Plan Your Investment

Europe in Focus: Positive Momentum, Lasting Potential

Krungsri Asset Management Company Limited (“KSAM”) in collaboration with Goldman Sachs Asset Management recently hosted a seminar on “Europe in Focus: Positive Momentum, Lasting Potential” to explore the outlook for European equities and announced the transition of the master fund of KSAM’s Europe Equity Funds (from Allianz Europe Equity Growth Fund) to the Goldman Sachs Europe CORE® Equity Portfolio, reinforcing KSAM’s commitment to greater diversification and improved risk-adjusted returns for its funds, namely KF-EUROPE, KF-HEUROPE, and KFEURORMF.

Deep Dive into Experts Insights

- Mr. Kiattisak Preecha-anusorn, CFA, Chief Alternative Investment, Krungsri Asset Management

- Ms. Sedhvi Gupta, CFA, Executive Director, Quantitative Investment Strategy in Hong Kong, Goldman Sachs Asset Management

- We have seen clear signs of European recovery expected to begin in 2026, supported by easing inflation, tariff impacts, and fiscal stimulus. Although often overlooked by many global investors, European equities are now well-positioned for recovery and present a timely opportunity for those seeking resilience, diversification, and sustainable long-term growth.

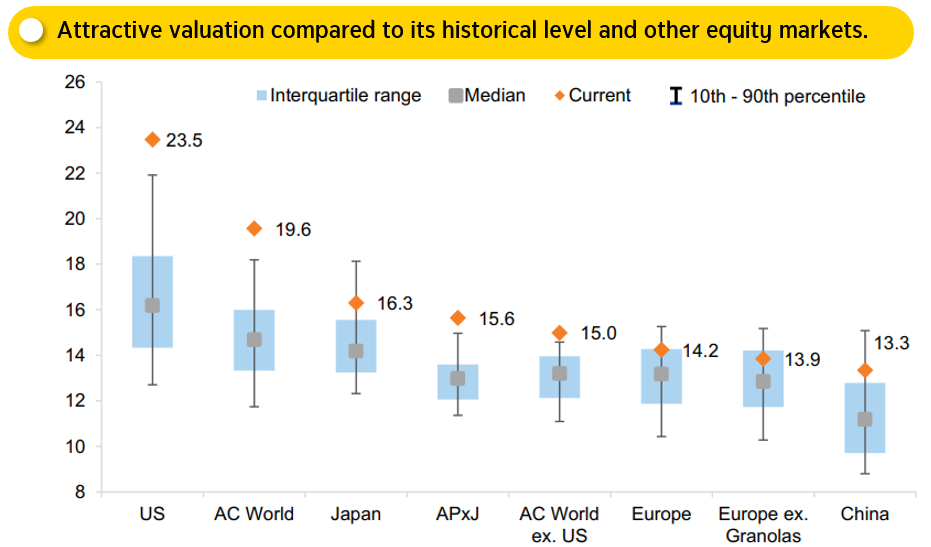

- European equity valuations are now highly attractive, both in comparison to their historical averages and compared with other global markets, with earnings sentiment improving as profit forecasts are revised upward.

Source: FactSet, Goldman Sachs Global Investment Research as of 22 Sep'25

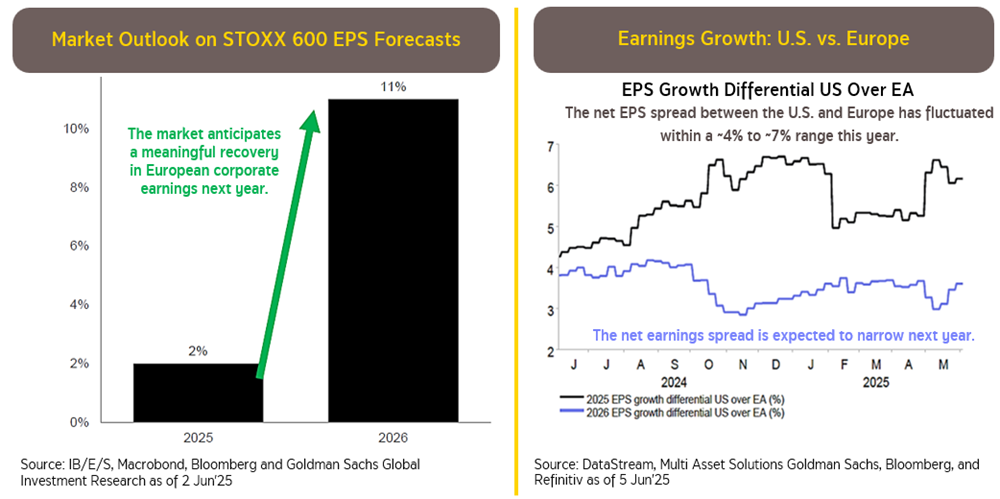

- The appreciation of the euro, which weighed on markets earlier, is likely to ease. Corporate earnings are projected to grow by 11% in 2026. Despite relatively low fund inflows, Europe remains under-owned, leaving ample room for upside once confidence returns.

