News/Announcement

Promotions/Fund Highlight

KFCSI300...Seize China Golden Opportunity with A Shares Index Fund

IPO: 19 - 26 June 2023

Krungsri China Equity CSI 300 Fund (KFCSI300)

While the market has started recovering with valuations that remain attractive amidst factors that spur economic growth, now it’s time to access an opportunity to invest in China, the second largest economy in the world with superior growth potential despite the global economic slowdown through A-shares stocks investing made through CSI 300 Index ETF fund.

IPO: 19 - 26 June 2023.

Why investing in China A-Shares now?

- China’s stock market has the favorable growth potential supported by attractive fundamental factors including size of the economy, population structure, and consumption, etc.

- The “New Economy” sector which begins to gain higher share in China's economy provides opportunity for economic growth.

- Valuations remain inexpensive compared to historical averages and those of other major countries.

Why CSI 300 Index ETF?

- Market capitalization of companies that are constituents of the CSI 300 Index accounts for over 70% of total market capitalization, making the index a good indicator of the performance of China A-shares market.

- China A-shares market has an opportunity to benefit from inclusion on the key indices.

Why selecting ChinaAMC CSI 300 Index ETF as the Master Fund?

- It is the third largest A-Shares ETF listed outside Mainland China and the second largest ETF listed on the Hong Kong Stock Exchange.

- It can closely track the performance of the underlying index thanks to high liquidity and competitive fees.

Why now is the right time to enter the China’s market?

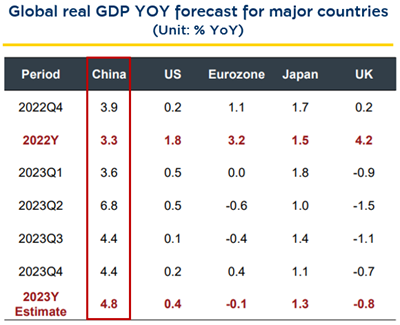

1. Analysts predict that China will be among the countries with highest economic growth rates in the world, while the Government policies are expected to stay accommodative to foster economic growth.

2. China stocks’ valuations remain attractive.

Even though the market has started recovering, the China stocks’ valuations remain low compared to historical average and other countries.

3. Opportunity from investors’ higher weighting

Presently global investors still give relatively low weighting to Chinese shares, but signs of improvement are emerging. China A-shares market has an opportunity to benefit from an inclusion on the key indices.

To invest in China, why should consider KFCSI300?

Invest in the foreign investment fund titled ChinaAMC CSI 300 Index ETF (the Master Fund), one of the world’s biggest ETFs that focuses on investing in China A-shares. The Master Fund will invest in the shares of top 300 Chinese companies, comprising 300 largest A-shares companies in terms of market capitalization effectively replicating CSI 300 Index movements. As a result, this has become an effective investing opportunity in A Shares thanks to the large fund size, competitive fee, and high liquidity. (Source: ChinaAMC (HK), Bloomberg as of 30 Apr. 23)

Master Fund: ChinaAMC CSI 300 Index ETF

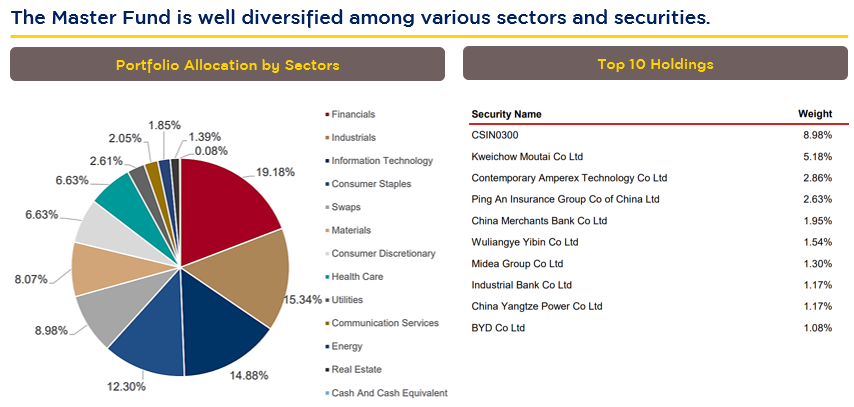

The Master Fund has the objective to replicate the movements of CSI 300 Index and is well diversified among various sectors that tend to benefit from China’s economic recovery and the growth of “New Economy” sectors, namely Financials, Industrials, IT, and Consumer Discretionary. (Sources: ChinaAMC(HK), Bloomberg; as of 30 Apr 2023. | The Total Expense Ratio (TER) is based on the total expenses for the accounting period ending 31 Dec 2022 which include the management fee, trustee fee and other fees.)

