Ahead of the Curve: Capturing Alpha in the U.S. Equities

Summary of key takeaways from the seminar "Ahead of the Curve: Capturing Alpha in U.S. Equities," where experts shared a positive outlook on the U.S. economy in 2026. In this respect, Krungsri Asset Management Company Limited (KSAM) believes the U.S. economy is entering a phase of strong, above-trend growth, creating attractive opportunities for active investors to generate alpha, or excess returns. At the seminar, KSAM also introduced Krungsri US Select Equity Plus Fund (KF-US-Plus), investing in the Morningstar 5-star* rated JPMorgan Funds - US Select Equity Plus Fund, as a core holding to navigate this landscape. (*Source: Morningstar as of 30 Sep'25. This ranking is not related to the ranking by AIMC in any way.)

Deep Dive into Experts Insights

- Ms. Pornchanok Rattanarujikorn, CFA, Vice President, Alternative Investment Department, Krungsri Asset Management

- Ms. Ladawan Arunyingmongkhol, Vice President, Southeast Asia and India Intermediaries, J.P. Morgan Asset Management

- U.S. equities continue to be well supported by robust economic growth, declining interest rates, and strong corporate earnings. Despite some geopolitical risks, the U.S. GDP is expected to grow by 2.5% in 2026, fueled by large-scale investment in Artificial Intelligence (AI), ongoing fiscal stimulus under the “One Big Beautiful Bill Act,” and looser financial conditions stemming from expected Federal Reserve rate cuts. (Source: Dallas Fed, Revelio Labs, ADP, Bloomberg and Multi Asset Solutions Goldman Sachs, KKP, 10 Oct'25)

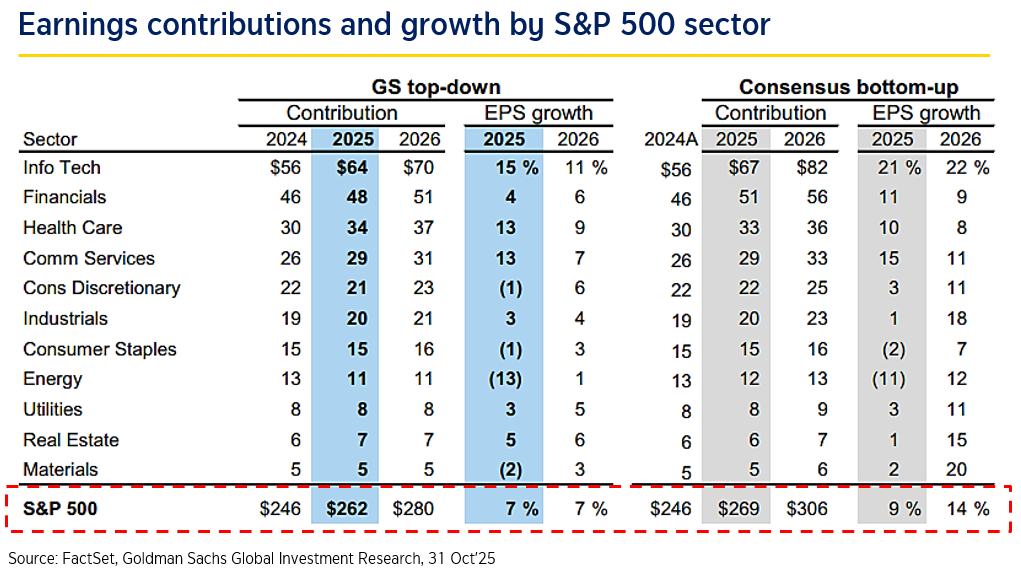

- Corporate earnings continue to surprise on the upside, while S&P 500 earnings rose 11% in Q3, beating expectations, and are forecasted to grow 9% this year and 14% in 2026. KSAM expects any short-term volatility from the Fed’s policy decisions to be temporary, with cooling inflation and a softer labor market giving the Fed room to lower rates and extend the economic cycle.

