News/Announcement

Promotions/Fund Highlight

KFNDQ...Investing in the Rising Star Nasdaq-100 Index Comprising Big Tech Stocks

IPO: 21 - 28 August 2023

KFNDQ ... Seize Growth Opportunity of Nasdaq-100 Index Gathering New World Businesses

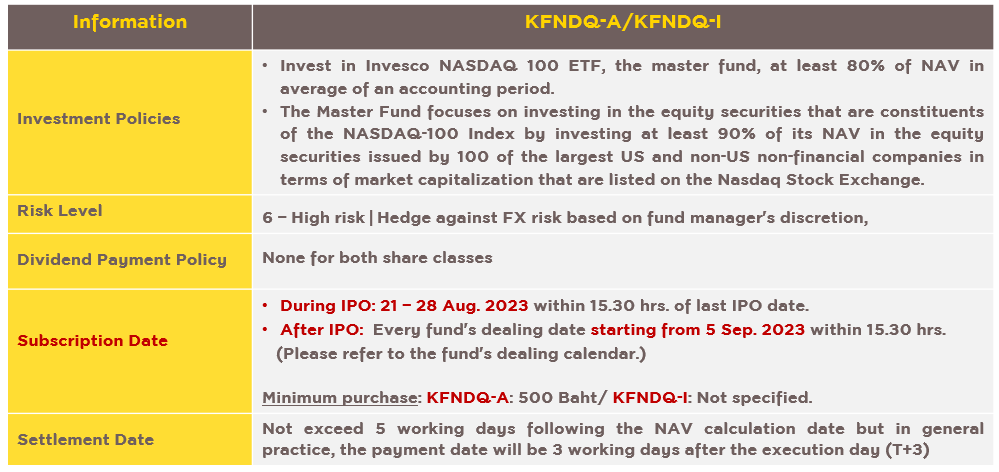

Krungsri NDQ Index Fund (KFNDQ)

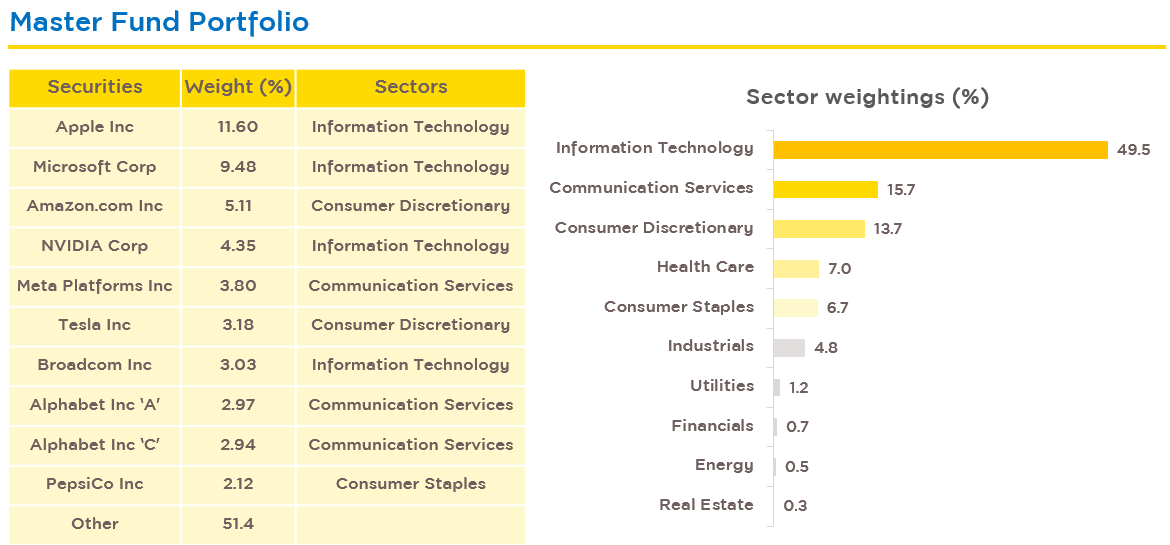

Investing through Invesco NASDAQ 100 ETF (Master Fund) whose portfolio was allocated into the largest 100 companies trading on the Nasdaq stock market where technology and innovation sectors have represented about 50% of the index weight, including global Big Tech names, such as Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla, KFNDQ will benefit from the master fund’s high liquidity and competitive fee charge, which will help increase the opportunity to generate returns closely replicating the Nasdaq-100 index performance.

IPO: 21 – 28 August 2023

Minimum purchase: KFNDQ-A - 500 Baht

Why is Nasdaq-100 recommended for Growth-Seeking Portfolio?

