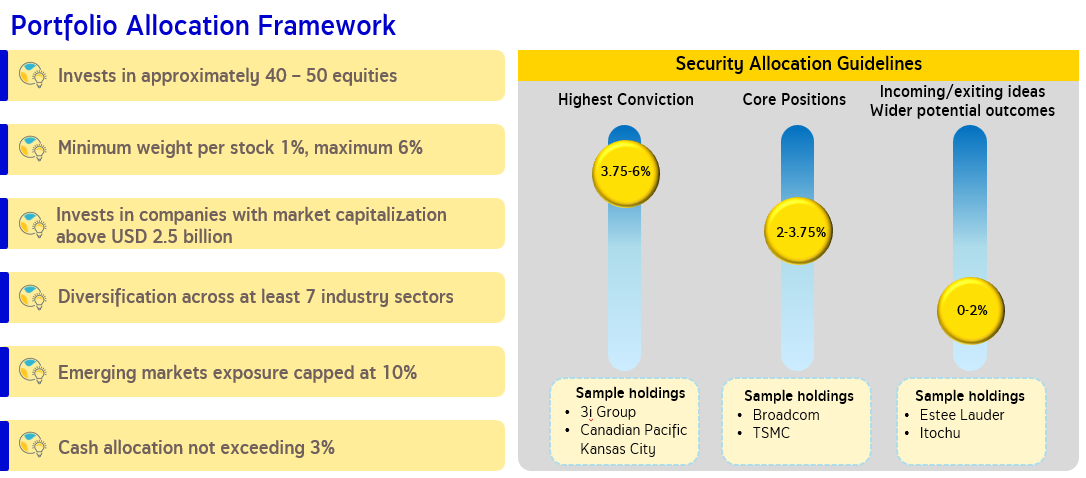

- Active Management with a Balanced Portfolio: The fund is actively managed with emphasis on both cash flow generation and capital growth. Stock selection is based on rigorous fundamental analysis, with higher allocations to high-conviction holdings. The portfolio is not limited to dividend stocks only, but also captures opportunities from both growth and value stocks, resulting in a balanced structure suitable as a core holding in an equity portfolio.

Source: Invesco as of 31 Dec 2025. For illustrative purposes only. Not a recommendation to buy or sell securities. | Investment framework and allocations may change at the fund manager’s discretion. | Industry diversification is based on the Global Industry Classification Standard (GICS), which was developed and is owned by MSCI, Inc. and Standard & Poor’s.

