Plan Your Investment

Triple Power of Equity Funds: KF-US-PLUS/ KFHTECH / KFGDIV

Bank of Ayudhya Public Company Limited (by Krungsri Private Banking), in collaboration with Krungsri Asset Management Company Limited, recently hosted the “Triple Power: US Equities, Global Tech, Dividend Plays” seminar, highlighting 3 standout funds from Krungsri Asset Management that can drive portfolio growth in today’s market conditions:

- Krungsri US Select Equity Plus Fund (KF-US-PLUS)

- Krungsri Global Technology Equity Fund (KFHTECH)

- Krungsri Global Dividend Equity Fund (KFGDIV)

- Pornchanok Rattanarujikorn, CFA, Vice President, Alternative Investment Department, Krungsri Asset Management

- Quincy Wang, Vice President, Product Strategist, BlackRock

- Kiattipoom Thirapatsakun, Senior Sales Manager, Wholesale Distribution, Southeast Asia, Fidelity International

- Rohini Chopra, Vice President, Client Advisor for Southeast Asia Funds, J.P. Morgan Asset Management

From Krungsri Asset Management

- An investment portfolio strategy that blends U.S. equities, global technology stocks, and dividend-generating equities, aiming to strike a balance between growth opportunities and income stability. This approach is well-suited for a market environment that continues to face volatility, uncertainties over U.S. tax policy, and the ripple effects of interest rate cuts on global capital flows.

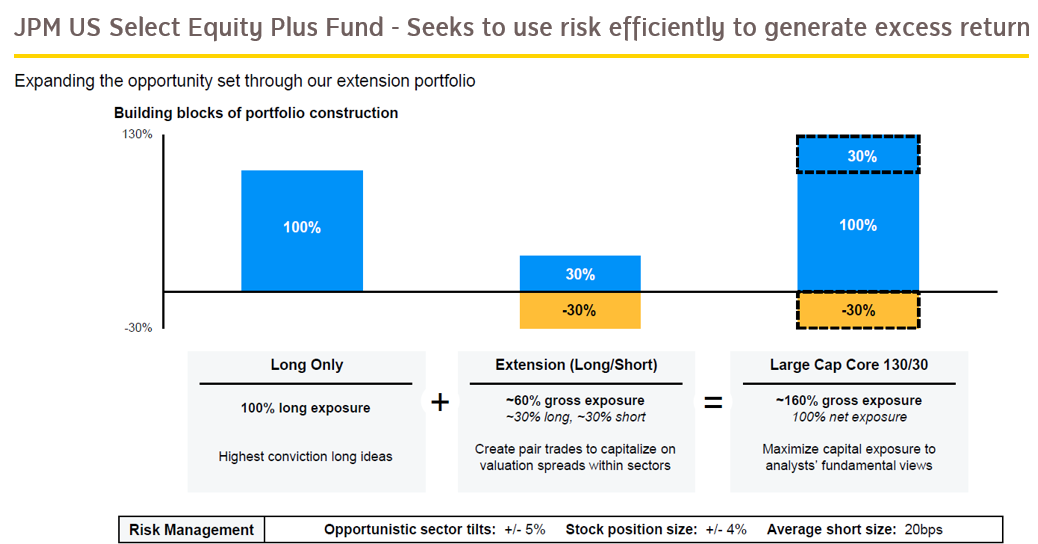

- Investing in U.S. equities through the master fund, JPMorgan Funds – US Select Equity Plus Fund, KF-US-PLUS stands out as a solid long-term core portfolio option. Managed by J.P. Morgan Asset Management, the fund employs a proprietary 130/30 extension strategy - taking 130% long positions in high-potential growth stocks and 30% short positions in structurally challenged companies. This approach maintains market neutrality while enhancing alpha generation, with volatility levels comparable to the overall market.

Source: J.P. Morgan Asset Management. For illustrative purposes only.

From J.P.Morgan Asset Management

Representing the JPMorgan Funds - US Select Equity Plus Fund, a master fund of KF-US-PLUS

- The US Select Equity Plus Fund is managed by a team of veteran portfolio managers and analysts, leveraging J.P. Morgan Asset Management’s 37-year valuation framework and advanced AI tools to guide stock selection. ESG factors are fully integrated into the research process.

