ข่าว/ประกาศกองทุน

Promotions/Fund Highlight

Grow Your Wealth in USD ... Invest in Global Dividend Stocks with KF-GDIV-USD

Krungsri Global Dividend USD Fund (KF-GDIV-USD)

Invest in Fidelity Funds – Global Dividend Fund, a 5-star Morningstar-rated fund*, offering the potential for consistent growth supported by strong cash flows from leading global dividend stocks.

- The fund adopts a bottom-up stock selection strategy, focusing on companies with strong fundamentals and the ability to deliver sustainable and growing dividend income.

- Quality dividend stocks with defensive characteristics can help mitigate overall portfolio risk amid ongoing market uncertainty.

- Investments are denominated in U.S. dollars (USD), helping to reduce the impact of exchange rate fluctuations and currency hedging costs.

- Investors can gain returns comparable to those of the master fund without the tax burden associated with direct investment in the offshore fund.

Fund’s IPO Period: 12 – 21 January 2026. | Minimum purchase: 100 USD.

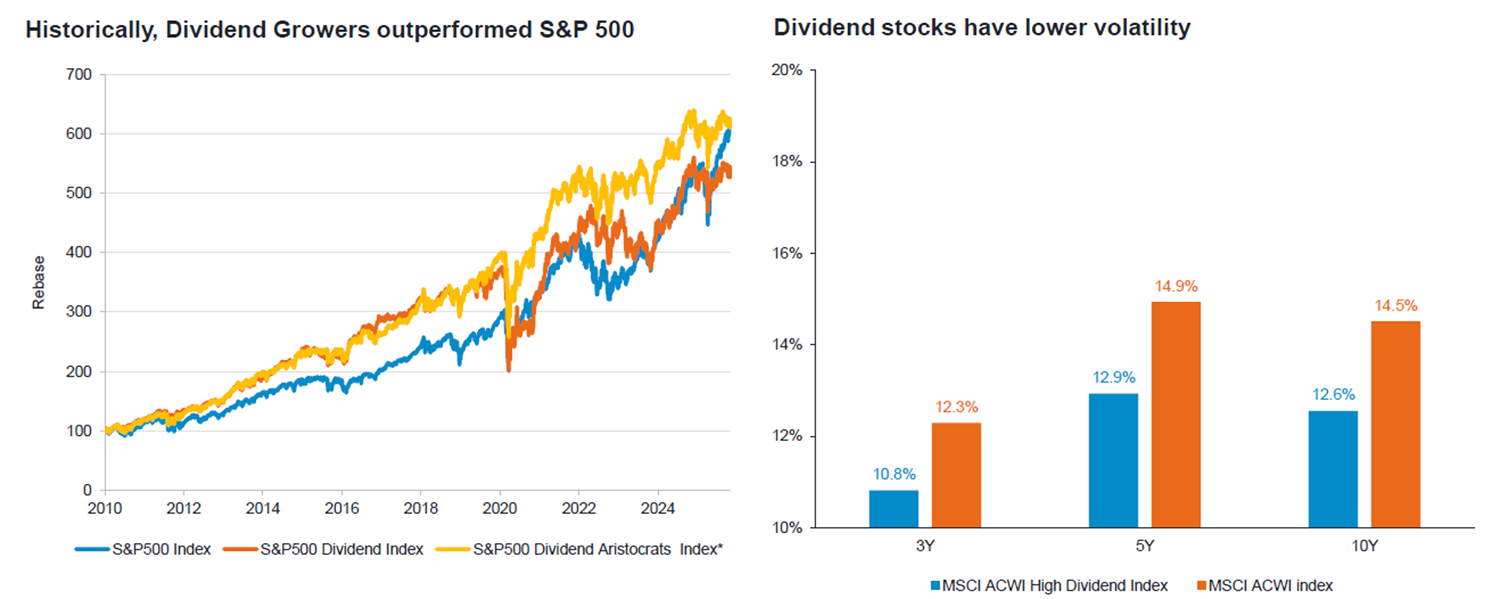

Why "Dividend Stocks"?