Insights from J.P. Morgan Asset Management

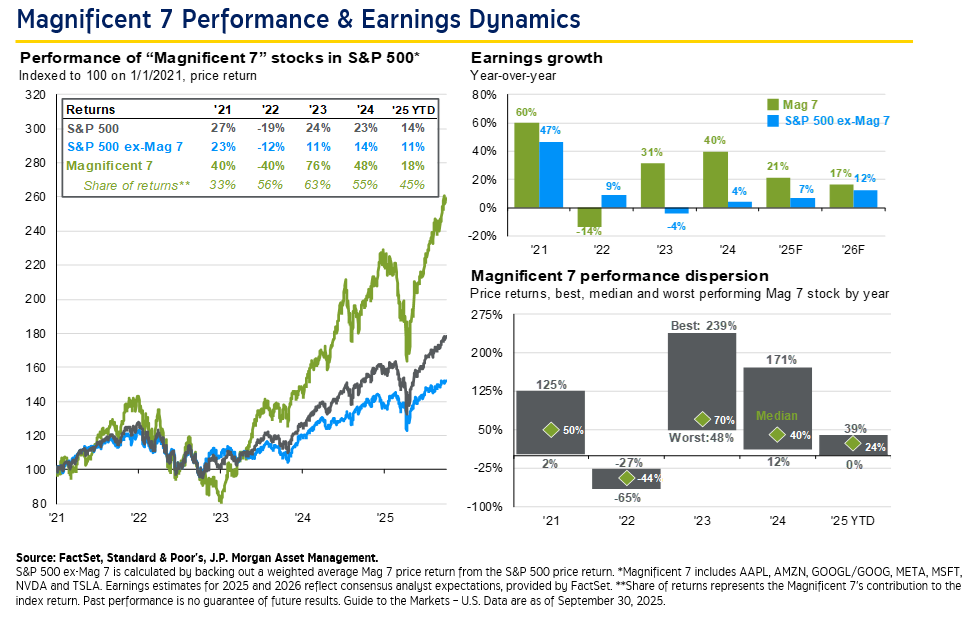

- Challenge of market concentration, particularly the dominance of the so-called “Magnificent 7” stocks collectively accounts for approximately 40% of the S&P 500 Index. Active diversification plays a crucial role in mitigating this risk, while inflation has likely peaked, it is expected to remain slightly elevated - around 3% to 4% through next year. Despite this, near-term volatility can be a valuable entry opportunity for investors who adopt an active, tactical approach.

- Technology remains the leading growth engine, expected to deliver double-digit earnings expansion in 2026. However, opportunities extend beyond mega-cap tech names, with the fund actively exploring mid- and small-cap equities and underappreciated sectors such as financials, real Estate, and healthcare - all of which stand to benefit from enduring consumer strength and supportive fiscal policies. (Source: J.P. Morgan Asset Management)

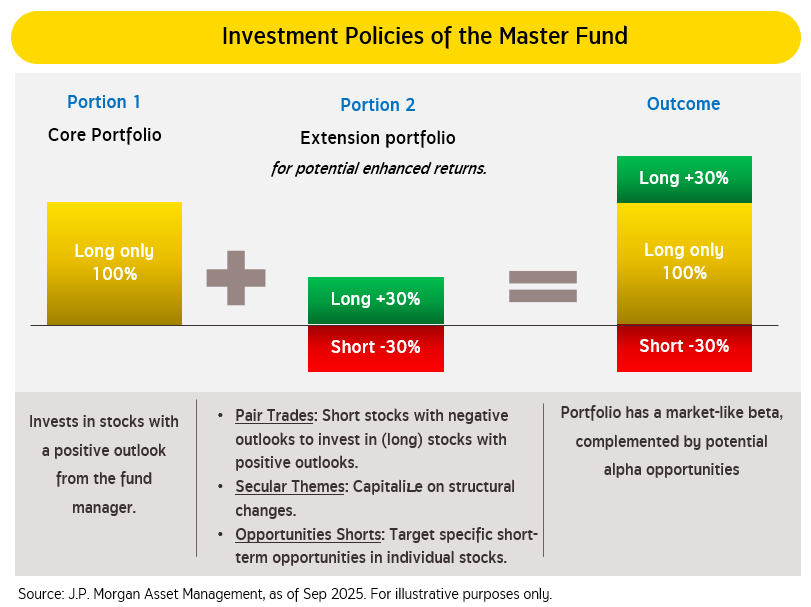

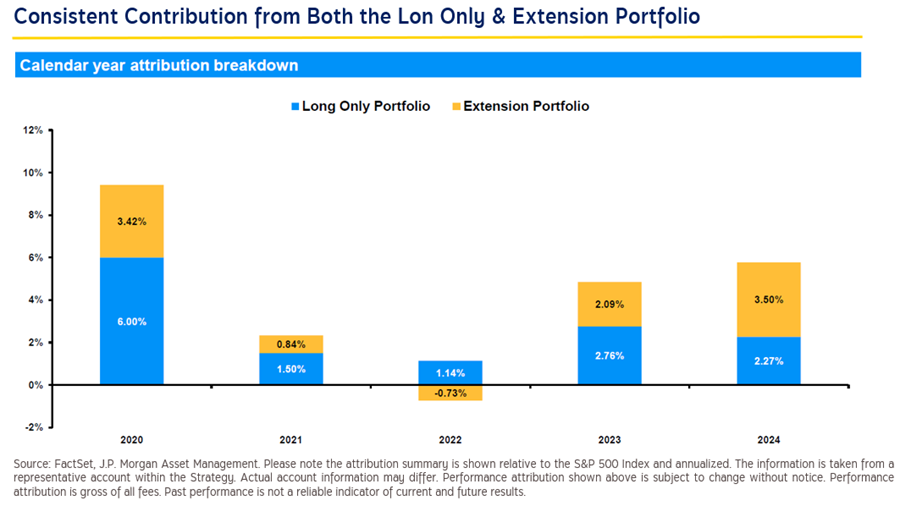

- The US Select Equity Plus Fund employs a “super active” strategy combining both long and short positions to capture returns in varying market conditions. The core long-only portfolio provides steady market exposure, while an extension portfolio tactically combines long and shorts strategies for potential enhance returns. This structure helps maintain consistent alpha generation while controlling overall volatility.