Insights from Goldman Sachs Asset Management

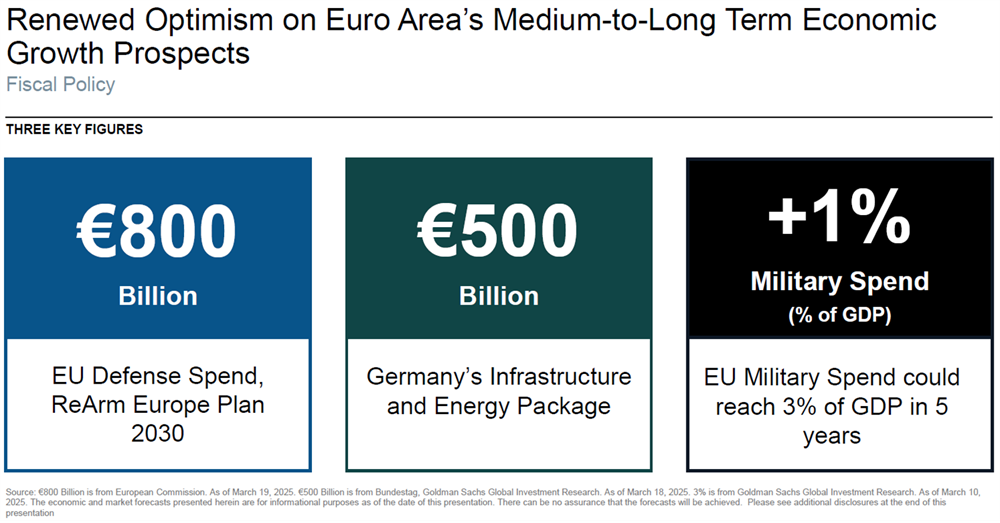

- Amid the ongoing geopolitical challenges and uneven growth across the region, structural initiatives such as the European Union’s ReArm Europe Plan 2030, Germany’s renewed infrastructure and energy investment, and Europe’s military spending are set to underpin medium- to long-term GDP growth.

- Europe currently offers entry valuations cheaper than those in the United States, while corporate earnings recovery is expected to accelerate from 2026 onwards.

- With government-backed spending on defense, infrastructure, and energy transition providing additional momentum, the balance of growth and value stocks in Europe also presents unique opportunities distinct from the more growth-heavy U.S. market.

- A major advantage of Europe lies in its "Diversity". With over 50 countries, more than 20 central banks, and a wide range of fiscal and monetary policies, the market is fragmented and complex but filled with opportunities