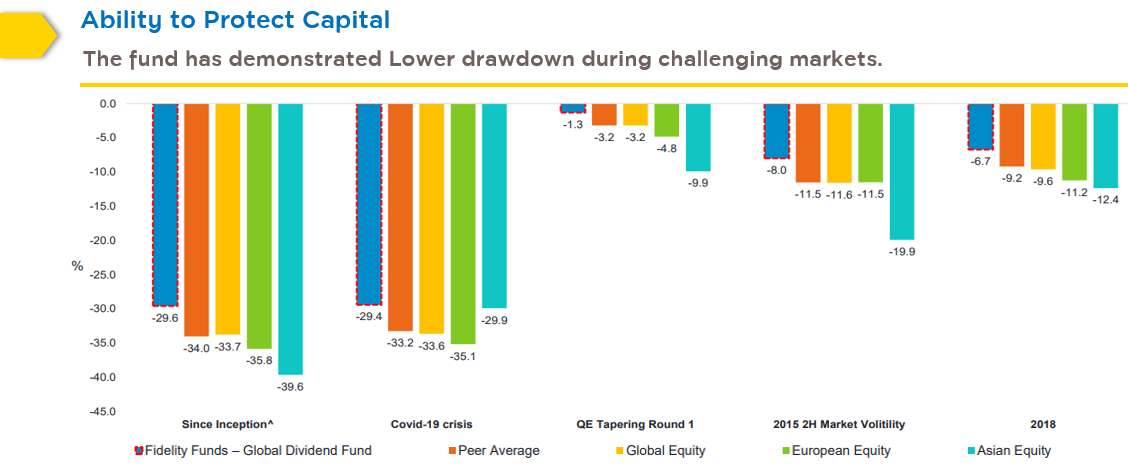

- Defensiveness: Dividend stocks tend to be more resilient in market downturn whilst outperforming over the long-term with lower drawdowns during market downturns

Source: Fidelity International, Bloomberg, Morningstar as of 31 Oct 2025. The S&P 500 Dividend Aristocrats Index measures the performance of S&P 500 companies that have increased dividends every year for the last 20 consecutive years. The information provided is for illustrative purposes only and may change.ด้

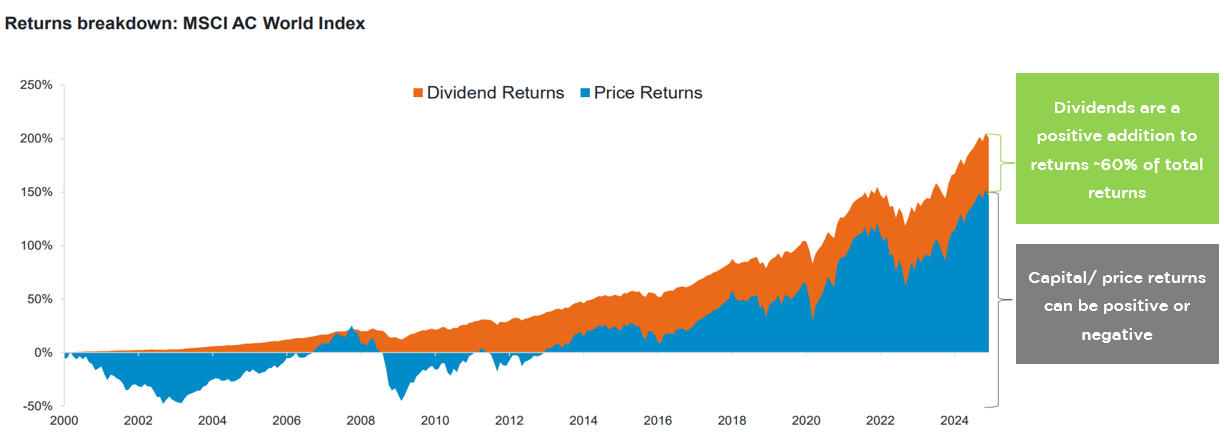

- Ballast for the portfolio: Dividends can act as a safety net when markets are rocky.

Source: Fidelity International as of 30 Dec 2024 (latest data as of 31 October 2025). The information provided is for illustrative purposes only and may change.

- Building portfolio resilience amidst a changing world order: Dividend investing offers broad diversification across asset classes and regions, providing greater exposure beyond the U.S. market, thereby improving overall risk diversification.

Source: Fidelity International, 2025. The information provided is for illustrative purposes only and may change.