1. Positive investor sentiment since there’s a probability that Fed will stop raising interest rate.

2. Global tech companies representing the major businesses of the index have delivered solid financial performance with growth potential and opportunity to create long-term returns for the index.

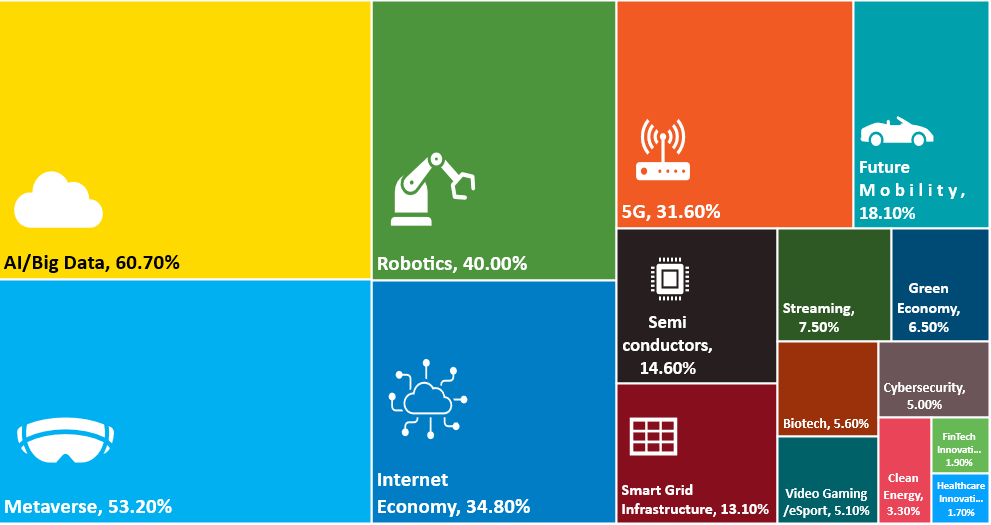

3. High growth potential of the index thanks to the innovation developments of tech companies in the Nasdaq-100. These companies spend nearly twice as much in R&D, on average, compared to those in the S&P 500 with 10.1%1 weighted average R&D as sales, contributing to investment opportunities and business profitability when there are users these innovations, such as ChatGPT from OpenAI that has become the world’s fastest-growing app ever, reaching 100 million users2. And it’s anticipated that global AI market share will grow at a CAGR of 19% in 20263.

Source: 1Nasdaq, Factset, Invesco as of 31 Mar. 2023 | 2Goldman Sachs GIR as of 5 Jul. 2023 | 3BofA Global Research, IDC as of 28 Feb. 2023 Source: Bloomberg as of 8 Aug. 2023

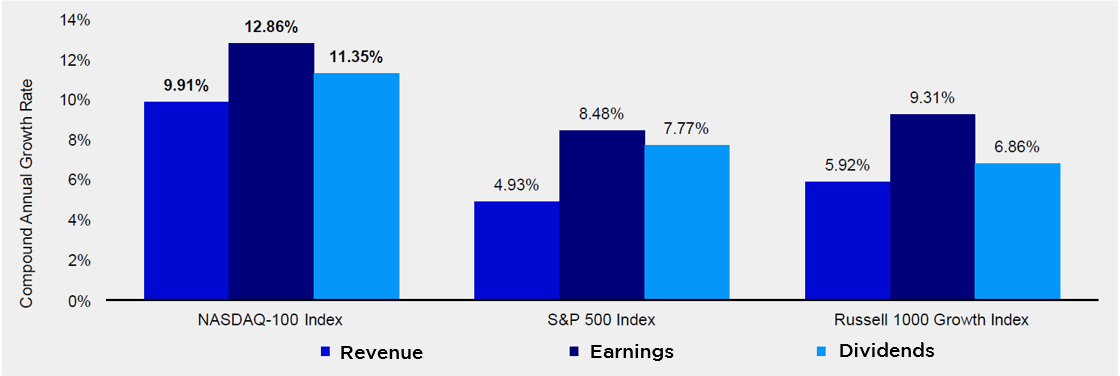

4. In the past 10 years, Nasdaq-100 constituents have generated higher growth rates across revenue, earnings, and dividends than those of other US stock Indices. Source: Bloomberg L.P., 31 Dec. 2011 through 31 Dec. 2021.