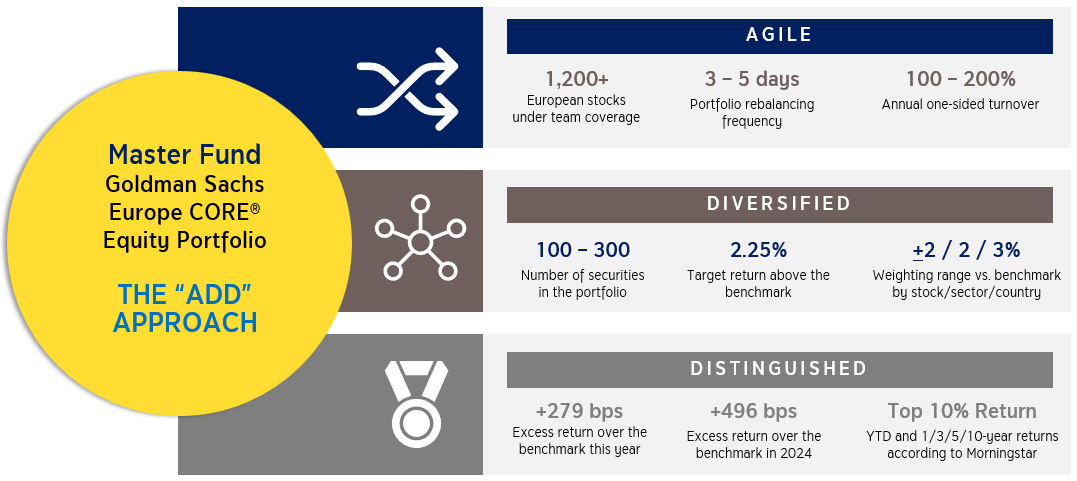

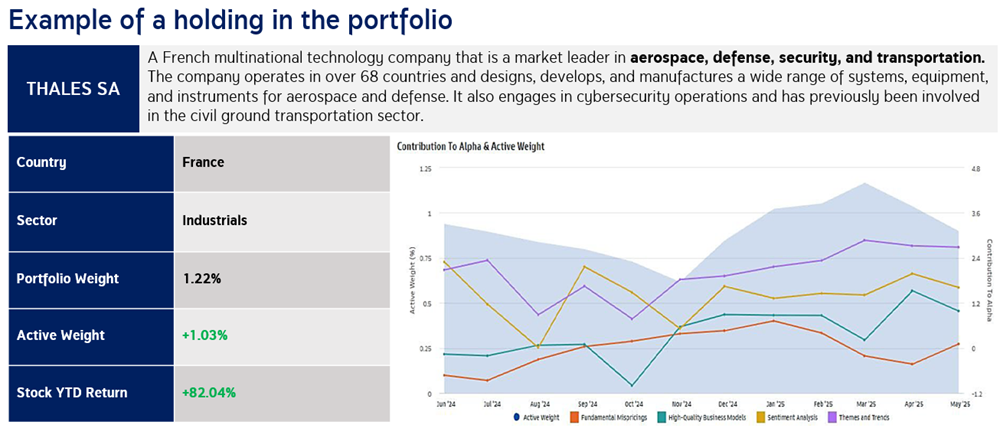

- This environment is particularly suitable for the Quantitative Investment Strategy of Goldman Sachs Europe CORE® Equity Portfolio fund, employing data-driven methods to screen over 1,200 stocks, using 200 - 400 different metrics to identify high-quality companies with strong fundamentals - such as solid balance sheets, stable management, sound governance, and attractive valuations. Supported by AI and Big Data, these stocks are analyzed daily, while the investment team also monitors emerging market trends.

Source: Goldman Sachs Asset Management as of 30 Jun’25. | The peer group for performance comparison is Morningstar Europe Large-Cap Equity. | The benchmark is MSCI Europe. The performance shown is that of the master fund and does not comply with the performance measurement standards of the Association of Investment Management Companies.

- Currently, the fund’s portfolio has greater exposure to the aerospace, materials, and information technology sectors. Thanks to its active and systematic approach, the fund rebalances its portfolio every three days, allowing it to respond swiftly and capitalize on market opportunities.

Conclusion: KSAM’s Shift to New Master Fund: Goldman Sachs Europe CORE® Equity Portfolio

The new master fund, Goldman Sachs Europe CORE® Equity Fund adopts a more diversified approach, investing in more than 174 securities across various sectors and geographies. It blends growth and value strategies to adapt to Europe’s cyclical market rotations, offering greater flexibility and resilience.

- The fund holds a five-star Morningstar rating*, reflecting its consistent ability to deliver superior returns while maintaining disciplined risk management. Performance data further underscores its strength. Since 2020, it has outperformed the MSCI Europe benchmark in 15 out of 17 quarters, with only two quarters of underperformance - each by a modest margin of just 1 - 2%.

Source: Goldman Sachs Asset Management as of 30 Jun'25 | The portfolio is actively managed. Information shown is as of the stated date and may not reflect future investments. The holdings and/or allocations shown may not represent the portfolio’s entire investments. | Sector classifications are based on the Global Industry Classification Standard (GICS). | Returns shown are gross of fees and do not reflect investment advisory fees, which may reduce returns. | The above information is not intended as investment advice. Future investments may or may not generate profit. Fund returns may fluctuate due to foreign exchange movements.

*Source: Master fund fact summary as of 31 Jul'25 and Morningstar as of 31 Jul'25 | The mentioned ratings are not related to AIMC. | The performance shown reflects that of the master fund and is not in accordance with AIMC’s mutual fund performance measurement standards.

- By partnering with Goldman Sachs Asset Management, KSAM aims to bring Thai investors access to world-class strategies, while Mr. Kiattisak added that, this is a crucial moment to include Europe, about 10 - 15%, as part of a well-diversified portfolio.

- KF-HEUROPE fully hedges currency risk

- KF-EUROPE and KFEURORMF apply discretionary hedging depending on market conditions.

- Each invests no less than 80% of its NAV in the Goldman Sachs Europe CORE® Equity Portfolio, ensuring close alignment with the master fund’s performance. All funds have risk level at 6 – high risk.

For more information or to request a prospectus, please contact Krungsri Asset Management Co., Ltd. at 02-657-5757, press 2

Disclaimers

- RMFs are long-term retirement-oriented funds. Investors should understand the product features, returns, risks, and tax benefits in the investment prospectus before investing. Past performance does not guarantee future results.

- This material is based on reliable sources as of the date shown. Krungsri Asset Management cannot guarantee the accuracy, reliability, or completeness of the information and reserves the right to change information without prior notice.

- Since KF-EUROPE and KFEURORMF employ foreign exchange hedging at the fund manager’s discretion, investors are exposed to FX risk, which could result in gains or losses or returns below the initial investment.

- Investors should review the tax benefits specified in the investment guide. Unitholders will not be entitled to such tax benefits if they fail to comply with the investment conditions, and they must return any tax benefits previously received within the prescribed period. Otherwise, they will be subject to additional payments and/or penalties under the Revenue Code.

For KF-EUROPE details, click

For KF-HEUROPE-A details, click

For KFEURORMF details, click