News/Announcement

Krungsri Group holds a seminar "Staying ahead of Changes: Investing in Disruptive Technology"

17 May 2019

KFHTECH-A, a new tech equity fund of Krungsri Asset Management that will be investors' opportunity to make profit in the new tech-driven era of the global economy. The fund’s IPO will be made during May 21-29, 2019.

14 May 2019 - Bank of Ayudhya Public Company Limited in corporation with Krungsri Asset Management Company Limited (the Management Company) has organized a seminar “Staying Ahead of Changes: Investing in Disruptive Technology” with an introduction of Krungsri World Tech Equity Hedged FX Fund – Accumulation share class (KFHTECH-A), which will invest mainly in BGF World Technology Fund, the world’s five-star mutual fund rated by Morningstar*. The master fund will follow the rising tech trend which leads to changes in people’s lifestyle and structures of industries worldwide. (Source : Morningstar rating from Blackrock, as of 28 Feb 19. The above awards and rankings are not relevant to the AIMC.)

.aspx)

Krungsri Asset Management has invited Mr. AJ Ziegler, CFA, Vice President of BlackRock, Inc. and one of the team managing BGF World Technology Fund, and Mr. Kiattisak Preecha-anusorn, Assistant Vice President of Alternative Investment Department at Krungsri Asset Management to exchange ideas to invest in tech stocks and discuss on investment opportunities and risks of BGF World Technology Fund. The fund’s management styles, stock selection processes, and the past performances have also been in the discussion.

.aspx)

Mr. Kiattisak said that the current risk to stock markets around the world is the escalating US-China trade war which has sent stocks into corrections, but believing the ongoing trade negotiations will help sustain stock markets further. Therefore, now is the right time and opportunity for investment in equities particularly tech stocks which have not been highly affected by the trade tensions, given high growth potential. Tech stocks are also estimated as the most important drive for the global economic growth in the next decade.

.aspx)

Source: BlackRock, Feb 19. AI: Artificial intelligence. EV: Electric vehicles. AV: Autonomous vehicles. OTT: Over-the-top. CPG: Capital goods

Apparently, technology is playing a major role and bringing sweeping changes in people’s daily life such as communications, services, online trade, e-Payment, etc. AI (Artificial Intelligence) and 5G will also bring major changes in people’s behavior and lifestyle. Besides, technology has led to business disruption and transformation in several industries spanning from media, advertising, retail, finance and automobiles.

New players with technology will come with competitive advantages and could become market leaders. For example, in the advertising industry, Google and Facebook have managed to capture 25 per cent of the world’s advertising expenses(3). Tesla has led the US automobile industry(4). Or Yu’e Bao of Alibaba has become the world’s largest money market fund in only four years after its establishment(5). These moves point out to technology as an entire replacement of the traditional businesses within a short period.

Presently, technology is one among the world’s biggest industries. Seven tech stocks are now among the world’s top 10 in terms of market capitalization(1). In the past 10 years, only two - Microsoft and Apple were among the top 10. In the previous year, Apple was the first U.S. firm with its market capitalization of over one trillion US dollar(2).

Apparently, technology is playing a major role and bringing sweeping changes in people’s daily life such as communications, services, online trade, e-Payment, etc. AI (Artificial Intelligence) and 5G will also bring major changes in people’s behavior and lifestyle. Besides, technology has led to business disruption and transformation in several industries spanning from media, advertising, retail, finance and automobiles.

New players with technology will come with competitive advantages and could become market leaders. For example, in the advertising industry, Google and Facebook have managed to capture 25 per cent of the world’s advertising expenses(3). Tesla has led the US automobile industry(4). Or Yu’e Bao of Alibaba has become the world’s largest money market fund in only four years after its establishment(5). These moves point out to technology as an entire replacement of the traditional businesses within a short period.