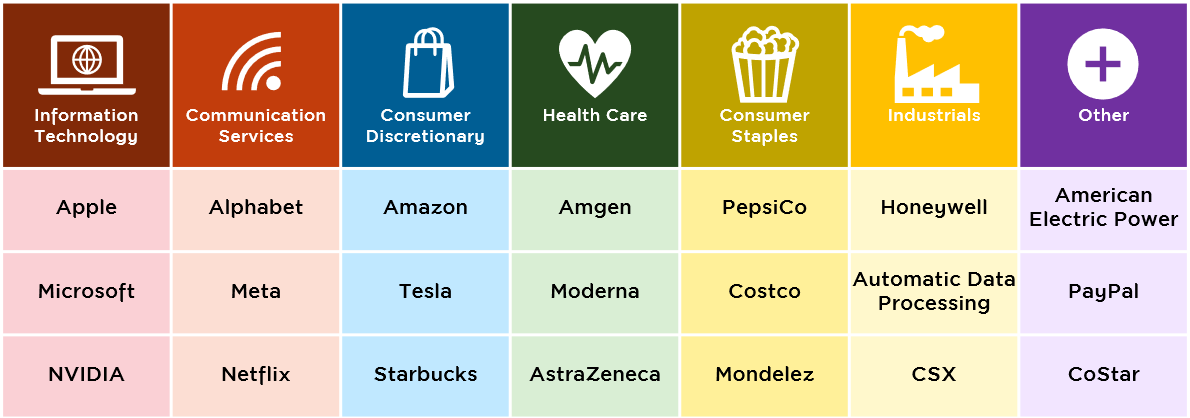

Businesses in the Nasdaq-100

Examples of companies and their investment themes by index weights. Source: Invesco as of 28 Jul. 2023 and Nasdaq, Bloomberg L.P., FactSet, Invesco as of 31 Dec. 2022. | Total sum may not equal 100 since each company might have more than one investment theme.

Master Fund Characteristics Invesco NASDAQ 100 ETF

- Focus to invest in companies being constituents of Nasdaq-100 index with potential to generate returns from solid fundamental factors to reflect the performance of the index.

- Positive investor sentiment together with technology and innovation advancements make many companies in portfolio the rising star of the decade.

- High liquidity and competitive fee charges help enhance the opportunity to generate attractive returns.

Source: Invesco as of 28 Jul. 2023

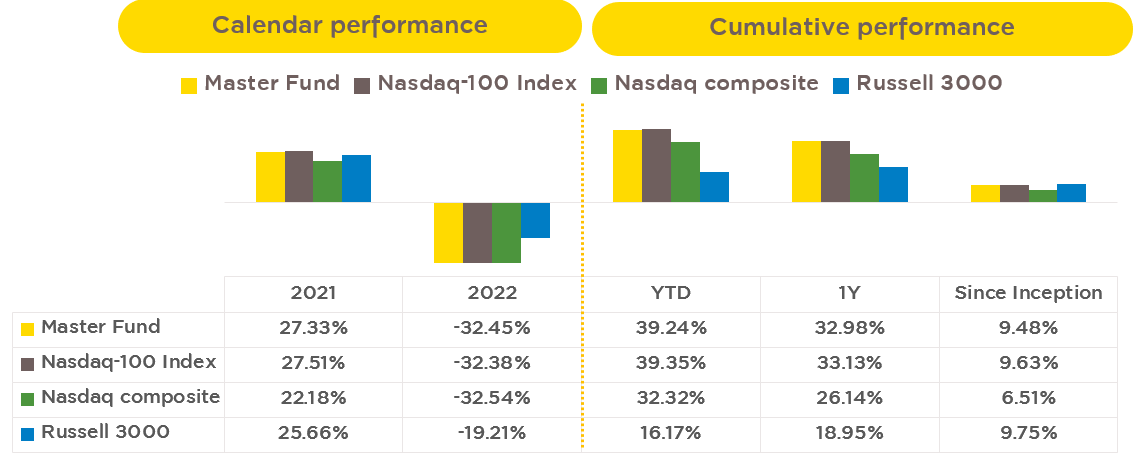

- Impressive Past Performance

KFNDQ was divided into two share classes:

- Krungsri NDQ Index Fund-A (KFNDQ-A)

- Krungsri NDQ Index Fund-I (KFNDQ-I)

Disclaimer

- This document has been prepared based on information obtained from reliable sources at the time of presentation, but the Management Company does not provide any warranty of the accuracy, reliability, and completeness of all information. The Management Company reserves the right to change all information without any prior notice.

- KFNDQ is hedged against foreign exchange risk at the discretion of the fund manager and is therefore subject to exchange rate risk which may result in losses or gains on foreign exchange or cause investors to receive lower return than the amount initially invested.

- Should carefully study the fund features, conditions of returns, and risks before making an investment decision. Past performance is not a guarantee of future results.

Krungsri Asset Management Co., Ltd. Tel. 02-657-5757 press 02.

.aspx)