About Provident Fund

Provident fund is a fund set up voluntarily between the employer and employees to serve as a security for the employees in case of their resignation, retirement, disability, or death. A provident fund is regulated by the government through the “Provident Fund Act” to protect rights and benefits to which employees are entitled.

The objective of the Provident Act is not only to promote financial welfare to employees but also to strengthen the saving system and to build strong foundation for the country’s financial stability.

A provident fund established under the act has a juristic person status which is separate from the employer’s juristic person. A management company undertakes to control and manage the fund by a group of committee members who are appointed through election. The registrar as prescribed by law is The Securities and Exchange Commission (SEC). The SEC also monitors performance of the management companies in charge of provident funds.

- Amounts contributed by employees are called “employee’s contribution” with the employees’ consent for deduction from their wage monthly from 2 per cent but no more than 15 per cent of the wages as prescribed in the fund’s articles.

- Amounts contributed by employers are called “employer’s contributions” which shall not less than 2 per cent but no more than 15 per cent of the wages. Contribution rate may be different based on conditions, terms of employment, or duration of membership as prescribed in the fund’s articles.

- Benefits derived from savings investment is called “benefit of employee’s contribution”.

- Benefits derived from contributions investment is called “benefit of employer’s contribution”.

1.2 Pooled Fund means a fund established for two or more employers which has the same investment policy. This type of fund is suitable for small and medium size companies or companies requiring an initial set up or companies having small number of employees. The Pooled fund helps with reduction of expenses while increasing investment opportunity for higher yields.

2.2 Master Pooled Fund means a fund established for two or more employers and each fund may adopt multiple investment policies. This type of fund is suitable for companies that never have a provident fund or companies whose provident funds require investment flexibility. Master Pooled Fund can also accommodate Employee’s Choice when members are ready to make investment themselves.

- Tax Benefits for Employers

Employers may deduct the actual amount of contributions made to the fund in each accounting period as expenses.

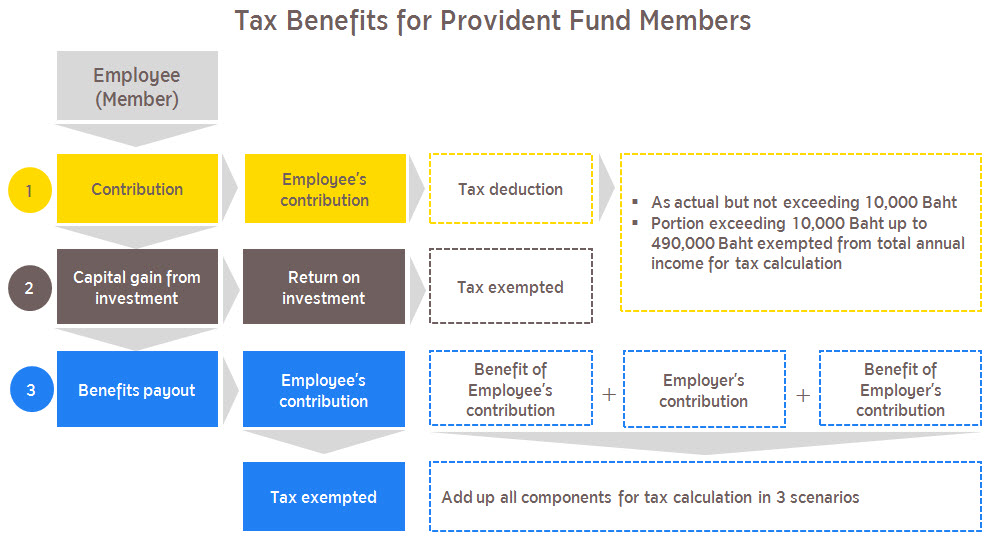

- Tax Benefits for Employees

Employees will receive tax benefits throughout duration of the provident fund membership as follows:

Remark: Year of service used as a basis for tax calculation refers to the case where members resign from the company only. If members resign from the provident fund membership without resigning from company, Year of service cannot be used and the benefits payout must be included in the total income of the year for tax calculation.