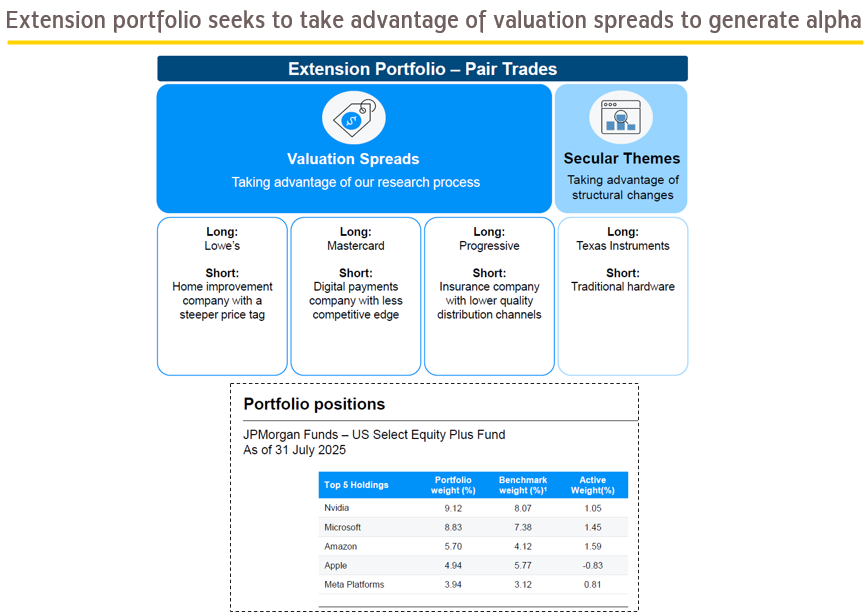

- The Fund has consistently outperformed the S&P 500 across multiple time frames, driven by its ability to capture upside in resilient innovators while hedging against structural decline. With over 270 holdings across diverse sectors, the fund offers a balanced yet bold strategy for navigating both rising and volatile market conditions. Moreover, the fund maintains volatility at a level close to that of passive funds, while its Extension Portfolio is strategically structured - taking long positions in leading innovation stocks such as Nvidia and Amazon, and short positions in structurally challenged names like Netflix. This approach helps deliver superior risk-adjusted returns. The blended strategy enables the fund to outperform the benchmark.

Source: J.P. Morgan Asset Management. For illustrative purposes only. The holdings/allocations listed above are not named as recommendations to buy or sell. | ¹Benchmark is the S&P 500 Index. The portfolio is actively managed. Holdings, sector weights, allocations and leverage, as applicable, are subject to change at the discretion of the investment manager without notice. Figures may not add up to 100% due to cash & cash equivalent components.