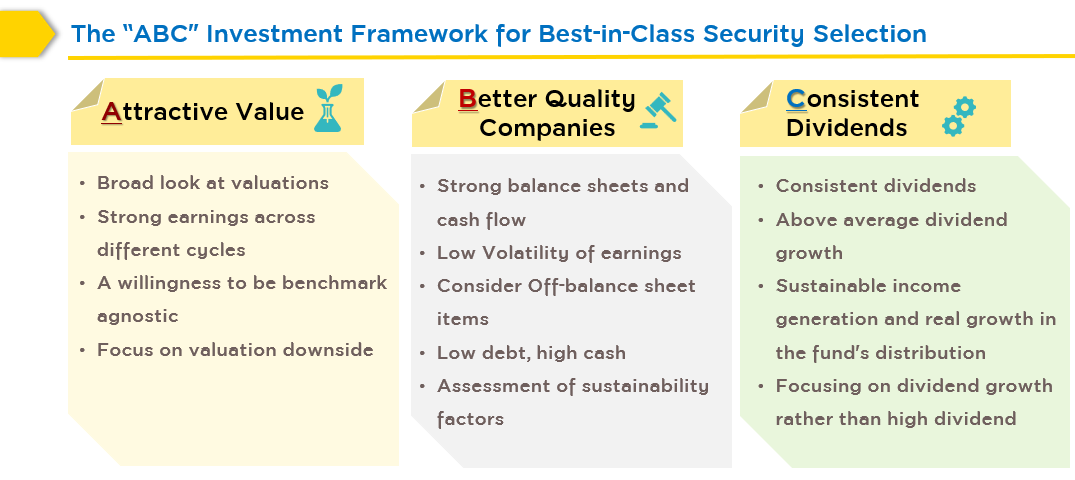

Why Fidelity Funds – Global Dividend Fund?

- Distinctive Investment Philosophy and Strategy: The fund focuses on investing in high-quality dividend-paying equities, guided by a distinctive investment philosophy that emphasizes stock selection as the core driver of performance.

Source: Fidelity International, 2025. The information provided is for illustrative purposes only and reflects Fidelity’s current views, which are subject to change.

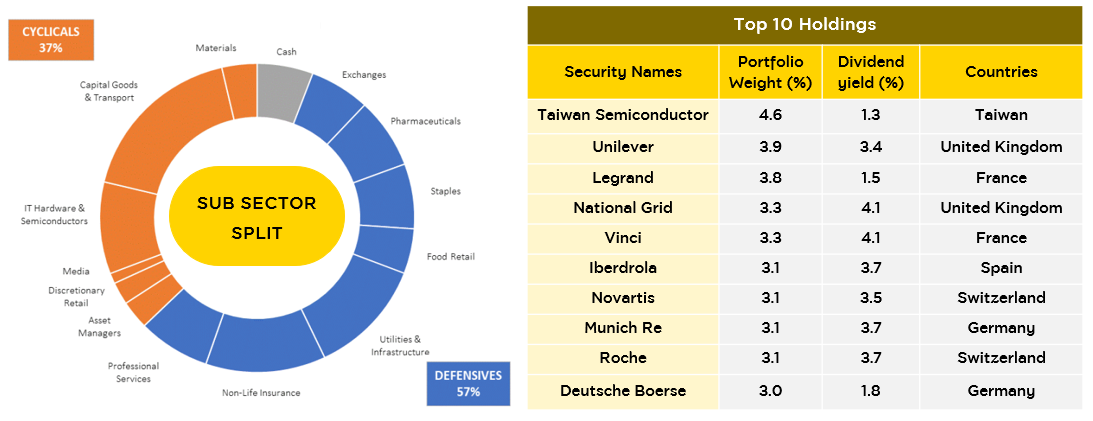

- A flexible, actively managed portfolio combining defensive and opportunistic investment approaches, focusing on companies with strong dividend potential and broad global diversification, unconstrained by benchmark indices. The fund also allocates part of its portfolio to high-quality cyclical stocks to enhance growth potential, while maintaining a strong focus on capital preservation and limiting downside risk through a defensive approach.

Source: Fidelity International, LSEG DataStream as of December 2025. Left image data as of 30 September 2025. Right image data as of 31 October 2025. The information provided is for illustrative purposes only. Investors should be aware that the views expressed may not reflect current views and are subject to change in accordance with Fidelity’s perspective. The securities shown are for illustrative purposes only and do not constitute a recommendation to buy or sell. Dividend yield is based on the trailing 12-month historical dividend yield of each security as of 31 October 2025. Dividend yields shown are not guaranteed and may change in response to market conditions.

Source: Fidelity International, Bloomberg as of 11 Nov 2025. The securities shown are for illustrative purposes only and do not constitute a recommendation to buy or sell.