CSI 300 Index: A China A-Shares Stock Index that comprehensively represents the market and has attractive growth potential.

- Market capitalization of CSI 300 Index constituents account for more than 70% of the total market capitalization, making the index a good indicator of overall market performance. Diversification into various sectors of the Index also made them different from FTSE China A50 Index that is composed of only 50 stocks and therefore concentrates heavily in certain sectors. Plus, the Index also has opportunities to generate impressive returns compared to other indices. (Source: Bloomberg, ChinaAMC(HK) as of 30 Apr. 23)

- CSI 300 Index price remains slightly higher or 8% compared to the country’s pre-reopening period even though the overall market is starting to recover particularly the service sector, which still shows growth potential. (Source: Bloomberg as of 31 May 23.)

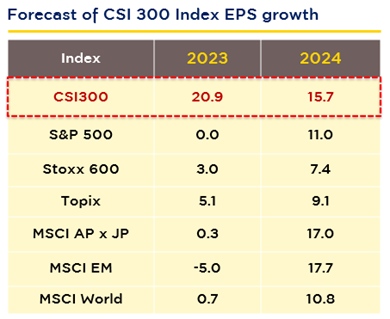

- PE ratio of CSI 300 Index has been hovering at low levels over the past 5 years and is expected to achieve the EPS Growth as high as 20.9% in 2023 and 15.7% in 2024, beating the forecast in other major countries.

Sources: Bloomberg as of 31 May 23 and FactSet, STOXX, Goldman Sachs Global Investment Research as of 22 May 23.

- CSI 300 Index has an opportunity to generate impressive returns in 2023 – 2024.

Master Fund’s Portfolio and Performance

Source: ChinaAMC(HK), Bloomberg as of 30 Apr. 23

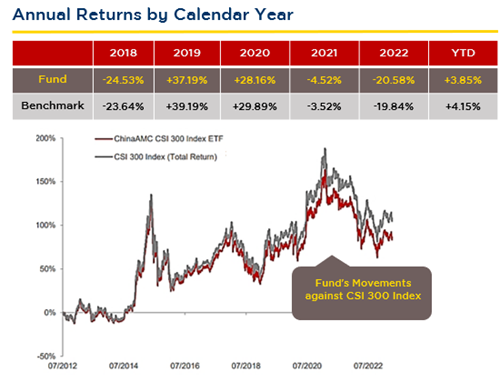

Master Fund’s past performance is close to the CSI 300 index’s movement.

Master Fund’s past performance is close to the CSI 300 index’s movement.

Sources: ChinaAMC(HK), Bloomberg; as of 30 Apr 23. | Benchmark refers to the CSI 300 Index (Total Return). | The Fund’s launch date is 17 Jul. 12. Accumulative returns since launch are calculated from 16 Jul. 12, the first date on which the NAV was officially announced. | The Fund’s returns are calculated in terms of RMB based on the changes of NAV without taking into consideration the reinvestment of dividends while the performance of CSI300 Index is calculated from price returns in RMB. | The performance as demonstrated is the performance of the Master Fund which is not in accordance with the mutual fund performance measurement standards of AIMC.