From BlackRock

Representing the BGF World Technology Fund, a master fund of KFHTECH

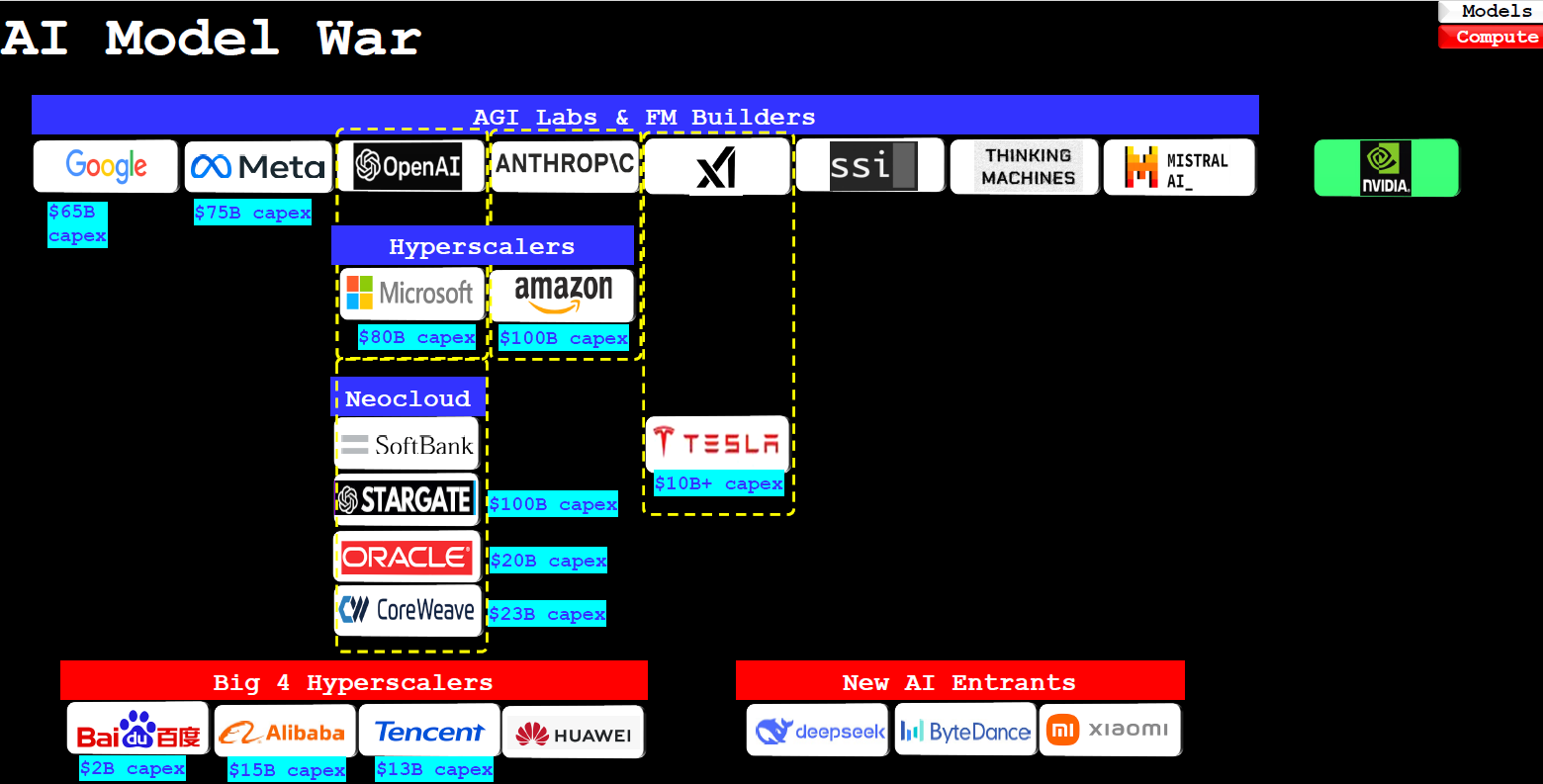

- The global tech landscape is undergoing a major transformation, fueled by AI innovation, making investment in tech-focused funds increasingly essential. The AI ecosystem spans foundational models, cloud infrastructure, and applications, with major capex investments from U.S. giants such as Microsoft, Amazon, and Nvidia, as well as rising Chinese players like Alibaba, ByteDance, and DeepSeek. This indicates that not only U.S. tech stocks, but also Chinese tech companies are poised for robust growth, reinforcing the case for diversified exposure across geographies within the tech sector.

Source: BLK, as of Jul 2025. For illustrative purposes only. Reference to the third-party company names and logos mentioned in this communication should not be construed as investment advice or investment recommendation of the company. The third-party logos and images set out in this document are used for illustration purposes only, and do not imply any sponsorship or endorsement by, or affiliation or association with, BlackRock. All currency mentioned are in USD.

- Despite strong performance in 2023 - 2024, tech valuations remain grounded in earnings growth rather than speculative multiples. The sector is undergoing “creative destruction,” where innovation redefines leadership and long-term value.

Source: FactSet and BlackRock, as of 30 Jun 2025. The displayed time series represents the average EV to consensus of 1 year forward revenue within the team’s proprietary universe of >2000 companies There is no guarantee that any forecasts made will come to pass.