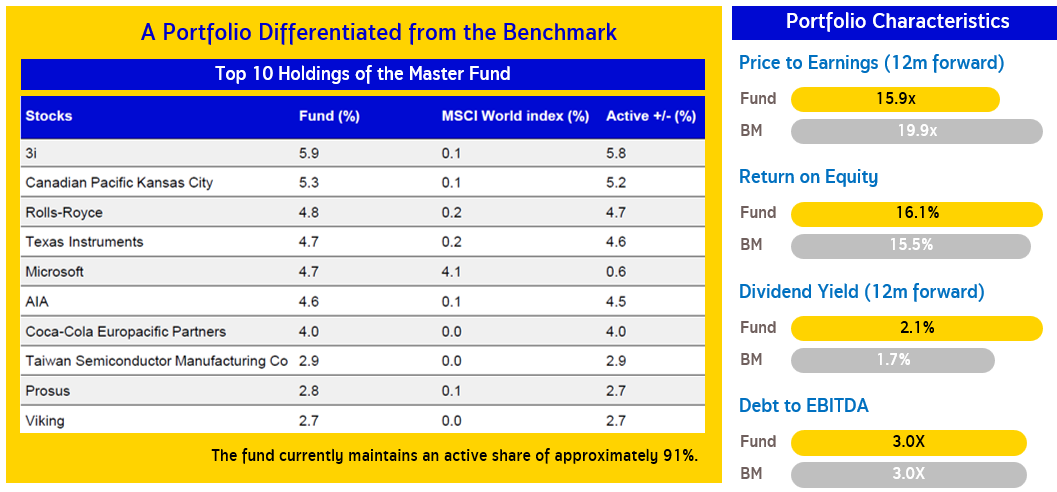

Source: Invesco as of 31 Dec 2025 | The benchmark (BM) is the MSCI World Index | Return on Equity and Debt to EBITDA are based on the trailing 12 months | Figures may be subject to rounding | For illustrative purposes only and not intended as investment advice or a recommendation to buy or sell any securities | The benchmark is shown for comparison of investment strategies only. The fund is actively managed and is not intended to track the performance of the benchmark.

- Focuses on investing at prices below intrinsic value: The fund focuses on investing in stocks trading below their intrinsic value, enhancing growth potential and supporting total returns beyond dividend income.

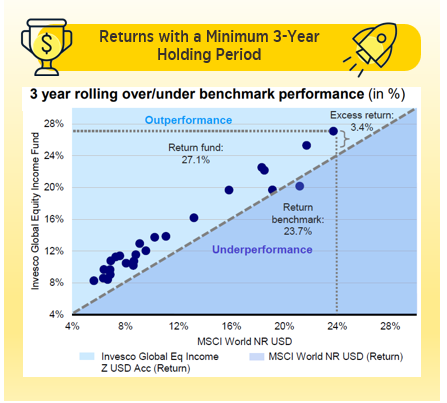

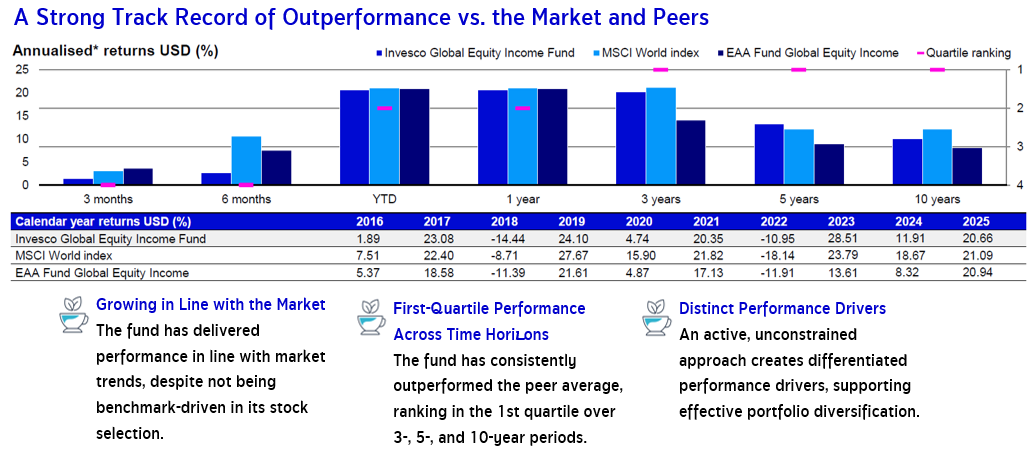

- A strong long-term track record across multiple dimensions.

Source: Invesco and Morningstar as of 31 Dec 2025, calculated based on daily returns from 1 Oct 2020 to 31 Dec 2025 in USD | Returns shown are net management fees and include reinvested dividends | The benchmark is shown for comparison of investment strategies only. The fund is actively managed and does not seek to replicate the performance of the benchmark | Performance shown is based on the Z Share Class, which is offered only to qualified investors in approved jurisdictions, while KF-GEI invests in the C (Acc) Share Class. Both share classes follow the same investment strategy | Performance shown represents the performance of the master fund and is not calculated in accordance with the performance measurement standards of AIMC.

