News/Announcement

Promotions/Fund Highlight

KFTHAIESG: New Tax Saving Fund ... Growth Opportunity from Sustainable ESG Stocks.

Receive special promotion when investing according to terms & conditions*

Key Facts on Thailand ESG Fund (Thai ESG), click here.

Krungsri Enhanced SET Thailand ESG Fund (KFTHAIESG)

Minimum purchase: 500 Baht | Receive KFCASH-A units valued at 100 Baht per every 50,000 Baht of investment in SSF/ RMF/ Thai ESG according to terms & conditions*What makes KFTHAIESG interesting?

1. Investment process that ensures sustainable growth potential through integrating ESG factors with all-round consideration.

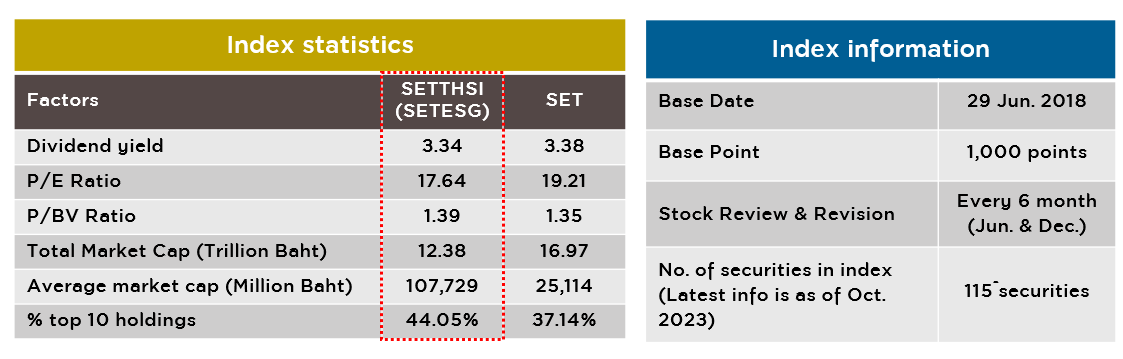

2. Invest primarily in Thailand’s leading companies with outstanding ESG reputation in reference to the SETESG Index, a treasure of leading companies in sustainability. The Index has the capability to reflect the price movements of stocks of sustainable companies which have met the stipulated criteria in terms of size and liquidity.

Sustainable growth potential of SETESG Index

At present, we have seen an increasing number of companies in the index list across industrial sectors that has enhanced their growth potential.

Index Information: SETESG

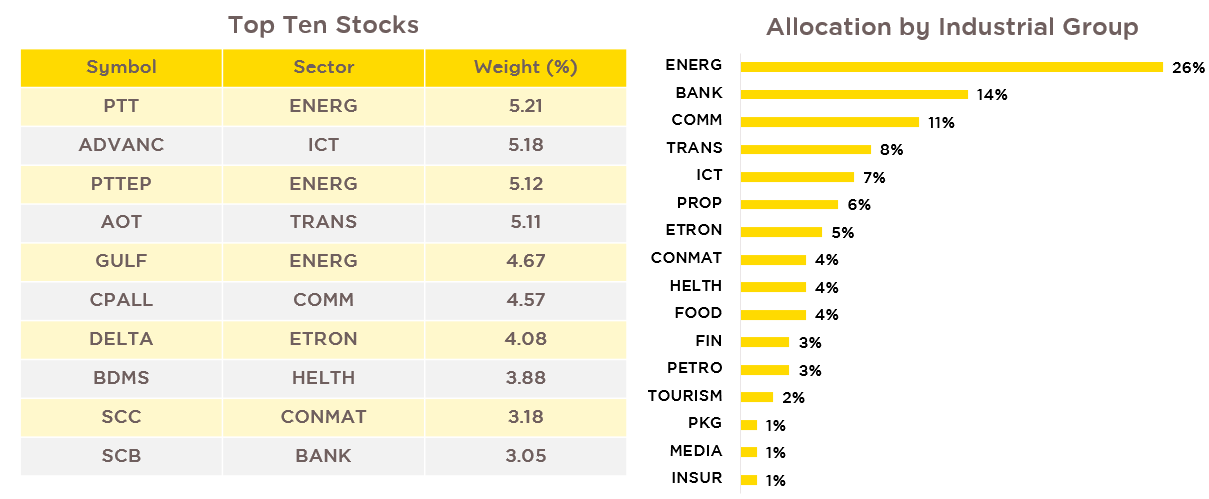

Current Constituents of the SETESG Index

Source: https://weblink.set.or.th/dat/report/product/SETTHSI_MonthlyReport_20231031.pdf | Information as of Oct. 2023