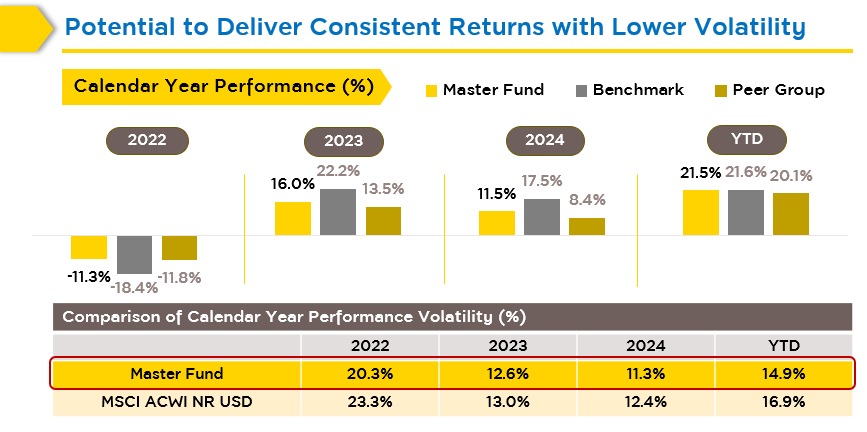

- Performance Reflecting a Proven Track Record of the Investment Strategy .

- 2022: During periods of severe market correction, the fund effectively managed downside risk through disciplined valuation analysis and a focus on defensive equities.

- 2023–2025: Despite market concentration in AI-related and technology stocks, particularly the “Magnificent 7,” the fund continued to deliver positive returns, even without significant exposure to these sectors.

Sources: Top chart: Fidelity International as of 31 Oct 2025; Morningstar Direct as of 12 Dec 2025. Performance shown is based on Share Class Y-QINCOME(G)-USD. Benchmark: MSCI ACWI NR USD. Peer group: Morningstar EAA Fund Global Equity Income. Bottom chart: Source: Morningstar Direct, 31 October 2025. ^ Since Inception refers to the commencement of the A-MINCOME(G)-USD share class (which is 30 January 2012). Covid-19 crisis from 19 Feb 2020 to 30 Mar 2020. QE tapering round 1 from 1 May 2013 to 30 Jun 2013. 2015 2H market volatility from 1 Jun 2015 to 31 Dec 2015. 2018 from 1 Jan 2018 to 31 Dec 2018. Global Equity is MSCI AC World NR index. European Equity is MSCI Europe NR index. Asian Equity is MSCI AC Asia Pacific ex Japan NR index. Peer Average is the Morningstar EAA Fund Global Equity Income. Performance is for the A-MINCOME(G)-USD share class, NAV-NAV (before initial sales charge), in USD terms. The performance shown represents that of the master fund and is not measured in accordance with the performance measurement standards of the Association of Investment Management Companies.

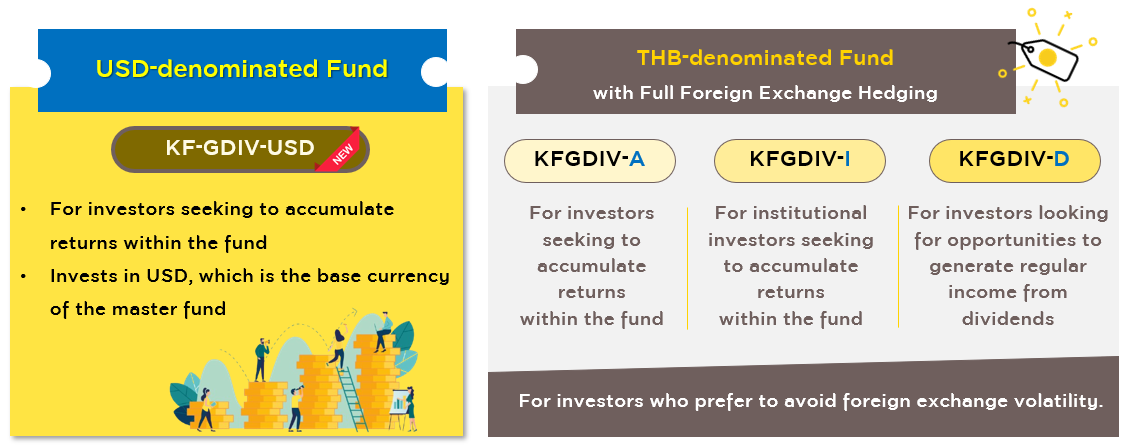

- Information of KF-GDIV-USD

- A range of investment options in Fidelity Funds – Global Dividend offered by Krungsri Asset Management.

- Key Information of KF-GDIV-USD

- For account opening & Foreign Currency Fund transaction procedures, click

- This document is prepared based on information from reliable sources as of the date shown; however, the Company does not guarantee the accuracy, reliability, or completeness of such information and reserves the right to change the information without prior notice.

- For KF-GDIV-USD, if investments are made in currencies other than USD, the fund manager may consider currency hedging at their discretion. As a result, the fund is exposed to foreign exchange risk, which may lead to gains or losses from currency movements and may result in returns lower than the initial investment.