Source: Invesco as of 31 Dec 2025 | *Returns for periods longer than one year are annualised. | Peer group data is based on Morningstar’s EAA Fund Global Equity Income category | Returns shown are net of management and transaction fees and are presented in USD | Performance shown is based on the Z Share Class, which is offered only to qualified investors in approved jurisdictions, while KF-GEI invests in the C (Acc) Share Class. Both share classes follow the same investment strategy | Returns shown are net of management fees with dividends reinvested | Performance shown represents the performance of the master fund and is not calculated in accordance with the performance measurement standards of AIMC.

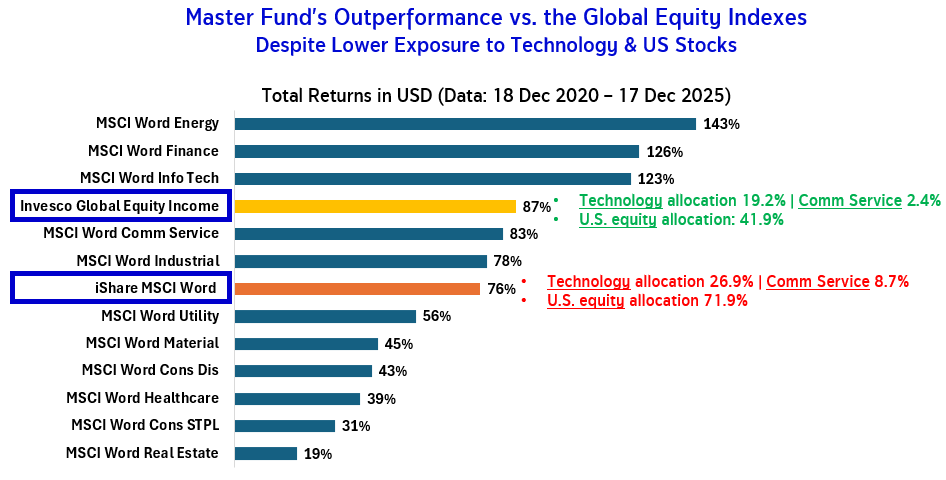

2) Ability to Outperform Global Equities even with lower allocations to technology stocks and US equities.

Source: Bloomberg as of 18 Dec 2025. US equity allocation based on* Invesco data as of 30 Nov 2025 and **iShares data as of 16 Dec 2025. | Performance shown represents the performance of the master fund and is not calculated in accordance with the performance measurement standards of AIMC.

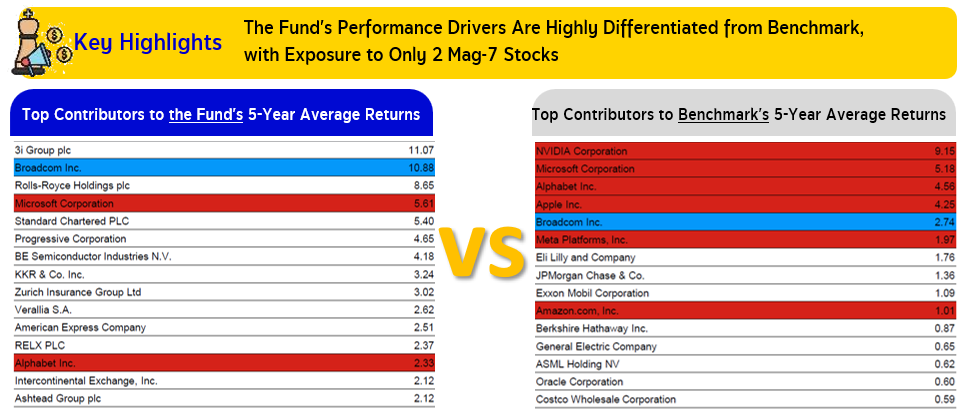

3) Differentiated Return Drivers Beyond Technology Stocks

Source: Invesco as of 31 Dec 2025 | Benchmark: MSCI World Index | For illustrative purposes only and not intended as investment advice or a recommendation to buy or sell any securities | Portfolio allocation and investment views are subject to change without prior notice.