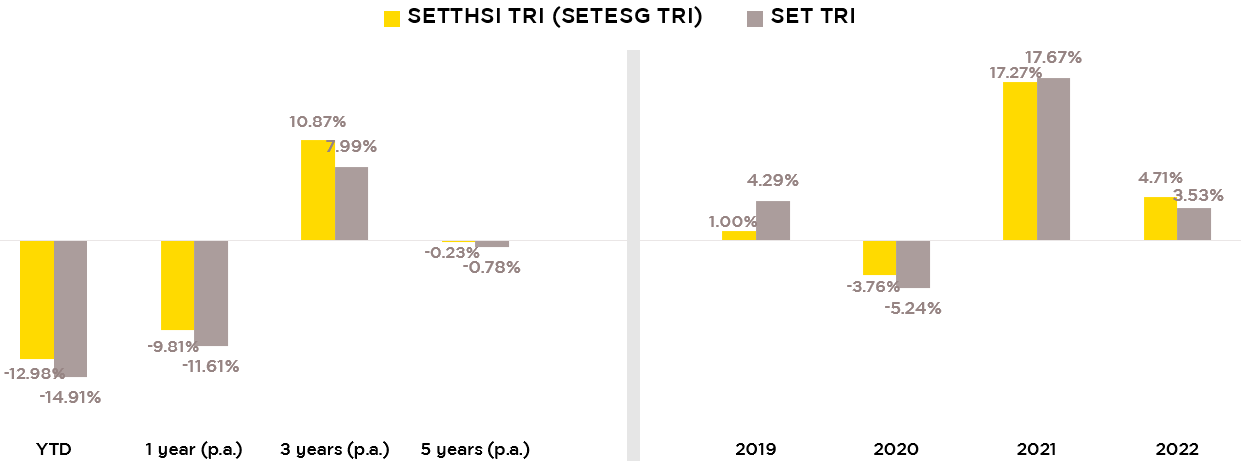

Comparison of historical performance between the SETESG Index and the overall market

3. Opportunity to generate excess returns higher than the index through Active Management strategy: In this respect, about 90% of portfolio shall invest principally in the stocks of listed companies that are constituents of the SETESG Index through the adoption of Quant Strategy to mirror the performance of the SETESG Index as if it invests 100% of the portfolio in the index. Besides, for the remaining 10%, the fund has the capability to generate excess returns from Krungsri Asset-style Active Management strategy.