- Investors should carefully study fund features, return conditions, and risks before making an investment decision. Past performance of a mutual fund is not a guarantee of future performance.

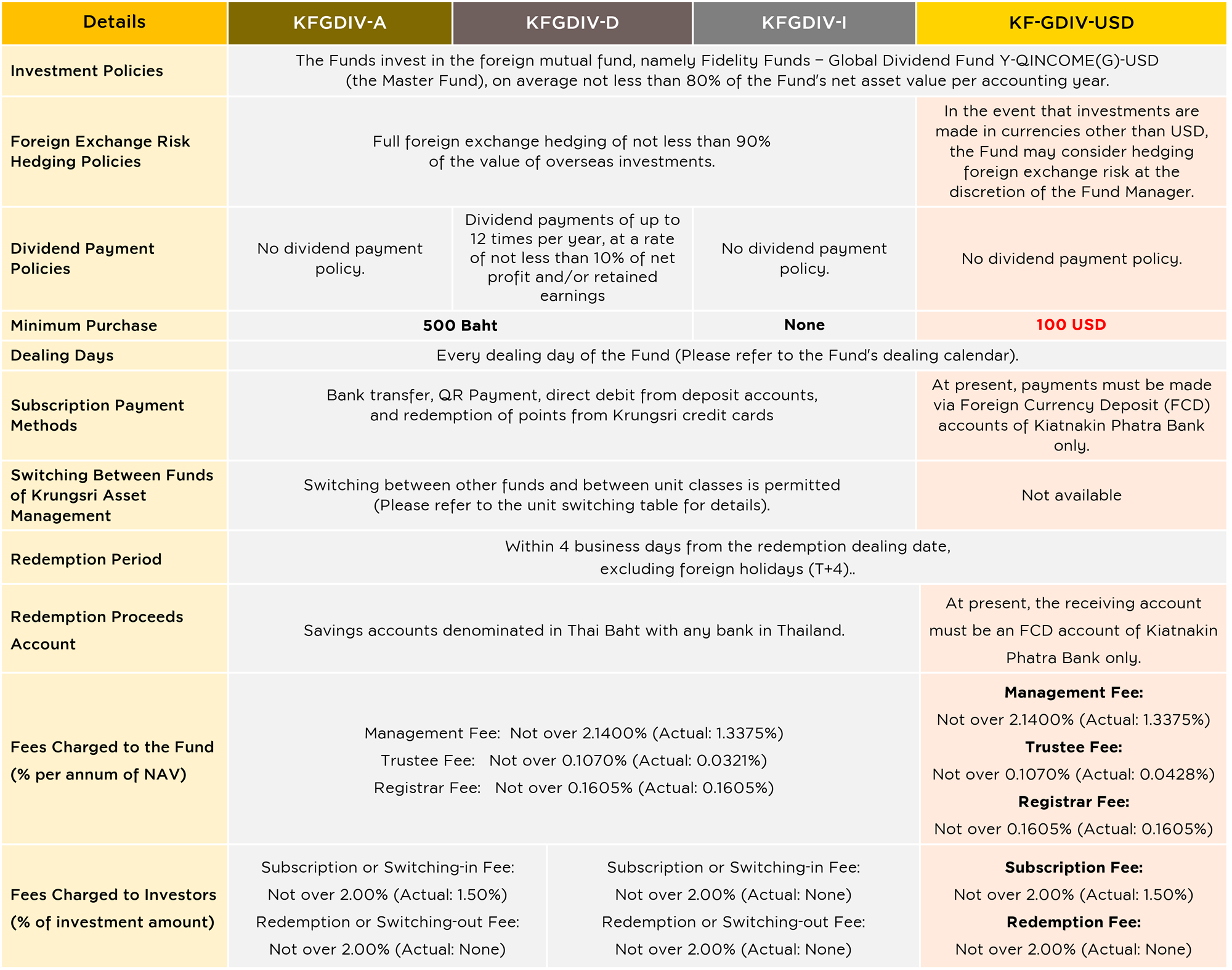

Differences Among Funds Investing in Fidelity Funds – Global Dividend

Remarks:

- Switching fees are waived between unit classes KFGDIV-A, KFGDIV-D, and KFGDIV-I.

KFGDIV funds are fully hedged against foreign exchange risk, which may incur hedging costs and slightly reduce overall fund returns. - For KF-GDIV-USD, currency hedging may be applied at the fund manager’s discretion, exposing investors to foreign exchange risk.

- All fees charged to the fund and/or investors are inclusive of VAT, specific business tax, or other applicable taxes