(Source : (1) Bloomberg, Forbes 500, April 2019

(2) www.investingmoney.biz, April 2019

(3) https://singularityhub.com as of April 2019

(4) Bloomberg, April 2019

(5) macrobusiness.com.au , Moody’s, Wind, Bloomberg, May 2017)

.aspx)

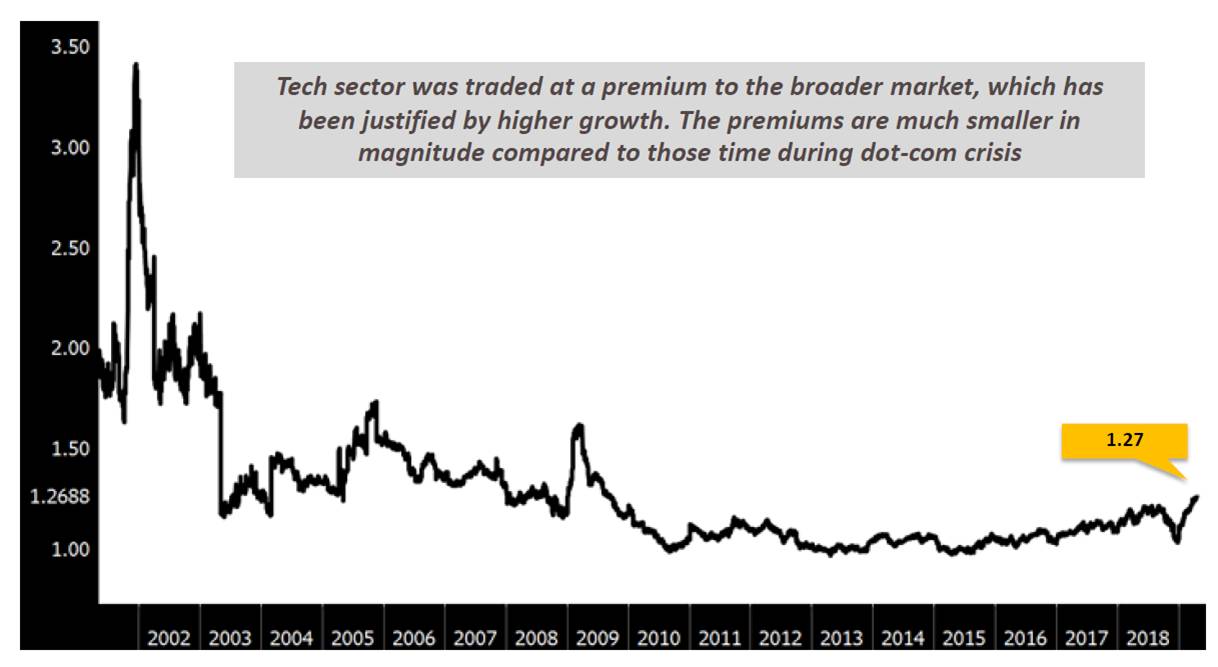

Mr. Ziegler, one of the management team for BGF World Technology Fund, said that thanks to these changes, tech firms have recorded high growth with satisfactory cash flow and great profit, becoming an attractive industry for investment. The nature of such growth differs from the dot-com crisis some 20 years ago when stocks were traded at 60-80 times and, eventually, were in bubbles. Although the current market P/E has doubled that in 2008 and tech stocks currently outperform the overall stock market, the tech industry has better fundamentals with ability to grow stably. Prices of tech stocks still remain reasonable, based on robust balance sheets.

MSCI All Country World IT Premium

Source : Bloomberg 19 Apr 19. Premium = MSCI All Country World IT Index / MSCI All Country Index

BGF World Technology Fund is the fund specializing in tech stocks for more than 10 years with a team of highly-experienced fund managers who manage funds for over 25 years. Thanks to its large size and location in Silicon Valley where innovations always happen, the team is able to gain easy access into information of companies, analyze them for proper factors for investment. The fund’s investment portfolio consists of about 80-120 tech stocks worldwide.

BGF World Technology Fund sets its strategy to select stocks all over the world, based on a combination of fundamentals and growth. While having leading, large-sized companies with good earnings results and steady growth, the fund always seeks new companies with high potential to replace existing players and ability to grow and make profit in the future.