From Fidelity International

Representing the Fidelity Funds - Global Dividend Fund, a master fund of KFGDIV

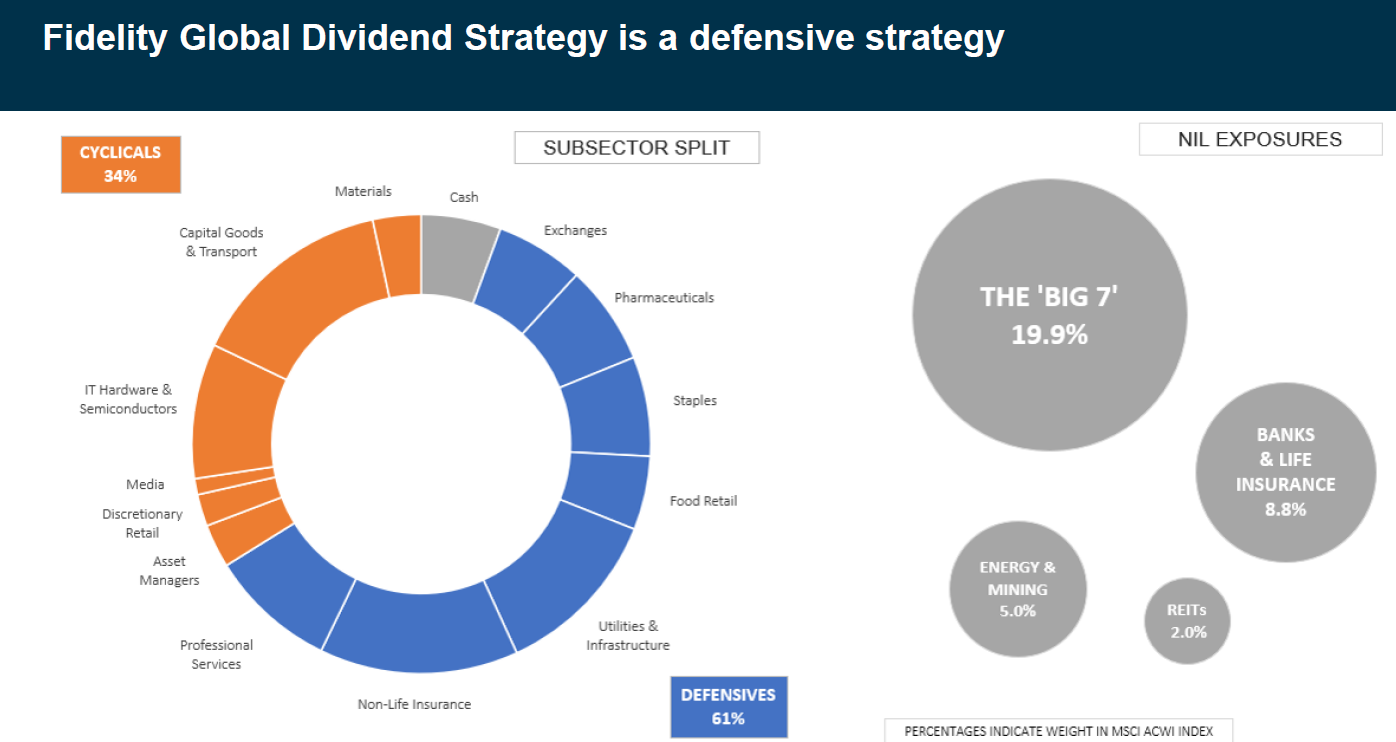

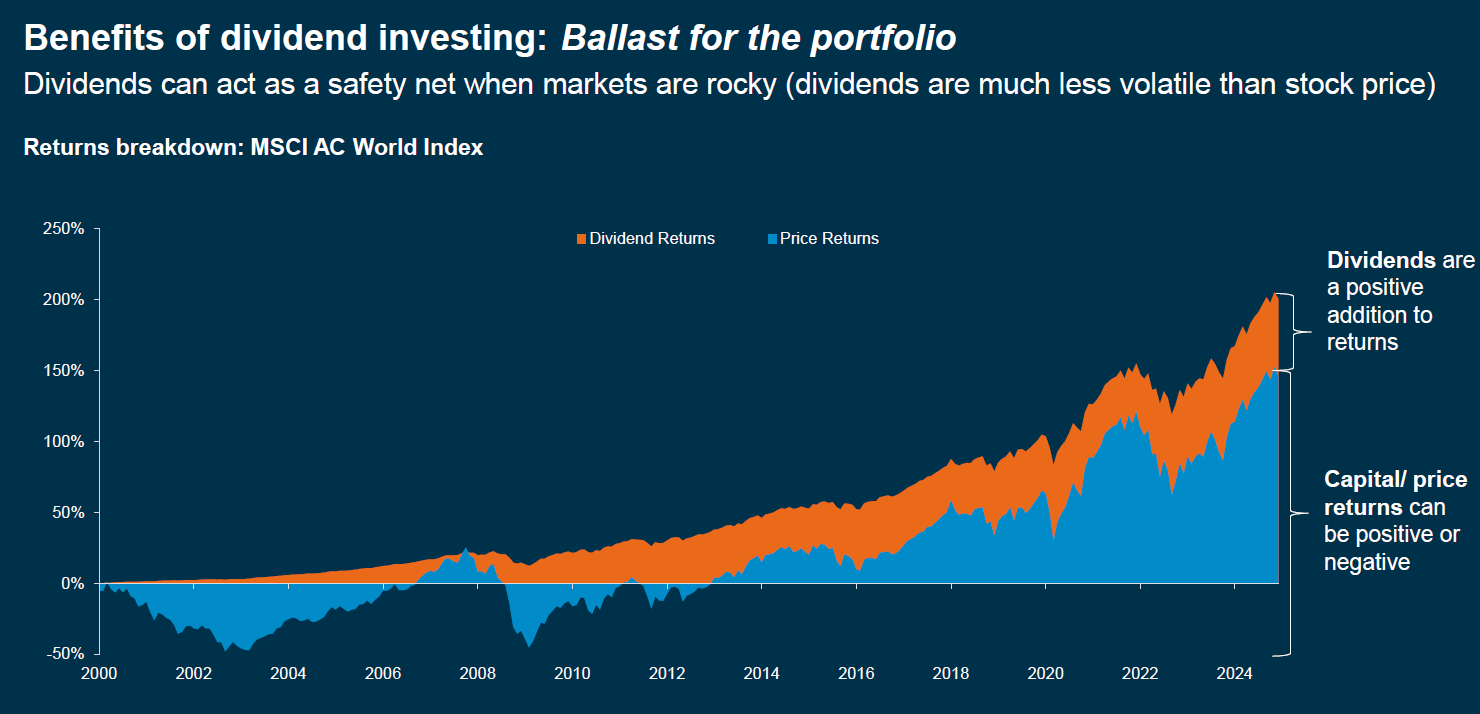

- The global dividend fund is a Defensive Anchor in volatile markets. With no exposure to high-growth U.S. tech, the fund focuses on quality companies with consistent earnings and strong balance sheets. Instead of chasing the ‘Magnificent 7’, it invests in a reliable universe of 100 stocks that offer attractive valuations, superior quality, and consistent dividends.

Source: Fidelity International, as at 30 June 2025. The Big 7 refers to the stocks of American technology companies: Nvidia, Meta, Apple, Amazon, Tesla, Microsoft, Alphabet. The above information relates to the Fidelity Funds - Global Dividend Fund, which the Krungsri Global Dividend Hedged FX Fund feeds into. Fidelity Funds - Global Dividend Fund is not registered with the Securities and Exchange Commission for offering to retail public in Thailand

- The average dividend yield of the underlying stocks in the Fidelity Funds - Global Dividend Fund currently stands at 3.01%*. The fund has historically shown lower drawdowns compared to the global equity index, highlighting the portfolio’s resilience. Its overweight positions in financials, industrials, and consumer staples, along with a focus on Europe and the UK, reflect a value-oriented strategy.

Source: Fidelity International, Bloomberg, data as at 31 Dec 2024.

In summary, this trio of funds; KF-US-PLUS/ KFHTECH / KFGDIV can be well-positioned for the current market cycle. Whether investors are seeking growth, stability, or income, this strategy offers a blend of active precision, sector leadership, and long-term resilience.

For summary of 3 Krungsri Asset Funds, click here

- Investors should understand the fund features, conditions of returns and risks before making an investment decision. Past performance is not a guarantee of future results.

- KF-US-PLUS is hedged against foreign exchange risk at the Fund Manager’s discretion. Hence, it is subject to foreign exchange risk that may cause investors to lose money or gain from foreign exchange fluctuation/ or receive a lower return than the initial investment amount.

- For KFHTECH, since the fund is highly concentrated in specific industry sectors that may result in substantial losses of capital, investors should seek further advice before investing.

- This document is prepared based on the information compiled from various reliable sources as of the date of publication. However, Krungsri Asset Management cannot guarantee the accuracy, reliability, and completeness of all information. The Company reserves the right to change the information without any prior notice.

please contact Krungsri Asset Management Co Ltd. | Tel. 2657 5757

For KF-US-PLUS-A details, click

For KFHTECH-A details, click

For KFGDIV-A details, click

For KFGDIV-D details, click