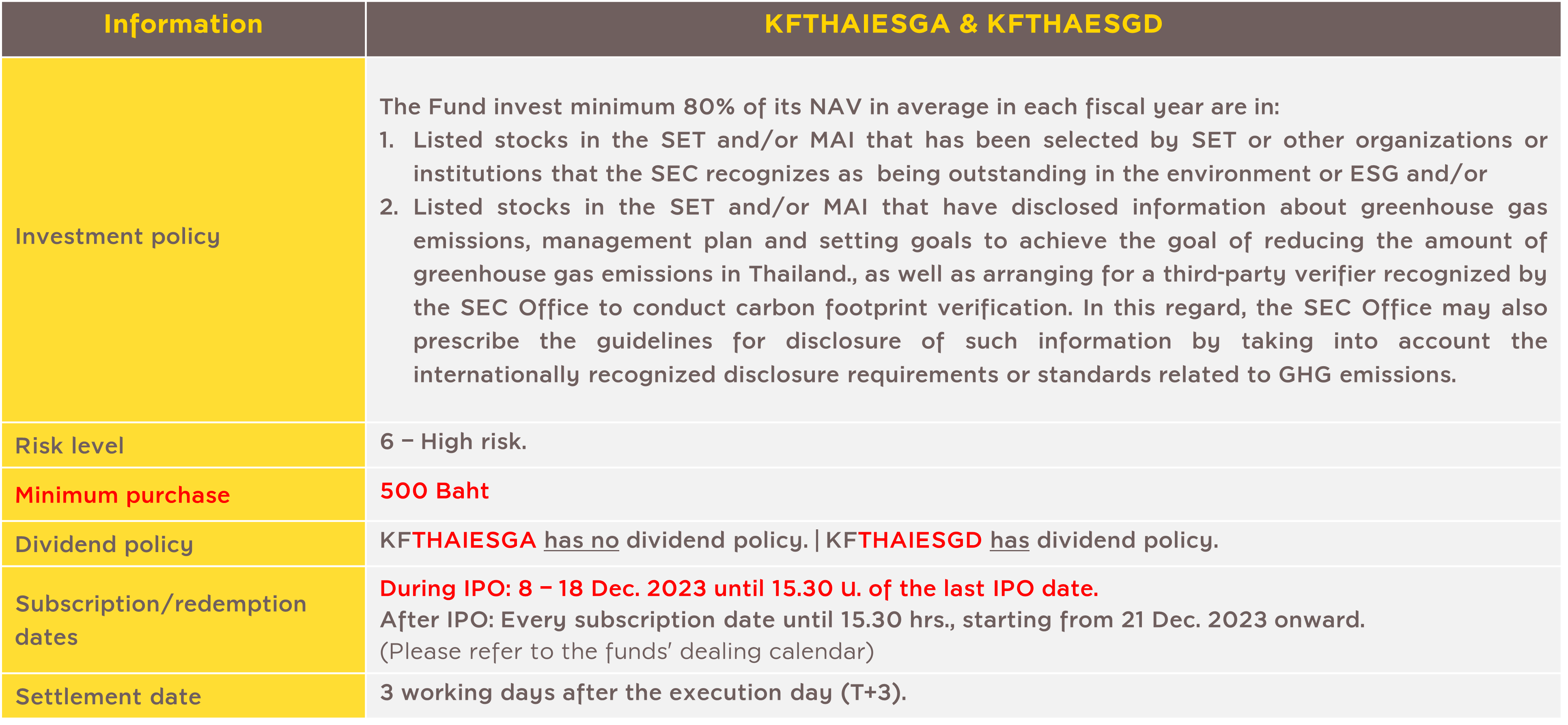

KFTHAIESG was divided into two share classes:

- Krungsri Enhanced SET Thailand ESG Fund-Accumulation Class (KFTHAIESGA)

- Krungsri Enhanced SET Thailand ESG Fund-Dividend Class (KFTHAIESGD)

Krungsri Asset Management Co., Ltd. at tel. 0 2657 5757.

*Terms & Conditions of SSF/ RMF/ Thai ESG Investment Promotion

- This promotion campaign is eligible for an investment in SSF/ RMF/ Thai ESG managed by Krungsri Asset Management Co., Ltd. (“the Company”), except KFCASHSSF, KFCASHRMF and any other SSF/ RMF/ Thai ESG 2024 according to the Company's announcement for exemption, with the accumulated investment amount during 2 Jan. – 30 Dec. 2024*.

- Investors must hold investment units invested during this promotion period until 29 Mar. 2025, which is the date the Management Company will calculate the net accumulated investment for KFCASH-A units’ entitlement.

- The net accumulated investment amount consists of (1) a total investment amount of subscription and switch-in transactions from other non-SSF, non-RMF, non-Thai ESG of the Management Company and (2) transfers of SSF/ RMF/ Thai ESG from other management companies, excluding the transfers from PVD to RMF, being deducted with the total investment amount of redemption, switch-out transactions to SSF/ RMF/ Thai ESG not participating in this promotion or other fund of the Management Company, and transfers from SSF/ RMF/ Thai ESG units of the Management Company to other companies. The exception will be allowed only when the redemption, switch-out and transfer are made from the outstanding balances on 28 December 2023 calculated with FIFO basis by the Management Company, according to tax benefit conditions specified by the Revenue Department.