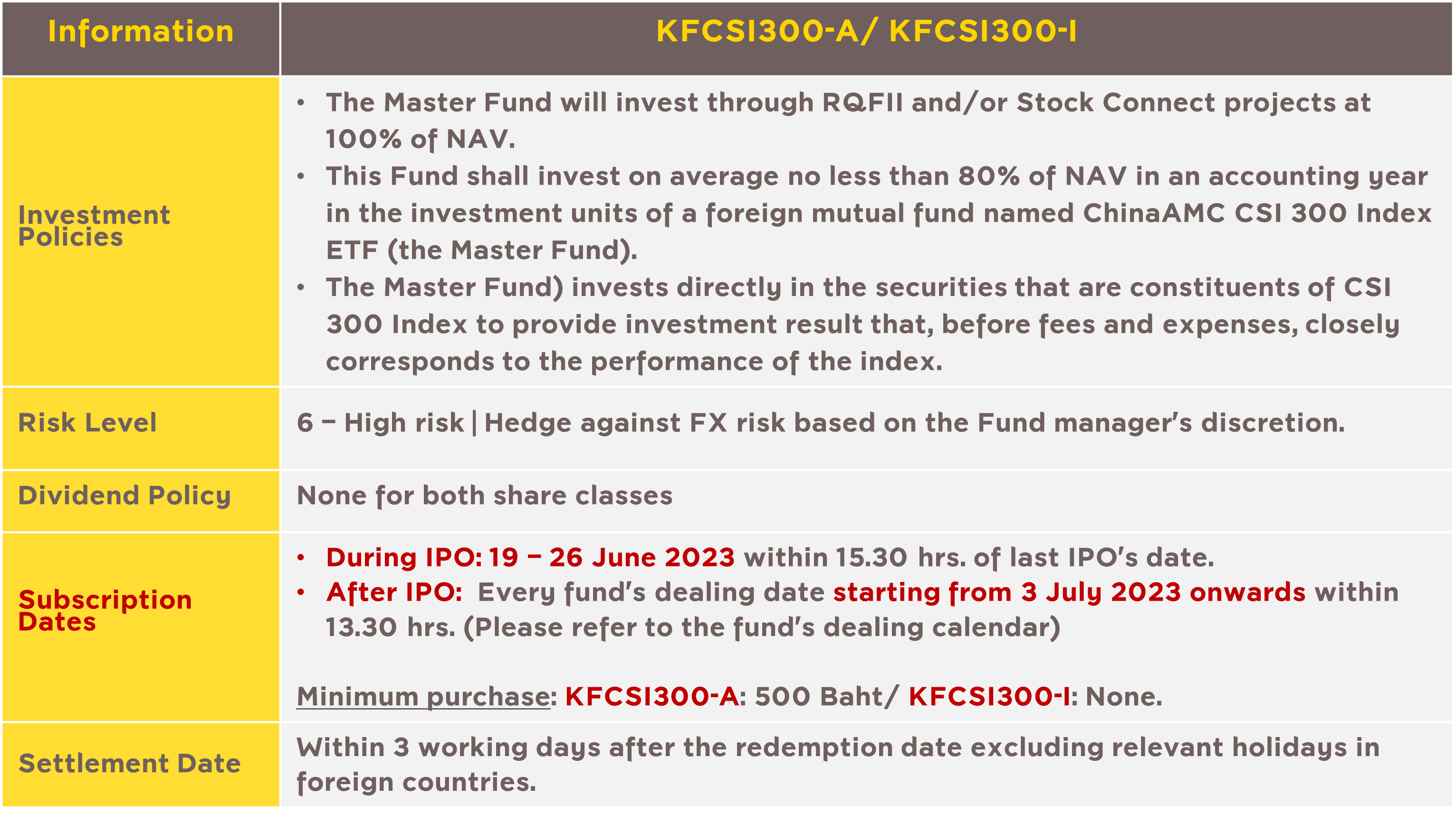

KFCSI300 was divided into two share classes.

KFCSI300 was divided into two share classes.

- Krungsri China Equity CSI 300 Fund-Accumulation (KFCSI300-A)

- Krungsri China Equity CSI 300 Fund-Institutional investor (KFCSI300-I)

Disclaimer

- This document has been prepared based on information obtained from reliable sources at the time of presentation, but the Management Company does not provide any warranty of the accuracy, reliability, and completeness of all information. The Management Company reserves the right to change all information without any prior notice.

- KFCSI300 is hedged against foreign exchange risk at the discretion of the fund manager and is therefore subject to exchange rate risk which may result in losses or gains on foreign exchange or cause investors to receive lower return than the amount initially invested.

- Investors are advised to carefully study the fund features, conditions of returns, and risks before making investment decision. Past performance is not a guarantee of future results.

For more information or request for fund prospectus, please contact:

Krungsri Asset Management Company Limited