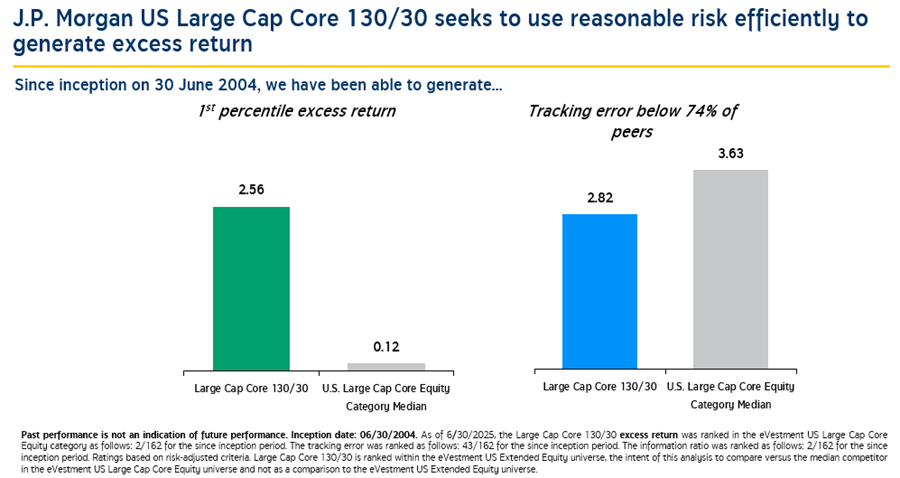

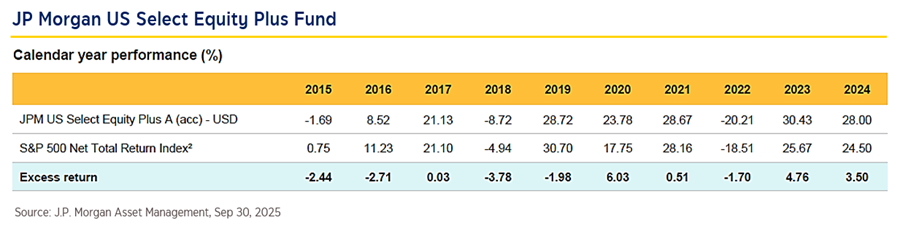

- A proven track record and deep research foundation contributed to the fund’s success. Over the past 20 years, the fund has generated an average annual alpha of 2.5% with low tracking error, supported by a yearly research investment of USD 2.7 million. The Fund’s current positioning reflects high conviction, maintaining overweight exposure to companies with strong growth prospects such as Howmet Aerospace, Mastercard, Lowe’s, Amazon, and Wells Fargo, while holding underweight or reduced positions in names like Tesla, Berkshire Hathaway, Home Depot, and Netflix, where valuations or industry headwinds warrant caution. (Source: J.P. Morgan Asset Management as of 30 Sep’25)

- Since the 2020 crisis, the fund has outperformed the S&P 500 Index by nine percentage points, with two-thirds of this alpha attributed to its long-only core portfolio. Notably, its disciplined risk management has resulted in a maximum drawdown significantly lower than the broader market, limiting losses to just 3% during the worst periods.

Conclusion from Krungsri Asset Management

- We strongly recommend KF-US-PLUS as a core holding for investors seeking consistent long-term returns and alpha generation, while the fund offers a balanced approach to capturing U.S. equity market opportunities amid easing monetary policy.

- We also advised investors to adopt a “buy on dip” strategy, noting that any short-term market corrections or temporary disappointment following a potential Fed rate hold could represent an ideal entry point ahead of the expected long-term downtrend in interest rates.

Investment Policies/ Disclaimers

- KF-US-PLUS / KF-US-PLUSRMF invest in the master fund, JPMorgan Funds - US Select Equity Plus Fund, at least 80% of NAV in average of an accounting period. Risk level 6: High risk.

- RMFs are long-term retirement-oriented funds. Investors should understand fund features, condition of returns, risks, and tax benefits in the investment manual before making an investing decision. Past performance does not guarantee future results.

- The Funds are hedged against foreign exchange risk at the Fund Manager’s discretion. Hence, they are subject to foreign exchange risk that may cause investors to lose money or gain from foreign exchange fluctuation/ or receive a lower return than the initial investment amount.

- This document is prepared based on the information compiled from various reliable sources as of the date of publication. However, Krungsri Asset Management cannot guarantee the accuracy, reliability, and completeness of all information. The Company reserves the right to change the information without any prior notice.

For KF-US-PLUS-A details, click

For KF-US-PLUS-I details, click

For KF-US-PLUSRMF details, click

For Tax Saving Promotion 2025, click