- For investors having more than one fund account, the Management Company will count the net accumulated investment amount from all their accounts by considering the ID Card number.

- The Management Company will transfer KFCASH-A units according to the investment and entitlement conditions to investors by 30 Apr. 2025. KFCASH-A units will be calculated at its NAV price on the allocation date.

- Net eligible investment units from SSF/ RMF/ Thai ESG Regular Investment for 12 consecutive months from Jan. – Dec. 2023 will be not considered for this above-mentioned promotion.

- RMF units transferred from PVD will be eligible only for RMF-for-PVD promotion, but not for this promotion mentioned above.

- The Management Company reserves the rights to change the promotional conditions without giving prior notice. In case of any dispute, the Management Company’s decision shall be deemed final.

- Investors can use Krungsri participating credit cards, namely Krungsri Private Banking, Krungsri Exclusive Signature, Krungsri Signature, Krungsri Platinum Visa/ Master, Krungsri Visa/ Master, HomePro Visa Platinum Credit Card, Krungsri Lady Titanium, Krungsri Manchester United, Krungsri Doctor Card, AIA Visa, Krungsri JCB Platinum, Siam Takashimaya (all types), Krungsri NOW, Central The 1 Credit Card, Simple Visa Card, Krungsri First Choice, and Lotus's Credit Card to purchase SSF and RMF. (except KFCASHSSF, KFAFIXSSF, KFCASHRMF, KFAFIXRMF, KFGOVRMF, KFLTGOVRMF, KFMTFIRMF, and any other SSF/ RMF/ Thai ESG in 2023 according to the Company’s announcement for exemption.)

- Any investment units from subscription will not join the credit card promotion and reward points accumulation.

- Conditions in using credit cards will be as set forth by the Management Company and the Credit Card Companies.

- The Management Company reserves the right to change the conditions in subscribing the funds through credit cards without giving prior notice. In case of any dispute, the Company’s decision shall be deemed final.

Disclaimers

- Investment constraints: Since the Fund has a stock universe that is constrained to only the companies that are selected as outstanding in terms of Environment or Sustainability (ESG) or the companies that pass the internal ESG stock screening criteria, the Fund is therefore unable to invest in other companies with strong fundamentals or good profit potential but do not comply with the ESG criteria as specified in the stock universe.

- Investment Risks of the ESG Fund: Since the Fund relies on ESG data from external sources which may not be instantly updated particularly upon occurrence of specific incident relating to any company included in the list of outstanding ESG companies, it’s possible that stocks of these companies might not be included in the ESG framework anymore. In addition, the Fund may be exposed to the risk of concentrated investment in certain sustainability-related stocks and the risk of being unable to buy or sell some stocks at the right price and time due to the conditions stipulated for the sustainable stocks invested by the Fund.

- Additional costs: The Fund may incur additional expenses in commissioning a third-party certifier to audit the stock selection and investment processes of the SRI Fund as actually paid, and the expenses for using or making references to the stock indices, trademarks and/or service marks of the stock exchange and/or index provider, including the articles, licenses, trademarks, or any other information of the service provider, and so on.

- The Thai ESG Fund aims to promote long-term savings and encourage Thailand’s sustainable investment. Investors should understand the fund features, conditions of returns, and risk, and study the tax benefits in the Investment Manual, before making an investment decision. Past performance is no guarantee of future results.

- This document is prepared based on information obtained from reliable sources at the time of the presentation. However, the Management Company does not provide any warranty of the accuracy, reliability, and completeness of all information.

- Purchase of investment units through a credit card is not eligible for participating in the promotional campaign of the credit card.

- Investors should study the tax benefits stated in the Investment Manual. Unitholders in breach of investment conditions shall not be entitled to tax benefits and must return all the tax benefits received earlier within the specified timeframe, otherwise they will be liable to surcharge and/or fine in accordance with the Revenue Code.