Why Invest in KF-GEI Now?

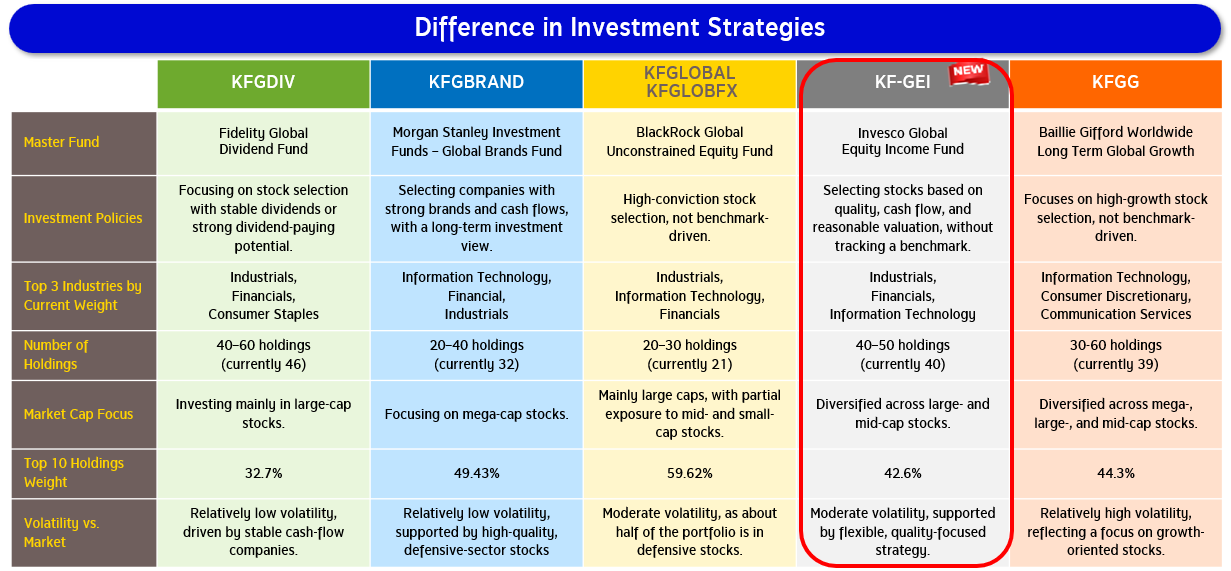

- The fund offers broad diversification, aligning with a global equity market that is expected to rise in a more distributed manner, rather than being concentrated solely on technology stocks.

- The fund aims to deliver long-term returns above the global equity benchmark through the power of dividend income and dividend growth, making it suitable as a core portfolio holding in all market conditions.

Remarks: KFGLOBAL, KFGBRAND and KF-GEI may hedge foreign exchange risk at the fund manager’s discretion and therefore remain exposed to FX risk, which may result in gains or losses from exchange rate movements and returns lower than the initial investment. | KFGLOBFX does not hedge FX risk and is therefore subject to higher currency risk, which may result in gains or losses from exchange rate movements and returns lower than the initial investment. | Source of the below table: Master funds’ fact sheet as of 30 Nov 2025.

For more information or to obtain the prospectus, please contact Krungsri Asset Management Company Limited at 0-2657-5757 press 2, or Bank of Ayudhya Public Company Limited / Krungsri Securities Public Company Limited.

- This document is prepared by sources believed to be reliable at the time of publication; however, the Company does not guarantee the accuracy or completeness of such information.

- KF-GEI may hedge foreign exchange risk at the fund manager’s discretion and therefore remain exposed to FX risk, which may result in gains or losses from exchange rate movements and returns lower than the initial investment.

- Investors should carefully study product features, conditions, returns and risks before making an investment decision. Past performance is not indicative of future results.