The keys to drive the tech industry extend from AI, Cloud Computing, Internet of Things, 5G to technology for services - Netflix or Spottify, and automatic cars. Companies which can develop and extend these factors to businesses will earn the ability to grow. For example, one among top AI companies - Square develops electronic payments, focusing on fraud protection. Or Cloud Computing technology has led to the development of software programs for services. Therefore, BGF World Technology Fund has considered such issue as a factor for investment. The fund weighs its investment in stocks involving software programs for services and Internet. These stocks are Alibaba, Amazon, Netflix and Tencent. The fund also puts its priority to emerging markets with high growth rates. Given this style of its investment portfolio, the fund has given returns which have consistently outperformed its rivals and the key performance indicators for over 10 years.

Superior performance over peers and benchmark

.aspx)

.aspx)

Source: BlackRock, Morningstar, 28 Feb 19. *YTD performance is not annualized. Inception date: 3 March 1995. Performance is shown in US$ (Class A2 on a NAV price basis, with income reinvested, net of expenses, and annualised for periods longer than 1 year. The performance data do not take account of the commissions and costs incurred on the issue and redemption of units. Effective 1 January 2010, the benchmark (previously the MSCI World Information Technology Index) was changed to the MSCI All Country World Information Technology Index. Prior to 1 July 2002, the benchmark was the Merrill Lynch Tech 100 Index. Index returns are for illustrative purposes only. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. The return of your investment may increase or decrease as a result of currency fluctuations. This shows the performance of the master fund, so it is not complied to AIMC’s standard

Mr. Kiattisak added that given strong performance and other said factors, KSAM has selected BGF World Technology Fund as the master fund for KFHTECH-A. Interested investors can make investment in BGF World Technology Fund through the open-ended KFHTECH-A. The fund is suitable for investment in the medium or longer term as investing in technology requires time. The fund also hedges no less than 90% of overseas investment against foreign exchange risks

Click here for fund promotion details

Mr. Kiattisak added that given strong performance and other said factors, KSAM has selected BGF World Technology Fund as the master fund for KFHTECH-A. Interested investors can make investment in BGF World Technology Fund through the open-ended KFHTECH-A. The fund is suitable for investment in the medium or longer term as investing in technology requires time. The fund also hedges no less than 90% of overseas investment against foreign exchange risks

Click here for fund promotion details

Disclaimer

1. Please carefully study fund features, performance, and risk. Past performance is not a guarantee of future results. This document is not the fund’s prospectus, produced for general information only.

2. Krungsri Asset Management Co., Ltd. believes the information contained in this document is accurate at the time of publication, but does not provide any warranty of its accuracy. Similarly, any opinions or estimates included herein constitute a judgment as of the time of publication. All information, opinions and estimates are subject to change without notice.

3. KFHTECH-A invests in the master Fund named BGF World Technology Fund (Class D2 USD), on average in an accounting year, of not less than 80% of fund’s NAV. The master fund has investment policy to invest globally in the equity securities of companies whose predominant economic activity is in the technology sector, therefore the Fund may have risks from economic and/or political and/or social changes in the country where the master fund invested in.

4. The fund may invest in non-investment grade or unrated debt securities, so investors may be exposed to risk which result in loss of investment return and principal

5. The Fund has specific investment in sector fund, so it may has risk and price volatility higher than general mutual funds with diversification in several industries.

6. The funds will enter into a forward contract to hedge against the exchange rate risk at a particular time for the value of at least 90% of the foreign investment value, in which case, it may incur costs for risk hedging transaction and the increased costs may reduce overall return

7. The fund and/or master fund may invest in or make available a forward contract to enhance efficiency in investment management. This means the fund may contain higher risks than other funds and therefore the fund is suitable for investors who prefer higher return with higher risk tolerance than general investors. Investors should make investment only when they understand the risks of the contract by considering their investment experience, investment objectives and financial status.

For more details or to request for the Fund Prospectus, please contact:

Krungsri Asset Management Co., Ltd.

1st -2nd Zone A, 12th Floor, Ploenchit Tower 898, Ploenchit Road, Lumpini,

Pathumwan, Bangkok 10330

Tel: 662-657-5757 | Fax: 662-657-5777

E-mail: krungsriasset.mktg@krungsri.com | Website: www.krungsriasset.com

To download Adobe Acrobat Reader Click Here free of charge.